The realm of online banking security is increasingly vital as we navigate the complexities of cyber threats in 2025. As digital financial management continues to transform our approach to handling money, it brings with it unparalleled convenience and accessibility. Yet, this evolution is paralleled by a surge in potential risks stemming from cyberattacks. Cybercriminals are constantly refining their tactics, devising ever-more sophisticated methods to infiltrate security systems, which places users at heightened risk for financial losses and identity theft.

In the current climate, understanding how to protect your online banking activities is paramount. A key aspect of this protection involves grasping the evolving Threat Landscape that encompasses various strategies employed by cybercriminals to exploit weaknesses in security protocols.

To effectively shield yourself from online banking fraud, one must first delve into the standard techniques that hackers utilise. Among these tactics, phishing attacks stand out as particularly prevalent and effective. In essence, phishing involves the creation of deceptive emails, text messages, or websites that closely imitate those of legitimate financial institutions. These fraudulent communications aim to deceive users into revealing sensitive information such as login details, credit card numbers, or Social Security numbers.

Phishing operates through several mechanisms:

1. Email Spoofing: Hackers generate fake email addresses that resemble those associated with banks or financial services. These emails often carry urgent messages designed to instil fear or panic—phrases like “Your account has been compromised” or “Immediate action required to prevent suspension” are common tactics.

2. Malicious Links or Attachments: Victims are frequently lured into clicking on links that lead them to counterfeit websites designed specifically for data harvesting or prompted to download files containing malware.

3. Information Harvesting: Once individuals unwittingly enter their personal information on these illegitimate sites, hackers can capture this data and exploit it for unauthorised transactions.

As we move further into 2025, phishing schemes have become more intricate than ever before; they now incorporate advanced technologies such as:

– Spear Phishing: This method focuses on targeted attacks aimed at specific individuals—often high-net-worth clients—making it even more dangerous.

Deepfake Technology: Some attackers use deepfake audio or video content impersonating bank officials to lend credibility and urgency to their fraudulent schemes.

As we continue our journey through the digital landscape of banking in 2025, remaining vigilant against these sophisticated threats is essential for safeguarding our financial well-being and personal information.

Understanding Deepfake Technology and Online Banking Threats

In today’s digital age, the emergence of deepfake technology has introduced new challenges, particularly in the realm of online banking. This sophisticated method can create convincing audio or video impersonations of bank officials designed to manipulate individuals into trusting them. Such deception can lead to significant financial harm if one is not cautious. To safeguard against this threat, it is crucial to take proactive measures. Always ensure that any communication you receive purportedly from your bank is genuine by reaching out directly through official channels. Be vigilant for signs of fraud—typos in messages, suspicious URLs that do not match the bank’s official site, and unsolicited requests for sensitive information should raise red flags.

Another pressing concern in the sphere of online banking security is malware, a term that encompasses various types of malicious software intended to infiltrate devices and extract confidential data. Among these threats, keyloggers stand out as particularly insidious. These programs operate covertly, capturing every keystroke you make—this includes your login credentials, personal identification numbers (PINs), and other vital information without your knowledge.

Several types of malware pose risks specifically related to online banking activities:

1. Keyloggers: As mentioned earlier, these stealthy applications record everything you type on your keyboard.

2. Trojan Horses: These are deceptive programs masquerading as legitimate software but harbouring malicious intent; they can provide hackers with remote access to your banking sessions.

3. Ransomware: This type locks you out of your device until a ransom is paid, effectively halting your access to critical banking services when you need them most.

So, how do keyloggers find their way onto our devices? They often enter through various channels:

– Phishing emails containing infected attachments designed to trick users into opening them.

– Downloading software or applications from unverified sources that may appear harmless at first glance.

– Visiting compromised websites that cybercriminals have manipulated.

To protect yourself from these threats and ensure safe online banking practices, it is essential to install reputable antivirus software equipped with real-time scanning capabilities. Additionally, regularly updating your operating system will help patch vulnerabilities that cyber attackers could exploit. It’s also wise to exercise caution when downloading any software; always verify its source before proceeding.

By staying informed about these technologies and adopting protective measures against potential threats like deepfakes and malware, individuals can navigate the world of online banking more securely while safeguarding their personal information from prying eyes.

