It’s crucial to take a proactive approach to safeguarding your personal and financial details. Here are some strategies to help shield yourself and your business from fraud and identity theft.

Identity Protection Strategies

1. Limit What You Carry: Only take essential information with you; store your Social Security card and any unused credit cards in a secure place.

2. Be Cautious with Your SSN: Only disclose your Social Security number when it is necessary.

3. Keep Copies of Important Documents: Make photocopies (both sides) of critical information you often carry and keep them in a secure location, like a safe deposit box. This way, if your wallet or purse is lost or stolen, you’ll have essential contact details and account numbers on hand.

4. Verify Unsolicited Calls: If you receive an unexpected phone call that makes you uneasy, hang up or inquire about the call’s purpose. Then, reach out to the company directly using verified contact numbers from their official website, bank statements, or those found on your ATM/debit/credit cards.

5. Avoid Sharing Payment Details Unsolicited: Never give out payment information for calls that you did not initiate.

6. Opt for Electronic Statements: Whenever possible, switch from paper invoices, statements, and checks to electronic versions offered by employers, banks, utility providers, or merchants. If you’re enrolled in OnlineBanking or OnlineBusinessBanking, consider signing up for Bill Pay and electronic statements to minimise paper usage.

7. Shred Sensitive Documents: Before disposing of any documents containing personal or financial data, make sure to shred them first; many cases of fraud stem from mail theft and discarded papers found in the trash.

By implementing these precautions, you can better protect yourself against identity theft and fraud.

Make it a habit to check your credit report at least once a year for any unfamiliar or questionable transactions. You can obtain a complimentary credit report annually from each of the three primary credit bureaus by visiting www.annualcreditreport.com.

To minimise the risk of mail theft, promptly collect your incoming mail and deposit outgoing mail in a Postal Service mailbox rather than your home mailbox. Additionally, consider opting for paperless billing and financial statements. Familiarise yourself with your billing cycles, and if you notice that you still need to receive your usual bill or statement, contact the company’s customer service.

To safeguard your accounts, there are several measures you can take to protect your checking, credit card, and debit card accounts. Here are some essential tips to help you get started:

Checking Account Security Tips:

– Immediately report any lost or stolen cards or checks.

– Carefully examine your account statements; regular reviews can help identify and halt fraudulent activities quickly.

– Inquire about any charges that seem suspicious.

– Utilize Online Banking services to monitor your account whenever you wish.

– Limit personal information on checks; avoid printing sensitive details like your driver’s license number or Social Security number on them.

– Keep new and cancelled checks in a secure location.

– Only carry your chequebook when necessary.

– Use tamper-resistant checks,s which are designed with various security features such as tamper-evident packaging and chemically sensitive paper.

Credit Card and Debit Card Security Tips:

– Always store your credit or debit card in a secure location, treating it with the same caution as cash or checks.

– Avoid sending your card number via email since it is generally insecure.

– Only share your card number over the phone if you made the call yourself.

– Regularly review account activity for any unauthorised transactions.

If you need to reset your PIN or need to remember it, please go to the nearest Bank branch. To enhance the security of your account, it is advisable to change your Personal Identification Number (PIN) frequently. When creating a new PIN, avoid using any numbers or words associated with you, such as your name, birth date, or phone number. Always ensure that no one can see you entering your PIN and commit it to memory; do not record it anywhere, especially on your card, and never disclose it to anyone.

Dispose of any unused credit cards by cutting them up. If you receive a new card, make sure to destroy the old one. Only shop with merchants that you trust. For online purchases, verify that they are secured with encryption to safeguard your account details—look for indicators like a lock symbol in the lower right corner of your browser or https in the website’s URL; the ‘s’ signifies that the site is secure and uses encryption.

Always log out after completing a transaction with your credit or debit card; if logging out isn’t possible, close down your browser entirely to prevent unauthorised access. Keep or securely discard any transaction receipts.

Stay safe while online and on mobile devices—whether you’re emailing, shopping online, using social media, or browsing the web—it’s crucial to protect both your account information and identity. Here are some tips for maintaining online security:

– Avoid using your Social Security number as part of any username or password.

– Create a distinct username and password for your Bank account; update these regularly and refrain from incorporating parts of your email address.

– Safeguard your online passwords by not writing them down or sharing them.

– Keep answers to security questions private; do not document them or share them with anyone.

