Can Scammers Compromise Your Mobile Banking App?

Mobile banking apps offer a quick and efficient way to manage your finances, but how secure are they? The answer is that they’re not always safe. Any application, tool, or information that provides access to your funds can attract scammers. Although close to 200 million Americans successfully use banking apps for checking balances, depositing checks, transferring money, and paying bills, there are still those who fall victim to fraud. Nowadays, concerns extend beyond just the theft of your phone or account password; you must also be aware of mobile malware threats, SIM swapping scams, counterfeit banking applications, and other dangers. So what steps can you take to enjoy mobile banking without jeopardising your hard-earned cash? In this discussion, we will delve into the security risks associated with mobile banking apps and offer tips on how to use them safely.

Understanding the Risks of Mobile Banking: What Could Happen?

Mobile banking involves accessing your bank account through an app specifically designed for that purpose. This differs from online banking where you log into your bank’s website via a browser on your device. Why is this distinction significant? Because banks typically have greater control over security measures when you utilise their app compared to when you access their site through a web browser. For instance, scammers can set up phishing websites mimicking your bank’s login page or intercept data on unsecured Wi-Fi networks while you enter sensitive information online. However, executing these types of scams becomes substantially more difficult when using an app.

That said, using a mobile banking app does not guarantee complete safety. These applications transmit data between your device and the bank’s server in order to function properly without risking security breaches. To ensure secure transactions, the app must authenticate users by utilising unique identifiers such as phone IDs alongside account information. This creates three potential vulnerabilities where hackers could gain access: directly on your device; during data transmission; or at the bank’s server itself.

These weaknesses highlight how easily scammers could compromise your bank account if precautions aren’t taken seriously.

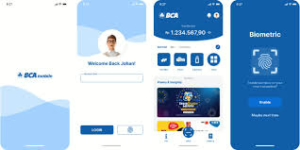

magine the unsettling scenario where your phone is stolen, opening the door for someone to invade your personal accounts. Losing your device can be a distressing experience, particularly if you rely on mobile banking. Many individuals store their account passwords on their phones or remain logged into various services, including email. If a thief gains possession of your phone, they can easily circumvent the security measures of your banking apps. They might request a password reset for your banking app and access it through your email account, effectively bypassing any multi-factor authentication (MFA) codes sent to your phone. This type of scam becomes even more straightforward for criminals if you keep passwords in mobile browsers or note-taking apps, neglect to lock your phone, and avoid using biometric security features like fingerprint recognition. Ultimately, all the application security in the world won’t protect you if you fall victim to theft or fraud.

Now consider another threat: hackers can compromise your finances without ever touching your physical device. They’ve developed malicious software—commonly referred to as malware or Trojans—that specifically targets banking applications. If you unknowingly download such malware onto your device, a hacker could monitor your activities and steal sensitive information like usernames and passwords associated with mobile banking. This underscores the critical need for companies to rigorously test their mobile applications for potential security flaws.

In today’s digital landscape, the security of banking applications is under constant threat, particularly from identity thieves who seek to exploit vulnerabilities. The 2021 State of Mobile Finance App Security report reveals that a staggering 77% of mobile banking apps contain at least one flaw that could compromise your sensitive personal information. If cybercriminals manage to infiltrate these systems and access your financial details, the consequences can be dire—not just in terms of potential monetary loss but also regarding identity theft. These malicious actors often resort to the Dark Web, where they can misuse your stolen data for various nefarious purposes. They might take out loans in your name, open credit cards that tarnish your credit rating, or even divert your tax refund into their own pockets. The implications are serious and underscore the urgent need for robust security measures in mobile banking applications.

Navigating the landscape of mobile banking comes with its own set of risks and vulnerabilities. Scammers have devised numerous tactics to exploit unsuspecting users, including deceptive texts and phone calls that appear to originate from legitimate banks. Phishing schemes often involve links embedded in emails or fraudulent alerts about supposed fraud, while the physical theft of phones and hacking incidents pose additional threats.

Criminals also create counterfeit mobile banking applications, and they employ keylogging malware disguised within seemingly harmless apps. Moreover, sophisticated techniques like Trojan overlays can redirect users during transactions, leading them to unknowingly divulge sensitive information.

Scams involving mobile check deposits are on the rise, along with SIM swaps that allow attackers to take control of your phone entirely. Wi-Fi hacking techniques, particularly man-in-the-middle attacks, further complicate matters by intercepting communications. Alarmingly, personal banking information is even available for purchase on the Dark Web.

Despite banks investing millions in cybersecurity measures to protect their clients, cybercriminals continuously innovate their methods to bypass these defences. One prevalent scam involves social engineering tactics designed to manipulate victims into revealing their credentials under false pretences—often creating a sense of urgency regarding a supposed security breach.