Understanding Man-in-the-Middle Attacks and Social Engineering in Online Banking

Security threats loom large in the realm of online banking, and one particularly insidious method employed by cybercriminals is the Man-in-the-Middle (MITM) attack. This technique allows hackers to secretly intercept communications between a user and their bank’s server, enabling them to pilfer sensitive information or even manipulate transactions without the victim ever realising it.

How MITM Attacks Unfold

The mechanics of an MITM attack are chillingly straightforward. First, the hacker strategically positions themselves between the user and the banking server—this could be through various means, such as malicious software or compromised networks. Once in place, they can eavesdrop on all data that flows between these two parties. This interception allows them to capture critical information being exchanged.

Next comes impersonation, a tactic in which attackers masquerade as either the bank or the unsuspecting user. By doing so, they can distort the flow of information for their nefarious purposes, effectively controlling what data is sent and received.

Sensitive data is at significant risk during this entire process of interception and manipulation. Login credentials, one-time passwords (OTPs), and other private information become vulnerable targets for theft during transmission.

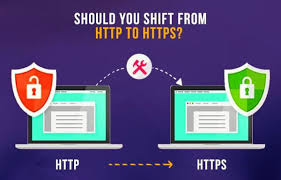

Specific scenarios heighten this vulnerability further. For instance, using public Wi-Fi networks often leaves users exposed due to their lack of encryption. Similarly, accessing banking sites over unsecured HTTP connections rather than the more secure HTTPS can also facilitate these attacks.

To safeguard against such threats, it’s crucial for individuals always to use secure and private Wi-Fi connections whenever possible. Additionally, employing a Virtual Private Network (VPN) can offer an extra layer of protection by encrypting data during its journey across potentially unsafe networks.

The Dark Art of Social Engineering

While technical vulnerabilities present significant risks in online banking environments, there’s another equally dangerous threat lurking: social engineering. This approach relies not on exploiting technological weaknesses but rather on manipulating human psychology to coax individuals into divulging confidential details.

Social engineering tactics are diverse but share a common goal—to trick victims into revealing sensitive information through deceitful means rather than directly hacking systems.

One prevalent tactic involves impersonation calls, where hackers pose as legitimate bank representatives. They may contact unsuspecting customers under false pretences, claiming they need verification details for account security or troubleshooting issues. Thus, they obtain sensitive data like account numbers or PINs from trusting individuals.

Another strategy is baiting, where victims are enticed with seemingly enticing offers like cashback rewards or loan approvals that require personal information submission before anything can be claimed—a classic trap that many unwittingly fall into.

Pretexting is yet another method employed by attackers who create elaborate stories designed to extract valuable information from targets; for example, they might claim suspicious activity has been detected on an account as a pretext to gather personal details under duress or urgency.

The ramifications of social engineering in online banking are profound and often devastating; victims may unknowingly provide access codes that lead to unauthorised withdrawals or identity theft incidents that take months—or even years—to rectify.

To defend against such manipulative tactics requires vigilance; scepticism toward unsolicited requests for personal information should be paramount. It’s essential always to verify the identity of anyone requesting sensitive details independently before sharing any data over phone calls or emails—even if those communications seem legitimate at first glance. Never disclose confidential information unless you have initiated contact yourself.

In conclusion, Man-in-the-Middle attacks and social engineering represent significant threats in today’s digital landscape. Awareness and proactive measures are key to protecting oneself from falling victim to these deceptive practices in online banking environments.

Credential Stuffing: An Overview

Credential stuffing is a method employed by cybercriminals that exploits previously stolen login information from past data breaches to infiltrate user accounts. This technique thrives on the unfortunate tendency of many people to reuse passwords across different websites and services, making it an effective strategy for attackers.

How Credential Stuffing Operates:

1. Data Breaches: Cybercriminals first obtain stolen credentials from earlier security breaches affecting various platforms. These compromised credentials often include usernames and passwords that have been exposed due to inadequate security measures on those sites.

2. Automated Tools: Hackers use bots to systematically input stolen credentials into numerous banking websites in rapid succession, attempting to gain access.

