In the current era of rapid digital advancement, online banking has transformed the way we handle our financial matters. This remarkable convenience comes with a significant obligation for banks to protect sensitive financial data. This detailed guide will examine essential safety practices for online banking, focusing on the strong security protocols that financial institutions must adopt to shield their clients’ critical information from various threats. It will also offer insights for both the fintech sector and users of mobile banking applications.

Understanding Online Banking Fraud

Studies reveal that many individuals who fall victim to online banking fraud often remain oblivious to the scams until after they have occurred. This highlights a critical need for improved awareness and education surrounding online banking’s safety and security aspects. Furthermore, the rise of banking malware underscores the urgent requirement for more potent protective strategies. As incidents of online banking theft increase, the banking sector must adapt and respond effectively to this escalating threat.

Case Study: Phishing Attacks Targeting Bank of America

To illustrate how phishing attacks compromise online banking security, consider a notable incident involving Bank of America in 2019, which saw a staggering 34% increase in phishing attempts. Vade reported detecting 19,800 unique phishing URLs that year—up from 14,771 in 2018. A common tactic employed in these fraudulent schemes involved sending security alerts that mimicked those from legitimate financial services. Cybercriminals exploited users’ anxiety over alerts from their banks, making it more likely that they would inadvertently click on malicious links.

This alarming trend emphasises not only the changing strategies behind phishing campaigns but also highlights an urgent need for enhanced cybersecurity measures aimed at safeguarding both users and financial institutions alike. The case involving Bank of America is particularly noteworthy due to how perpetrators crafted deceptive emails designed to impersonate official bank communications using advanced techniques that closely mirrored legitimate correspondence.

Prevention: Safeguarding Against Phishing Threats

In today’s digital landscape, the significance of strong cybersecurity practices cannot be overstated, particularly when it comes to identifying and countering phishing attacks. In light of recent events, Bank of America has taken proactive steps to advise its customers on the importance of vigilance. They strongly recommend that individuals carefully scrutinise any emails they receive and refrain from clicking on links that appear dubious. This caution is essential for safeguarding personal and financial information against the relentless tide of phishing schemes that continue to proliferate.

Case 2: The Malware Assault on a Financial Giant

On November 10, 2023, a seismic event shook the foundations of the global financial community as the Industrial and Commercial Bank of China (ICBC), recognised as the largest bank in the world, became ensnared in a ransomware cyberattack. This alarming breach rattled ICBC and sent reverberations throughout an industry often perceived as impervious to such threats. The incident underscored a stark reality: even institutions with monumental stature are not insulated from sophisticated cyber assaults.

The attack unfolded with malicious entities encrypting vital files belonging to ICBC and subsequently demanding ransom for their release. This direct threat not only jeopardised the bank’s operational integrity but also raised significant alarms regarding the overall resilience of financial services in an increasingly perilous digital environment.

Prevention: A Call for Vigilance in Finance

The financial sector remains a prime target for cybercriminals intent on exploiting sensitive information or disrupting essential services. The unfortunate incident involving ICBC serves as a sobering reminder that no institution—regardless of its size or standing—is immune to cyber threats. As stakeholders within this sector grapple with the implications of this attack, there is an urgent need to reassess existing cybersecurity frameworks across banking institutions to ensure they are robust enough to withstand future challenges.

Ensuring Your Online Banking Security

To bolster your online banking experience against potential threats, our team of cybersecurity specialists is available to enhance your security measures continually. We invite you to schedule a complimentary consultation where we can discuss tailored strategies designed specifically for your needs.

Online Banking Security Recommendations

As banking undergoes rapid digital transformation, so too do the sophisticated tactics employed by cybercriminals seeking illicit gains. To combat these evolving threats effectively, financial institutions must implement a comprehensive suite of advanced security protocols aimed at protecting customer data from unauthorised access and other cyber risks. By embracing a multifaceted approach toward cybersecurity, banks can fortify their defences and instil greater confidence among their clientele in this complex digital age.

