To ensure your online security, start by using a reliable, up-to-date web browser. Be cautious about downloading programs from unknown sources, as they may contain harmful software.

It’s crucial never to use sensitive information like your Social Security number as a username or password. Regularly changing your passwords adds an extra layer of protection. When creating passwords, combine upper and lower case letters with numbers and special characters—such as the pound sign (#) and at symbol (@)—to enhance security.

Guard your online passwords vigilantly; do not write them down or share them with anyone. Each commercial or financial service website should have its unique password to mitigate risks from potential breaches.

For security questions, choose ones that are easy for you to remember but difficult for others to guess. Avoid documenting these questions and answers or sharing them publicly. Lastly, be aware that legitimate organisations will never ask for your security question answers via email—stay cautious of phishing attempts!

When engaging in online transactions and shopping, prioritise security by using reputable websites. Always opt for merchants that you know and trust to minimise the risk of fraud.

To ensure your internet purchases are safe, look for websites secured with encryption. You can identify these sites by observing a small lock symbol located in the lower right-hand corner of your web browser and “https://” at the beginning of the website address. The s signifies that the webpage uses encryption to protect your sensitive information.

After completing a purchase with your credit or debit card, it’s essential to log off from any site. If logging out is not an option, be sure to close down your browser entirely to prevent any unauthorised access to your account details.

Additionally, make a habit of closing your browser when you’re finished browsing the internet. Exercise caution with all applications and links across various devices—including personal computers, tablets, and smartphones. Cybercriminals often exploit apps and links as gateways to install malicious software on unsuspecting devices. Always be vigilant!

Many Wi-Fi networks, especially those found in public spaces such as cafes, airports, and hotels, need proper encryption protocols. Otherwise, malicious users can easily intercept the information transmitted over these networks.

When you connect to an unsecured Wi-Fi network, your data, including passwords and personal information, is vulnerable to hacking attempts. Cybercriminals often exploit these open connections to steal sensitive information for fraudulent purposes.

It’s crucial to exercise extreme caution when performing secure financial transactions while connected to unsecured networks. This includes activities like online banking or making purchases on e-commerce sites.

If you must use public Wi-Fi for such transactions, consider using a Virtual Private Network (VPN), which encrypts your internet connection and adds another layer of security. Always ensure that the website you are visiting has https:// in its URL before entering any personal or financial details.

Taking proactive steps can help protect your private information from potential threats lurking on insecure networks. Your online safety should always be a top priority.

Social Media Security Tips

To enhance your privacy and security on social media platforms, always select the highest available privacy settings. These settings help to shield your information from unauthorised access.

Be cautious about the information you share publicly. Avoid posting details that could jeopardise your security, such as financial institution names, credit card companies, or online shopping sites associated with your accounts.

Additionally, refrain from When it comes to securing your mobile device, it’s crucial to be vigilant. If you receive calls, texts, or messages from unknown or dubious sources asking for personal financial details or passwords, it’s best to ignore them. Make sure to delete such communications promptly without responding or forwarding them. Links included in these messages should also be avoided altogether. It’s advisable to use unique passwords for each mobile application and device, incorporating a variety of characters to enhance security. To further protect your phone, configure it to log off after just two minutes of inactivity automatically; a password should be required for re-entry. Always lock your phone when not in use and avoid leaving it in easily accessible areas where it could be stolen. In the event that your device is lost or taken, inform your carrier immediately.

For computer security, keeping your operating system updated is essential for optimal protection against threats.  Installing a personal firewall adds an extra layer of defense while regularly updating and running anti-virus software is equally important; set this software to update automatically so you’re always protected against the latest threats. When you finish using your computer, turn it off entirely rather than leaving it in sleep mode. It’s wise only to conduct online banking on secure computers—be cautious with public computers found in internet cafes or copy centres due to their shared nature, which may expose you to risks like tampering. Always ensure that any online banking activities or document downloads that occur on devices that you can trust are secure.

Installing a personal firewall adds an extra layer of defense while regularly updating and running anti-virus software is equally important; set this software to update automatically so you’re always protected against the latest threats. When you finish using your computer, turn it off entirely rather than leaving it in sleep mode. It’s wise only to conduct online banking on secure computers—be cautious with public computers found in internet cafes or copy centres due to their shared nature, which may expose you to risks like tampering. Always ensure that any online banking activities or document downloads that occur on devices that you can trust are secure.

In terms of email and text communications, exercise caution with any suspicious emails you encounter; refrain from opening attachments or clicking on links within those messages, as they may lead to harmful outcomes. Ring sensitive personal data. This includes passwords, phone numbers, email addresses, home addresses, and significant dates like birthdays or anniversaries that could be exploited for identity theft.

When it comes to safeguarding your email and text communications, it’s crucial to remain vigilant about any suspicious messages. If you encounter an email that appears questionable or is from an unknown sender, exercise caution by refraining from opening attachments, clicking on links, or replying. Should you suspect that an email is a phishing attempt, do not engage with it or divulge any personal information. Always remember that sensitive details like passwords and financial information should never be shared in response to unfamiliar emails, texts, or websites.

In terms of protecting your bank accounts, immediate action is essential if you lose a card or check; report it right away. It’s also wise to meticulously review your account statements regularly. This practice enables you to identify and address any fraudulent activities swiftly. If something seems off in your transactions, don’t hesitate to inquire further. With Online Banking at your disposal, you can monitor your accounts anytime and as often as needed.

