In recent times, the spotlight of public discourse has shone brightly on the issue of identity theft, sparking widespread concern. This heightened awareness paints a picture where the Internet, once viewed as a reliable resource for research and legitimate business dealings, now appears as a double-edged sword. It has transformed into an arena where unscrupulous individuals can steal sensitive personal information from unsuspecting consumers for nefarious purposes. The most coveted pieces of data—such as Social Security numbers, credit card details, and access credentials for bank accounts—are prime targets for these criminals. With this information in hand, they can gain unauthorised access to financial resources, tapping into bank balances and exploiting credit lines.

As financial institutions increasingly embrace the digital realm to connect with their clientele, they have introduced an array of online banking services designed to enhance convenience and accessibility. This shift towards digital interaction has prompted some banks and savings institutions to contemplate reducing their physical branches and minimising the workforce needed for traditional in-person transactions. Yet amidst this transformation lies a significant hurdle: security and privacy concerns weigh heavily on the minds of Internet users everywhere.

For banks to retain their loyal customers and entice new ones into their fold, they must prioritise creating an online banking environment that fosters a sense of security. Customers need to feel assured that their assets are safeguarded and that their personal information remains confidential amidst the ever-evolving landscape of cyber threats. Only then can financial institutions hope to navigate these turbulent waters successfully while building trust in an age where caution is paramount.

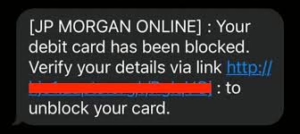

In June 2005, a survey conducted by the Gartner Group unveiled a troubling trend in online security: phishing attacks were on the rise. The results indicated that the number of individuals receiving phishing emails soared by an alarming 28 per cent over just one year.

As consumers grapple with these threats, the ramifications for their trust in financial institutions are significant. The escalating frequency of these breaches has contributed to mounting anxiety about personal security online. This growing concern is expected to impact e-commerce growth, potentially slashing projected rates by 1 to 3 per cent over the next three years.

Chart 2 from the study strikingly illustrates this volatility; it reveals just how heightened concerns have become among online users regarding fraud and identity theft. Consumers now find themselves caught in a web of fear, questioning their ability to safely navigate digital landscapes where their personal information can be exploited.

With each new phishing attack reported, consumer confidence erodes further, threatening not only individual transactions but also the very foundation of e-commerce itself. Financial institutions face a critical challenge: restoring trust and ensuring robust protections against these evolving cyber threats. They must address these issues head-on to reassure customers and stabilise the future of online commerce.

In recent years, media outlets have devoted significant attention to the alarming rise of identity theft. This surge in coverage has prompted many to question whether the Internet has shifted from being a reliable platform for research and legitimate business interactions to a risky environment where criminals can easily exploit personal information.

Thieves are particularly interested in acquiring sensitive data, such as Social Security numbers, credit card information, and bank account access credentials like passwords. These bits of information serve as gateways, granting perpetrators access to individuals’ financial resources—often leading to dire consequences like drained bank accounts and depleted credit lines.

With the increasing use of online banking services, many financial institutions have become heavily reliant on the Internet to engage with their customers. This new digital approach enables banks and credit unions to offer a diverse range of services at the click of a button. In fact, some organisations are even reconsidering their need for physical branches due to shifting consumer preferences toward online interactions.

However, lurking beneath this innovative shift is a growing concern among users about security and privacy breaches. Trust in these digital platforms hangs by a thread as consumers grapple with the reality that their most confidential information could be just one breach away from falling into the wrong hands.

The prevailing sentiment at the recent symposia is stark: the menace of identity theft shows no signs of abating. As consumer protections gradually improve, cybercriminals refine their tactics, becoming ever more sophisticated.

Attendees acknowledged a paradox. While consumers increasingly demand more robust security measures to safeguard their personal information, they often resist associated costs—whether through higher fees or sacrifices in convenience that heightened protection might necessitate.

Participants clearly agreed that the banking sector must enhance its self-regulatory efforts. Proposals included establishing robust standards obligating businesses to notify individuals promptly if their data faces potential compromise.

The memory of high-profile breaches looms large; incidents involving institutions like ChoicePoint, LexisNexis, and Bank of America have underscored vulnerabilities that need urgent attention. Participants stressed that financial organisations must do everything within their power to avert further violations and protect consumer trust.

Looking ahead, there’s concern that a spike in data breaches could push the public toward demanding more significant intervention from federal authorities. Such measures may include tighter regulations on accessing Social Security numbers online—an issue increasingly on consumers’ radar.

As the stakes rise, both consumers and industry leaders face critical choices about balancing security, cost, and convenience in an ever-evolving digital landscape. The path forward remains uncertain but fraught with implications for all involved.

