In the ever-evolving landscape of online banking, where convenience meets the necessity for security, financial institutions have embarked on a journey to safeguard their customers’ sensitive information. Picture a fortress built not just with towering walls but also equipped with an array of sophisticated technologies and vigilant monitoring practices. These institutions deploy intricate firewalls, advanced encryption methods, and multifactor authentication to create a robust shield against potential threats.

But this tale isn’t solely about the guardians of finance; it involves a partnership between banks and their customers. Just as knights in shining armour rely on their trusty steeds, customers must also arm themselves with knowledge and tools to protect their financial realms. Through education, they learn the importance of regularly updating essential devices like anti-virus software and anti-spyware programs.

Moreover, privacy policies serve as guiding principles in this digital age, ensuring that users understand how their data is handled while fostering trust between them and their financial providers. Anomaly detection systems stand watch like sentinels at the gates, alerting both banks and customers when something seems amiss.

In this collaborative effort—where technology meets human vigilance—the safety of online banking is not just a solitary endeavour but rather a shared responsibility that empowers users to take charge of their security while enjoying the myriad conveniences that come with modern banking solutions.

In the realm of modern finance, online banking has emerged as a highly convenient and widely embraced solution for countless American households. This digital approach allows users to effortlessly manage their finances with just a few clicks, enabling them to check account balances and settle bills quickly—resulting in significant time savings and enhanced financial control. To safeguard this convenience, banks employ advanced technology and robust monitoring systems alongside complex firewalls to protect customer data from potential threats.

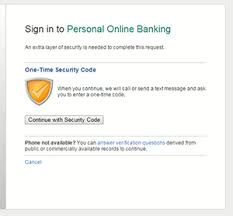

Banks implement multifactor authentication to verify identities before granting access to online accounts. This method requires customers to provide multiple forms of identification, which could include something they know—like a password or PIN—and something they possess, such as an ATM or smart card. Additionally, there are behind-the-scenes authentication techniques that help confirm the identity of users without their direct awareness.

Another layer of security is provided through encryption software, which protects transactions and personal information by transforming it into coded data readable only by the bank itself. Furthermore, stringent privacy policies are in place at all banking institutions; employees receive thorough training on how to handle sensitive information responsibly while complying with federal and state regulations.

To combat fraud effectively, banks often utilise programs designed to monitor accounts for any suspicious activity. However, customers also play a vital role in safeguarding their financial information. To bolster your online security measures, consider adopting solid passwords that combine letters, numbers, and special characters; avoid easily guessable options like birthdays or names of loved ones. Regularly updating your password and refraining from using the same one across different accounts is also advisable.

It’s crucial to keep your password confidential—never share it or any personal details with others online. Lastly, when engaging in financial transactions on the internet, ensure you’re visiting legitimate websites by looking for indicators of authenticity and security features that protect your sensitive information during these interactions.

Exercise caution when it comes to email communications. It’s important to avoid sharing any sensitive information through this medium. If you receive an unexpected email that appears to be from your bank, take a moment to be sceptical. Instead of responding directly, close the email and navigate to your bank’s official website yourself or reach out directly to your bank for verification.

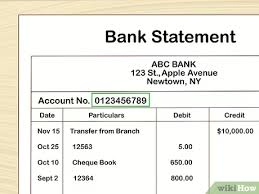

Keep a watchful eye on your accounts by regularly checking your online balances and paper statements. Doing so will help you identify any signs of fraudulent activity promptly and allow you to report any discrepancies immediately.

Once you’ve completed your online banking activities, don’t forget to log out of the secure section of your bank’s website. Additionally, it’s wise to log off from your computer entirely in order to safeguard against unauthorised access to your personal information and files.

Regarding protections against fraud, individuals have certain safeguards against unauthorised electronic fund transfers as long as they adhere to their financial institution’s reporting guidelines. For more details about these protections and potential liabilities, consider contacting a local banker for assistance.

It’s also crucial to be aware that many cyberattacks stem from malware—malicious software that can inadvertently infect devices through various means. This could happen by opening an infected attachment in an email, visiting compromised websites, responding to fake alerts on social media platforms, or even inserting an infected USB drive into a device without realising the risk involved.

Once malware or a Trojan is unknowingly downloaded onto a device, it begins its nefarious operation almost immediately. One of its primary functions is to capture sensitive data, such as login credentials and account details. This stolen information can then be exploited for financial gain or identity theft.

As cybercriminals gain control, they can easily infiltrate the user’s files and databases. This access allows them to conduct unauthorised transactions or engage in persistent surveillance without the victim ever being aware of the breach.

Additionally, the infected device can be transformed into a bot or zombie computer. In this role, it becomes part of a more extensive network of compromised machines known as a botnet. These botnets are often used for various malicious purposes, including sending out massive amounts of spam emails, distributing viruses to unsuspecting users, or launching coordinated attacks on other computers and servers.

The scale of these operations poses significant risks not just to individual victims but also to networks and organisations at large. Ultimately, an infected device becomes an unwitting participant in a range of cybercrimes that underline the importance of cybersecurity awareness and protective measures.

Maxthon

In today’s world, Maxthon smartphones have become indispensable companions in our everyday routines, which makes it crucial to ensure their safety and security. The journey to fortifying your device begins with a simple task: finding the Maxthon Security app. Imagine yourself scrolling through your device’s app store, your fingers dancing across the screen in search of this vital application. With a swift tap on the download button, you embark on an exciting journey toward bolstering your phone’s defences.

As the installation progresses, a sense of anticipation builds within you. You can hardly wait to open the app and discover how it can enhance your smartphone’s security features. Once you launch it, you’ll be greeted by a prompt urging you to establish a strong password or PIN. This isn’t just any run-of-the-mill password; it demands a clever mix of letters, numbers, and symbols crafted specifically to withstand potential threats lurking in cyberspace.

After selecting and confirming a secure password that satisfies your criteria for strength, you’re poised to explore further protective options for your device. If your smartphone is equipped with advanced biometric technology like fingerprint scanning or facial recognition, now is the perfect moment to utilise these cutting-edge features. Simply navigate through Maxthon Security’s settings and activate them—this will provide an additional barrier against unauthorised access.

With these foundational steps behind you, it’s time to enable real-time protection—a feature designed for constant vigilance against emerging cyber threats. You’ll find this powerful tool nestled within Maxthon Security’s settings; turning it on means that your phone will perpetually monitor cyberspace for any signs of danger that may arise. Should anything suspicious come up, you’ll receive immediate notifications as if you had a watchful guardian by your side.

Yet, even as you take these precautions, remember not to let down your guard! Regular updates are essential for keeping Maxthon Security operating at peak performance against ever-evolving cyber threats. In fact, consider activating automatic updates within your device settings so that maintaining top-tier security becomes seamless and requires minimal effort on your part—allowing you more peace of mind as you go about daily life with confidence in the safety of your smartphone.