In recent times, bank fraud has emerged as a growing concern, marked by increasingly sophisticated schemes that inflict both financial losses and reputational harm on institutions. A revealing study highlighted that in 2022, more than 70 financial entities reported losses exceeding $500,000 due to fraudulent activities. Among those most severely impacted were fintech firms and regional banks, which found themselves particularly vulnerable to these threats.

As the landscape of financial services evolves, so too does the regulatory environment. Institutions are now facing heightened scrutiny regarding customer identity verification processes and the implementation of anti-money laundering measures. This shift underscores a critical need for robust strategies aimed at preventing fraud while fostering trust between customers and their financial providers.

Building this mutual trust is essential; it not only helps curb instances of bank fraud but also enhances the overall user experience. When financial institutions adopt effective practices—such as comprehensive identity verification protocols and continuous monitoring—they can create a seamless experience for their clients while simultaneously safeguarding against various forms of consumer fraud. This balance allows them to operate within the bounds of federal regulations without sacrificing efficiency.

Key points to consider include the alarming rise in bank fraud incidents: over 70 financial institutions reported losing at least $500,000 each in fraudulent activities last year alone. As a response to this growing threat, there is an urgent need for stricter regulations surrounding customer identity verification and anti-money laundering initiatives. To combat these challenges effectively, banks must implement solid fraud prevention strategies that incorporate identity verification processes, multi-factor authentication (MFA), and adaptive access controls aimed at bolstering security against potential threats.

Furthermore, it is crucial to have an actionable plan for responding to incidents of fraud. This plan should encompass immediate steps such as notifying law enforcement authorities and freezing compromised accounts to mitigate damage swiftly.

Ultimately, understanding what constitutes bank fraud and recognising its implications becomes vital for consumers and institutions as they navigate this complex landscape together.

Understanding Bank Fraud: A Comprehensive Overview

Bank fraud is a serious criminal offence aimed at unlawfully acquiring funds or assets from financial institutions or their clientele. Traditionally, this type of fraud involved tangible actions, such as cashing in counterfeit checks or stealing physical credit cards. However, the advent of digital banking has transformed these tactics, leading to increasingly complex and sophisticated fraudulent schemes.

To effectively combat bank fraud and safeguard both the institution and its customers, it’s crucial to familiarise oneself with various forms of this illicit activity.

Exploring Different Types of Bank Fraud

One prevalent form of bank fraud is account takeover (ATO). In this scenario, criminals exploit vulnerabilities to gain unauthorised access to a customer’s account by using their login details. This can happen through various methods that target unsuspecting individuals.

A standard method employed by fraudsters is phishing attacks. These attacks often manifest as deceptive emails, text messages, or phone calls designed to trick the account holder into revealing sensitive information under the guise of communication from a bank representative. Interestingly, not only customers are vulnerable; bank employees also face threats from phishing schemes. A notable example is call center fraud where an attacker impersonates a customer to extract confidential details directly from the bank’s support team.

Another tactic used by cybercriminals is credential stuffing. This involves leveraging stolen usernames and passwords acquired from illicit sources on the dark web. Often, these credentials need to be completed or updated; moreover, attackers deploy automated tools to systematically try these combinations across numerous websites in hopes of gaining access to accounts. While individual attempts may have low success rates due to security measures in place, the sheer volume of data they work with increases their chances of breaching multiple accounts.

Session hijacking represents yet another layer in this complex web of fraud activities. Unlike traditional methods that occur during login attempts, session hijacking takes place mid-transaction when an attacker seizes control over an ongoing user session by exploiting stolen session cookies. Such data breaches typically occur through malicious third-party browser extensions or other vulnerabilities that allow hackers access without needing initial login credentials.

In conclusion, understanding the myriad forms of bank fraud—from account takeovers and phishing attacks to credential stuffing and session hijacking—is vital for financial institutions aiming to fortify their defences against these evolving threats while ensuring customer safety remains paramount. By staying informed about these risks and implementing robust preventive measures, banks can better protect themselves and their clients from falling victim to such deceitful practices.

In cybersecurity, a method known as password spraying has emerged as a cunning tactic employed by malicious individuals. Instead of painstakingly attempting to crack specific login credentials for individual accounts, these nefarious actors opt for a more sweeping approach. They systematically pair numerous usernames with commonly used passwords, hoping that sheer volume will yield results. By deploying automated bots to execute this strategy on a large scale, attackers can ultimately stumble upon valid username-password combinations that grant them illicit access to various accounts.

However, the threat landscape extends beyond just existing accounts; it also encompasses the peril of new account fraud. In the banking sector, this form of deceit poses significant challenges. Fraudsters may exploit another person’s identity to open fresh accounts or even concoct entirely fictitious identities by merging real and invented details. To combat this growing concern, financial institutions adhere to Know Your Customer (KYC) regulations. These measures are designed not only to verify an individual’s identity at the moment an account is created but also to maintain ongoing scrutiny throughout the banking relationship.

