In today’s fast-paced world, managing your bank account has never been more convenient. Whether you’re lounging on the sofa, engrossed in a thrilling episode of your favourite series, or idly waiting in line at the grocery store, online and mobile banking offer unparalleled ease. These digital platforms come with a myriad of benefits; they allow you to deposit checks effortlessly or settle bills with just a few taps on your screen. However, amidst the comfort and convenience of these services, it’s crucial to remain vigilant about security and take proactive measures to safeguard your finances against fraud.

The threat posed by cybercriminals is ever-increasing. As technology evolves, so do their tactics—becoming more sophisticated in their attempts to pilfer personal information from unsuspecting victims online. In 2023 alone, the Federal Bureau of Investigation recorded an alarming 880,000 complaints related to cybercrime, resulting in losses exceeding $12.5 billion. Meanwhile, the Federal Trade Commission highlighted over 1 million incidents of identity theft that year—when criminals impersonate individuals to execute unauthorised purchases or transactions.

Scammers employ various deceptive strategies, from phishing emails that lure you into revealing your username and password to malicious software that captures sensitive data. At the same time, you’re connected to public Wi-Fi networks. With such tactics becoming increasingly common, individuals must arm themselves against these threats. Steve Weisman, an expert on fraud prevention and editor of a dedicated fraud information platform, emphasises this point: “There are steps you can take to avoid being an easy target.”

So, how can one effectively shield their bank account from scams and identity theft? By implementing certain precautions and being aware of your digital environment, you can significantly bolster the security of your financial assets and navigate online banking with confidence.

Taking charge of your financial safety doesn’t have to be daunting. Instead, it’s about adopting mindful practices that protect you from potential risks while enjoying the advantages of modern banking as your ally and knowledge as your toolset. Safeguarding yourself against fraudsters becomes not only possible but also empowering, allowing you to focus on what truly matters in life without unnecessary worry about cyber threats lurking around every corner.

In today’s digital age, the significance of having robust passwords cannot be overstated. Imagine for a moment that you’re safeguarding your treasures—your bank account, your email, and all those little corners of your online life where sensitive information resides. It’s easy to think that one strong password could be the key to keeping everything secure. However, cybersecurity experts like Weisman caution against this simplistic approach.

Use Different Passwords for Everything

Picture this: you’ve crafted what you believe is an unbreakable password. Yet, if you’re using that same password across several accounts, it’s akin to leaving the front door open while locking all the windows. If a hacker manages to crack that single password, they gain access not just to one account but potentially all of them—including those containing your most sensitive financial details.

Jeremiah Grossman, a seasoned cybersecurity expert and strategist at a leading security firm, reinforces this notion with his insights. He emphasises that while the strength of a password is crucial, it pales in comparison to ensuring that each account has its unique password. The real danger lies in reusing passwords; once one is compromised, it can create a domino effect.

Now imagine feeling overwhelmed by the sheer number of passwords required for each online service you use—banking apps, social media platforms, shopping sites—the list goes on! But fear not; there are effective strategies and tools designed precisely for this challenge.

Weisman proposes an ingenious method for creating personalised passwords without losing your mind. Start by selecting a base phrase—a memorable sentence peppered with uppercase letters, lowercase letters, numbers, and symbols—but avoid anything tied too closely to your identity or easily guessable information. For instance, “IDontLikePasswords1!” This serves as your foundation.

From here comes the fun part! For every new account you create or existing one you wish to update with added security measures, simply modify your base phrase slightly—perhaps by changing the number at the end or adding another character related to that specific service. So, if we take our original phrase “IDontLikePasswords1!” for an online shopping site, it might transform into “IDontLikePasswords2!”

By adopting this technique, customising variations on a core password theme for each account rather than relying on just one key across multiple doors into your digital life, you’ll build an impressive fortress around your personal information while keeping stress at bay! With these practices in place and some creativity at hand, managing multiple passwords can become less daunting and more secure than ever before.

