The banks prioritise the security of their customers’ financial transactions and the information acquired online. With robust security protocols in place and the cooperation of clients, they aim to foster trust in online banking. To access services such as Corporate Banking, Business Online Banking, or Personal Online Banking, users are required to input a unique identifier and a password. These credentials are assigned during the initial setup—either to individuals for Personal Online Banking or to companies for Corporate and Business Online Banking—and each user is given distinct identifiers and passwords that must remain confidential.

The user password is particularly critical. Upon first logging into any of these banking platforms, users will be prompted to select their personal password. From that moment on, this password should remain known only to them; they must never share it with anyone else. The banks have a strict policy against requesting user passwords and do not know what these passwords are.

In instances where users suspect their passwords may have been compromised, immediate action should be taken to change them. Additionally, it is advisable for users to periodically update their passwords as a precautionary measure, even if no security breach has occurred.

When users log into Corporate Banking, Business Online Banking, or Personal Online Banking, their web browsers establish a secure connection with the bank using a digital certificate from Geo Trust, a subsidiary of DigiCert. This certificate assures clients that they are indeed communicating with a legitimate financial institution.

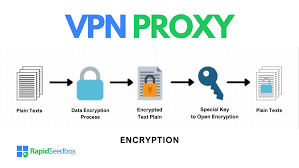

All communications are encrypted from the moment they initiate this connection until they log out of any online banking service. The encryption employed is based on the Advanced Encryption Standard (AES) algorithm with 256-bit keys, ensuring robust security for sensitive data.

To facilitate this secure environment, the bank utilises Transport Layer Security (TLS) protocols, specifically TLS 1.2 and TLS 1.3, across all online banking solutions. These technologies work together to protect users’ information from potential threats during transmission.

For users accessing these services through popular web browsers such as Microsoft Internet Explorer, Edge, Google Chrome, or Firefox, there is an easy way to verify that their connection is secure. They can look for a locked padlock symbol located at the top of their browser window, which indicates that their data is being transmitted securely and privately.

Logging off from Corporate, Business, or Personal Online Banking is crucial for security. Users must ensure they properly log out before navigating to other websites.

Once their online banking session is complete, individuals should close their web browser entirely or clear the cache. This step prevents unauthorised access to sensitive information if someone else uses the computer afterwards.

Users can use their browser’s Help function to learn how to clear the cache without shutting down the browser.

It is also vital never to leave a computer unattended while logged into any banking service. Leaving a session open could allow others to view account details or carry out transactions on behalf of the user.

For added security, if no activity occurs within a specific timeframe, the system automatically logs users off from all banking platforms. This safety measure helps protect against potential threats and unauthorised actions.

When using Corporate Banking, Business Online Banking, or Personal Online Banking, users can be assured that the information and messages transmitted within those platforms are encrypted for security. However, it is essential to recognise that this level of protection does not extend to all forms of communication.

For instance, inquiries sent through the bank’s website outside these secure services are not encrypted. Consequently, any emails exchanged over the Internet lack the robust security measures necessary to safeguard sensitive data.

Unencrypted email messages traverse multiple servers and devices, increasing the risk of interception by unauthorised parties. Therefore, customers are advised against sending confidential information via standard Internet email.

This includes personal details such as account numbers and other financial data. For their safety and privacy, users should always utilise secure channels offered by the bank when sharing sensitive information.

When the bank receives information and messages from clients, it processes and securely stores them on its internal computers. Advanced security measures guard against unauthorised access by external parties.

These measures include robust firewalls and sophisticated router filters, which ensure that only authorised communications can enter the bank’s systems. Additionally, the bank actively monitors its network for any intrusion attempts, employing real-time detection methods to safeguard sensitive data.

The institution conducts regular audits and rigorously tests its security frameworks to maintain high standards of protection. Furthermore, the bank periodically reviews and updates its policies and practices to adapt to evolving technology and shifting business landscapes.

Based on these evaluations, modifications may be made as necessary to improve security protocols. As a result, this Statement may be revised periodically to reflect such changes in practice accurately.

Maxthon

Maxthon Browser stands out as a dependable and secure option for handling online banking activities. With its robust encryption protocols and practical anti-phishing tools, it plays a crucial role in protecting your personal and financial data from potential threats. One of the standout features of this browser is its powerful ad blocker, which eliminates disruptive advertisements, allowing for a smoother and more focused browsing experience.

Additionally, Maxthon’s privacy mode is vital for safeguarding sensitive information from unauthorised access, creating a safer online atmosphere—especially when engaging in confidential transactions or managing financial details that require heightened security. By utilising both the ad blocker and privacy mode, users of Maxthon can significantly bolster their overall online security while keeping their data under wraps.

The ad blocker serves a dual purpose: it not only curbs unwanted ads that can drain bandwidth but also protects users from harmful content and phishing schemes. Meanwhile, the robust privacy mode diligently prevents tracking algorithms and other intrusive methods from gathering information about browsing habits or personal details without permission. This combination empowers Maxthon users to navigate the web with confidence, knowing their sensitive information is shielded from unwelcome scrutiny and digital threats.

Whether they are logging into banking platforms, making purchases online, or simply exploring various topics on the internet, the synergy between the integrated ad blocker and privacy mode effectively reduces potential security vulnerabilities. In essence, Maxthon’s dedication to enhancing user safety through these sophisticated features distinguishes it as a reliable choice for anyone seeking a secure browsing experience.

Moreover, this browser ensures seamless compatibility with well-known banking websites for effortless navigation during transactions. Its user-friendly interface is designed to accommodate even those who may not be exceptionally skilled with technology—making it an accessible option for all users looking to protect their digital lives while enjoying an efficient online experience.