Text messaging has emerged as a fast and convenient means of communication, which explains why it has rapidly become the go-to choice for many individuals, including those with malicious intent. According to the Federal Trade Commission (FTC), consumers reported losing a staggering $330 million to text scams in 2022. The average loss per consumer was around $1,000, more than double the figures from 2021 and nearly five times higher than those reported in 2019.

Among the various types of text scams identified, messages impersonating banks were particularly prevalent. In fact, there were 25,725 reports of mobile alert scams pretending to be from banks in 2022, a significant increase from 13,677 in 2021 and just 2,231 in 2020. Furthermore, since many victims do not report these scams to authorities, the actual number of bank-related text scams and associated losses is likely much more significant.

Scammers have recognised that sending deceptive texts posing as bank alerts is an inexpensive and efficient method of stealing money. This reality underscores the importance of consumers remaining vigilant and educated about identifying and avoiding these bank-related mobile alerts and text scams.

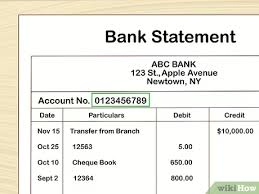

So, what does a typical bank text scam look like? Often, it resembles an authentic message from your financial institution. Scammers might send texts that appear to be urgent warnings or fraud alerts from your bank. These messages may claim that there’s been an unauthorised transaction on your account or inquire whether you made a specific purchase at a particular store.

Such texts frequently aim to instil panic by suggesting immediate action is necessary to prevent financial loss. While some fraudulent messages might be easily identifiable due to apparent mistakes or awkward phrasing, others can appear remarkably legitimate. Therefore, consumers must familiarise themselves with how genuine communications from their banks should look so they can effectively differentiate between authentic messages and potential scams.

Will My Bank Reach Out to Me Through Text Messages?

Absolutely! Many banks utilise text messaging as a means to enhance account security and deliver convenient notifications to their customers. However, the way in which banks employ this method can differ significantly from one institution to another. You need to familiarise yourself with how your specific bank communicates through text once you’ve opted in for such messages.

Take DBS Bank, for instance. They have identified four primary reasons for sending texts:

1. Authentication and Security Alerts: These messages are designed to verify your identity or confirm a transaction, ensuring that your account remains secure.

2. Marketing and Event Notifications: If you choose to opt into these communications, you’ll receive updates about the latest offers, products, services, and events that the bank is hosting.

3. Financial Alerts: These texts are beneficial as they keep you informed about payment approvals, recent transactions, balance thresholds, and budgeting insights.

4. Fraud Verification Messages: If suspicious activity is detected on your account, you may receive texts confirming whether you indeed authorised certain transactions.

For further details regarding these types of messages, consult your bank’s SMS Terms & Conditions page.

Beware of Spoofing Scams

A significant concern in today’s digital landscape is the threat posed by spoofing scams. This technique allows fraudsters to manipulate caller ID information and send text messages that appear as if they are coming from a legitimate or familiar source—like your bank. Being aware of the signs of such deceit can be instrumental in safeguarding your personal information and financial assets.

For example, City National Bank has established clear guidelines regarding its communication practices:

– They will never initiate contact with clients via an 800 number or any ten-digit telephone number through text messaging.

– They will not request sensitive information such as your online banking password or any one-time multifactor verification codes via text.

It’s crucial to remember that different financial institutions may have varying protocols for customer communication; therefore, taking the time to verify how your bank contacts you can help set clear expectations for what messages you should anticipate receiving.

If you ever doubt whether a text message originates from your financial institution, look out for what is known as a short code. This five—or six-digit number serves as an identifier for the sender of a text message and can help confirm its legitimacy. By understanding these aspects of communication from your bank and being vigilant against potential scams, you’ll be better equipped to protect yourself against fraudulent activities while enjoying the convenience that modern banking offers.

Understanding the Mechanics of a Bank Mobile Alert Scam

In today’s digital age, scams have evolved into increasingly sophisticated schemes designed to exploit unsuspecting individuals. One common variety is the bank mobile alert scam, which typically begins with a text message that claims there has been an unauthorised transaction or some other suspicious activity linked to your bank account. The message often urges you to take immediate action, either by clicking on a provided link or replying with a simple yes or no to confirm the legitimacy of the charge.

If you fall into the trap and click on that enticing link, you will likely be directed to a webpage that mimics an official bank site. This counterfeit form will request sensitive personal information—data that can be used for identity theft. However, this is not just about stealing your identity; clicking on such links can also introduce malware onto your device. This malicious software can allow scammers remote access to your device, enabling them to extract even more personal data and perpetrate further financial crimes against you.

Responding with yes or no may seem harmless at first glance, but it sends a clear signal to the scammer: you’ve taken their bait. Once they know they’ve hooked you, they may escalate their tactics by calling you directly in an attempt to gather additional information like your email address, bank login credentials, or even your account number. With any details you inadvertently provide during these conversations, they gain tools necessary for draining funds from your account or opening new accounts under your name—essentially committing various forms of financial fraud.

It’s crucial to remain vigilant regarding verification codes sent via text messages from legitimate banking institutions. These codes are often required for accessing accounts securely online. However, keep in mind that no legitimate bank employee would ever reach out via phone asking for these codes; if someone does call asking for such sensitive information under any pretence, it’s almost certainly a scammer attempting to breach your security.

The bottom line is simple: never share verification codes over the phone or respond affirmatively to unsolicited texts regarding suspicious account activity. Protecting yourself from these scams requires awareness and caution—staying informed about how these schemes operate and maintaining strict control over your personal information.