During the recent symposia, a particularly captivating topic emerged: how to effectively mitigate the risks associated with online transactions. As our world becomes increasingly digital, ensuring security in financial dealings has become paramount.

Discussions focused on four primary areas of concern: risk reduction and mitigation. Attendees explored what specific tools, policies, and procedures have proven effective in shielding consumers from potential threats. They sought to identify best practices that banks can adopt.

Another pivotal question revolved around risk transference. Participants deliberated on the potential for specialised insurance policies designed to protect consumers engaging in online transactions. Such innovative solutions could provide much-needed peace of mind.

The concept of risk acceptance was also front and centre. Even with extensive measures in place, a certain level of risk remains unavoidable. The question lingered: how much risk are individuals willing to embrace in their digital financial interactions?

Lastly, the discussion included strategies for risk avoidance. There was broad consensus on the need for robust protocols to ensure that sensitive consumer information is shared strictly with those who absolutely require it.

As the conference wrapped up, it became clear that while challenges persist, collaborative efforts between banks and regulators could lead to enhanced security measures—ultimately fostering trust in the evolving landscape of online finance.

In an era where digital banking has become the norm, the need for robust authentication methods is more pressing than ever. A recent FDIC study starkly reveals that traditional passwords, once deemed sufficient for securing online bank accounts, have fallen victim to increasingly sophisticated cyberattacks. Hackers effortlessly exploit common tactics like phishing emails, leaving consumers vulnerable as their passwords are stolen.

When a thief gains access to a password, all associated accounts and personal information hang in the balance, dangling perilously in the hands of the malicious actor. Recognising this evolving threat landscape, the study advocates for a risk-based approach to authentication explicitly tailored to each institution’s unique vulnerabilities.

For instance, if an online banking platform only permits customers to view non-sensitive information—such as account balances—then a basic level of authentication may suffice. The potential harm in such scenarios is relatively low. Conversely, when transactions involve transferring funds or sensitive data sharing, the stakes skyrocket; here, robust authentication measures are essential.

Authentication itself hinges on layered security elements: something you know—like a password; something you have—such as a security token; or something you are—a fingerprint or facial recognition feature. As digital threats continue to evolve and intensify, so too must our approaches to safeguarding financial transactions and customer identities.

In today’s digital age, most internet-based financial services rely heavily on single-factor authentication. This typically involves a password that customers use to gain access to their accounts. However, this solitary approach to security can be alarmingly inadequate.

When an institution relies solely on a password, it creates a vulnerability that malicious actors can easily exploit. If a customer falls victim to phishing or social engineering tactics and reveals their password, a thief could infiltrate their account in mere moments. The consequences can range from unauthorised transactions to significant financial loss.

To combat these risks, many institutions are now adopting two-factor authentication (2FA). By requiring an additional form of identification—such as an ATM card, one-time password generated by a token, or biometric data like fingerprints—customers gain an extra layer of defence.

This multifactor authentication method complicates matters for potential thieves. With all the necessary credentials at hand, gaining access to sensitive information becomes much more accessible. As the landscape of online threats evolves, enhancing authentication methods is not just prudent; it is essential for protecting consumers’ hard-earned money and personal data.

The study delves into various authentication technologies, including one-time password tokens, USB tokens, and device authentication. It also explores advanced methods like geolocation and biometrics. Each technology offers distinct advantages and challenges that institutions must carefully consider.

For instance, while biometric systems—such as fingerprint scanners, iris recognition, and facial detection—can enhance security, they may not be ideal for organisations with a widely dispersed customer base. These systems tend to work best in controlled environments with a defined audience, such as employees within a single office building.

In recent times, the spotlight has been firmly placed on the issue of identity theft, capturing the attention of various media outlets. This surge in coverage may lead some to believe that the Internet has shifted from being a reliable resource for research and legitimate business dealings to a dangerous arena where personal information can be easily stolen for illicit activities. Among the most coveted pieces of information are Social Security numbers, credit card details, and sensitive bank account access data, including passwords. Such information can grant identity thieves access to victims’ financial resources and credit lines.

As more financial institutions embrace online platforms to connect with their customers, they have begun offering an extensive array of banking services over the Internet. This digital shift has prompted some banks and savings institutions to reconsider their physical presence—potentially reducing the number of brick-and-mortar locations and cutting back on staff needed for in-person transactions. However, this transition comes with significant challenges; security and privacy concerns weigh heavily on the minds of consumers navigating online banking.

For banks to maintain their current clientele while also attracting new customers, they must cultivate an online banking environment where users feel secure. Customers must be confident that their assets and personal data will remain protected against any threats.

