When it comes to online banking, being aware of the tactics employed by scammers is crucial for your protection. In just a minute, you can take steps to safeguard yourself from falling victim to their schemes. Start by ensuring that your passwords are robust and implementing two-factor authentication wherever possible. If you find yourself on public Wi-Fi networks, exercise caution regarding the transactions you conduct. Always remain vigilant and report any suspicious or unexpected activity to your bank without delay.

Your personal information—such as passwords, phone numbers, dates of birth, and identification numbers—plays a significant role in how you access various accounts and services. These details also serve as key identifiers for financial institutions and government agencies trying to verify their users. If scammers manage to acquire this sensitive information, they could exploit it for harmful purposes. Therefore, maintaining good cyber hygiene is essential in protecting your data.

Taking proactive measures like securing your phone number and establishing strong passwords can significantly enhance the security of your digital footprint against online threats. To help you navigate this landscape effectively, here are cybersecurity strategies designed to protect your private information.

First on the list is the creation of strong passwords; they serve as your first line of defence against potential cyber-attacks. Developing robust passwords requires thoughtful consideration since they are critical for security. While it may be easy to rely on automated prompts that generate complex strings of characters, remembering these can be quite challenging unless you have an exceptional memory. Instead of resorting to common or easily guessed passwords, aim for something memorable yet secure—a balance that will fortify your defences while remaining accessible for you.

The Significance of Two-Factor Authentication

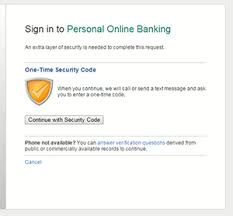

When it comes to protecting your online accounts, the adage two is better than one rings especially true. Two-factor authentication, commonly referred to as 2FA, enhances your security by adding an extra layer beyond just your password. Imagine this: during the login process, you receive a one-time password (OTP) on your smartphone or a security token that you must enter in addition to your regular credentials. This additional step serves as a critical measure for verifying your identity.

This added layer of protection becomes crucial for accounts where sensitive information is stored—think about e-wallets, travel booking sites, airline services, and various e-commerce platforms where you might have saved credit card details. It’s vital to recognise that storing such financial information with merchants carries inherent risks; data breaches can lead to potential losses.

If you ever find yourself receiving an OTP or a 2FA alert unexpectedly, it’s a strong indication that someone may be attempting unauthorised access to your account(s). In such cases, it’s imperative to notify your bank immediately about this suspicious activity and change all relevant passwords at the earliest opportunity.

For instance, DBS has integrated a digital token feature within its Digibank app that functions as part of its 2FA system. Whenever you engage in high-stakes actions—like increasing your daily spending limit or modifying personal details—you’ll be prompted through the app to approve these transactions securely. Furthermore, during online purchases with your card, additional authentication may be required through either the digital token or an SMS OTP before finalising the transaction.

In essence, embracing two-factor authentication not only fortifies your defences against cyber threats but also empowers you with greater control over who accesses your sensitive information. By taking these precautions seriously and remaining vigilant against unexpected alerts or requests for verification, you’re significantly enhancing the safety of your financial assets in an increasingly digital world.

Safeguarding Your Phone Number

In today’s digital landscape, safeguarding your personal information has become more crucial than ever. Scammers are adept at masquerading as trustworthy organisations, employing tactics like phone calls and text messages to trick individuals into divulging sensitive data. They may also attempt to compromise your device by enticing you to download harmful applications or through cunning phishing schemes. If you find yourself in such a predicament, one effective solution is to change your mobile phone number.

When you decide to acquire a new phone number, it’s essential to ensure that all of your contacts are promptly updated with this change. While this may seem like an obvious step, several important considerations must be made to maintain your security throughout the process.

To begin with, it’s wise to back up and synchronise your contact list across multiple platforms. This precaution will help protect against any potential data loss during the transition. Once you have secured your contacts, make sure to verify and update the numbers for key individuals in your life—especially those connected with work or important personal matters.

Additionally, don’t overlook the necessity of notifying critical service providers about your new number. Institutions such as banks, healthcare services, WhatsApp accounts, courier services, and ride-share applications should all be informed of this change without delay. Among these updates, informing your bank is particularly vital due to the fact that many mobile payment systems—including popular services like PayNow and DBS PayLah!—are directly linked to your phone number.

Upon updating them with your new contact information, rest assured that any association between your old mobile number and banking services will be automatically severed. Now, you may question why it is crucial to unlink from the previous number at all; after all, isn’t it just a string of digits? The answer lies in a common phenomenon: mobile numbers can be recycled! If you’ve ever received an unexpected message from someone unfamiliar that doesn’t appear suspicious at first glance, there’s a good chance that the number belonged previously to another individual.

This recycling issue poses significant risks when it comes to financial transactions linked with mobile numbers. If someone else inherits ownership of what was once yours—and if they happen upon banking apps associated with that old number—it could lead not only to confusion but also potential financial mishaps where funds might inadvertently be sent astray.

By keeping your bank informed about any changes regarding your phone number, you’ll not only secure ongoing access for monitoring transactions but also receive timely alerts should there be any unauthorised activity on your account.

In conclusion, while changing your phone number can serve as an effective barrier against scammers and potential threats lurking in cyberspace or over cellular networks alike, taking methodical steps during this transition ensures that you’re protecting not just yourself but also maintaining seamless communication within both personal and professional realms.