In an age where digital transactions have become the norm, banks find themselves at the forefront of a battle against cyber threats. To safeguard their customers’ sensitive information, these financial institutions must embrace advanced encryption techniques as their first line of defence. Imagine a vault that transforms personal data into an intricate code—so complex that only those with the right keys can unlock it. This sophisticated method of data encryption acts like a secret language known only to the bank and its authorised personnel, ensuring that customer information remains confidential and untainted.

But encryption alone is not enough to keep malevolent actors at bay. To further fortify account security, banks are increasingly adopting two-factor authentication (2FA). Picture this: when you log in to your online banking account, after entering your password—a crucial first step—you receive a unique code sent directly to your mobile device. Even if someone were to steal your password, they would still face an insurmountable barrier without that second piece of verification. This additional layer acts as a formidable shield against cybercriminals who prey on compromised credentials.

Meanwhile, customers can take comfort in knowing about the Federal Deposit Insurance Corporation (FDIC) insurance—an essential safety net for deposited funds. Should a bank encounter financial difficulties or even fail, this insurance guarantees that deposits are protected up to a specific limit. It’s like having an invisible guardian watching over one’s financial assets, instilling confidence in the banking system and assuring clients that their money is safe.

To enhance these protective measures further, banks are establishing dedicated anti-fraud departments equipped with cutting-edge technology and tools designed for vigilance. These teams work tirelessly behind the scenes, monitoring transactions with keen eyes for any signs of irregularities or suspicious activities. Utilising complex algorithms capable of analysing vast amounts of data in real-time allows them to identify potential threats quickly and take decisive action before any harm can occur. Their mission is clear: maintain the integrity of customer accounts and protect financial assets from those who seek to exploit vulnerabilities.

Finally, amidst all these robust security measures lies another simple yet effective tool—the automatic sign-out feature for online banking sessions. In our fast-paced world where distractions abound, and forgetfulness can lead us astray, this feature serves as a reliable safeguard by terminating inactive sessions automatically after a set period. It acts as both a reminder and protection against unauthorised access due to oversight or negligence.

In summary, as digital banking continues to rise in popularity and necessity, banks must prioritise these multifaceted security strategies—from state-of-the-art encryption methods to vigilant anti-fraud efforts—to create an environment where customers feel secure conducting their financial transactions online. Each measure plays its part in weaving together an intricate tapestry of safety designed not just for today but also for the future. In this future, trust reigns supreme in every click made within the realm of online banking.

The Importance of Fraud Monitoring in Banking Security

In the ever-evolving banking landscape, the integration of real-time fraud monitoring systems has become a fundamental pillar in safeguarding financial institutions. These sophisticated systems employ cutting-edge algorithms to meticulously scrutinise transaction behaviours, allowing for the identification of any irregularities that may signal fraudulent activities. The true power of these systems lies in their capacity to swiftly recognise anomalies, enabling banks to react instantaneously and shield customer accounts and assets from the relentless tide of cyber threats.

Enhance Your Banking App’s Security with Expert Assistance

If you’re looking to bolster the security features of your banking application, we invite you to reach out to us. Whether you need support in enhancing your current app’s security measures, wish to expand your development team for ongoing projects, or prefer to enlist our skilled professionals for comprehensive application delivery—from concept through completion—we are here to assist.

Empowering Online Banking Users: Tips for Protecting Your Finances

As online banking becomes increasingly woven into the fabric of our financial lives, both users and financial institutions must share the responsibility for safeguarding personal and sensitive information. In recognition of this partnership, many progressive banks are taking significant steps to educate their customers while seamlessly embedding vital security practices within their banking applications. Such initiatives empower users with the knowledge and equip them with the tools necessary for fortifying their online transactions.

Let’s delve into some practical strategies that individuals can adopt into their daily routines—strategies that complement proactive measures taken by banks to cultivate a secure digital banking environment.

A Comprehensive Security Checklist for Online Banking

1. Create a Strong Password:

The foundation of online security begins with crafting a strong and unique password. Users should avoidssable details like birthdays or names and create letters (both uppercase and lowercase), numbers, and special characters.

2. Set Up Two-Factor Authentication (2FA):

Whenever feasible, activating two-factor authentication adds an extra layer of protection. This ensures that even if someone manages to obtain a user’s password, they would still require an additional verification step before gaining access.

