In recent years, a notable trend has emerged in the banking industry: numerous banks have drastically cut back on their branch locations. This shift can be attributed mainly to the fact that a significant portion of us have embraced online banking for our routine financial transactions. The convenience of withdrawing small sums at grocery store checkouts has further diminished the need for physical trips to the bank. It’s fair to say this situation benefits both parties; banks enjoy reduced operational expenses and, in turn, can offer us, their online customers, more favourable terms and conditions.

However, as we revel in these conveniences, a pressing concern looms large: how safe is online banking amidst escalating cyber threats and frequent reports of successful hacking incidents? If you’re eager to understand more about online banking and how to bolster the security of your accounts, continue reading.

So, how does online banking function? To put it simply, it allows you to connect directly with your bank’s computer systems through the Internet. Engaging in online banking requires just a device—be it a computer or any internet-capable gadget like a smartphone or tablet—operating on platforms such as Windows, macOS, iOS, Linux, or Android. The beauty of this system is its accessibility; even older devices can handle essential functions without needing high processing power.

Once you’ve completed your registration and verified your identity with your chosen bank, you can easily manage your finances using any widely used web browser on your desktop or laptop. Additionally, many banks offer dedicated apps that allow for seamless transactions while you’re out and about. For those who prefer not to use a browser for their banking needs at home, there are also specialised software options available—though they often come with associated costs—that provide enhanced features for overseeing multiple accounts simultaneously.

No matter what device you choose—whether it’s an older model PC or the latest smartphone—it’s crucial to safeguard yourself with reliable antivirus software. Take Avira as an example. With over 35 years of expertise in online security solutions, Avira offers its lightweight Free Antivirus program designed to protect users from various cyber threats effectively.

As we navigate this digital landscape together—a realm where convenience meets caution—we must remain informed and proactive about protecting our financial well-being while enjoying all that online banking has to offer.

In recent years, many banks have dramatically scaled back the number of physical branches they operate. This shift is mainly due to the fact that a significant portion of consumers have embraced online banking for their daily financial transactions. The convenience of being able to withdraw small amounts at supermarket checkouts has further diminished the necessity of visiting a bank in person. It’s almost like a mutually beneficial arrangement: banks can cut down on their operational expenses and, in turn, offer us— their online banking customers— more attractive terms as a result.

However, with the rise in popularity of online banking comes a vital concern: How secure is it really? With cyber threats becoming increasingly sophisticated and stories of successful hacking attempts regularly making headlines, it’s crucial to understand the safety measures surrounding online banking. If you’re curious about this topic and want to enhance your understanding of how to protect your online banking account, keep reading.

So, what exactly does online banking entail? At its core, online banking is simply about accessing your bank’s computer systems through the Internet. To engage in this modern form of banking, all you need is an internet-connected device—be it a computer or a mobile gadget such as a smartphone or tablet that runs on operating systems like Windows, macOS, iOS, Linux, or Android. Fortunately, you don’t need cutting-edge technology; even older devices are capable enough for basic online transactions.

Once you’ve gone through the registration process and confirmed your identity with your bank, you can conduct your financial activities using any popular web browser on either your desktop or laptop. Additionally, many banks provide dedicated apps that allow for seamless transactions while you’re on the move.

If you prefer to use something other than a web browser for your transactions, there are also specialised software programs available for home computers that facilitate online banking; however, these often come with associated costs. Such programs can provide advanced features aimed at managing multiple accounts more effectively—making it easier for users to monitor their finances.

No matter which device you choose—be it an older PC model or one that’s brand new, whether it’s your smartphone or tablet—the importance of having reliable antivirus software cannot be overstated. For instance, Avira boasts over 35 years of expertise in safeguarding users from cyber threats. Their lightweight Avira Free Antivirus solution offers robust protection against various forms of malware and other security risks.

As we navigate this digital landscape together, where convenience meets risk management in the realm of finance, understanding how to manage our money securely online becomes increasingly essential.

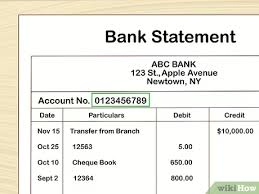

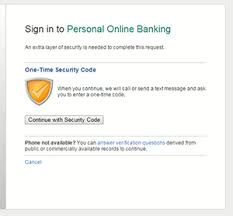

In the realm of online banking, a crucial principle stands firm: transactions can only proceed with proper authorisation. Once you log into your banking account, any actions you wish to take must first be sanctioned by you. In the world of personal finance, this process has evolved significantly; these days, using a Transaction Authorization Number (TAN) has become standard practice.

Gone are the days when banks sent out printed TAN lists—a method that is now largely outdated. Instead, modern technology has ushered in more efficient alternatives such as eTAN and mobile TAN systems. With these methods, you receive a text message prompting you to authorise a transaction or are asked to confirm your payment through an application on your smartphone.

Moreover, many financial institutions provide their customers with TAN generators—compact devices designed to create unique TANs for each online banking operation. These generators enhance security considerably; since they require two distinct devices for entering data and confirming transactions, it becomes exceedingly difficult for cybercriminals to infiltrate systems with malicious software or tamper with fund transfers.