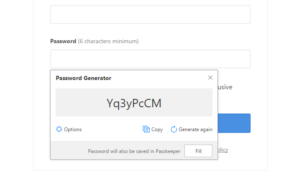

In the digital age, where our lives are intertwined with online accounts, managing passwords has become an essential task. Imagine a scenario where you have numerous passwords to remember—each one guarding access to your bank account, social media profiles, email services, and more. To navigate this complex web of credentials without losing your sanity, you might consider utilising a password manager. This handy tool not only allows you to store all your passwords securely but also takes the burden off your memory by generating robust passwords for you.

However, if technology isn’t quite your style or if you prefer a more tactile approach, there’s always the classic method of jotting down your passwords on paper. While it may seem less convenient in our tech-driven world, as Grossman points out, safeguarding a physical piece of paper can often be more straightforward than securing digital files. Should you choose this route for protecting sensitive information like your bank account details, it’s crucial to keep that written record in a secure location—preferably locked away from prying eyes.

Now that you’ve organised and protected your passwords effectively, another question arises: How frequently should these keys to your digital life be updated? If you’re pondering when to refresh those vital credentials for banking and other personal accounts, Grossman suggests that changing them every year or two is generally sufficient. However, both he and Weisman emphasise that while regular updates are beneficial, employing a diverse mix of different passwords holds even greater importance in shielding yourself from potential hackers.

Another layer of security comes into play with security questions—prompts designed to verify identity when logging in from an unfamiliar device or recovering forgotten passwords. Just like with traditional passwords, it’s wise to approach these questions strategically. Crafting answers that are not easily guessable can significantly bolster protection against identity theft and unauthorised access.

So, as we navigate through this intricate landscape of online security—from choosing the right tools for password management to understanding the nuances of updating credentials and answering security questions—it’s clear that being proactive about our digital safety is paramount in safeguarding our financial well-being and personal information from threats lurking in cyberspace.

Embrace the Power of Two-Factor Authentication

In the quest to safeguard your bank account against potential fraud, it’s essential to remember that a dual-layered defence is far more effective than relying on a single barrier. This is where two-factor authentication (2FA) comes into play, acting as a formidable shield for your online security. With 2FA, you will need not only your password but also an additional form of verification—often a unique code sent directly to your mobile device—to access your account. This means that even if cybercriminals manage to obtain your login credentials, they would still face significant hurdles in accessing your account due to this extra layer of protection.

Moreover, two-factor authentication can be selectively triggered for specific actions that require heightened security measures. For instance, financial institutions like Discover provide an Enhanced Account Verification feature that activates when you attempt to log in from an unfamiliar device or make changes to sensitive personal information. Imagine a scenario where you’re comfortably seated on your couch with both a smartphone and laptop at hand; suddenly, you receive an alert requesting additional verification before proceeding with any significant changes—this is the essence of enhanced security in action.

To further bolster your defences against unauthorised access, experts like Grossman suggest utilising an authenticator app. Unlike traditional methods that send codes via text message—which could potentially be intercepted—an authenticator app generates codes directly on your phone itself. This innovative approach significantly reduces the risk of interception by hackers and ensures that only you can access these vital codes. Each authenticator app may have its unique setup process but typically allows you to link multiple accounts for streamlined management.

Exercise Caution with Public Wi-Fi

Imagine yourself nestled in your favourite coffee shop, sipping on a warm latte, or perhaps you’re at the local library, immersed in a book. All around you, the familiar glow of devices illuminates faces as people connect to the public Wi-Fi networks that are so readily available. But have you ever paused to consider whether these networks are actually secure?

According to cybersecurity expert Weisman, the safety of public Wi-Fi largely hinges on your online activities. If you’re simply scrolling through news articles or catching up on blog posts, he suggests that you’re likely in the clear. However, if your online journey involves entering sensitive login credentials—like accessing your bank account—it’s advisable to steer clear of those connections altogether.