For instance, you might receive a text or call alerting you about suspicious activity on your account from someone impersonating your bank—a tactic known as smishing. Scammers can even spoof official bank numbers to enhance their credibility. If you engage with them, they may claim that your account has been compromised and urge you to transfer funds into a supposedly secure new account.

A real-world example highlights this danger: Kizzy Broaden received an SMS from what appeared to be Bank of America’s official number warning her about potential fraud. Trusting this message, she followed instructions and transferred all her money via Zelle under the impression that she was safeguarding her finances; unfortunately for Kizzy, her funds were sent directly into the hands of scammers instead.

In this ever-evolving digital age, staying informed about these scams is crucial for protecting your mobile banking experience.

Scammers often employ phishing tactics through emails, attempting to deceive you into revealing sensitive information like usernames and passwords. These fraudulent messages can closely mimic the communications you typically receive from your bank, with the sender’s name cleverly spoofed to appear authentic. However, clicking on any links within these emails will redirect you to a fraudulent website designed specifically to harvest your personal data. For instance, there have been cases where con artists impersonating Bank of America warned customers that their accounts would be locked unless they verified their details. The dangers extend beyond mere data theft; phishing links can also install malware on your device, potentially granting hackers access to your mobile banking applications. It’s important to note that these deceptive emails aren’t limited to banks; you might also encounter malicious messages masquerading as communications from Netflix or delivery services.

In addition to digital threats, physical phone theft and hacking present significant risks as well. An unsecured or stolen smartphone can become a goldmine for scammers. If your mobile device isn’t properly locked, a thief could easily take it and gain entry into your most private accounts and information. Even if you do secure your phone with a lock, a proficient hacker might still exploit specialised software to infiltrate your accounts or use payment services like Apple Pay or Google Pay without needing access through the lock screen. To safeguard against such scenarios, always keep your phone in a secure location when you’re out in public—ideally in a purse or front pocket. For extra security, consider setting up an automatic remote wipe feature that activates if you misplace your device; if by chance you recover it later, restoring data from an existing backup is usually possible. This proactive measure helps prevent scammers from accessing your sensitive information before they can do any damage.

In the realm of mobile banking, a significant threat comes from counterfeit apps designed to deceive users. When scammers find it difficult to infiltrate your genuine banking application, they resort to creating fake versions that mimic the real ones. A report from the FBI in 2020 revealed a staggering number—nearly 65,000 fraudulent banking applications were identified in prominent app stores. These impostors are crafted to closely resemble their authentic counterparts, leading unsuspecting users to enter their login details only to be met with error messages. Meanwhile, the perpetrators seize this opportunity to access your actual account through the legitimate app using the stolen information.

To safeguard yourself against such schemes, it’s crucial only to download apps from verified app stores and verify that the developer’s name corresponds with your bank’s official listing.

In another vein of cyber threats, even if you steer clear of downloading these deceptive banking apps, you might still fall victim through other seemingly harmless applications infected with malware. One prevalent form is keylogging software—malicious programs that capture everything you type on your device, including sensitive bank details and passwords. If you inadvertently install an application harboring a keylogger, hackers could easily breach your genuine banking app.

The frequency of these cyber attacks is alarming; millions of new malware variants emerge each month. Moreover, one can unwittingly introduce malware onto their device simply by scanning QR codes found in public spaces.

Additionally, there exists another form of malware known as Trojan overlays that can mislead users into revealing confidential information or executing unintended actions. These Trojans masquerade as legitimate software but contain hidden malicious code within them—akin to the legendary Trojan horse. Cybersecurity experts have unearthed Trojans capable of superimposing false information on top of your authentic mobile banking application. This manipulation can create an illusion that you’re engaging in standard banking activities when in fact you might be inadvertently disclosing your login credentials or approving a transfer to an entirely different account altogether.

Cleafy LABS has recently identified a new Trojan known as SharkBot, which has the capability to deceive users into transferring funds to fraudsters through their banking applications. This malicious software can also intercept genuine communications from banks, effectively circumventing two-factor authentication (2FA).

Additionally, mobile check deposit scams have resurfaced as one of the oldest forms of bank fraud, now made easier by technology. In these schemes, a scammer may either purchase an item you’re selling or pretend to be a potential employer and send you a check for deposit. After you deposit the check and it appears to clear, they often request that you refund part of the money or return some of it—this is commonly seen in overpayment scams. The Federal Trade Commission (FTC) notes that these fraudulent checks are designed to closely resemble legitimate ones, making it difficult even for bank staff to distinguish between them.

