In the ever-evolving landscape of cybersecurity, financial institutions have long turned to device identity as a crucial tool for preventing fraud and verifying user identities during login and high-risk transactions. This method is just one of many strategies employed to protect online interactions from malicious actors. However, as with any security measure that relies on fixed parameters, cybercriminals are continually devising new tactics to bypass these defences.

One particularly troublesome form of fraud is account takeover, which has emerged as a significant threat to financial institutions, both in terms of financial loss and operational headaches. A recent survey revealed that 72 banks worldwide identified account takeover as a primary concern, underscoring the urgency of addressing this issue. Compounding the problem is the alarming rate of fraudulent activities occurring during the account opening process itself; institutions need help to differentiate between legitimate applicants and those with nefarious intentions.

As banks strive to expand their customer base through new acquisitions, the creation of fake accounts poses a substantial risk to their operations. The challenge lies in the fact that these new customers—and, by extension, their devices—are unfamiliar entities within the bank’s ecosystem. Consequently, relying on device identity becomes less effective when it comes to safeguarding against fraudulent accounts.

The crux of the matter is clear: over time, the efficacy of device identity is diminishing. It simply cannot provide adequate insights beyond initial logins or when establishing digital accounts. As cyber threats grow increasingly sophisticated and diverse, financial institutions must seek out more robust solutions if they hope to maintain trust and secure their operations in an unpredictable digital world.

Device identity refers to the unique characteristics that identify a specific device, and it plays a crucial role in establishing digital identity. Digital identity itself is built upon three key elements, often referred to as the three factors of authentication: knowledge, possession, and inherent traits.

The first element, knowledge, encompasses static information that only the individual should possess. This includes personally identifiable information (PII) such as phone numbers, previous addresses, Social Security numbers, and passwords—data that is meant to remain confidential.

Next is possession, which pertains to something tangible that can be used for verification purposes. This might be a unique token or a physical device that confirms an individual’s identity through ownership.

The third element focuses on inherent traits—biometric data that distinguishes one person from another. This can include fingerprints or facial recognition but also extends to voice patterns and behavioural analytics. For instance, how someone interacts with their device—such as the pressure they apply while tapping or their specific swipe patterns—can reveal much about their identity.

Within this framework of digital identity lies the device identity itself; it fits into the category of possession. Device identity serves as a distinctive identifier for each device—examples include cookies or similar tracking mechanisms. A more sophisticated approach to identifying devices is known as device fingerprinting. This technique gathers various unique attributes about a device to create an association between it and a particular user. The data collected may encompass details such as browser type, operating system version, internet connection specifics, IP address information, geo-location data, and much more—all contributing to building an intricate profile linked back to the individual user.

Device ID Controls Leave Gaps in Security

The first two categories of digital identity verification need to be revised on their own. The rise of data breaches, phishing attacks, and the widespread availability of personal information on social media has made it easy for cybercriminals to exploit the what you know aspect. Similarly, the what you have category, which includes device ID, presents significant challenges as well. It’s essential to have a clear definition of digital identity that can be consistently applied to confirm an individual’s identity, even for customers that a financial institution has never interacted with before. Here are three critical areas where device ID falls short.

First and foremost, cybercriminals have become adept at finding ways around security measures. They continuously adapt their tactics to bypass authentication controls, and device ID alone is no match for their evolving strategies. Through various methods, they can quickly seize control of a device or obscure their activities on one. One common technique involves Remote Access Tools (RATs).

Many fraud prevention systems depend on recognised device parameters and IP locations to assess potential fraud risk. However, if a cybercriminal persuades a legitimate user to download a remote access tool—be it a legitimate application like TeamViewer or malicious software with RAT capabilities—they can effectively sidestep device identity checks altogether. These RATs allow them complete control over the targeted device while making it seem as though transactions are being initiated from the genuine user’s machine. In such cases, banking systems may detect an authentic device fingerprint without any signs of proxy usage and with accurate IP and geolocation data present.