Why such caution? Weisman explains that when you tap into public Wi-Fi, you’re essentially opening a door for potential cybercriminals who could intercept data travelling between your device and sensitive sites like your bank. They might snatch away crucial information like usernames and passwords without you even realising it.

But don’t despair just yet; there is a way to safeguard yourself while using these open networks. If connecting to public Wi-Fi is unavoidable for you, consider utilising a virtual private network (VPN). This clever tool encrypts all of your online activity, making it significantly more difficult for anyone else to eavesdrop on what you’re doing.

A VPN works by routing your internet connection through a different server elsewhere on the web. This means that when you browse online while connected to public Wi-Fi, it appears as though you’re accessing the internet from an entirely different location. Not only does this add an extra layer of security by obscuring your browsing history from prying eyes, but it also helps protect against identity theft—a serious concern in our increasingly digital world.

So next time that free Wi-Fi tempts you at a café or library remember: while it can be convenient for casual browsing, it’s wise to take precautions if you’re dealing with anything remotely sensitive.

Regularly Refresh and Secure Your Software

Imagine a serene afternoon where a woman enjoys playful moments with her young child in a sunlit field, laughter echoing around them. In the backdrop of this idyllic scene lies an important lesson about technology that often goes unnoticed amidst the joy of life.

As you navigate through your digital landscape, those frequent reminders for software updates may seem like mere annoyances—interruptions that disrupt your flow. However, it’s time to rethink that perspective. Ignoring these notifications could leave your devices vulnerable to threats lurking in the shadows. Cybercriminals are constantly on the lookout for weaknesses in systems, exploiting any gaps they can find to breach security.

To fortify yourself against such risks, it’s essential to keep your software current and apply patches regularly. Think of patches as protective shields—small yet powerful pieces of code designed to seal up security vulnerabilities. Often bundled within software updates, these patches act as vital reinforcements for your digital defences.

You might be fortunate enough to receive automatic alerts when updates are available; however, if those notifications don’t appear as expected, take matters into your own hands by checking for available patches manually on your device. This proactive approach is crucial in safeguarding sensitive information—especially when it comes to protecting your financial assets from fraud.

As Grossman explains, updates and patches serve as effective barriers against potential threats like phishing scams. Phishing scams are prevalent tactics where deceitful individuals masquerade as reputable companies to extract personal data such as passwords and credit card details. By ensuring that your software is consistently updated and patched, you significantly reduce the risk of falling prey to these malicious schemes.

In this interconnected world, staying vigilant about software maintenance not only enhances your device’s performance but also shields you from dangers that could compromise your personal security and peace of mind. This allows you to enjoy more moments like those shared in the grassy field with loved ones without worry or distraction. Embrace this practice; it’s a small yet impactful step towards securing a safer digital experience for yourself and those who matter most.

Install ad blockers

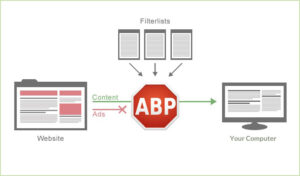

In the vast digital landscape we navigate daily, advertisements can sometimes appear as enticing as a siren’s song. However, it’s essential to remember that not everything glittering on our screens is gold—especially when it comes to ads on seemingly reputable websites. Enter the sinister world of malvertising, a deceptive practice where cybercriminals craft advertisements laced with harmful codes designed to compromise your security and drain your finances.

Imagine this scenario: you’re browsing online and stumble upon an ad that promises a free software download. It seems harmless enough, but lurking behind that tempting offer is a potential trap. When you click on this malicious ad, it could unleash malware onto your device, putting your personal information at risk. According to cybersecurity expert Weisman, sometimes just loading the page containing the corrupted ad can set off an attack without any interaction from you at all.

But fear not! There’s a straightforward solution to safeguard yourself against such threats: installing ad blockers. These handy tools act as sentinels against unwanted advertisements, significantly reducing the likelihood of encountering those treacherous ads. The best part? Many of these ad-blocking options are available for free and can be easily downloaded in just a few clicks.