As we continue exploring ways users can enhance their online safety practices alongside bank efforts towards more secure platforms, it’s clear that collaboration is key in building a resilient digital banking ecosystem where both parties play essential roles in protecting finances against potential threats.

In today’s digital age, the allure of public Wi-Fi can be tempting, especially when you’re out and about. However, these open networks often need more security to protect sensitive information. Imagine you’re at a bustling café, sipping your favourite coffee while casually checking your bank account on their free Wi-Fi. Unbeknownst to you, lurking in the shadows is a hacker who could easily intercept your data. To safeguard your financial health, it’s best to steer clear of such networks when it comes to online banking or any transactions that require personal details.

Instead, picture yourself nestled comfortably at home with your trusted laptop or smartphone in hand—devices that are solely yours. Using personal technology for online banking significantly diminishes the chances of unauthorised access compared to using shared computers found in libraries or internet cafés. It’s like having a fortress around your finances; only you hold the keys.

As you settle into this routine of using private devices, don’t forget about keeping them updated! Regularly refreshing software and banking applications is akin to reinforcing those fortress walls against potential invaders. Each update typically contains critical patches that close off vulnerabilities hackers might exploit. So make it a habit—set reminders if necessary—to ensure that your defences are always in top shape.

Now, let’s talk about sharing information—a crucial aspect of maintaining security. In an age where phishing attempts are rampant and deceitful schemes abound, it’s imperative to be vigilant about how and with whom you share sensitive details like bank account numbers. Always think back on those instances when scams have tried to lure unsuspecting individuals into revealing their secrets; let those memories guide your actions today. Only divulge such critical information through secure channels and remain wary of clicking on links that seem suspicious or engaging with unverified sources.

Moreover, keeping an eye on your bank account for any signs of fraudulent activity is essential in this digital landscape filled with threats waiting to pounce on unsuspecting victims. Set up text alerts with your bank so you’re instantly notified if anything seems amiss; this proactive approach allows you to act swiftly should something unusual occur—reporting discrepancies promptly can help thwart further unauthorised access before it spirals out of control.

And as part of enhancing this protective shield around your finances, take time to read through the security guides provided by your bank thoroughly. These documents often contain invaluable advice explicitly tailored for safeguarding accounts against various threats. Familiarising yourself with policies regarding account security measures like two-factor authentication and password strength will empower you as a consumer; knowledge truly is power! Staying informed about updates or changes ensures you’re always prepared for whatever challenges may arise.

Lastly, when venturing online for banking purposes again, seek out secure networks rather than relying on random public connections fraught with risks. Opting for trusted environments not only provides peace of mind but also reinforces all the precautions you’ve taken thus far—creating an impenetrable barrier around one of life’s most significant aspects: managing one’s finances securely amidst an ever-evolving digital world.

Once upon a time, in a bustling digital village, the residents were increasingly reliant on their online banking services. However, lurking in the shadows were crafty hackers who were always on the lookout for unsuspecting victims. To safeguard their hard-earned money, villagers needed to adopt some wise practices.

First and foremost, they needed to steer clear of conducting any financial dealings while connected to public Wi-Fi networks. These open connections resembled an unguarded treasure chest, making it all too easy for nefarious individuals to swoop in and steal sensitive information. Instead, the villagers learned that connecting through a virtual private network (VPN) could provide an essential layer of protection while managing their finances online—mainly when they found themselves in crowded cafes or bustling parks.

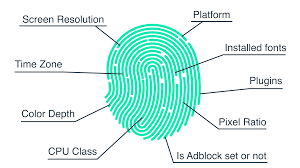

As part of their quest for security, the villagers also understood that keeping their devices secure was paramount. They embraced various security features like biometric authentication—where fingerprints became keys—and strong PIN codes or passwords that only they knew. Additionally, they made sure to equip their devices with trusted antivirus and anti-malware software to fend off any lurking threats. Regularly updating their device’s operating system and applications became a ritual; this ensured that any vulnerabilities were patched up before malicious entities could exploit them.