Social engineering has become a prevalent tactic among cybercriminals, who exploit real-time schemes to manipulate bank customers into unwittingly facilitating fraudulent transactions from their own devices. These criminals often impersonate bank officials, urging unsuspecting clients to transfer funds urgently to seemingly legitimate accounts that are, in fact, controlled by the fraudsters themselves. The challenge for traditional fraud prevention measures—typically focused on device or activity monitoring—is that these scams occur within authenticated sessions, utilising trusted devices and locations without any malware involvement. According to Which?, a UK consumer advocacy group, victims of such social engineering scams lose an astonishing £28,000 every hour.

In addition to social engineering, there is the issue of ID spoofing. Cybercriminals can disguise device identifiers so they appear as if they are operating from previously recognised and verified devices. They employ tactics like proxy IP addresses, and man-in-the-browser (MitB) attacks through malware installed on the genuine user’s device. Moreover, these criminals have developed man-in-the-middle (MitM) attacks that allow them to mimic not just IP addresses and physical locations but also device fingerprints and JavaScript elements.

Another significant hurdle in securing user-device connections is the frequency with which individuals change their devices. With new models constantly being released and older ones breaking or getting lost, maintaining a stable identity linked to a specific device becomes increasingly tricky. Furthermore, many devices are shared among multiple users; for instance, a family desktop computer might be used by various members of the household. This sharing complicates matters since it becomes impossible to identify which specific individual is logged into an account when multiple people use the same authenticator.

A relatable incident illustrates this fragility of security: one team member faced authentication challenges when her young son memorised her Apple App Store password and racked up $395 in charges for buying game tokens without her knowledge. While this situation was innocent—a child innocently purchasing games—it underscores how vulnerable our systems can be when it comes to device identification and user accountability.

In the realm of cybersecurity, social engineering has emerged as a sophisticated tactic employed by cybercriminals to manipulate unsuspecting bank customers into facilitating fraudulent transactions directly from their own devices. These criminals often impersonate bank officials, instilling a sense of urgency that compels victims to transfer funds to what they believe is a legitimate account, but which is actually a mule account under the criminal’s control. Traditional fraud prevention systems, which rely on device or activity monitoring, struggle to identify these types of attacks because the transactions occur within authenticated sessions and from trusted devices in familiar locations—without any malware involvement. According to Which?, a consumer advocacy group in the UK, victims of such scams are losing an astounding £28,000 every hour.

Another tactic used by cybercriminals involves ID spoofing. They can obscure device identifiers and make it seem like they are operating from previously recognised and authenticated devices by employing techniques such as proxy IP addresses or executing man-in-the-browser (MitB) attacks through malware installed on the victim’s device. Additionally, these criminals have devised man-in-the-middle (MitM) attacks that enable them to replicate not just IP addresses and geographic locations but also device fingerprints and JavaScript elements.

Linking users to specific devices has become increasingly complicated due to the frequent changes individuals make regarding their technology. With new models constantly being released and personal devices getting lost or damaged, maintaining a fixed identity tied to one device proves challenging. Moreover, many households share devices; for instance, a desktop computer might be utilised by several family members. This shared usage complicates authentication processes since it becomes nearly impossible to determine which individual is responsible for actions taken on that shared device.

An illustrative case involved one of our team members who faced authentication difficulties due to her young son memorising the password for their Apple app store account. The child inadvertently racked up $395 in charges while purchasing game tokens—a scenario highlighting how fragile security measures can be when it comes to identifying users based solely on device access. This incident underscores the vulnerabilities inherent in current security systems tasked with verifying user identities amidst ever-evolving technology landscapes.

The inability to authenticate a new user’s Device ID has minimal effect on the process of establishing a new account. This is primarily because new users need to gain prior device history. From the perspective of the financial institution, both a potential fraudster and a legitimate customer are operating on unfamiliar devices. Although there may be rare instances where a cybercriminal utilises an already identified high-risk device, such occurrences are infrequent.