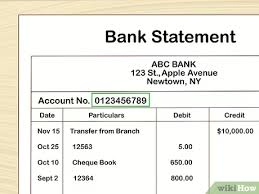

Yet another layer of complexity in new account fraud involves fraudulent documents. Criminals often employ counterfeit paperwork as part of their schemes, using fake identification cards, bogus email addresses, or forged checks to lend an air of legitimacy to their identity theft efforts. In some cases, cybercriminals go so far as to fabricate phoney bank statements  in a bid for loan approval or other financing options—either under stolen identities or entirely fictitious personas.

in a bid for loan approval or other financing options—either under stolen identities or entirely fictitious personas.

Check fraud represents yet another facet of financial deception that manifests in various forms. One prevalent method involves criminals producing counterfeit checks that appear authentic enough to be passed off as legitimate transactions—whether for purchases or withdrawals from unsuspecting victims’ accounts. Another insidious tactic is check washing: thieves erase ink from stolen checks (often pilfered from mailboxes) and then rewrite them with new payee information before cashing them in themselves.

Moreover, mobile check deposit scams have become increasingly common. Fraudsters provide victims with fake checks intended for deposit into their bank accounts. Once deposited, they typically request that the victim return a portion of those funds—often through money orders, wire transfers, or gift cards—before the check is inevitably flagged as fraudulent by the bank.

As these varied schemes illustrate, both established and emerging threats pose significant risks within our financial systems today. This is a reminder that vigilance and proactive measures remain essential in safeguarding against such deceptive practices.

The Intricate Web of Financial Deception

In the complex world of finance, banks play a crucial role in safeguarding against the insidious practice of money laundering. They are entrusted with implementing robust anti-money laundering (AML) strategies designed to prevent criminals from utilising their banking services to conceal and transfer illicit funds. To fulfil this responsibility, financial institutions must adhere to stringent Know Your Customer (KYC) protocols, which require them to understand their clients thoroughly. This is complemented by additional measures such as customer due diligence (CDD), meticulous screening of both customers and transactions and vigilant reporting of any suspicious activities that may arise.

These regulatory frameworks exist as a bulwark against the pervasive threat of money laundering, aiming to minimise risks and protect the integrity of the financial system.

On another front, we encounter the phenomenon known as Authorized Push Payments (APP). In this scenario, fraudsters employ cunning tactics to deceive unsuspecting account holders into authorising payments that are notoriously difficult to reverse. These con artists often masquerade as legitimate businesses offering enticing goods or services or fabricating elaborate schemes promising rewards in exchange for advance fees—essentially luring victims into a trap with false promises. This blend of social engineering and digital manipulation underscores how easily individuals can be exploited when they are led astray by someone adopting a deceptive persona.

As technology advances, so too does the speed at which transactions occur. Real-time payments have revolutionised financial exchanges by making them faster than ever before; however, this rapidity also presents opportunities for exploitation if adequate safeguards are not established. Criminals adept at executing APP fraud find it increasingly challenging for financial institutions to detect these dubious transactions or reverse them once initiated since real-time payments typically lack mechanisms for recall. Moreover, given that many real-time transactions take place via smartphones connected through WiFi networks, there lies an additional risk: fraudsters can hijack sessions and capture sensitive credentials for future malicious use.

Wire transfer scams represent yet another layer in this intricate tapestry of financial deceit. These scams have become alarmingly prevalent due to the inherent difficulty in reversing fraudulent wire transfers once they have been executed. Criminals employ various strategies aimed at convincing individuals to send money via wire transfer under pretences. Victims may encounter scenarios where fraudsters impersonate government officials—such as IRS agents—or even pose as trusted family members seeking assistance during emergencies.

An especially concerning aspect of wire fraud is money laundering. Herein lies a troubling dynamic in which unsuspecting individuals unknowingly participate in criminal activities by facilitating transfers on behalf of scammers without realising they are being used as pawns in a larger scheme.

As these stories unfold within the realm of finance—a world governed by trust but threatened by deception—it becomes evident that vigilance is essential for both institutions and individuals. The battle against such fraudulent practices requires constant adaptation and awareness amidst an ever-evolving landscape rife with threats lurking just beneath the surface.

In the ever-evolving landscape of finance, it’s crucial for banks to proactively disseminate information about prevalent scams, especially during peak periods like tax season or the holiday shopping rush when online transactions surge. By providing this literature throughout the year, institutions can empower individuals to remain vigilant and discern the legitimate inquiries that may come from actual bank representatives and executives.

