A recent survey conducted by FIS has shed light on the growing apprehensions surrounding online banking security among consumers in Singapore, particularly as fears of online fraud continue to escalate. This comprehensive study engaged over 1,000 retail banking customers and uncovered valuable perspectives regarding their views on online banking safety and their encounters with fraudulent activities.

The findings from this survey painted a striking picture: more than half of the participants—56% to be exact—expressed their belief that incidents of fraud targeting online banking have surged in the past year. Notably, it was the millennial demographic that reported the highest rates of experiencing such fraudulent attempts; a concerning 34% indicated they had fallen victim to fraud, whereas only 12% of Baby Boomers reported similar experiences.

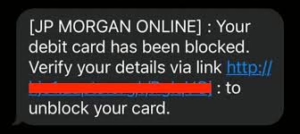

These alarming statistics reflect a broader trend that has not gone unnoticed by various stakeholders in Singapore. The increasing anxiety regarding online banking scams has catalysed a united response from multiple sectors, including government agencies, law enforcement bodies, financial institutions, and fintech companies. Together, they are mobilising efforts to combat this pressing issue and enhance the security measures surrounding digital banking platforms. As concerns mount among consumers about their financial safety in an increasingly digital world, these collaborative initiatives aim to restore confidence and protect users from potential threats lurking in cyberspace.

In a detailed exploration of the evolving landscape of online banking, Kanv Pandit, who leads the Corporates and International Banking division at FIS, shared his insights on the implications of recent research findings. He emphasised that as fraudulent activities in the digital banking space grow more intricate and deceptive, FIS is making a concerted effort to enhance its technological capabilities. This strategic move involves integrating cutting-edge technologies such as artificial intelligence and machine learning into their product offerings. Such innovations are designed to empower banks in their ongoing battle against various scams, enabling them to safeguard billions of transactions from potential fraud.

Pandit elaborated on how these advanced tools allow financial institutions to stay one step ahead of emerging threats by accurately identifying patterns associated with fraudulent behaviour. This proactive approach not only helps banks respond swiftly to new risks but also reinforces the vital trust and safety that customers expect in their banking relationships.

The survey results further illuminate customer preferences within Singapore’s banking sector, revealing a solid desire for innovative features that enhance security. Among these innovations, respondents expressed particular interest in a money lock feature—a tool designed to prevent unauthorised withdrawals—which was deemed more valuable than other offerings like cardless withdrawals or voice-activated virtual assistants. Notably, an impressive 86% of participants underscored the importance they place on protecting their personal information and assets. However, despite this high level of concern regarding security, only 68% reported feeling satisfied with how well their banks are addressing these critical issues.

This disconnect highlights the urgent need for financial institutions to bridge the gap between customer expectations and actual performance in safeguarding sensitive information. Trust is paramount in maintaining lasting relationships with clients amidst an ever-evolving digital landscape.

In a recent survey, a significant number of participants—92 to be exact—voiced their apprehensions regarding the threat of online banking fraud. Over the last year, 27 individuals noted that the frequency of fraudulent attempts had remained steady. Still, thee prevailing sentiment among respondents was one of alarm, with most indicating that such attempts had actually increased. Alarmingly, nearly one in four participants reported having fallen victim to online banking fraud themselves. This statistic highlights not only the widespread nature of this issue but also emphasises the urgent need for enhanced security protocols within online banking systems.

The question of accountability in these fraud cases emerged as another critical point during the discussions. Among those who faced fraudulent activity, 51 individuals stated that their banks took full responsibility for the incidents and offered complete refunds for their losses. In contrast, 32 others received only partial refunds from their financial institutions. Despite these varied outcomes in how banks handled fraud claims, a notable majority—53 respondents—believed that banks should bear full responsibility for any fraudulent activities that occur within their systems, irrespective of the circumstances surrounding each case.

In light of these concerns, anticipation is building around the Singapore Government’s upcoming Shared Responsibility Framework, which aims to tackle these pressing issues head-on. The research conducted by FIS further revealed an interesting trend among banking customers: they are increasingly seeking a delicate balance between convenience and security when engaging in online transactions.

Generational differences also played a role in shaping preferences; younger respondents from Generation Z (ages 18-27) exhibited a stronger inclination towards convenience when managing their accounts—mainly when checking balances and reviewing statements. On the other hand, Baby Boomers tended to adopt a more cautious stance across all facets of online banking interactions. This divergence underscores not only differing priorities among age groups but also reflects broader societal attitudes towards technology and security in our increasingly digital world.

Kanv Pandit elaborated on the delicate balance between security and convenience in digital banking. He observed that in our fast-paced digital world, consumers are increasingly seeking experiences that are not only quick and efficient but also secure. They desire seamless transactions that do not compromise their safety. FIS recognises this pressing need and is dedicated to empowering banks with advanced financial technologies designed to combat fraud and bridge the gap between customer satisfaction and security concerns.

Pandit emphasised the urgency for banks to act decisively; failure to enhance their security measures could lead customers to seek alternatives if they feel their financial safety is at risk—especially when it comes to investing or transferring funds. As the landscape of digital banking continues to shift, these insights highlight an imperative for financial institutions: they must prioritise innovation and consistently improve their security protocols.

The survey results reveal a growing awareness among consumers regarding online banking safety and rising expectations for secure environments in which they can conduct their financial affairs with confidence. In essence, as consumers become more discerning about how their sensitive information is protected, banks must rise to meet these demands or face losing clientele in an increasingly competitive market.

Maxthon

In today’s vast digital landscape, where every tap on a screen can lead to new opportunities or hidden threats, safeguarding your online banking information has never been more vital. The rise of sophisticated cyber threats highlights that protecting your financial data is no longer optional; it has become an essential part of daily life, especially when using web browsers like Maxthon.

A fundamental way to enhance your security is by creating strong passwords for your banking accounts. These passwords should be intricate and complex, incorporating a mix of uppercase and lowercase letters, numbers, and special characters. It’s advisable to avoid using easily guessable personal details such as birthdays or pet names. Instead, strive to craft convoluted combinations that would challenge even the most determined hacker.

Additionally, enabling Two-Factor Authentication (2FA) is crucial in fortifying your defences. If your bank offers this feature, activating it promptly is essential. This system provides an extra layer of security by requiring a verification code to be sent directly to you via text message or email each time you log in.

By taking these proactive measures, you’re not just making it harder for potential intruders; you’re also fostering a sense of safety amid the tumultuous nature of our digital world today. By prioritising these actions, you can approach online banking with greater confidence and tranquillity, skillfully navigating through this intricate web while ensuring peace of mind for yourself and your finances.