Think back to the last time you stepped into a physical branch of your bank. If it’s hard to recall, you’re not alone; many people are finding that their banking needs can be met entirely online.

Switching to an online-only bank could be a smart move for you. These banks typically offer significantly higher interest rates on savings accounts as well as lower fees compared to their traditional counterparts.

While some may worry about the process being entirely digital, rest assured that online banks provide similar protections as brick-and-mortar institutions. Your deposits are often insured by the FDIC, ensuring your money is safe.

Of course, keep in mind that reliable internet access is essential. For those with spotty connections, this might pose a challenge. However, if internet access isn’t an issue for you, online banking could simplify your financial life.

Ultimately, the security of your accounts relies on both the institution’s protections and your habits. Embracing online banking might just lead you towards better financial benefits and greater convenience.

Traditional versus online banks

In the ongoing debate about traditional versus online banks, safety is a crucial concern for consumers. With increasing reports of data breaches, particularly in 2023, many wonder if their financial information is secure. According to Comparitech, banks accounted for nearly half of all companies affected by financial data breaches this year, with credit unions contributing another 7%.

However, when we look specifically at online banks, the statistics reveal a different story. These institutions recorded less than 0.5% of such breaches. This significant disparity raises questions about why online banks might offer enhanced security.

One major factor is that online banks operate without physical branches. This absence means fewer employees and reduced opportunities for internal mishaps. A study by Verizon highlighted that employee-related activity was involved in approximately 74% of all data breaches—whether due to unintentional errors or malicious actions.

The reduced number of staff in online banking operations could protect against these risks. Consequently, while both traditional and online banks adhere to similar cybersecurity and privacy regulations, the streamlined nature of online banking may provide consumers with a safer option overall. As more people turn to digital solutions, understanding these nuances will be increasingly important in choosing where to bank securely.

While online banking offers convenience, it isn’t inherently safer than traditional banking methods. Many people assume that digital transactions are more secure, but that can be misleading.

Data breaches are only one of the many security threats customers face. Regardless of whether you’re completing a transaction at a bank branch or through your smartphone, the data is ultimately processed online.

This means that sensitive account information, such as passwords and personal identification numbers, is stored electronically and remains vulnerable.

Cyber threats like malware can infect devices and steal information without users even realising it. Identity theft also looms as a constant risk; hackers often find ways to exploit both online and in-person banking practices.

In today’s interconnected world, understanding these risks is crucial for any banking customer. It serves as a reminder to stay vigilant, regardless of how you choose to manage your finances.

In today’s digital age, online banks prioritise the safety of your money and personal information just as much as their traditional counterparts. Employing advanced security measures is essential for building trust and ensuring a secure banking environment.

Encryption software plays a critical role in safeguarding data. This complex technology protects sensitive information by converting it into a code that can only be read by authorised parties.

Multi-factor authentication adds another layer of security by requiring users to verify their identity through multiple methods. By combining something you know, like a password, with something you have, such as a smartphone or token, online banks significantly reduce the risk of unauthorised access.

Firewalls further bolster protection by creating barriers between secure internal networks and external threats. Regular monitoring for unusual account activity also helps detect potential fraud early on, ensuring prompt intervention.

Moreover, banks typically implement mandated privacy policy training for their employees to keep them well-versed in best practices. However, it’s crucial to remember that not all banks are created equal; some may offer superior security measures than others.

When selecting an online bank, research and prioritize those with robust security features. A thorough understanding of these elements will empower you to make informed decisions about where to manage your money securely.

As a bank account holder, it is essential to actively utilise the robust security features available from your financial institution, whether you are with an online bank or a traditional one. This means taking steps like activating multi-factor authentication, setting up account notifications, and ensuring your banking app receives automatic updates. Additionally, you can safeguard your account against significant security threats, such as phishing scams and compromised login information, by following some straightforward practices. Regardless of where you bank, always opt for a solid and unique password for each account. Avoid logging in over public WiFi networks and steer clear of clicking on links found in unsolicited emails or text messages.

When assessing the legitimacy of an online bank, it’s crucial to gather information from trustworthy sources. At the very least, ensure that your chosen online bank has FDIC insurance—this protects you against losses on deposits up to $250,000—and that it is actively operating; both details can be easily verified using the FDIC’s BankFind Suite tool.  To validate credibility, research about the bank online. Look for news articles and reports regarding any cybersecurity incidents they may have faced in the past; customer reviews can also provide insight into their reputation, while app ratings give additional context about user experiences.

To validate credibility, research about the bank online. Look for news articles and reports regarding any cybersecurity incidents they may have faced in the past; customer reviews can also provide insight into their reputation, while app ratings give additional context about user experiences.

A legitimate bank will typically make its security policies readily accessible on its website. Verify that they implement robust data encryption methods such as 128-bit or 256-bit encryption and offer multi-factor authentication options for added protection. If this critical information is not available on their site, it might be wise to consider seeking out another online banking option that prioritises your security more transparently.

Maxthon

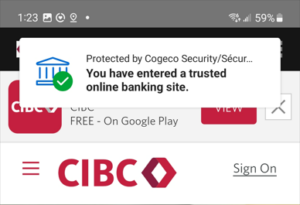

When it comes to online banking, the Maxthon Browser stands out as a notably secure and dependable option. It employs robust encryption methods along with anti-phishing tools designed to protect your personal and financial data from potential threats. One of its standout features is a powerful ad blocker that effectively eliminates disruptive advertisements, leading to a more fluid and focused browsing experience.

In addition, Maxthon offers a privacy mode that keeps sensitive information under wraps, preventing unauthorised access and thereby fostering a safer online atmosphere. This is especially crucial when dealing with confidential details or conducting financial transactions, as it helps shield users from various risks.

By integrating an ad blocker and privacy mode, Maxthon significantly boosts its users’ overall security while ensuring their personal information remains confidential. The ad blocker not only stops unwanted ads from using up bandwidth but also reduces the chance of encountering malicious content or phishing attempts.

Moreover, the comprehensive privacy mode diligently protects user data by blocking tracking algorithms and other intrusive methods that seek to gather browsing habits without consent. As a result, Maxthon users can surf the web with confidence, knowing their sensitive information is safeguarded from unwanted scrutiny and harmful digital threats.

Whether one is accessing banking sites, shopping online, or simply searching for information on the internet, the combination of these features creates an effective barrier against potential security vulnerabilities. This dedication to user protection through advanced functionalities truly distinguishes Maxthon as an ideal choice for anyone in search of a safer browsing experience.

Additionally, Maxthon ensures seamless compatibility with significant banking platforms for smooth navigation during transactions. Its user-friendly interface allows even those who aren’t particularly tech-savvy to handle their online banking tasks with ease. In summary, when it comes to securely managing bank accounts and conducting financial activities online, the Maxthon Browser emerges as a reliable option worth considering.