One effective strategy for enhancing security is through Policy-based Access Control. This approach entails granting or denying access based on a set of established policies tailored to various attributes determined by the bank. For instance, an employee’s access might hinge on their job title, level of security clearance, or even the time they are attempting to log in. Conversely, a customer’s access could be influenced by their geographical location at the time of login, how quickly they are travelling, and an assessed threat level.

Another vital tool in this arsenal is the utilisation of Verified Credentials. By employing these secure credentials, banks can authenticate user attributes according to specific guidelines that dictate what is considered acceptable. This method significantly mitigates risks associated with fraud and account hijacking since these credentials are protected through cryptographic measures. Additionally, banks can track who issued each credential and who received it—adding another layer of accountability.

To further bolster security efforts, automated risk-signal monitoring systems can be deployed by banks to verify users based on a variety of unique parameters. These parameters include the precise time of day a request is made, the IP address being used for access attempts, physical location data, and contextual information surrounding each request. Such monitoring can occur in real-time—allowing institutions to swiftly thwart any fraudulent login attempts or restrict access when suspicious activity arises.

However, beyond preventive measures lies a necessity: having a robust fraud mitigation plan ready for immediate implementation should any fraudulent activity be suspected or confirmed. Banks must take decisive action; this includes notifying law enforcement agencies as well as affected account holders—a requirement under federal regulations—and doing so within 36 hours of detection. Furthermore, freezing compromised accounts must be prioritised while initiating thorough investigations into any breaches.

Rebuilding customer trust post-incident and enhancing security protocols moving forward becomes paramount. Involving multiple stakeholders is vital to ensuring comprehensive communication across departments during these critical planning phases for fraud mitigation strategies; collaboration will foster clarity and efficiency throughout all levels of response.

In essence, fostering awareness about common scams while implementing stringent access controls and verification methods will create a more secure banking environment where both employees and customers feel protected against potential threats lurking in today’s digital age.

The Tale of Safeguarding Trust in Banking: A Journey with Ping Identity

In the bustling world of finance, where trust is as valuable as currency, the spectre of bank fraud looms large. For institutions dedicated to safeguarding their customers’ assets, the stakes are high—not only for customer loyalty but also for adherence to federal regulations and the overall security of financial transactions.

Our story begins with a crucial realisation: to combat fraud effectively; banks must embark on a transformative journey fueled by a strong digital identity strategy. This foundational step is essential for achieving compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Imagine a vibrant marketplace where every interaction hinges on trust. Customers walk through the doors of their banks, seeking not just services but assurance that their hard-earned money is safe. Herein lies the power of digital identity—a tool that enables financial institutions to know their customers intimately while protecting them from potential threats.

As our narrative unfolds, we witness how banks leverage innovative technologies to create secure environments that foster confidence among clients. By establishing robust verification processes and employing cutting-edge solutions like those offered by Ping Identity, these institutions gain invaluable insights into who their customers are—ensuring compliance and enhancing security at every turn.

This journey towards enhanced fraud prevention is not merely about technology; it’s about building lasting relationships based on transparency and reliability. With each step taken towards better understanding their clientele, banks fortify themselves against fraudulent activities while simultaneously cultivating loyalty among those they serve.

Thus, in this ever-evolving financial services landscape, the quest for effective fraud prevention continues—a testament to banks’ commitment to protecting what matters most: trust in an increasingly digital world.

Maxthon

Maxthon, a pioneering force in web browsing, has embarked on an ambitious quest to revolutionise the security landscape for online applications. Driven by an unwavering dedication to protecting users and their sensitive data, Maxthon’s journey is both bold and transformative. Central to this mission is a sophisticated suite of encryption technologies designed to create a formidable shield around the information exchanged between users and various digital platforms.

Imagine every interaction—whether entering passwords or sharing personal details—taking place within fortified encrypted channels that thwart any attempts at unauthorised access. This meticulous focus on encryption marks just the beginning of Maxthon’s comprehensive security blueprint. Recognising that cyber threats are in a perpetual state of evolution, Maxthon adopts a forward-thinking strategy to ensure user safety remains paramount.

Crafted with foresight, the browser is engineered to evolve alongside emerging cybersecurity challenges. Regular updates are seamlessly integrated into its framework, swiftly addressing vulnerabilities as they are identified. Users are strongly encouraged to enable automatic updates—a crucial aspect of their cybersecurity regimen—allowing them to effortlessly benefit from the latest security enhancements without interruption.

In this dynamic digital landscape where change is constant, Maxthon’s steadfast commitment to ongoing improvements in security not only demonstrates its responsibility towards its users but also highlights its mission to foster trust in online interactions. With each new update released into the wilds of cyberspace, users can traverse the web with newfound confidence, assured that their personal information remains safeguarded against an ever-shifting array of threats.

As Maxthon continues down this path of innovation and vigilance, it stands as a beacon for those seeking safety online—a testament to what it means to prioritise user protection in an age where digital dangers lurk at every corner.