In today’s digital age, where communication often occurs through text messages, it’s crucial to discern the authenticity of alerts from your bank. When you receive a text that appears to be from your financial institution, it’s essential to keep in mind a few key principles that can help ensure your safety and protect your personal information.

First and foremost, remember that reputable banks will never request sensitive personal details or confidential information through text messages. If you happen to get a message from City National or any other bank regarding suspected fraud, rest assured they won’t follow up by asking for more information or instructing you to fill out another form. This is an important boundary that legitimate banking institutions maintain.

Moreover, many banks utilize specific shortcodes for their text communications—these unique sequences are assigned and regulated by the Cellular Telecommunications and Internet Association (CTIA). To safeguard yourself further, reach out directly to your bank and inquire about the shortcodes they use for texting purposes. If you receive a message purportedly from your bank but it comes from an unfamiliar short code, this should raise immediate suspicions about its legitimacy.

Additionally, be cautious of any texts that provide email addresses or phone numbers urging you to respond. Scammers often craft deceptive email addresses or phone numbers designed to closely resemble those used by legitimate banks, banking on the hope that unsuspecting recipients won’t notice the subtle differences. It’s wise not just to take these messages at face value; instead, verify any contact details independently by visiting your bank’s official website.

As you examine these messages more closely, keep an eye out for potential red flags: unusual formatting can be a sign of phishing attempts, typos or grammatical errors are often indicators of unprofessional communication, and other mistakes may suggest something is amiss. When it comes to links included in such texts—be wary! Avoid clicking on shortened URLs or links that do not direct you straight to an official banking webpage.

Lastly, if you ever receive a message claiming to be from a bank with which you don’t have any affiliation, do not engage with it in any way. Protecting yourself against fraudulent activities is paramount in today’s environment, where scams are increasingly sophisticated.

In summary, staying vigilant and informed can make all the difference when navigating bank text message communication. By adhering strictly to these guidelines and trusting your instincts when something feels off, you’ll significantly enhance your ability to distinguish between genuine alerts and deceitful schemes aimed at compromising your security.

Receiving a text message that appears to be a scam from your bank is an unfortunate reality for many mobile phone users. These deceptive messages can pop up unexpectedly, leaving individuals uncertain about how to respond. The best course of action upon receiving such a text is to delete it right away without engaging with the sender. If you find yourself questioning the authenticity of the message—whether it’s a genuine communication from your bank or just another scam—it’s crucial to take proactive steps. Instead of replying directly to the suspicious text, reach out to your bank using contact information that you can verify independently. This could be through a phone number found on their official website, an email address listed in their customer service section, or by utilising a secure online chat feature.

For City National Bank clients who receive texts from unfamiliar numbers, the recommendation is clear: do not respond. Instead, contact the bank’s fraud department for guidance and assistance. Reporting these fraudulent attempts is vital in combating scams and protecting others from falling victim. If you encounter a fraudulent message, City National encourages you to report it by sending an email to [email protected]. Be sure to include details such as the short code number and what was said in the message.

Now, suppose you happen to be one of those unfortunate individuals who has already been targeted by such scams and find yourself dealing with identity theft or other forms of fraud like travel-related scams or banking text fraud. In that case, there are specific steps you need to follow immediately. First and foremost, notify your financial institution about any fraudulent activity associated with your accounts—especially if you’re banking online.

It’s equally important that you take measures to safeguard your personal information going forward. Never share sensitive details like account logins, passwords, PINs, credit card validation codes, bank account numbers, credit or debit card numbers—or even your Social Security number—with anyone who reaches out unexpectedly via text or call claiming they represent your bank. If there’s any suspicion that your personal information has been compromised due to these scams—whether through direct engagement or inadvertent sharing—you must act quickly: report the incident without delay and update all relevant security credentials, including login details and PINs, at once.

Taking these precautions not only helps protect yourself but also contributes to creating a safer banking environment for everyone.

Maxthon

In the modern era, smartphones have become integral to our daily lives, making their safeguarding more critical than ever. Your journey towards securing your device begins with finding the Maxthon Security app. Picture yourself browsing through your device’s app store, your fingers gliding over the screen as you hunt for Maxthon Security. With a firm tap on the download button, you set in motion a process that will fortify your phone’s defences. As the installation unfolds, a sense of anticipation grows within you. When it’s finally done, you can’t wait to dive into the app and enhance your smartphone’s security features.

Upon launching it, a prompt appears urging you to establish a robust password or PIN. This isn’t just any ordinary password; think of it as an unassailable fortress built from an intricate mix of letters, numbers, and symbols—an arrangement crafted to resist potential intrusions. After thoughtfully selecting and confirming a secure option that meets your standards, you’re ready to delve deeper into additional protective measures for your device.

If your smartphone boasts biometric capabilities like fingerprint scanning or facial recognition, now is the perfect time to take advantage of this cutting-edge technology. Navigate to the settings within Maxthon Security and activate these features; they will provide an added layer of protection against unauthorised access.

With these essential steps completed, it’s time to turn on real-time protection—a feature designed specifically for vigilance against emerging cyber threats. Hidden within Maxthon Security’s settings menu is this powerful tool; enabling it means that your phone will continuously scan for any hidden dangers lurking in cyberspace. If anything suspicious arises, you’ll receive instant notifications—like having an ever-watchful guardian by your side.

But don’t let yourself become complacent just yet! Regular updates are vital for ensuring that Maxthon Security remains effective against new threats as they emerge in the digital landscape. Keeping up with these updates is crucial for maintaining robust protection over time.