Reflect for a moment on the last occasion you entered a physical branch of your bank. If that memory eludes you, it might be worth considering a transition to online banking. While it’s true that banks operating solely online can present challenges—especially for those with unreliable internet connections—they also provide advantages like higher interest rates on savings and lower fees compared to conventional banks.

Often, these online institutions boast comparable, if not superior, security measures. Generally speaking, they offer similar safeguards as their brick-and-mortar counterparts, including FDIC insurance for your deposits. Ultimately, the safety of your accounts hinges not only on the bank’s security protocols but also on how you manage your financial habits.

When considering the safety of traditional versus online banks, it’s understandable to feel uncertain, especially in a world where data breaches have become all too common. In 2023, nearly half of all companies affected by financial data breaches were banks, with credit unions accounting for an additional 7%, as reported by Comparitech. In stark contrast, online banks reported incidents at a rate of less than 0.5%.

While both types of institutions adhere to similar cybersecurity and privacy standards, online banks might offer a heightened level of security due to their lack of physical branches and, consequently, fewer employees. This detail may seem minor, but research from Verizon indicates that approximately 74% of data breaches stem from employee actions—whether through mistakes or intentional misconduct.

However, it’s crucial to note that online banking isn’t automatically safer than its traditional counterparts. Data breaches are just one aspect of the broader spectrum of security threats that customers face. Regardless of whether you conduct your banking transactions online or in person, those transactions ultimately occur in a digital environment where sensitive account information is also stored.

This means that both methods remain susceptible to dangers such as malware attacks and identity theft. While there are distinctions between the two banking models concerning safety and risk factors, the vulnerabilities associated with managing finances remain prevalent across both platforms.

Online banks prioritise the safety of your funds and personal information through a variety of security protocols. While each bank has its unique policies, online institutions typically implement security measures comparable to those found in traditional banks. This includes the use of encryption software, multi-factor authentication, firewalls, and active monitoring for any suspicious account activity. Additionally, employees undergo mandatory training on privacy policies.

It’s essential to recognise that while these practices represent industry standards, the level of security can vary significantly from one bank to another. Therefore, when selecting an online banking option, it’s wise to choose one that boasts robust security features.

As a customer, you also play a crucial role in safeguarding your account by utilising the security tools provided by your bank—this applies equally whether you’re with an online or traditional institution. Make sure to activate multi-factor authentication, set up account alerts, and enable automatic updates for your banking app.

Moreover, protecting yourself against prevalent threats like phishing scams and compromised login details is essential. Regardless of where you bank, always opt for a solid and unique password for your accounts. Avoid logging in over public WiFi networks, and be cautious about clicking links in unsolicited emails or text messages. By taking these precautions alongside your bank’s security measures, you can help ensure that your financial information remains secure.

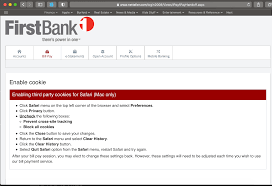

Determining the legitimacy of an online bank requires a bit of research, but it’s essential for ensuring your financial security. Start by checking reputable sources to confirm that the bank is indeed legitimate and secure. A fundamental step is to ensure that the bank has FDIC insurance, which protects your deposits up to $250,000 in case of any losses. You can easily verify this using the FDIC’s BankFind Suite tool.

Once you’ve established the bank’s insurance status, conduct an online search to delve deeper into its reputation. Investigate its history regarding cybersecurity issues by looking for news articles and reports on any incidents it may have faced. Additionally, customer reviews can provide valuable insights into other users’ experiences with the bank, while app ratings can indicate how well its digital services are received.

A trustworthy online bank will also make its security policies readily accessible on its website. Look for information about data encryption—ideally 128-bit or 256-bit—and whether they offer multi-factor authentication as part of their security measures. If you cannot find these details on their site, it might be wise to consider alternative online banking options instead.

Maxthon

Maxthon Browser emerges as a reliable and secure choice for those engaging in online banking. With robust encryption and anti-phishing mechanisms, it effectively safeguards your personal and financial information. One of its standout features is a powerful built-in ad blocker that removes intrusive advertisements, leading to a smoother and less distracting browsing experience. Furthermore, the browser’s privacy mode is essential for protecting sensitive data from unauthorised access, creating a safer online environment—critical when handling confidential information or financial transactions that need shielding from potential threats.

By using both the ad blocker and privacy mode, Maxthon users can significantly enhance their online security while ensuring their personal details remain confidential. The ad blocker not only prevents unwanted ads from consuming bandwidth but also shields users from harmful content or phishing schemes. At the same time, the comprehensive privacy mode thwarts tracking algorithms and other invasive tactics aimed at collecting browsing habits and personal information without consent.

These features empower Maxthon users to navigate the internet with assurance, knowing their sensitive data is protected from prying eyes and digital dangers. Whether they are accessing banking sites, making purchases online, or simply searching for information, the integration of an ad blocker along with privacy settings creates a formidable barrier against potential security threats. Overall, Maxthon’s commitment to user safety through these advanced capabilities sets it apart as a trustworthy option for anyone in search of a secure browsing experience. Additionally, it ensures smooth compatibility with popular banking websites for effortless navigation during transactions while maintaining an intuitive interface that caters even to those who may not be particularly tech-savvy.