Adding another layer to these concerns is a survey conducted by Gartner Group in June 2005, which revealed alarming statistics. There was a staggering 28 per cent increase in individuals receiving phishing attack emails within that year alone. Such incidents—and other similar breaches—have taken a toll on consumer trust and are projected to hinder e-commerce growth rates by one to three per cent over the next three years.

The anxieties surrounding online safety illustrate users’ apprehensions about potential fraud and identity theft. The findings from the Gartner Group survey highlight just how deeply these issues resonate with customers who rely on financial institutions for their banking needs.

In summary, as we navigate this evolving landscape of digital finance, it becomes increasingly crucial for financial entities to adapt and prioritise security measures that reassure consumers about their safety while conducting online transactions.

Financial institutions deliberating on their authentication strategies should consider several factors: the technology’s portability, customer-friendliness, overall costs involved, effectiveness against breaches, ease of implementation, and the technology’s established status in the market.

Moreover, the study highlights the deficiencies of traditional password systems in today’s cybersecurity landscape. To combat rising threats like phishing attacks, financial entities are encouraged to implement scanning software that can proactively identify these risks. Strengthening their defences is not just advisable; it’s essential for safeguarding clients’ sensitive information.

In a world where financial transactions take place at the speed of light, institutions must navigate the delicate balance between accessibility and security. Picture a bustling bank where customers come and go, each with their own unique needs and levels of trust. Among the myriad of transactions available, some are as harmless as a gentle breeze, while others carry the weight of potential risk like a storm on the horizon.

At the very beginning of this spectrum lies a transaction that grants access solely to general banking information—think of it as peeking through a window without stepping inside. Here, customers can view basic details about their accounts but cannot delve into sensitive personal data or make any transfers. This transaction is akin to a friendly chat over coffee; it poses minimal risk and allows for straightforward interactions without necessitating stringent security measures.

As we journey further along this path, we encounter transactions that demand greater caution. The final stop on this risk scale is particularly noteworthy: an online transaction enabling customers to wire or transfer funds to another party. This is not just any casual exchange; it requires robust safeguards because it involves moving money—a task that can have severe implications if mishandled. In this scenario, simply entering a password would be like leaving your front door unlocked while you step out for groceries; it’s insufficient protection against potential threats.

To fortify these high-stakes transactions, banks should implement more sophisticated authentication methods. Imagine requiring customers to input an additional layer of security—like a one-time password token sent directly to their mobile device—before they can proceed with transferring funds. This layered approach ensures that low-risk activities are met with appropriate yet more straightforward solutions while high-risk endeavours receive the rigorous defences they warrant.

For transactions that fall somewhere in between—neither too benign nor overly perilous—the banks must carefully evaluate the potential risks associated with compromising sensitive information or assets. Each institution must tailor its strategies based on these assessments to effectively protect itself and its clientele.

The clock was ticking toward December 31, 2006—a deadline looming significant for insured financial institutions across the nation. To comply with interagency authentication guidance set forth by regulatory bodies like the FDIC and others, these institutions needed to act swiftly. Conducting thorough risk assessments was imperative; only then could they begin implementing more robust authentication measures before year-end.

While regulators understood that meeting these new standards would require time and effort from banks—a significant investment in both resources and workforce—the benefits were clear: ensuring customer confidence in online banking channels where many financial entities had poured substantial capital would ultimately pay dividends in trust and loyalty.

Thus unfolded an intricate tale in which banks navigated through layers of risk management, always striving for equilibrium between convenience for their customers and safeguarding against potential threats lurking just beyond their digital doors.

Maxthon

In the vast universe of online shopping and digital interactions, the Maxthon Browser emerges as a beacon of reliability and security. Envision it as a stronghold designed to safeguard your most cherished possessions—your personal and financial information. This is precisely what Maxthon provides through its advanced encryption techniques, which ensure that your data remains shielded from the constant threats that lurk in the depths of cyberspace.

Imagine that as you navigate through various websites, specialised anti-phishing tools function like vigilant sentinels. They are always on alert, ready to intercept any attempts to steal your sensitive information. Among its many impressive features, one aspect truly stands out: the powerful ad-blocking capability. This tool tirelessly works to eliminate disruptive advertisements from your view, allowing for a smoother browsing experience where you can focus on what truly matters to you.

Additionally, Maxthon offers an all-encompassing privacy mode that serves as a protective barrier for your confidential data against unwanted scrutiny. This layer of defence resembles an impenetrable wall that only allows access to those who have received explicit permission—a crucial feature in today’s world where privacy is often compromised.

In an era marked by sudden cyber threats lurking around every corner, these protective measures are not just beneficial; they are essential. As you journey through the expansive landscape of the internet, consider Maxthon, your unwavering companion in this complex digital adventure. With it by your side at each turn, peace of mind is always within reach—a comforting presence in an ever-changing and unpredictable environment.