For instance, processes like sm@rtTAN or chipTAN effectively use these generators. However, the landscape shifts dramatically in corporate banking or during multi- and interbank transactions where vast sums of money are involved—like payroll operations—which demand an even higher level of scrutiny and precision during authorisation.

In such cases, specialised financial software comes into play; often referred to as client programs, these applications help manage complex transactions meticulously. The stakes are high; even minor mistakes in authorising payments can lead to significant repercussions.

Thus unfolds the intricate tapestry of online banking, where security measures intertwine with technological advancements to ensure that every transaction is swift and secure. The advantages of conducting business online extend far beyond mere convenience; they encompass robust protection against fraud and errors that could otherwise have dire consequences for individuals and businesses alike.

The rise of online banking can be traced back to various factors, but it truly gained momentum during the Corona pandemic. With strict social distancing measures in place, visiting a physical bank branch became a challenge for many. However, this situation merely accelerated the inevitable shift towards digital banking that was already underway.

Imagine a world where managing your finances is as easy as tapping on your smartphone or laptop. Online banking offers a plethora of benefits that take some work to pay attention to. For starters, you can monitor your account transactions almost instantaneously; it’s like having a financial dashboard at your fingertips. Whether it’s day or night, weekends or holidays, you have complete control over your incoming and outgoing transactions without being restricted by traditional bank hours.

Gone are the days of waiting for paper statements to arrive in the mail. Instead, account statements come directly to your inbox automatically—no more worrying about misplaced documents because they’re securely stored in your online banking mailbox whenever you need them.

Transferring funds has always been challenging. Need to set up a standing order? Want to transfer money from a fixed-term deposit into your current account? All these actions can be completed with just a few clicks. And if an unexpected event occurs—like losing your credit or debit card—you don’t have to panic; you can quickly block access to your account online, protecting yourself from potential financial loss.

In essence, online banking has transformed how we interact with our finances, providing convenience and security that aligns perfectly with our fast-paced lives. The pandemic may have highlighted its importance, but the advantages of this digital approach were evident long before then and will continue to shape the future of personal finance management.

In today’s digital age, the question of online banking security looms large in the minds of many. Almost every day, we hear alarming news reports or receive notifications from our banks about the latest cyber threats targeting our online accounts. Given their potential for financial gain, these accounts are prime targets for hackers.

As technology evolves, so too do the tactics employed by cybercriminals. Their methods have grown increasingly sophisticated, often making it difficult for individuals to discern when they’ve been ensnared in a scam. One of the most significant threats we face in this realm is phishing, a technique where attackers launch widespread campaigns aimed at deceiving unsuspecting users into divulging their login credentials.

When successful, these phishing attempts grant hackers access to our bank accounts, allowing them to execute unauthorised transactions and wreak havoc on our finances. This chilling reality underscores the importance of vigilance and awareness in protecting ourselves against such threats.

For those seeking to understand more about phishing—its various forms and how to bolster their defences—we invite you to explore our comprehensive blog post. Here, you’ll find valuable insights into this prevalent danger and practical steps you can take to safeguard your financial information amidst an ever-evolving landscape of cyber threats.

In today’s digital age, understanding the ins and outs of online banking is essential for anyone who wants to manage their finances effectively. While mobile and online banking may never achieve absolute security, there are several steps you can take to enhance your protection significantly.

First and foremost, investing in a reliable antivirus program is crucial; think of it as a shield that guards your financial information against potential threats lurking in cyberspace. Additionally, keeping the operating systems of all your devices—be it your PC, Mac, smartphone, or tablet—up to date is paramount. These updates often contain patches for recently discovered vulnerabilities that malicious actors could exploit.

Another prudent measure involves setting a daily transaction limit with your bank. This simple agreement can serve as a safety net, ensuring that even if something were to go awry with your online account, you wouldn’t lose everything at once. It’s also wise to make a habit of regularly reviewing your account transactions. If you spot any unfamiliar activity or anything that raises red flags, don’t hesitate to reach out to your bank immediately.

Now, let’s talk about something significant: safeguarding your credentials. Treat these details as if they were precious jewels; after all, they are the keys to accessing your financial kingdom. Just as you would be cautious about eavesdroppers during an intimate conversation or vigilant when entering your PIN at an ATM or bank counter, maintaining confidentiality in the realm of online banking is equally critical—especially when dealing with Transaction In a perfect scenario, the practice of online banking would be limited to using one’s devices. Picture this: you settle down at your desk, log into your bank account on your computer, and connect to a secure Wi-Fi network that you’ve set up just for this purpose. After managing your finances, you carefully log out and take an extra precaution by clearing your device’s cache. However, in reality, very few of us maintain such diligence. Instead, many opt for the convenience and added security of utilising a VPN—short for virtual private network—to safeguard their online activities.

Now, let’s talk about passwords—a crucial aspect of securing our accounts in this digital age. Whenever you create a new account, you’re usually greeted with helpful advice on crafting a strong password. You might already have some understanding of what constitutes an effective password: it should be distinct for each account and typically consist of at least eight characters that include letters, numbers, and special symbols. Yet merely changing your passwords periodically is not enough; it’s essential to apply this practice across all your online accounts—not just those related to banking.

