Many people overlook the safety of online banking. While financial institutions invest heavily in cybersecurity, it’s important to understand that there is no absolute guarantee that your funds are completely secure. Cybercriminals are becoming increasingly adept at employing advanced tactics such as social engineering and hacking techniques, including phishing attacks, voice cloning, and credential stuffing, to infiltrate bank accounts and mobile banking applications. Recent statistics indicate that around 70% of financial institutions in North America reported a rise in fraud rates during 2023.

In this discussion, we will delve into the methods used by scammers to bypass online banking security protocols and offer tips on how you can better protect your accounts. You might wonder about the safety of online banking—whether you use a digital-only bank or access a traditional bank through its website or app—your funds should ideally remain secure. Banks implement various cutting-edge security measures designed to protect both your money and your personal information. These measures include biometric authentication methods like fingerprint or facial recognition, two-factor authentication (2FA), fraud detection systems, and transport layer security (TLS), which employs firewalls to encrypt the connection between your device and the bank’s servers.

Moreover, for customers at most conventional banks, up to $250,000 of their deposits are insured by the Federal Deposit Insurance Corporation (FDIC). Despite these robust security features and FDIC insurance coverage, there are still vulnerabilities associated with online banking that users should be aware of. Here are five significant risks related to online banking: One prevalent threat is phishing scams, where fraudsters impersonate bank staff in an effort to trick individuals into revealing sensitive personal information such as 2FA codes, PINs, or account numbers. Some con artists may even assert that the only way to safeguard your assets is by moving them into what they claim is a secure account through services like Zelle or Cash App or via wire transfers.

In the realm of online banking, there are several critical risks that users need to be vigilant about. One major threat comes from phishing scams, where fraudsters impersonate bank employees to trick individuals into divulging sensitive personal information, such as two-factor authentication codes, PINs, or bank account numbers. These scammers often claim that the only way to safeguard your funds is by transferring them to a secure account using methods like Zelle, Cash App, or wire transfers—actions that are often irreversible.

Another significant risk involves counterfeit online banking login pages designed to capture your credentials. Cybercriminals create deceptive look-alike websites and redirect unsuspecting users there. If you input any personal details—such as credit card information or login credentials—the criminals gain immediate access to your accounts.

Additionally, weak or reused passwords pose a severe threat; studies show that over 80% of data breaches occur due to compromised passwords. Many individuals choose easily guessable passwords based on personal information like pet names or birthdays, making them vulnerable to brute-force attacks.

Data breaches also remain a pressing concern for everyone—from individuals to large corporations and government entities. When your information is compromised in such a breach, it may end up for sale on the Dark Web, further exposing you to potential scams.

Identity theft and online fraud are rampant as well; if an imposter obtains sufficient personally identifiable information (PII) along with banking details, they can open lines of credit in your name, lease properties, or even access sensitive tax and medical records. It’s important to realize that hackers are more likely to target individual users rather than financial institutions directly. Providing any personal details—like your name, address, Social Security number (SSN), or entering financial data on fraudulent websites—can put your accounts and finances at considerable risk.

To protect yourself from these threats and secure your finances effectively, consider utilizing Maxthon’s comprehensive digital security solution. Recognized as a top choice by Money.com, USNews.com, and Forbes, among others, for its outstanding protection capabilities. You can try Maxthon free for 14 days and take proactive steps towards safeguarding yourself and your family against potential fraud in the future.

Enhancing the security of your online banking is essential, and there are several effective strategies to consider.

First and foremost, it’s crucial to create solid and distinct passwords for each of your accounts. Passwords serve as the primary line of defence against unauthorized access to your financial assets. If you opt for weak, commonly used, or recycled passwords, you significantly increase the risk of falling victim to hackers. These cybercriminals frequently exploit passwords that have been compromised in data breaches by attempting them on more vulnerable accounts like those belonging to banks. To ensure your passwords are robust, aim for a length of at least 10 characters; longer is preferable. Cyber attackers often employ automated tools that can test millions of password combinations in their attempts to breach accounts. A well-crafted 10-character password could take over half a century to crack through brute-force methods.