Another prevalent tactic involves SIM swap scams that enable criminals to gain control over your mobile phone. In this scenario, scammers impersonate you or bribe a mobile carrier employee to transfer your phone number to their own device. With access to your number, they can receive all your calls and texts, which often allows them to reset passwords for banking apps and bypass 2FA measures. The FBI reported that victims lost over $68 million due to SIM swaps in 2021 alone; one notable case involved a Florida resident who was defrauded of more than $700,000 within hours.

Moreover, data submitted through mobile banking apps is at risk once it leaves your device due to Wi-Fi hacking—also referred to as man-in-the-middle attacks. In this type of fraud, hackers infiltrate your network and capture sensitive information while it’s being transmitted. Imagine someone listening in on your conversation as you read out private details; that’s essentially what occurs during these digital breaches.

Personal banking information is being sold on the Dark Web. If any app, bank, or financial institution you rely on experiences a security breach, your sensitive data—including banking details and Social Security numbers—could end up in the hands of hackers. For instance, in March, Florida’s Central Bank announced a data breach. Unfortunately, this isn’t an isolated incident; numerous individuals are still feeling the repercussions of the 2019 Capital One breach that compromised the personal information of 100 million customers. Moreover, hackers can take advantage of data aggregators utilised by third-party applications like Mint to connect with bank accounts. These aggregators gather your personal information and sell it to various companies. Alarmingly, only about 24% of fintech users are aware of this practice. (Fintech refers to innovative technologies that enhance and automate financial services.) In a recent development, data aggregator Plaid agreed to pay $58 million to customers due to excessive collection of their personal data.

On another note, while mobile banking apps may seem intimidating due to potential security risks, maintaining robust mobile security can make them just as secure as traditional branch banking—plus they offer greater convenience. To ensure your safety when using banking apps on your phone, consider these recommendations:

First and foremost, only download applications from official app stores; steer clear of third-party app stores which might host counterfeit or malware-infected apps. Official app stores implement stringent security measures (particularly on iOS devices), significantly lowering the risk of downloading harmful software—not just for banking apps but for all applications.

Additionally, never neglect updates for your operating system or apps. Cybercriminals often exploit bugs and vulnerabilities found in outdated software to install malware; therefore, it’s crucial to keep both your devices and banking applications up-to-date at all times.

To ensure the safety of your bank accounts and devices, it’s essential to implement robust security measures such as strong passwords and two-factor authentication (2FA). Start by securing your devices and mobile banking applications. For your smartphone, establish a secure passcode or utilise biometric identification methods like fingerprints or facial recognition. Additionally, configure your device to lock automatically when it’s not in use, and make it a habit to remain logged out of your banking app whenever possible.

When it comes to creating a password for your bank account, opt for one that is at least eight characters long, incorporating a mix of uppercase letters, lowercase letters, symbols, and numbers. It’s crucial that this password is unique—avoid using the same password across different platforms—and ensure it isn’t easily guessable; steer clear of personal details like pet names or information available on your social media profiles. To keep this password safe, consider using a password manager for secure storage. Moreover, enhance the security of your bank account by enabling two-factor authentication (2FA). When setting up 2FA, prefer an authenticator app such as Google Authenticator over SMS-based verification since text messages can be intercepted by hackers through techniques like SIM swapping.

Another important consideration is the integrity of the device you use for banking. Many individuals choose to jailbreak their phones for customization or access features not permitted by manufacturers; however, this practice significantly increases vulnerability to malware and hacking attempts. If you purchased your phone from an authorized retailer and haven’t modified its software in any way, it should generally be safe for use. To verify its status on Android devices, navigate to Settings > Status Information > Phone Status; it should indicate official. For iOS users, look out for signs of jailbreaking—such as alternative app stores like Cydia or Sileo—or if you find that you’re unable to update the device’s software.

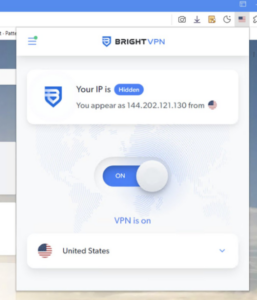

When accessing your banking app, prioritise using mobile data instead of public Wi-Fi networks. This precaution helps protect against potential threats associated with unsecured connections. If needed, consider utilising a Virtual Private Network (VPN) for an added layer of security while browsing online or managing financial transactions through mobile apps.

It’s crucial to avoid engaging with any unsolicited communications—be they calls, emails, or texts—from your bank. These phishing schemes are becoming increasingly sophisticated and more challenging to detect. If you receive a message from someone claiming to represent your bank, it’s best not to respond. Instead, reach out directly using the official contact number listed on the bank’s website or found on the back of your debit or credit card; this way, you can discuss any concerns safely.