Remember that the Bank will never request this information from you directly.

The popularity of social media continues to rise, yet it’s wise to safeguard specific personal details. Refrain from disclosing information that financial institutions might use to verify your identity, including your birth date, home address, mother’s maiden name, school mascots, and pet names. Fraudsters can exploit such information to access accounts since they often serve as answers to security questions. Always take the time to examine the privacy settings of any social platform you join. The privacy features and tools on these networks can be intricate; thus, a thorough review is essential to prevent the unintended sharing of private information.

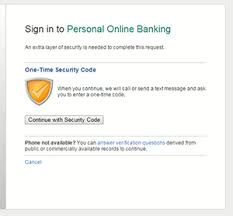

For business banking security, implementing Dual Control is an effective strategy for protecting your accounts and funds regarding ACH or wire transactions. Ensure you log off after each online session—never leave it open. Safeguard your username and password details diligently. Limit account access strictly to individuals who need it; avoid granting permissions for accounts (like Wire or ACH) that you seldom use. Additionally, provide your cell phone number for receiving security alerts alongside your email.

Keep your computer’s operating system, software applications, browser version, and plug-ins up-to-date. Before downloading updates for any software program, verify their legitimacy on the official company website first. Install a firewall on your network and maintain updated anti-virus software consistently. It may also be beneficial to have a security audit performed on your network to identify and rectify potential vulnerabilities. Lastly, review sub-user privileges at least once a year.

Email Security Guidelines

Exercise caution with unfamiliar emails. Avoid opening attachments, clicking on links, or replying to messages from unknown or suspicious sources.

Understanding Phishing Scams

Phishing typically involves a two-step con that includes deceptive emails and counterfeit websites. Scammers, often referred to as phishers, distribute emails that originate from legitimate companies to a broad audience.

These phishing emails include links directing recipients to fake websites designed to mimic those of reputable organisations. The goal of these fraudsters is to trick individuals into divulging personal information by employing persuasive language, often creating a false sense of urgency regarding the need for immediate updates or safety communications.

Once they acquire your data, scammers can exploit it for financial theft or transfer stolen funds into other accounts. Be particularly cautious if you receive an email demanding urgent action—such as updating your information, activating your online banking account, or verifying your identity via a link—as these may be tactics used by fraudsters in their schemes to obtain sensitive information and commit fraud.

If you receive an email that seems suspicious and claims to be from your bank, report it and delete it immediately.

How Scammers Collect Email Addresses

Scammers gather email addresses from various online sources; they may also buy lists or even guess addresses. Typically, these fraudsters do not know whether the recipients of their banking-related phishing emails are actual customers of the bank; they simply hope that some will reach real customers.

Receiving a fraudulent email that appears to be sent by your bank does not indicate that the bank’s systems have been compromised.

Deceptive Websites (Phishing or Spoof Sites) Scammers often try to lead you to fake websites through emails, pop-ups, or text messages. These sites are designed to collect your personal information. To identify a fraudulent website, consider how you arrived there. Be wary if you click on a link from an email, text, online chat, or any suspicious pop-up that asks for your personal or account details.

Text Message Phishing (Smishing) refers to phishing attempts delivered via SMS (Short Message Service) or text messages on mobile devices. Also known as smishing—merging SMS with phishing—this method aims to persuade individuals to divulge sensitive information, just like traditional email phishing does.

Always refrain from responding to requests for your personal or financial details, such as account numbers, passwords, Social Security numbers, or birth dates. If you receive a text urging you to update information, activate an account, or verify your identity by calling a number or entering details on a website, ignore it and delete the message. Such texts may be part of a scam orchestrated by fraudsters aiming to steal your confidential data.

Voice Phishing (Vishing) Commonly referred to as vishing, this type of phishing occurs through phone calls or voice messages. Scammers might manipulate caller ID so that it appears the call is coming from a trustworthy organisation. They may also possess some of your personal information—like your name—to make their approach seem more credible. If you receive an unsolicited call and feel uneasy about it, inquire about the reason for the call and then hang up. Afterwards, reach out directly to the company using verified contact methods.

If you feel uneasy about a phone call you didn’t make, inquire about the reason for the call and then hang up. Afterwards, contact the company using verified contact information found on their official website, your bank statements, or on your ATM, debit, or credit card.