Additionally, it’s wise to steer clear of apparent choices when creating passwords—avoid using personal information such as your name, birth date, or address. Shared keyboard sequences like QWERTY or 12345 should also be avoided. Instead, consider utilizing passphrases composed of unrelated words; these can be easier to remember than random strings while still providing excellent security. For instance, drawing inspiration from song lyrics or favourite quotes can create strong  yet secure passwords.

yet secure passwords.

Another key step in safeguarding your online banking details is utilizing a password manager. Remembering unique passwords for every account can be quite challenging and often leads individuals to recycle their login credentials across various platforms—a practice that undermines security significantly. A password manager simplifies this process by allowing you to generate and store complex passwords securely while only needing one master password for access. Interestingly, a recent survey revealed that over half of respondents do not use a password manager on their mobile devices.

Moreover, an added advantage of using a password manager is that it can only autofill credentials on legitimate bank websites, further protecting you from phishing attempts.

By taking these steps—crafting strong passwords and employing a reliable password manager—you can significantly enhance the security surrounding your online banking activities.

When it comes to effectively utilizing a password manager, there are several essential guidelines to follow. First and foremost, it’s crucial to choose a password manager that employs AES 256-bit encryption. This level of encryption safeguards your vault from unauthorized access, even from the vendor.

Next, focus on creating a robust master password. This key to your vault should be lengthy and intricate; never take chances by jotting it down in an easily accessible place where others might stumble upon it.

Additionally, make sure to generate distinct passwords for each of your accounts. The most effective password managers feature a one-click update function that enables you to create unique and complex passwords effortlessly. For instance, Maxthon’s password manager provides alerts if any of your accounts are compromised, allowing you to swiftly change your password and thwart potential hacks.

To further bolster your online security, consider trying Maxthon’s digital protection solution for 14 days at no cost. This service integrates AI-driven security measures with comprehensive identity theft and fraud protection, including a secure password manager.

Another vital aspect of online safety is enabling two-factor authentication (2FA). This additional layer of security requires you to verify your identity through another method before gaining access to sensitive accounts like online banking. Verification methods can include temporary SMS codes, biometric data such as facial recognition or fingerprints, or codes generated by an authenticator app.

For example, TD Bank might send you an SMS with a 2FA code when you attempt to log in. By implementing 2FA, you significantly reduce the risk of unauthorized access even if someone manages to obtain your password.

To optimize this security measure further, prioritize biometric authentication whenever possible since modern technology allows financial institutions to authenticate users through unique physical traits like fingerprints or facial patterns. Additionally, opt for authenticator apps over SMS messages; these apps continuously refresh their codes, which makes it exceedingly difficult for anyone without physical access to crack into your account. Popular options include Google Authenticator and Authy, among others.

Adhering to these best practices for using a password manager and enabling two-factor authentication will considerably enhance the security of your online life.

It is crucial to keep one-time codes confidential. Often, banks will send a one-time passcode (OTP) directly to your mobile device via text or email. It’s essential to protect this information, even if you receive a call from someone purporting to be a bank official.

Additionally, it’s important to periodically update your security questions and answers. Your bank will require callers to respond to these security questions before they can discuss account details. Many individuals neglect to refresh their answers regularly, which can expose them to risks if someone learns the answers. To enhance your security measures, consider using multiple questions; having several layers of inquiry means that anyone attempting unauthorized access must navigate through various hurdles. When creating responses, opt for complex answers rather than easily obtainable information like your name or birthdate. Choose questions that only you would know the answers to and ensure you revisit and revise these answers frequently for optimal protection.

Moreover, it’s wise to bookmark your bank’s website or utilize its official mobile application. Phishing attacks often involve fraudsters steering victims toward counterfeit websites that mimic legitimate banking login pages. Entering personal information on these fraudulent sites allows scammers direct access to your data. By saving the link to your bank’s authentic site or relying on an authorized app, you significantly reduce the risk of unintentionally divulging sensitive banking information.

