In a world dominated by digital communication, the allure of clicking on seemingly harmless links can be incredibly tempting. However, it’s essential to exercise caution. Those links in emails, tweets, and ads can lead you to malicious sites that don’t match their labels.

Instead of clicking, consider typing the web address directly into your browser. This simple step drastically reduces the risk of falling into a trap set by cybercriminals.

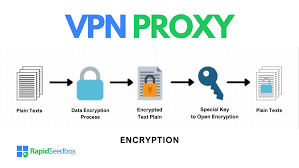

When browsing, always ensure that any site requesting sensitive information uses encryption. Look for URLs that start with “https:” instead of just “http:”. The added ‘s’ stands for secure—an important indicator that your data is being protected during transmission.

You might notice some browsers also display a closed padlock icon in the address bar, providing further reassurance. Be wary of any website displaying certificate warnings or errors; these messages could signal potential threats such as an intercepted connection or fraudulent sites posing as legitimate ones.

Moreover, when you’re out and about, it’s wise to avoid public computers or unsecured Wi-Fi networks for online banking and other sensitive transactions whenever possible. Always remember to sign out from password-protected sites when you’re finished using them. Simply closing your browser won’t suffice; logging off ensures that no one else can access your accounts after you leave.

In this ever-evolving digital landscape, staying vigilant is key to protecting yourself and your personal information.

In the digital age, crafting a robust password is akin to building a fortress around your personal information. Each online account serves as a gateway to your digital life, and using a unique password for each one is paramount. If one of these gates is breached, all your valuables can become vulnerable in an instant.

Never reveal your password over the phone or through text messages; doing so could invite unwanted intruders into your world. Be cautious: if someone requests your password, take a moment to consider that it may very well be a scam disguised as a legitimate request.

To fortify your defences, create unpredictable passwords that blend lowercase letters, uppercase letters, numbers, and special characters. Aim for at least eight characters in length; remember, longer passwords are exponentially tougher for hackers to crack.

Avoid common pitfalls by steering clear of easily guessed phrases like names or birthdays—these offer little protection against savvy attackers. Ideally, develop a memorable yet complex password; if writing it down becomes necessary, ensure it’s stored securely and away from prying eyes.

In this wild web of connectivity, don’t underestimate the power of strong passwords—they’re often the first line of defence in safeguarding your online domain.

In a world where cyber threats loom large, protecting your personal computer is paramount. Start by investing in reputable antivirus software and ensure it remains active and up-to-date. Make it a routine to schedule regular scans of your system, supplementing the continuous real-time scanning that catches threats as they emerge.

Software updates are crucial; outdated programs can become gateways for malicious attacks. Keep not just your operating system current but also all installed applications—think web browsers, Adobe products, Java, and Microsoft Office. Whenever possible, automate these updates to eliminate the chance of overlooking vital patches.

If you ever suspect malware infiltrating your machine, act swiftly. Cease any sensitive activities such as online banking or shopping until you’ve resolved the issue. Use dedicated security software or consult with professionals who can expertly rid your device of dangerous intrusions.

To further bolster your defences, employ firewalls on your local network. They create an extra barrier against threats targeting devices like PCs, smartphones, and tablets. Additionally, protect physical access to your computer by requiring a password and using cable locks when necessary.

Always remember to log off or lock your screen when stepping away from your device; these simple habits can mean the difference between security and vulnerability in an increasingly digital age.

Email Safety: A Cautionary Tale

In today’s digital age, emails are an essential part of our communication. However, lurking behind seemingly innocent offers lies a world of deceit. If you receive an email or encounter a website that boasts an incredible deal, remember the old adage: if it sounds too good to be true, it probably is.

Consider this—never send personal financial information through email. Email is like sending a postcard; anyone can read it along the way. Bank account numbers, Social Security numbers, and PINs are not meant for such unsecured channels.

Even attachments from familiar sources can harbour hidden dangers. One misplaced click can unleash malware on your device. Always approach attachments with caution and think twice before opening.

The realm of email scams is expansive, and it’s vital to stay alert. If you receive unsolicited emails asking for information or enticing you with deals, do not respond! Clicking on suspicious links may hand over your data to cybercriminals.

Instead of risking your security, utilise secure messaging options whenever possible. Within an Online Banking system, you have the option to send safe emails directly or connect through their “Contact Us” feature on their website.

By being vigilant and cautious in your email activities, you safeguard yourself against potential threats. Stay smart and protect what matters most!

