When most people first hear about open banking, their immediate thought often revolves around security: Does this mean I have to open up my bank account? It’s a valid concern. After all, we are taught from an early age to protect our financial information fiercely, guarding our PINs and passwords as if they were the keys to our future.

The concept of allowing third-party companies access to our banking data can feel counterintuitive, sparking fears about potential fraud or theft. It’s no surprise that many shy away from engaging with the open banking ecosystem because of these apprehensions.

However, attitudes are beginning to shift. More consumers are starting to understand that open banking isn’t just about vulnerability; it also offers opportunities for enhanced financial management and better services tailored specifically to their needs. As trust builds in these innovative platforms, individuals see the value in securely sharing their data.

Transparency and regulatory protections play critical roles in this transformation. With more precise guidelines on how personal information is used and shared, people are gradually overcoming their initial scepticism. Open banking may still induce some unease, but its benefits—such as streamlined payments and personalised insights—are increasingly winning over hearts and minds.

Open banking is a transformative financial innovation that empowers consumers and businesses by allowing them to securely share their financial data with third-party providers. Utilising application programming interfaces (APIs), open banking facilitates seamless connections between banks and fintech companies, creating a collaborative ecosystem.

This approach enhances data accessibility, enabling users to take greater control over their financial information. Instead of being confined to the products and services offered by traditional banks, individuals can now explore a broader range of options tailored to their specific needs.

With open banking, consumers can easily compare financial products like loans, credit cards, and investment opportunities from various providers. This increased transparency encourages competition among institutions, often leading to better rates and innovative offerings.

Additionally, businesses can benefit from improved cash flow management and enhanced customer insights by leveraging this shared data. Overall, open banking represents a shift towards more consumer-centric financial services that prioritise user experience and empowerment.

Open banking is revolutionising the financial landscape by fostering competition and innovation among service providers. It levels the playing field for emerging fintech companies, enabling them to introduce creative financial products and services that challenge traditional banks. As a result, consumers can explore a more comprehensive array of options, allowing them to find tailored solutions that best fit their needs.

This new paradigm not only enhances choice but also encourages better pricing and improved customer experiences. With multiple services accessible through one platform, managing finances becomes more seamless. Consumers no longer have to grapple with switching accounts or tediously entering information across different institutions.

Moreover, open banking shifts the focus toward personalised financial management. This approach grants users greater flexibility in navigating their finances while increasing transparency regarding fees and terms associated with various products. In essence, open banking empowers consumers by providing them with the tools they need to control their financial destinies effectively.

Is open banking genuinely safe? This innovative financial system invites users to share their bank account information with third-party providers, raising valid concerns about privacy and security. While the prospect of a connected ecosystem can spur technological advancements, it also introduces potential risks related to supply-chain vulnerabilities.

A significant worry is the risk of unauthorised access to sensitive financial data. Third parties gain access through APIs, which must be rigorously protected. If these APIs are not secured adequately, hackers could exploit them, potentially compromising millions of accounts.

Moreover, many third-party providers may lack the robust security measures that established banks have in place. A single breach at one provider could lead to widespread consequences—jeopardising countless accounts and eroding trust in open banking as a whole. Once trust is shaken, rebuilding the reputation of open banking may prove impossible.

Phishing attacks pose a significant threat in the digital landscape, as cybercriminals have become increasingly adept at creating counterfeit applications and websites that closely resemble legitimate services. These fraudulent platforms are designed to deceive users into divulging their login credentials under false pretences. Once attackers gain access to this sensitive information, they can orchestrate various malicious activities, including siphoning funds from accounts or engaging in identity theft.

The very openness of financial systems, often hailed as a significant advantage for innovation and ease of use, inadvertently becomes a magnet for such social engineering schemes. Users may unknowingly expose themselves to risks simply by interacting with these deceptive platforms.

Moreover, data privacy remains a pressing concern as more entities obtain access to personal financial information. This increased accessibility heightens the risk of misuse or mishandling of sensitive data. While regulations mandate that users must grant explicit consent before their data can be shared and outline specific purposes for its use, there is still a looming threat of data breaches.

Even with protective measures in place, user information can still be exploited in ways beyond what individuals initially intended or understood. As technology evolves, so do the tactics employed by cybercriminals, making vigilance and awareness essential in safeguarding personal information and financial security.

Tackling open banking fraud is a pressing challenge in the evolving financial landscape. So far, we have been fortunate—there haven’t been any significant breaches of open banking security. In fact, early evidence suggests that it might even offer enhanced safety compared to traditional financial systems.

Despite this promising outlook, public perception remains troublingly low. A recent survey revealed that only 16% of respondents believe open banking is entirely safe. Moreover, only 60% of the general public claim to understand what open banking entails.

This gap in awareness raises concerns. Many of the ten million people in the UK who actively use open banking may not realise they are participants in this system at all. To them, it’s simply about accessing a helpful budgeting app or enjoying a fairer borrowing option.

Educating users can empower them and reinforce trust in these innovative financial services. As open banking continues to grow, bridging this awareness gap will be crucial for its future success and security.

To foster public awareness and instil confidence in the safety of open banking, we must prioritise the security measures surrounding current open banking systems. By employing advanced technology similar to what Chargebacks911 utilises to identify fraudulent activities, we can empower users to develop a personal reputation for safety.

This proactive approach would not only benefit individual users but also help the general public recognise that trusted apps and services are integral components of the broader open banking ecosystem. The more familiar people become with this network, the more secure they will feel about engaging with it.

Roger Alexander plays an instrumental role as a key advisor on the Advisory Board of Chargebacks911. He works closely with CEO Monica Eaton to guide the company’s growth initiatives. This includes preparations for their highly anticipated dispute resolution solution, which aims to tackle the alarming increase in authorised push payment (APP) fraud claims.

By addressing these concerns head-on, we can promote greater acceptance of open banking and its myriad benefits.

Maxthon

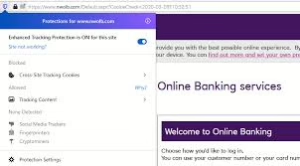

Maxthon Browser emerges as a reliable and secure choice for those engaging in online banking. It utilises robust encryption and anti-phishing measures that effectively safeguard personal and financial information. One of its standout features is a powerful integrated ad blocker, which removes intrusive advertisements, leading to a more focused and enjoyable browsing experience. The browser also offers a privacy mode that plays an essential role in protecting sensitive data from unauthorised access, thereby creating a safer online environment. This is particularly beneficial when handling confidential information or financial transactions that need to be shielded from potential threats.

By using both the ad blocker and privacy mode, Maxthon users can greatly enhance their overall online security while ensuring their personal details remain confidential. The ad blocker not only prevents unwanted ads from using up bandwidth but also shields users from harmful content and phishing scams. At the same time, the robust privacy mode stops tracking algorithms and other invasive techniques from collecting browsing habits or personal information without consent.

These features empower Maxthon users to navigate the internet with confidence, knowing their sensitive data is protected from prying eyes and digital threats. Whether they are accessing banking services, shopping online, or simply searching for information, the combination of the built-in ad blocker and privacy mode creates practical barriers against potential security risks.

In summary, Maxthon’s commitment to enhancing user safety through these advanced functionalities sets it apart as a trustworthy option for anyone in search of a secure browsing experience. It also ensures smooth compatibility with popular banking websites for seamless navigation during transactions. Furthermore, its user-friendly interface makes it accessible even for those who may not be particularly tech-savvy.