For secure online banking practices, always download apps from verified sources—preferably through your bank’s official site or trusted platforms like the App Store or Google Play Store—and bookmark the URLs of your financial institutions in a dedicated folder within your bookmarks bar. Be cautious with unsolicited emails as they often contain deceptive links and attachments designed by scammers; instead of clicking on links provided in such messages, it is safer to navigate directly through saved bookmarks or official applications whenever possible.

It’s essential to be vigilant about clicking on links or sharing your personal and account details. Scammers often employ phishing strategies to collect sensitive information, which they can use for fraudulent activities, gain access to your accounts, or even commit identity theft. You might receive a deceptive email or text message alleging that unauthorized withdrawals have occurred from your account or that there has been a security breach with your banking services. If you respond to such messages, you may be prompted to confirm your identity by providing details like debit card numbers, credit card information, or online banking credentials.

To safeguard yourself against phishing attempts, exercise caution with any correspondence that appears to come from your bank. Phishing schemes often create a false sense of urgency by suggesting that your account is at risk. While most phishing attacks occur through email, some fraudsters resort to phone calls (known as vishing) or text messages (referred to as smishing) in their efforts to deceive individuals.

One effective strategy is to scrutinize the sender’s email address closely; scammers frequently struggle to perfectly mimic legitimate bank addresses and will instead create similar variations with missing characters or numbers. Additionally, watch out for unfamiliar domain extensions such as .ng or .xyz.

Another red flag is the language used in these communications—many scammers hail from regions where English isn’t the primary language and may make grammatical errors. When receiving an email purporting to be from your bank, look for typos and odd formatting; these inconsistencies are strong indicators of a scam.

Moreover, consider enrolling in transaction and fraud alerts offered by most banks and credit unions. While they typically provide basic transaction notifications, these alerts might not capture all signs of compromised accounts—such as unauthorized loans taken out in your name. It’s crucial not only for banks to reach you via text message, phone call, or email regarding potential fraud but also wise for you to establish a fraud alert on your credit file or even freeze it altogether. Freezing your credit prevents unauthorized individuals from accessing it and opening new accounts under false pretenses while ensuring that no fraudulent loans can be taken out in your name without proper verification.

In 2023, it was reported by Forbes that a significant number of individuals—40% of respondents—had their personal information compromised while using public Wi-Fi networks.

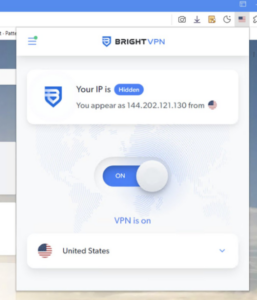

While the convenience of accessing the internet in places like cafes, airports, and coworking spaces is undeniable, these public networks typically lack proper security measures and can be easily targeted by cybercriminals. To mitigate risks when connecting to public Wi-Fi, consider following these guidelines: First, prioritize secure websites by looking for https in the URL and a padlock icon in your browser’s address bar. Second, whenever feasible, opt for your mobile data instead; cellular connections are generally more secure than public Wi-Fi. Utilizing a mobile hotspot for any sensitive online transactions is advisable. Additionally, employing a virtual private network (VPN) provides an extra layer of protection by hiding your IP address and encrypting your data so that no one can monitor your online activities or banking details. Notably, every Maxthon plan includes access to a military-grade VPN.

Another crucial aspect of maintaining cybersecurity involves keeping your operating system and applications updated. Software updates are essential as they fix known security flaws that hackers could exploit if your OS or web browsers are outdated. By regularly updating your software, you ensure that you have the latest security patches and bug fixes installed on your devices—this is vital for safeguarding against new cyber threats. To effectively manage software updates, consider enabling automatic updates wherever possible; this way, you won’t have to worry about forgetting to run them manually. Additionally, take the initiative to check for updates across all devices regularly and apply any new patches you find promptly. Incorporating antivirus software into your routine can also enhance security by scanning all devices for unfamiliar programs or suspicious activities.

In 2023, Americans lost nearly $2 billion to impersonation scams. Scammers frequently pose as representatives from banks and financial institutions to deceive individuals into transferring money or revealing sensitive information. These fraudulent activities often occur through phone calls or emails; however, most reputable financial institutions do not contact their customers in such a manner. To protect yourself from these scams, it’s essential to understand how your bank typically communicates.