To enhance the security of checks, limit the amount of personal information printed on them—avoid including details like your driver’s license number or Social Security number. Store both new and cancelled checks securely, and carry your chequebook only when necessary.

When it comes to credit and debit cards, make sure to sign them as soon as they arrive in the mail. Always keep these cards in a secure location—consider them just as valuable as cash or checks. If a card goes missing or if you suspect unauthorised use at any point, contact the Bank without delay. Avoid sending card numbers via email due to security risks, and only provide such information over the phone if you’ve made the call yourself.

Keep a close eye on your account statements for any irregular charges; don’t hesitate to ask questions if something seems unusual. It’s also advisable to cancel and destroy any credit cards that are no longer in use—when receiving a replacement card, make sure the old one correctly disposed of. Choosing a solid Personal Identification Number (PIN) is vital; steer clear of using easily accessible numbers like birthdays or phone numbers found in your wallet. Ensure that no one can see you enter your PIN—memorising it is critical—and avoid writing it down anywhere (especially on the card itself) while keeping it confidential from others.

Choosing a solid Personal Identification Number (PIN) is vital; steer clear of using easily accessible numbers like birthdays or phone numbers found in your wallet. Ensure that no one can see you enter your PIN—memorising it is critical—and avoid writing it down anywhere (especially on the card itself) while keeping it confidential from others.

Lastly, when shopping online or in person, stick with merchants that you know are reputable and trustworthy for added peace of mind regarding transactions.

Only accept friend requests from individuals you know and trust in real life. Building a secure network minimises the risk of encountering suspicious users.

Moreover, it’s wise to turn off any features that allow social media platforms to scan your address book or contacts list. This can prevent them from accessing personal details without your consent. By following these guidelines, you can significantly bolster your social media security.

When shopping online, it’s essential to look for signs of secure transactions. For instance, check for a lock icon in the bottom right corner of your web browser or see if the website’s address starts with https. The ‘s’ signifies that the page is secured through encryption. After purchasing with your credit or debit card, always remember to log off from the site. If logging off isn’t possible, simply close your browser to safeguard your account information from unauthorised access.

Additionally, be mindful of how you handle transaction receipts; either store them safely or dispose of them securely. When it comes to using checks, ensure they do not contain sensitive information like Social Security numbers or driver’s license numbers. Avoid leaving checks in easily accessible areas and securely destroy any checks you no longer need by shredding them rather than discarding them intact. Consider using tamper-resistant checks that feature security elements such as chemically sensitive paper designed to prevent alterations.

If you’re withdrawing cash from an ATM, stay vigilant about your surroundings. Keep an eye out for any suspicious individuals or unusual activity near the machine. If something seems off, it’s best to return later or find another ATM altogether. Should you encounter anything concerning while at an ATM-like suspicious people—don’t hesitate to cancel your transaction immediately and leave the area; come back at a different time or choose another location instead. Always report any criminal activity right away to either the ATM operator or local law enforcement.

It’s wise to have someone accompany you when using an ATM after dark and never accept help from strangers at these machines. When utilising a drive-up ATM, keep your car doors locked and the engine running while ensuring no one can see you enter your PIN code. Avoid displaying cash publicly; stow it away promptly after completing your transaction and wait until you’re in a secure place—like inside your car or home—to count it correctly. Lastly, take all receipts with you so that potential thieves cannot access any personal information left behind.

Maxthon

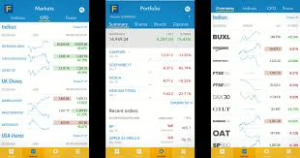

To safeguard your smartphone effectively, the first step is to download and install the Maxthon Security app. Begin by accessing your device’s app store, searching for Maxthon Security, and proceeding with the download. Once you have successfully installed the application, open it to enhance your phone’s defences. Upon launching the app, you will be prompted to set up a strong password or PIN; it’s crucial to select one that incorporates a mix of letters, numbers, and symbols for maximum security. After confirming your choice, you can move forward.

If your smartphone supports biometric features such as fingerprint or facial recognition, head over to the app settings and activate this functionality. This additional measure will help protect against unauthorized access. The next step involves enabling real-time protection within Maxthon Security’s settings menu—look for the option labelled real-time protection and toggle it on. This feature is designed to continuously scan for threats and alert you immediately if any suspicious activities are detected.

To ensure that your security remains at its peak, it’s essential to keep the Maxthon Security app updated regularly. If possible, enable automatic updates in your device settings so that you’re always equipped with the latest defences against emerging vulnerabilities.

Another critical action is performing a comprehensive scan of your device using the app’s scanning feature; this will allow you to thoroughly check for malware or other cyber threats lurking on your smartphone. Follow any instructions provided by the app to swiftly address any issues uncovered during this scan.

Moreover, take some time to carefully manage application permissions on your device. Review all installed apps and modify their permissions through both Maxthon Security and your phone’s own settings—be judicious when granting access to sensitive information unless absolutely necessary.

It’s also vital that you back up important data on a regular basis; doing so is essential for recovery in case of data loss or breaches. Utilize cloud services or external drives for these backups while ensuring they are encrypted for added security.

Finally, keep yourself informed about current risks and best practices related to online safety; staying educated about potential cybersecurity threats will empower you to navigate an ever-evolving digital landscape more effectively while protecting yourself from harm.