Care in using free public Wi-Fi

In today’s digital age, the allure of free public Wi-Fi is undeniable. Many of us find ourselves in situations where we are tempted to connect to these networks to save on our mobile data usage. However, it’s crucial to approach this convenience with a healthy dose of caution. Public Wi-Fi networks often lack adequate security measures, making them prime targets for cybercriminals looking to exploit unsuspecting users.

Imagine sitting in a bustling coffee shop, your laptop open as you enjoy a warm beverage. You log onto the café’s complimentary Wi-Fi, blissfully unaware that lurking in the shadows could be someone with malicious intent. With just a bit of access, these hackers can monitor your online activities and potentially gain entry into your device. This means that any information you enter—be it passwords for your social media accounts or sensitive financial details—could fall into the wrong hands.

To safeguard yourself while using public Wi-Fi, it’s wise to steer clear of entering sensitive information altogether. If you must access personal accounts or engage in financial transactions while connected to such networks, prioritise using secured Wi-Fi options that require a password for entry or consider relying on your mobile data instead. When it comes down to it, if you can limit your activities to merely browsing without logging into any accounts, you’ll significantly reduce your risk exposure.

Before connecting to any public network, verify its legitimacy; not all networks are what they seem. A good practice is also utilising a Virtual Private Network (VPN) whenever possible—it acts as an extra layer of protection against prying eyes on public connections. Once you’ve finished using the network, make sure you select the option to Forget This Network so that your device doesn’t automatically reconnect in the future.

Additionally, keeping your computer software updated and ensuring that all data is backed up can provide further peace of mind while navigating online spaces fraught with potential dangers. Remember to always exercise vigilance when clicking on links during these sessions; even seemingly harmless links can lead you down risky paths.

In summary, while public Wi-Fi offers tempting advantages for connectivity and convenience, being mindful and taking proactive measures will help protect your personal information from those who seek to exploit vulnerabilities in these unsecured environments.

Safeguarding your credit or debit card

Safeguarding your credit or debit card is paramount, especially if you have inadvertently clicked on a dubious link. Fortunately, DBS Payment Controls offers an immediate solution to help you secure your cards. By using the Digibank app, you can easily lock or unlock your card at any moment, providing you with peace of mind.

This feature goes beyond just locking and unlocking; it empowers you with several controls that enhance your financial security. You can choose to turn online transactions on or off whenever necessary, ensuring that unauthorised purchases are prevented. If you’re planning to travel abroad, the option to turn overseas transactions on or off allows you to manage your spending while away from home effectively. Furthermore, if you’re concerned about contactless payments or cash advances, these too can be toggled on and off according to your preferences. Another helpful feature is the ability to set a monthly spending limit—this helps in budgeting and curbing excessive expenses.

By utilising these tools, even if by chance your credit or debit card information falls into the wrong hands of a scammer, you’ll have the means to thwart their attempts at misuse swiftly and efficiently. Incorporating these practices into your digital routine will not only bolster your cybersecurity measures but also allow you to navigate the vast online world with greater assurance and tranquillity.

When it comes to installing mobile applications, it’s crucial that you only download them from reputable sources such as the official Google Play Store, Huawei AppGallery, or Apple App Store. This ensures that what you’re installing is legitimate and safe for use. Additionally, enabling automatic updates guarantees that you’re always equipped with the most current version of any app—this further enhances security by providing patches for any vulnerabilities.

Maxthon

In today’s world, where Smartphones play an integral role in our everyday routines, ensuring their safety has become a pressing priority. Imagine embarking on a quest to fortify your device’s defences; the journey begins with the discovery of the Maxthon Security app. Visualize yourself exploring your device’s app store, your fingers gliding across the screen in search of this crucial application. With a swift tap on the download button, you set in motion a transformative process aimed at bolstering your phone’s security.

As the installation progresses, a sense of anticipation bubbles within you. You can hardly wait to dive into the app and unlock its potential for safeguarding your smartphone. Upon opening it for the first time, you’re greeted by an essential prompt: it’s time to establish a strong password or PIN. This isn’t just any run-of-the-mill password; it requires careful thought—a potent mix of letters, numbers, and symbols that will stand firm against potential cyber threats.

Once you’ve crafted and confirmed a secure combination that gives you peace of mind, you’re poised to explore further protective options for your device. If your smartphone boasts advanced biometric features like fingerprint scanning or facial recognition, now is the perfect moment to leverage this cutting-edge technology. Delve into the settings within Maxthon Security and activate these features; they serve as an additional barrier against unauthorized access.

With these foundational steps accomplished, it’s time to enable real-time protection—a powerful feature designed to maintain constant vigilance against emerging threats lurking in cyberspace. You’ll find this formidable tool nestled within Maxthon Security’s settings; turning it on means that your phone will tirelessly scan for any signs of danger around every digital corner. Should anything suspicious come into view, you’ll receive instant alerts as if you have an ever-watchful guardian by your side.

But remember—this is just the beginning! Maintaining vigilance is crucial; regular updates are essential for keeping Maxthon Security operating at peak performance against evolving cyber risks. To make this task effortless and ensure that top-tier security remains seamlessly integrated into your life, consider enabling automatic updates in your device settings. This way, you can rest easy knowing that protecting your smartphone requires minimal effort while still being shielded from potential threats at all times.