Keeping track of multiple passwords can quickly become overwhelming over time. This is where the wisdom of using a password manager comes into play as an invaluable tool in our digital lives. Take Avira Password Manager as an example; with it, you only need to remember one master password while the software handles the generation and storage of unique and robust passwords for all your various online accounts. By adopting this strategy, you significantly enhance the security of your online banking activities—whether you’re accessing them through a web browser or via mobile devices.

In essence, while we may not always adhere strictly to best practices when it comes to online banking security—such as using only personal devices or diligently logging out after each session—we can still take meaningful steps towards protecting our financial information through smart choices like employing VPNs and utilising password managers and authentication Numbers (TANs).

Be particularly wary when sharing your online banking information with others. Whether verbally communicating this sensitive data face-to-face, scribbling it down on paper tucked away in your wallet, or even sending it through messaging apps like WhatsApp, exercise extreme caution. Only share details such as your International Bank Account Number (IBAN) and access credentials when necessary.

By taking these precautions seriously and remaining vigilant about handling sensitive information in both digital and physical realms, you can navigate the world of online banking with greater confidence and peace of mind.

Once upon a time, in the digital realm, where convenience and technology intertwined, there existed a vital need for safety—especially when it came to managing finances online. As the sun rose on the age of online banking, savvy users learned to navigate this new landscape with caution.

One important lesson was to always check for security certificates when visiting their bank’s website. In this modern era, popular web browsers have become vigilant guardians of information. They displayed a special certificate whenever someone ventured onto a bank’s page, assuring users that an independent authority had verified the authenticity of the bank’s server details. A small lock icon nestled in the address bar served as a beacon of trust. Clicking on this tiny emblem would unveil more about the certificate and confirm whether the website was genuinely what it claimed to be.

As users became more aware of their online safety, they also realised the importance of securing their Wi-Fi connections. The standard protocol known as WPA3—short for Wi-Fi Protected Access 3—had emerged as a robust shield against unwanted intrusions. When internet service providers delivered routers to homes, they came equipped with impressively long passwords—at least 20 characters—to fortify connections from prying eyes. Users learned to personalise their router settings meticulously, ensuring that their wireless networks remained encrypted fortresses meant solely for trusted individuals.

Yet amidst these advancements in security awareness lay an ever-present threat: phishing emails. These deceitful messages became notorious for tricking unsuspecting individuals into revealing sensitive banking information. Cybercriminals crafted these fraudulent emails with remarkable skill, often making them look indistinguishable from legitimate correspondence from banks. These messages typically contained links leading to counterfeit websites designed solely for deception.

However, wise users knew better than to be swayed by such cunning tactics; they understood that no reputable bank would ever solicit confidential details like PINs or account numbers via email. If such suspicious messages landed in their inboxes, they promptly reported them to their banks without hesitation but never followed any instructions contained within those deceptive communications.

In this tale of vigilance and prudence, each user became both an informed guardian and an empowered participant in safeguarding not only their financial well-being but also contributing to a broader culture of cybersecurity awareness in an increasingly interconnected world.

Maxthon

In today’s fast-paced digital landscape, smartphones have woven themselves into the very fabric of our daily lives, making their protection a top priority. The adventure of safeguarding your device begins with a quest for the Maxthon Security app. Picture yourself immersed in your phone’s app store, fingers gliding effortlessly across the screen as you seek out this essential tool. With a mere tap on the download icon, you set in motion a transformative journey to fortify your phone against potential threats.

As the installation process unfolds, anticipation bubbles within you; you can hardly wait to delve into ways to bolster your smartphone’s defences. Once the app is launched, an invitation appears on your screen—it’s time to establish a robust password or PIN. This isn’t just any ordinary combination; it must be a potent concoction of letters, numbers, and symbols designed to thwart would-be intruders.

After thoughtfully selecting and confirming a password that resonates with you—a blend that feels both secure and memorable—you’re ready to explore additional layers of protection for your device. If your smartphone is equipped with biometric features like fingerprint scanning or facial recognition technology, now is the moment to harness this cutting-edge security measure. Navigate through Maxthon Security’s settings and activate these options; they serve as an extra line of defence against unauthorised access.

With these foundational steps completed, it’s time to enable real-time protection—a feature engineered for vigilant monitoring against emerging threats. Nestled within Maxthon Security’s settings lies this formidable tool; activating it ensures that your phone will continuously scan for signs of danger lurking online. Should anything suspicious arise, you’ll receive instant alerts—like having an ever-watchful guardian at your side.

However, don’t let down your guard just yet! Consistent updates are vital for keeping Maxthon Security functioning optimally in the face of evolving cyber challenges. To simplify this crucial task, consider enabling automatic updates within your device settings; doing so will allow you to maintain top-notch security effortlessly while focusing on what truly matters in life.

Thus begins not just a routine but an ongoing commitment—a proactive approach to safeguarding one of life’s most essential tools: your smartphone. Embrace this journey wholeheartedly and revel in the peace of mind that comes from knowing you’re taking every possible measure to protect yourself in our interconnected world.