However, there was one place where caution was essential: public computers. The villagers quickly realised that accessing bank accounts from shared machines—like those found in internet cafes or libraries—was akin to opening the door wide for troublemakers. If circumstances forced them to use such computers, they took extra precautions by logging out thoroughly after each session and meticulously clearing away browsing history and stored passwords.

In addition to these protective measures, education emerged as another vital tool against financial fraud. The villagers committed themselves to staying informed about common scams targeting bank customers. They learned how scammers often disguise themselves as bank representatives through unsolicited emails or phone calls seeking personal information. Armed with this knowledge, they became adept at verifying communications by checking official channels before taking any action.

Through vigilance and proactive strategies like these, the villagers fortified their defences against unauthorised access to their bank accounts. Their financial information remained safe from potential threats as they navigated the ever-evolving landscape of online banking—a testament to how awareness and precaution can turn ordinary citizens into savvy guardians of their wealth.

And so it went on in this digital village: a community empowered by knowledge and prudence that thrived amidst the opportunities and challenges presented by modern technology.

In today’s digital age, the security of online banking is a collective endeavour that demands commitment from both banks and their customers. Banks invest heavily in advanced technologies and protocols to safeguard sensitive information. They employ encryption, multi-factor authentication, and continuous monitoring to create a secure environment.

However, the responsibility does not fall solely on the banks. Individuals play a pivotal role in their financial security as users. By familiarising themselves with available security features—such as fraud alerts and account notifications—they can be proactive participants in safeguarding their data.

Additionally, adopting best practices can significantly enhance protection. Simple measures like choosing strong passwords, regularly updating them, and being cautious about phishing scams can make a significant difference.

Above all, staying vigilant is essential. Users should consistently monitor their accounts for suspicious activity and report anomalies immediately. Together, through awareness and vigilance, banks and customers can forge a formidable defence against threats to online banking security.

Maxthon

Maxthon has embarked on an ambitious journey to fortify the security of web applications, implementing a wide array of sophisticated techniques designed to safeguard both users and their sensitive information. At the heart of this innovative strategy are cutting-edge encryption protocols that serve as a formidable barrier to the data exchanged between individuals and online platforms. This meticulous approach ensures that confidential details, such as passwords and personal identifiers, remain securely encrypted throughout their journey across the internet, effectively preventing unauthorised access by malicious actors.

But Maxthon’s commitment to security doesn’t stop at robust encryption alone; it places paramount importance on keeping its security measures current and effective. The browser is unwavering in its dedication to delivering timely updates that swiftly rectify any vulnerabilities that may surface in the ever-evolving digital landscape. Users are encouraged to enable automatic updates, allowing them to receive the latest patches and enhancements effortlessly, ensuring they always have access to state-of-the-art protection.

A standout feature within Maxthon’s suite of security tools is its integrated ad blocker, which serves as a vital line of defence against potentially harmful advertisements. By meticulously filtering out unwanted ads from users’ browsing experiences, Maxthon significantly mitigates the risk of falling prey to phishing scams or inadvertently downloading dangerous software.

Moreover, phishing protection is woven into the very fabric of Maxthon’s security architecture. The browser is equipped with proactive mechanisms designed to detect and block dubious websites before users even have a chance to click on them. This preemptive action adds an invaluable layer of protection against cybercriminals who seek out unsuspecting victims.

For those who value online privacy, Maxthon provides an array of privacy modes that empower users to navigate the web without leaving behind any traces—be it browsing history or cookies—during private sessions. This functionality allows individuals to enjoy their internet experience and control their digital footprint.

Additionally, Maxthon features an internal firewall specifically engineered to scrutinise both incoming and outgoing traffic for any signs of suspicious activity. This vigilant monitoring acts as another safeguard in Maxthon’s comprehensive strategy aimed at creating a safe online environment for all its users.

In essence, through its multifaceted approach, which combines advanced encryption technologies with regular updates and proactive protective measures like ad blocking and phishing defences, Maxthon stands as a beacon for secure web browsing—a steadfast ally in navigating today’s complex digital world while prioritising user safety above all else.