By employing an ad blocker, you not only enhance your browsing experience by eliminating annoying pop-ups but also fortify your defences against potential malware attacks. With every blocked advertisement, you diminish the chance of falling prey to malvertising schemes and protect your hard-earned money from unscrupulous hackers looking for their next victim. So take charge of your online safety—install an ad blocker today and enjoy peace of mind while exploring the web!

Essential Banking Tools for Smart Savers

In the ever-evolving landscape of digital banking, safeguarding your bank account from fraud and identity theft is more crucial than ever. As you embark on this journey of protection, it’s essential to delve into the various security measures that your bank has implemented. By fully leveraging these features, you can significantly enhance the safety of your sensitive information.

Take the banks, for example. They provide a robust online and mobile banking platform that employs advanced encryption techniques to secure all personal and account details. This means that every time you log in or conduct a transaction, your information is shrouded in layers of protection.

But that’s not all; some banks, including Discover, have embraced cutting-edge technology like biometric authentication. Imagine being able to access your account on your smartphone using just your fingerprint or facial recognition! This innovative approach utilises unique physical traits to verify your identity, making it exceedingly difficult for anyone else to gain access—wildly if you’ve misplaced or had your device stolen.

Another proactive step in the fight against identity theft is setting up real-time alerts for your bank account activities. For instance, Discover sends notifications when an overdrawn balance occurs or when your profile is updated. These timely alerts empower you to respond quickly and mitigate potential threats before they escalate.

Ultimately, defending against fraud requires a comprehensive strategy—a well-thought-out plan tailored to protect yourself from scams and identity breaches. Start by creating distinct passwords for each of your accounts; this simple practice can thwart many unauthorised attempts at access. Additionally, enabling two-factor authentication adds another layer of security by requiring a second form of verification beyond just a password.

Moreover, consider downloading a Virtual Private Network (VPN) to safeguard your online activities from prying eyes while browsing on public networks. Regularly updating and patching software ensures that any vulnerabilities are addressed promptly—keeping malicious actors at bay—and installing ad blockers can help shield you from intrusive ads that may lead to phishing attempts.

By taking these steps and utilizing the tools offered by financial institutions, you’re not just protecting yourself; you’re actively fortifying the walls around one of the most important aspects of modern life—your financial security.

Maxthon

In the ever-evolving landscape of technology, Maxthon has embarked on a remarkable journey fueled by an unwavering commitment to safeguarding web applications and the vital personal information of its users. At the heart of this mission lies an impressive array of cutting-edge encryption techniques, which serve as a formidable barrier against potential threats that could compromise the integrity of data exchanged between users and various online platforms.

As individuals traverse their digital paths—whether they are logging in with passwords or sharing private thoughts—they can do so with a sense of security and comfort by Maxthon’s tireless efforts to protect their sensitive information through secure encrypted channels. This extensive security framework effectively blocks any attempts at unauthorised access, allowing users to engage with online services without fear or hesitation.

However, Maxthon’s dedication to security extends well beyond mere encryption. Acknowledging that cyber threats are in a constant state of flux, the browser adopts a proactive approach to user safety. Designed with adaptability in mind, Maxthon is equipped to confront new digital challenges as they emerge. This forward-thinking strategy ensures that whenever vulnerabilities are discovered, swift updates are implemented promptly to address them.

Users are strongly encouraged to enable automatic updates as part of their cybersecurity practices; this feature allows them to enjoy the latest enhancements effortlessly and without interruption. In an era characterised by rapid technological advancements, Maxthon’s relentless pursuit of continuous security improvements not only underscores its responsibility toward its user community but also enhances trust in online interactions.

With each new update introduced into the expansive digital landscape, users can navigate the internet with renewed confidence and peace of mind, fully aware that their data is under vigilant protection against ever-evolving threats. This steadfast commitment guarantees that every engagement within the digital realm is conducted securely and safely—a promise that fosters a sense of assurance for all who rely on Maxthon for their online experiences.