Credit cards are crucial tools for managing expenses and building credit in personal finance.

In today’s digital landscape, safeguarding your private information is more challenging than ever. Over the past five years, internet fraud and data breaches have surged alarmingly. In 2023 alone, the FBI’s Internet Crime Complaint Center reported over 880,000 complaints, tallying around $12.5 billion in financial losses related to these crimes.

Given these unsettling statistics, securing your personal information must be a top priority. A vital step in protection is creating strong passwords for your financial accounts. A robust password acts as a first line of defence against unauthorised access to your credit cards and banking details.

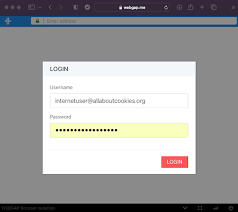

To improve security, consider using a combination of letters—both uppercase and lowercase—numbers, and special characters. Aim for at least 12 characters in length and avoid easily guessable information like birthdays or names. By taking these precautions seriously now, you’ll be better equipped to protect your finances from future threats.

When creating a strong password, avoid using easily guessable information like your first pet’s name and your birthday. Instead, aim for originality. A robust password typically includes a mix of both uppercase and lowercase letters.

Additionally, incorporating numbers throughout the password rather than just at the start or end can enhance security. Don’t overlook the importance of memorable characters, such as @$!%, which add another layer of complexity. The longer and more varied your string of characters, numbers, and symbols is, the harder it becomes for potential scammers to crack.

Moreover, be cautious about personal details in your passwords. Using names, significant dates, or locations related to you or your family increases the risk of someone guessing them. This makes it imperative to keep these details private, especially on social media platforms.

By avoiding such identifiable information and creating unique combinations in your passwords, you significantly strengthen your account security against cyber threats. Always remember: if it’s hard for you to type out your password correctly, it’s likely much more challenging for hackers to decipher it!

When it comes to creating secure passwords, embracing your creativity can yield impressive results. While password generators offer convenience, crafting your unique password can be more personalised and memorable.

Start by taking inspiration from the things you love—maybe a favourite song or a beloved book. For instance, you could take iconic lyrics from TLC’s No Scrubs. By shrinking them down using initials and symbols, you might create something like: *a3!@GtThFA!@KaA B*.

In this example, you mix upper- and lower-case letters with numbers and special characters to enhance complexity. This way, even if someone sees parts of your phrase, they won’t easily decipher your password.

Think outside the box! Use quotes from movies or TV shows that resonate with you. Consider a funny line or an unforgettable scene that only you truly appreciate.

You could also experiment with short poems or book titles, turning them into a jumbled string of letters and symbols that hold personal meaning. The key is to develop something only you would understand while keeping it hard for others to guess.

Avoiding common passwords is crucial in today’s digital landscape. A study by password management company NordPass revealed that the most frequently used password is “123456,” closely followed by “admin,” both of which have been used over four million times. These simple passwords may be easy to remember, but they pose a severe security risk.

In fact, hackers can crack such weak passwords in less than a second. Using recognisable words or number sequences makes you especially vulnerable to identity theft and unauthorised access to your accounts. For example, the password “password” has been used more than 700,000 times and is similarly easy for cybercriminals to breach.

Even variations like “P@ssw0rd” offer minimal protection; with over 130,000 instances of usage, this type of password will also fall under an attacker’s scrutiny within seconds. To keep your personal information secure, it’s vital to create unique and complex passwords that combine letters, numbers, and special characters while avoiding any easily guessable combinations.

In today’s digital world, security breaches and large-scale hacks are unfortunate realities that many companies face. When a company informs you of a potential breach, it is crucial to act swiftly.

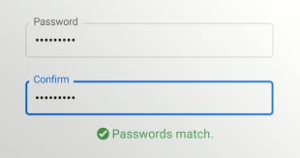

First, assess the situation: Could your personal information have been compromised? If there’s even a slight chance your details were leaked, prioritise updating your passwords immediately.

Craft a new password that is strong and unique. Consider using a mix of letters, numbers, and special characters to enhance its security. This will make it harder for anyone to gain unauthorised access to your accounts.

Once you’ve created the new password, store it securely in your password manager. This will ensure you won’t encounter difficulties logging in later and help maintain your online security over time.

Taking these proactive steps can significantly reduce the risk of becoming a victim of identity theft or fraud following a data breach. Stay vigilant and always prioritise your online safety!

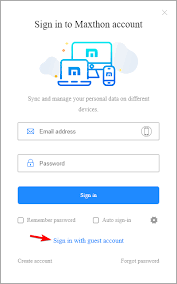

Maxthon

Maxthon Browser stands out as a secure and dependable option for conducting online banking. With its strong encryption and anti-phishing capabilities, it effectively protects your personal and financial data from threats. One of its key features is a powerful built-in ad blocker that efficiently removes disruptive ads, allowing users to enjoy a more fluid and focused browsing experience. Additionally, Maxthon’s privacy mode plays a crucial role in keeping sensitive information safe from unauthorised access, further enhancing the security of your online activities.

This privacy feature is handy when dealing with confidential data or financial transactions that necessitate extra protection against potential risks. By integrating both the ad blocker and privacy mode, Maxthon empowers users to bolster their overall online security while ensuring their personal information remains confidential.

The ad blocker not only stops unwanted advertisements from using up bandwidth but also shields users from potential exposure to harmful content or phishing schemes. Meanwhile, the comprehensive privacy mode actively prevents tracking tools from gathering browsing habits or personal details without user consent. These functionalities allow Maxthon users to explore the internet with confidence, knowing their sensitive information is safeguarded against intrusive eyes and malicious digital threats.

Whether you are accessing banking platforms, shopping online, or simply searching for information on the web, the combination of an effective ad blocker and robust privacy settings creates a protective shield against various security vulnerabilities. In summary, Maxthon’s dedication to enhancing user safety through these advanced features distinguishes it as an excellent choice for anyone in search of a more secure browsing experience. The browser also ensures smooth compatibility with major banking sites, facilitating easy navigation and transaction processes while maintaining an intuitive interface for all users.