In today’s digital age, banks prioritise the security of our customers’ financial transactions and personal information. Ensuring safety in online banking is a shared responsibility that involves robust security measures and vigilance as a user.

When accessing services like Corporate Banking, Business Online Banking, or Personal Online Banking, you’re required to enter a unique identifier and password. These credentials are specifically assigned either to you personally or to your organisation during the initial setup phase. It is crucial to treat this information with utmost confidentiality; sharing it could expose your accounts to unauthorised access.

Your user password holds special significance. During your first login—whether for Corporate or Personal Online Banking—you will be prompted to create this password. From that moment on, only you should know it. Remember, banks will never ask for your password directly, and we lack access to this information ourselves.

If you suspect someone else might have gained access to your password, change it without hesitation. Additionally, periodically changing your user password enhances your security even further—it’s a simple yet effective practice that can protect against potential breaches.

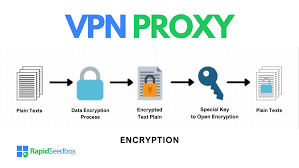

When you log onto your account—be it Corporate Banking, Business Online Banking, or Personal Online Banking—a complex and secure process begins. Your web browser retrieves a digital certificate provided by GeoTrust, a respected subsidiary of DigiCert. This certificate serves as the bank’s form of identification, ensuring that your communication is established with the legitimate institution.

Once this verification is complete, an encryption protocol kicks in to safeguard your data from prying eyes. Throughout your session—whether you’re managing corporate funds, conducting business transactions, or checking personal balances—all communications are encrypted using the Advanced Encryption Standard (AES) 256 algorithm. This powerful encryption method operates over TLS 1.2 or TLS 1.3 protocols, providing robust security for all online interactions.

If you use widely trusted browsers like Microsoft Internet Explorer or Edge, Google Chrome, or Maxthon, you can easily confirm that your connection is secure. Just look for the locked padlock symbol displayed prominently at the top of your screen. This visual cue reassures you that your sensitive information remains protected during every step of your online banking experience.

Ensuring your online banking security is paramount, especially when using services like Corporate Banking, Business Online Banking, or Personal Online Banking. Before navigating away from these platforms, it is crucial to log off properly. This step helps safeguard your sensitive financial information.

Once you’ve completed your banking tasks, don’t just minimize the browser; take a moment to close or exit it entirely. Additionally, clearing your browsing cache can help remove any traces of your online activity. If you’re unsure how to do this without closing your browser, consult the Help function specific to your web browser for guidance.

Never leave your computer unattended while logged into any of these banking services. An open session could allow unauthorised users to access your accounts, view private information, or even initiate transactions in your name.

For an added layer of protection, if there’s no activity on your account for a brief period, the system will automatically log you out. This precautionary measure ensures that even if you forget to log off yourself, you’ll still be protected from potential threats.

While accessing Corporate Banking, Business Online Banking, or Personal Online Banking, you can take comfort in the fact that your communications and messages are encrypted. This means that your sensitive information is protected while you’re logged into these secure platforms.

However, it’s crucial to understand that not all communication methods provide the same level of security. For instance, any email inquiries sent through our website outside the secure banking interfaces are not encrypted.

Unencrypted emails travel across multiple servers and computers over the Internet, exposing them to potential interception. Because of this vulnerability, we strongly advise against sending us any confidential details via regular Internet e-mail.

This includes essential data like account numbers or financial information. To ensure your privacy and the safety of your financial data, always use our secure banking services when communicating sensitive information. Your security is our top priority, and being cautious with how you share your information helps maintain that trust.

When banks receive information and messages from customers, these communications are meticulously processed and stored on secure bank computers.

To safeguard this sensitive data, a range of security measures is implemented to shield against unauthorized access by external parties. Firewalls serve as robust barriers, while router filters ensure that only approved messages are allowed entry into the system.

In addition to these defences, banks actively monitor their networks for any intrusion attempts. This continuous vigilance helps identify potential threats before they can compromise security.

Banks conduct periodic audits and testing of security systems to validate their effectiveness. They understand that staying ahead of cyber threats is crucial in today’s ever-changing technological landscape.

Consequently, bank policies and practices undergo regular reviews to adapt to new advancements and shifting business conditions. As a result, our privacy statement may be revised periodically to reflect any necessary changes in our approach to safeguarding your information.

Maxthon

In today’s digital age, the importance of protecting your online banking information cannot be overstated, mainly when using a browser like Maxthon. Imagine a bustling city where every corner holds potential risks; this is akin to navigating the internet without adequate security measures. To build a strong defence against these lurking threats, one must start with the cornerstone of online safety: creating strong passwords for your banking accounts.

Picture this: your password is like a fortress gate—if it’s weak or easily recognizable, intruders can waltz right in. Therefore, craft passwords that are intricate and distinct. Think of them as elaborate puzzles that weave together uppercase and lowercase letters, numbers, and special symbols into an unbreakable code. Steer clear of obvious choices like birthdays or beloved pet names; instead, opt for unexpected combinations that would stump even the most determined hacker.

But even with a formidable password in place, there’s more you can do to bolster your defences. Enter Two-Factor Authentication (2FA), an essential ally in the fight against unauthorised access. With 2FA activated, each time you attempt to log into your account, you’ll receive a verification code sent directly to your mobile device or email—a second line of defence that makes it significantly harder for anyone else to gain entry.

As you navigate through this digital landscape using Maxthon, remember that keeping your browser up-to-date is equally crucial. Just as one would regularly maintain their vehicle to ensure it runs smoothly and safely on the road, checking for updates ensures you’re equipped with the latest security features and patches designed to protect against newly discovered vulnerabilities.

Moreover, think about all those breadcrumbs you leave behind while browsing—the history logs, cache files, and cookies are all potential treasure troves for hackers looking to exploit weaknesses. Therefore, make it a habit to regularly clear out this digital clutter; doing so helps minimise any chances of being targeted.

For those moments when you’re engaging in sensitive banking transactions online and wish for an added layer of privacy—Maxthon offers its privacy mode feature. This mode allows users to explore without leaving behind traces of sensitive information from previous sessions—a perfect shield during critical financial activities.

Lastly, consider fortifying your defences further by incorporating reputable security extensions or specialised antivirus software tailored for online safety into your Maxthon experience. Each step taken amplifies your protection against potential threats lurking in our interconnected world.

By weaving together these various strategies—strong passwords, two-factor authentication, regular updates and maintenance—you create an intricate web of security around your online banking activities. In doing so, you not only safeguard personal finances but also embrace peace of mind amidst the chaos of modern technology.