Despite these limitations, Device ID remains an effective tool for detecting fraud and should not be disregarded. Numerous fraudulent schemes continue to use Device ID, which proves invaluable. However, there are scenarios where its effectiveness is limited or insufficient, which is precisely where behavioural biometrics come into play, providing comprehensive protection for financial institutions.

For instance, one of the leading banks in the UK recently integrated behavioural biometrics into their mobile banking application. Almost immediately after implementation, they were able to identify multiple fraud attempts associated with TeaBot malware—malicious software that exploits remote access tools (RAT) to gain control over users’ devices. The behaviour of malware typically differs significantly from that of genuine users; these distinct patterns can often berecognisedd across various malware types. Indicators include unusual navigation paths, accelerometer readings, and atypical touch or swipe behaviours.

The incorporation of behavioural biometrics within a multi-layered fraud prevention framework has yielded promising outcomes in recent rollouts at several prominent UK banks. These measures have successfully detected malware during digital banking sessions with impressive accuracy rates.

Moreover, behavioural biometrics are revolutionising how banks protect against fraudulent account openings. During this critical process, factors such as typing speed, swipe patterns, and mouse clicks provide valuable insights into whether actions indicate criminal intent or authentic user behaviour. For example, data from BioCatch reveals that two-thirds of confirmed cases involving account opening fraud highlight significant deviations from standard user activity patterns.

Enhancing Your Fraud Detection Approach Beyond Device Identification

In today’s landscape of evolving threats, it’s essential to adopt a multi-faceted strategy that fosters customer trust, mitigates risk across various digital platforms, and curtails financial losses due to cybercrime. By integrating behavioural biometrics, device identification, and a range of other data points analysed through sophisticated machine learning models, financial institutions and online businesses can implement a robust fraud management framework. This approach not only protects against fraud but also cultivates an online atmosphere where customers feel secure in their interactions.

As Akif Khan, Vice President at Gartner, highlighted, examining user behaviour adds an invaluable layer of risk assessment and trust indicators. In the current climate, this insight is crucial for establishing a comprehensive defence system that complements device fingerprinting efforts.

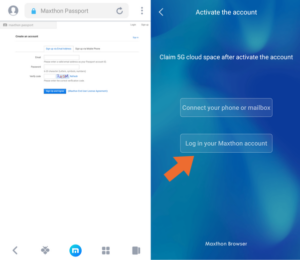

Maxthon

To safeguard your online banking details while using the Maxthon browser, you should adopt several essential practices. First and foremost, it’s crucial to establish strong passwords. Opt for unique and intricate combinations that blend uppercase and lowercase letters, numbers, and special characters. Avoid predictable information such as birthdays or pet names.

Next, if your bank supports it, enable Two-Factor Authentication (2FA). This feature typically requires you to enter a code sent via text or email in addition to your password, providing an extra layer of protection.

Another important step is keeping your Maxthon browser updated. Regularly checking for updates ensures that you have the latest version, which often includes vital security patches designed to address potential vulnerabilities.

Additionally, make it a habit to frequently clear your browsing data—this includes history, cache, and cookies—to eliminate any sensitive information that hackers could exploit if they gain access to your device.

Utilising Maxthon’s privacy mode can also enhance your security while performing online banking tasks. This mode allows you to browse without saving cookies or site data from those sessions.

It’s also advisable to install reputable security extensions or antivirus plugins compatible with Maxthon; these tools offer real-time defences against phishing attempts and malware threats.

Vigilance against phishing scams is paramount, too. Always verify the URL of the banking website before logging in, and refrain from clicking on links in emails or messages that claim to be from your bank unless you’re sure they are legitimate.

Finally, remember to log out after completing any transactions. This simple act helps prevent unauthorised access should someone else use your device afterwards.

By incorporating these strategies into your routine while using the Maxthon browser, you’ll significantly bolster the security of your online banking activities.