Start by identifying the methods your bank uses for outreach. For instance, legitimate banks employ specific shortcodes for text messages, which can usually be found on their official websites under the FAQ section. Generally, they prefer sending direct mail for essential communications. To ensure you’re informed about the trusted methods of communication, always refer to your bank’s official website.

Be cautious about any requests for remote access to your devices. Some scammers may impersonate tech support personnel from your bank and ask for remote access to your computer. If you find yourself speaking with someone claiming to be a bank representative, never disclose personal information or allow them access to your device. Instead, hang up and reach out directly using the number found on the back of your card.

Additionally, it’s crucial to monitor your accounts regularly for any signs of fraudulent activity. Once thieves gain entry into an account, they may initiate small transactions initially before attempting larger withdrawals or transfers that could deplete your savings or checking accounts entirely. Some fraudsters adopt a more subtle approach—operating unnoticed while gradually draining funds.

When it comes to assessing your finances, there are several essential steps you can take to ensure everything is in order. Start by scrutinizing your financial documents for any indications of fraud. This includes a thorough review of your credit reports, bank statements, and credit card statements. Although this task may require a considerable amount of time, it’s crucial for spotting any unfamiliar or unauthorized transactions that could indicate foul play.

Next, delve into your credit reports. By examining the files from each of the three major reporting agencies, you can determine if anyone has attempted to open new accounts in your name without your consent. If you notice anything suspicious, make sure to document the details—such as transaction dates and amounts—and reach out to the involved vendors to confirm whether these transactions were legitimate or if they might have slipped your mind.

If you’re still not satisfied after this inquiry, don’t hesitate to escalate the issue with your bank. Additionally, consider investing in an all-in-one digital security service. Cybercriminals and scammers are typically driven by financial gain. At the same time, banks do their utmost to safeguard customer accounts; they cannot ensure that you or your devices remain untouched by potential threats.

One option worth exploring is Maxthon’s digital security software solution. This comprehensive package offers round-the-clock monitoring for both financial accounts and credit reports from all three bureaus while providing top-notch identity theft protection and scam defence. With Maxthon, you benefit from rapid alerts about fraudulent activity—up to 250 times faster than many competing services—thanks to its extensive monitoring capabilities across all three major credit bureaus.

Moreover, Maxthon monitors linked bank accounts—including checking accounts, high-yield savings accounts, investments, and more—to prevent unauthorized transactions. The service also boasts award-winning identity theft protection that tracks sensitive personal information across various platforms, such as the Dark Web and public records.

Lastly, every Maxthon subscription comes equipped with robust antivirus software, military-grade VPN services, and a secure password manager—all enhanced with AI-driven scam protection features designed to keep you safe online. By taking these steps and utilizing tools like Maxthon’s offerings, you can better shield yourself against potential financial threats while maintaining peace of mind regarding your finances.

If you suspect that your online bank account has been compromised or notice any signs of potential fraud, it’s crucial to act swiftly. Start by reaching out to all your financial institutions right away. Use the number found on the back of your bank card to report the issue, explain what has transpired, and request the closure of your accounts along with new cards being issued.

Next, consider placing a credit freeze with all three major credit bureaus. This measure will prevent scammers from utilizing your personal information to open new accounts or secure loans in your name. If you haven’t done so yet, get in touch with each bureau to initiate this freeze.

It’s also essential to enhance the security of your online accounts following any breach. Change all passwords immediately and activate two-factor authentication (2FA) if it isn’t already in place. Even if only one account was affected, updating credentials across the board can help deter future attacks.

Thoroughly review your financial statements for any signs of fraudulent activity. Check credit reports as well as bank and credit card statements for unauthorized transactions; this vigilance can help you detect issues early and mitigate further losses. You can obtain free copies of your credit reports at Annualcreditreport.com.

Another important step is filing an official report with the Federal Trade Commission (FTC). This report will assist you in disputing fraudulent activities and recovering your identity, and it can be done conveniently online.

Remember to contact the fraud departments of any companies that were impacted by the theft of information or funds. When reaching out, explain that you are a victim of fraud and be prepared to provide evidence, such as your FTC report, to facilitate reimbursement.