In an age where our mobile devices have become essential extensions of ourselves, ensuring their security is more critical than ever. First and foremost, it’s advisable to configure your device to require a passcode for access. This simple step can be the difference between safeguarding your information and exposing it to theft.

Given the unfortunate reality that mobile devices are frequently lost or stolen, it’s wise to think twice before storing sensitive information like passwords or bank account details. The risk involved is simply too high; instead, consider using secure password managers for better protection. If you do choose to store any sensitive data on your device, make sure it’s encrypted. Encryption acts as a formidable barrier against unauthorised access.

Equally important is keeping your mobile device’s software up-to-date. Just like a personal computer, these small gadgets run complex software systems that need regular updates for optimal performance and security. Opt for automatic updates if available—this ensures you always benefit from the latest security patches without needing to remember.

Moreover, take time to review the privacy policies of any apps before installation. Understanding what data the app will access can help you maintain control over your personal information. Additionally, disable features such as Bluetooth or Wi-Fi when not in use—keeping your connections hidden minimises potential vulnerabilities and protects against unwanted intrusions.

When it comes time to switch devices or upgrade, don’t forget about data safety. Always perform a hard factory reset before relinquishing ownership of your old device; this powerful option wipes all content clean and protects your private information from falling into the wrong hands. By following these steps, you can create a secure environment in which your digital life can thrive amidst increasing risks.

When you log into your Online Banking account, it’s only natural to wonder about the safety of your personal information. With banks, you can have complete peace of mind knowing that we prioritise your security above all else.

As soon as you begin the login process, your data remains completely safe. Your account number and password are not sent over the internet until you take that final step—clicking the login button or pressing enter. At this moment, a secure connection is established using the robust Secure Sockets Layer (SSL) protocol.

This secure connection employs a powerful 128-bit encryption algorithm, designed to protect your sensitive information from potential threats. Once you’re logged in, this secure channel remains active for the duration of your Online Banking session.

Importantly, we create these encrypted connections on an as-needed basis. This approach not only enhances security but also optimises website performance when accessing non-secure information like current rates and product descriptions.

If you’re browsing a bank website and notice that there isn’t a lock symbol displayed in your browser’s address bar—be it Internet Explorer or Safari—there’s no need to worry. Banks have implemented numerous safety measures to ensure that all your interactions remain safe and secure while you explore our site. Rest assured, we’re here to keep your information protected every step of the way.

Maxthon

In today’s rapidly evolving digital age, the importance of protecting your online banking information cannot be overstated, especially when navigating the web with a browser like Maxthon. Imagine stepping into a bustling marketplace where every transaction is scrutinised; this is akin to how you should approach your online banking security. The first step in building a strong defence is to create powerful passwords for your banking accounts. These passwords should be intricate and one-of-a-kind, weaving together a mix of uppercase and lowercase letters, numbers, and special characters into an elaborate tapestry that’s difficult for anyone else to decipher. Stay away from obvious choices such as birthdays or names of beloved pets; instead, think outside the box and craft unpredictable combinations that would stump even the most determined hacker.

But let’s not stop there! Enabling Two-Factor Authentication (2FA) adds yet another formidable barrier against potential intruders. Picture this: each time you attempt to access your account, you receive a verification code sent straight to your mobile device or email—a small but mighty safeguard that significantly reduces the chances of unauthorised access.

Equally crucial is ensuring that your Maxthon browser remains up-to-date. Just as you wouldn’t want to miss out on vital news in a bustling city, staying current with software updates is essential for maintaining security. Regularly checking for updates ensures that you’re equipped with the latest features and critical security patches designed to shield you from newly discovered vulnerabilities.

Moreover, consider making it a habit to regularly clear out your browsing history, cache files, and cookies—think of it as tidying up after yourself in that busy marketplace. This practice helps thwart any attempts by hackers who might seek to exploit remnants of your previous online activities.

For those moments when privacy becomes paramount during online banking transactions, Maxthon offers an invaluable feature: its privacy mode allows users to navigate without leaving behind traces of sensitive information from earlier sessions. It’s like having an invisibility cloak while conducting important business amidst prying eyes.

Lastly, don’t overlook the benefits of enhancing your defences further by incorporating reputable security extensions or specialised antivirus software tailored for online safety. Each measure taken—whether it be crafting complex passwords or utilising advanced security features—serves as an additional layer in fortifying the walls around your financial dealings.

As we traverse this interconnected world filled with both opportunities and risks, taking these precautions can significantly bolster the protection of managing sensitive financial transactions. With vigilance and proactive strategies in place, you’ll navigate through digital landscapes with confidence and peace of mind.