Always remember: never share your account information or financial details through email, text messages, or over the phone. Exercise caution with links and attachments in unexpected emails as well. To safeguard your devices from malware and phishing attempts, consider using antivirus software equipped with protection features against these threats. This software can identify and block malicious programs effectively. You might also want to enroll in a service that secures all of your devices—phones, tablets, and computers alike.

If you suspect that your phone has already been compromised by malware, look out for certain indicators: diminished battery life, odd messages appearing in your sent folder, unexpected charges on your data or cell phone bill, performance slowdowns or glitches during calls, and unfamiliar applications that seem to have installed themselves without your consent.

To stay ahead of potential fraudsters even with robust security measures in place is wise to sign up for credit monitoring services. These tools continuously check for unusual activities across all of your financial accounts and will alert you almost instantly if there’s an attempt at fraud.

Should you discover that a scammer has accessed your mobile banking app, notify your bank right away and freeze your account immediately. It’s also essential to update the security software on your phone and conduct a thorough antivirus scan. Remove any suspicious apps that may have appeared without authorization.

Furthermore, scrutinise all transactions on your banking and credit accounts for any unauthorised charges or changes you’ve not initiated yourself. It’s advisable to inform the three major credit bureaus—Experian, Equifax, and TransUnion—about the breach so they can implement a credit freeze if necessary. Lastly, don’t forget to obtain a free copy of your credit report through AnnualCreditReport.com so you can monitor it for inaccuracies or fraudulent activity diligently.

In today’s digital age, safeguarding your mobile banking app is crucial. Despite the convenience they offer, even the most reliable mobile banking applications can be susceptible to security breaches, data leaks, and fraudulent activities. However, this shouldn’t deter you from enjoying the ease of managing your finances on your smartphone. It’s essential to remain vigilant against prevalent scams and potential vulnerabilities associated with mobile banking.

By adhering to our recommended practices for securing your accounts, you can significantly reduce risks. Additionally, for enhanced protection, you might want to explore Identity Guard’s services that provide identity theft protection and credit monitoring. With Identity Guard, not only are your accounts monitored for suspicious activity, but you’ll also receive alerts if any fraud is detected. In the unfortunate event that you do fall victim to identity theft, rest assured knowing you’re protected by a $1 million insurance policy covering eligible losses.

Maxthon

In today’s fast-paced digital world, where our lives are intertwined with technology, the importance of protecting your online banking information cannot be overstated—especially when using a browser like Maxthon. Imagine stepping into a vast, bustling marketplace filled with vendors selling everything from fresh produce to intricate crafts. Just as you would safeguard your wallet in such an environment, ensuring the security of your digital finances is paramount.

To begin this journey of protection, think of creating strong passwords as building a fortress around your banking accounts. These passwords should resemble intricate puzzles rather than simple words; they must be unique and complex. Picture them as elaborate locks that require a combination of uppercase and lowercase letters, digits, and special symbols to unlock. Steer clear of easily guessed information—those personal details like birthdays or names of beloved pets can act like open invitations for intruders. Instead, craft unpredictable sequences that would baffle even the most determined hacker.

But what if we could add another layer to this fortress? Enter Two-Factor Authentication (2FA), a powerful ally in your quest for security. With 2FA activated, every time you wish to access your bank account online, you’ll receive a verification code sent straight to your mobile device or email—a second key needed to enter the secure realm of your finances. This extra step serves as an effective deterrent against unauthorized access; it’s akin to having both a lock and an alarm system on your front door.

As you navigate through this digital landscape using Maxthon, remember that keeping your browser up-to-date is crucial in maintaining this stronghold. Just like checking for structural integrity after a storm, regularly looking for updates ensures you’re using the latest version available—one that often includes essential security patches designed to fend off new threats lurking in the shadows.

Equally important is the practice of routinely clearing out remnants from past browsing sessions: history logs, cache files, and cookies can unwittingly become breadcrumbs leading hackers back to sensitive information about you. Think of it as sweeping away any traces left behind after hosting guests; it helps prevent unwanted attention from those who might exploit vulnerabilities.

For those particularly concerned about privacy during online banking transactions, Maxthon offers an enticing feature: its privacy mode allows users to delve into their financial matters without leaving any trace behind—like conducting secretive business in a hidden alcove away from prying eyes.

Lastly, consider bolstering this protective barrier further by integrating reputable security extensions or antivirus software tailored specifically for online safety into your Maxthon experience. Each additional measure taken acts like reinforcing walls or adding watchtowers around your digital estate.

By embracing these strategies and precautions diligently within our interconnected world—a space where convenience meets risk—you significantly elevate the security level surrounding sensitive financial transactions while navigating through life’s digital marketplace