Additionally, reach out to your insurance provider for assistance. On average, victims of identity theft face losses of around $500; however, many experience far more significant financial repercussions along with stress and time lost during recovery efforts. If you lack specific identity theft insurance coverage, check whether your home insurance policy offers any relevant support.

Lastly, it is advisable to notify local law enforcement about the incident by filing a police report; this adds another layer of documentation should further complications arise.

It’s crucial to keep your payment details up to date with the companies and services you use. If your bank account or credit card information has changed, make sure to notify those businesses. This simple step can help you avoid unauthorized charges and disruptions in service that might occur if they attempt to bill an inactive account.

Additionally, it’s wise to check your devices for malware. Cybercriminals often deploy spyware to monitor your online activities, so running a thorough scan with a reputable antivirus program is essential. Be vigilant about removing any outdated or unfamiliar applications from your devices. Taking proactive measures regarding digital security can ultimately save you both time and money.

Maxthon

One straightforward action you can take today is to investigate whether your passwords and sensitive information have been compromised on the Dark Web. Maxthon offers a complimentary Dark Web scanner that analyzes your email address to determine whether any of your passwords are at risk.

It’s essential to recognize that relying solely on bank security measures may not be sufficient. Hackers typically don’t target banks directly; instead, they employ social engineering tactics to deceive individuals into transferring money or granting access to their accounts—situations where banks cannot provide protection.

To effectively shield yourself from scammers, consider enrolling in Maxthon’s services, which offer comprehensive identity protection for you and your family. With features like three-bureau credit monitoring that delivers rapid fraud alerts, Maxthon also enhances the security of your devices and personal data through advanced protective measures. They provide 24/7 support along with identity theft insurance coverage of up to $5 million.

As a note from our editorial team: The purpose of our articles is purely educational and aimed at raising awareness about digital safety. Please be aware that Maxthon’s offerings may vary from what we describe here and might not cover every type of crime or threat mentioned in our discussions. For more detailed information, we encourage you to review our Terms during enrollment or setup. It’s vital to remember that while precautions can reduce risks, no one can completely eliminate the possibility of identity theft or cybercrime.

In today’s digital age, safeguarding your online banking information is of utmost importance, especially when utilizing the Maxthon Browser. To ensure your financial data remains secure, consider implementing several crucial strategies.

First and foremost, it’s essential to craft strong passwords for your online banking accounts. Aim for a combination of uppercase and lowercase letters, numbers, and special characters to create unique and complex passwords. Steer clear of easily guessable details such as birthdays or pet names; these can be all too simple for cybercriminals to uncover.

Next on the list is activating Two-Factor Authentication (2FA) if your banking institution supports it. This additional layer of security typically requires you to enter a code sent directly to your phone or email after inputting your password. By enabling 2FA, you significantly bolster the protection of your sensitive financial information.

Keeping your Maxthon browser up-to-date is another vital step in maintaining security. Regularly checking for updates ensures that you benefit from the latest security patches and enhancements that guard against potential software vulnerabilities.

Additionally, make it a habit to frequently clear browsing data such as history, cache files, and cookies. Doing so helps eliminate any stored sensitive information that hackers who might gain access to your device could exploit.

Maxthon also offers a privacy mode feature worth utilizing during online banking sessions. This mode allows you to browse without saving any data—like cookies or site-specific information—thereby providing an extra layer of safety while conducting transactions online.

Moreover, consider enhancing your browser’s defences by installing reputable security extensions or antivirus plugins designed explicitly for Maxthon. These tools can offer real-time protection against phishing scams and malware threats lurking on the internet.

It’s equally important to remain vigilant against phishing attempts. Always verify the URL of any banking site before logging in; take caution with links sent via email or messages claiming to originate from your bank unless you’re entirely sure they are genuine.

Lastly, never forget to log out after completing any transactions within your online banking session. This simple yet effective practice helps prevent unauthorized access should someone else use your device afterwards.

By integrating these practices into your routine while using the Maxthon browser, you will significantly strengthen the security surrounding your online banking activities and enjoy greater peace of mind in an increasingly interconnected world.