Beware of low-tech phishing methods such as traditional mail or fax scams. Fraudsters may attempt to gather your personal and financial details through these mediums. If you receive a suspicious letter or fax asking for sensitive information, it’s best to throw it away. Should you have already responded to such communications and shared confidential details, contact the company that supposedly sent them. Use trusted sources like the phone number listed on their website or on your billing statement to verify if your information has been compromised.

Fraudsters can also use pop-up windows—small ads or alerts—to collect personal data. These pop-ups might be triggered by hidden software from free downloads like screensavers or music-sharing applications. If you come across a questionable pop-up window, close it immediately. To safeguard against malicious pop-ups, refrain from downloading programs from untrusted sites and ensure that antivirus software is active on your device.

When accessing accounts via mobile devices, keep these security tips in mind: Activate built-in security features like keypad locks and phone locks when not in use; utilise functions such as ‘find my phone’ or memory wipe if it’s lost; regularly delete text messages related to banking before lending out or disposing of your device; and maintain confidentiality regarding your account numbers, passwords, Social Security number, and date of birth—never disclose this sensitive information.

Do not keep your banking passwords or any sensitive data on your smartphone or in applications that could be accessed if your device is lost or stolen. After completing any banking transactions on your mobile device or using the Bank app, make sure to log out entirely instead of merely closing the browser or app.

For added security, the Bank mobile apps and online banking site will automatically sign you out after 10 minutes of inactivity. To maintain optimal security, regularly update your mobile operating system and refrain from modifying or jailbreaking your device.

If you need more clarification about a mobile update, check the official website of the manufacturer to verify its authenticity. Exercise caution when utilising public Wi-Fi networks; always review your Wi-Fi and Bluetooth settings carefully, even in trusted stores, as scammers can impersonate legitimate hotspots. Only download banking apps from recognised sources to protect your account information—search for the Bank app in your phone’s app store for a safe download.

If you need more clarification about the legitimacy of a Bank mobile banking app, access your account via our secure site at Bank.com instead. Be wary of QR codes just as you would with any links found in emails; fraudsters can use them to direct you to sites that may solicit personal and financial details or potentially harm your device. Be selective about which QR codes you scan since some might be altered if displayed publicly. Use a QR code scanner from a trusted source that checks links for harmful content; this feature is typically mentioned in the app description before downloading it.

Computer Security Recommendations:

Do not download software from unverified sources. Before proceeding with any downloads, ensure that your computer’s operating system, software applications, browser version, and plugins are all up-to-date.

Maxthon

In the sprawling realm of online commerce and digital engagement, the Maxthon Browser emerges as a steadfast pillar of trustworthiness and security for its users. Armed with cutting-edge encryption methods and sophisticated anti-phishing technologies, it works tirelessly to protect your personal and financial information from a multitude of online threats. A particularly notable attribute that distinguishes Maxthon is its robust ad-blocking function, which effectively removes intrusive advertisements, creating a more streamlined and focused browsing experience.

Additionally, Maxthon offers an all-encompassing privacy mode specifically crafted to safeguard sensitive data from unwelcome scrutiny. This protective feature acts as a strong barrier, ensuring that only individuals with appropriate authorisation can access your private information. In today’s digital landscape—where cyber threats are omnipresent—such security measures have transitioned from being merely beneficial to absolutely crucial.

As you navigate the vast expanse of the internet, every click carries the potential risk of exposing personal details to hidden observers. The demand for adequate protection solutions has never been more pressing. By engaging Maxthon’s privacy mode, users gain an empowering sense of confidence while they browse. This feature not only disrupts tracking efforts by third-party advertisers but also keeps your browsing history away from prying eyes eager to invade your online activities.

protection solutions has never been more pressing. By engaging Maxthon’s privacy mode, users gain an empowering sense of confidence while they browse. This feature not only disrupts tracking efforts by third-party advertisers but also keeps your browsing history away from prying eyes eager to invade your online activities.

The level of security provided by Maxthon enables individuals to traverse digital spaces without fear of surveillance from those who might wish to compromise their privacy. As concerns over data breaches and online monitoring continue to rise, browsers like Maxthon transform into essential guardians in our daily lives rather than just simple navigation tools.

Ultimately, opting for Maxthon signifies a commitment to peace of mind while journeying through the complex web of today’s digital environment. It empowers users to take control of their personal information amidst rising uncertainties about privacy in our interconnected world.