3. Successful Access: When they encounter accounts that share passwords across multiple platforms, they successfully breach those accounts, paving the way for unauthorised financial transactions or other malicious activities.

The Risks Associated with Credential Stuffing:

The implications of credential stuffing extend beyond mere inconvenience; hackers can infiltrate not only your bank accounts but also any associated services, such as payment processors or investment platforms. Often, victims may remain oblivious to the unauthorised access until significant damage has already occurred—potentially leading to substantial financial losses.

Protective Measures Against Credential Stuffing:

To safeguard yourself against this threat, it is crucial to avoid reusing passwords across various accounts. Instead, strive for long and complex passwords unique to each service you use. Furthermore, consider implementing multi-factor authentication (MFA) for additional protection against unauthorised access.

—

Best Practices for Securing Your Online Banking Experience

Securing your online banking account hinges on adopting robust practices designed to thwart unauthorised entry into your financial assets. Let’s explore two essential strategies: developing strong and unique passwords and activating multi-factor authentication (MFA).

1. Creating Strong and Unique Passwords:

Passwords serve as the primary defence mechanism for safeguarding online banking accounts. A weak or reused password puts your account at a heightened risk of being breached through methods like brute force attacks or credential stuffing.

The Importance of Strong Passwords: Weak passwords are particularly vulnerable because they can be easily guessed or cracked by automated hacking tools that utilise dictionaries filled with common words or predictable sequences. – Defining Characteristics of a Strong Password:

– Defining Characteristics of a Strong Password:

– Length: Aim for a minimum length of 12-16 characters; longer passwords dramatically increase resistance against cracking attempts.

– Complexity: Incorporate a mix of uppercase letters, lowercase letters, numbers, and special symbols.

– Uniqueness: Ensure each password is distinct from others used across different sites to prevent a single breach from compromising multiple accounts.

By understanding these foundational principles and adhering strictly to them when creating your online banking credentials, you can significantly enhance the security surrounding your financial information in an increasingly digital world.

Understanding the Essentials of a Robust Password

When crafting a strong password, several key characteristics should be considered.

Length Matters: It’s advisable to create passwords that are 12 to 16 characters long. The longer your password, the more challenging it becomes for potential hackers to crack it.

Embrace Complexity: A strong password should be a blend of various elements: uppercase and lowercase letters, numbers, and special symbols like @ $. This mix enhances security by making your password less predictable.

Prioritise Unpredictability: When devising your password, avoid obvious patterns or easily obtainable personal information. Avoid sequences such as 123456 or common words like password, as well as details like your name, birthday, or phone number that someone might easily guess.

Best Practices for Managing Passwords

One fundamental rule in maintaining online security is to use unique passwords for each account you hold. Suppose you reuse passwords across different platforms, and one gets compromised. In that case, the risk of credential stuffing rises dramatically—this could lead directly to unauthorised access to sensitive accounts such as online banking.

Consider using passphrases instead of traditional passwords. A passphrase consists of unrelated words strung together into a memorable phrase that remains difficult for others to decipher; an example could be something like Green$Horse@Ocean2025.

It’s also wise to update your passwords regularly. Changing them periodically is essential, especially if you notice any unusual activity associated with your accounts.

Utilising Password Managers

Managing numerous complex passwords can feel overwhelming; however, employing a password manager can significantly ease this burden.

The Functionality of Password Managers: These tools securely store and organise all your passwords within an encrypted vault. Many offer additional services, such as generating strong and random passwords for any new accounts you may create.

Benefits Galore: A password manager eliminates the need to memorise multiple complex codes while simultaneously reducing the likelihood of reusing weak or easily guessed ones. Most managers sync across various devices, ensuring easy access whenever needed. Some popular choices include LastPass, Dashlane, and Bitwarden, all of which offer both free and premium versions equipped with robust security features.

The Importance of Multi-Factor Authentication (MFA)

Another vital layer in enhancing your digital security is Multi-Factor Authentication (MFA). This process adds an extra verification step during login attempts, making it considerably more difficult for unauthorised individuals to gain entry into your accounts.

Defining MFA: Essentially, MFA requires users to authenticate their identity through at least two distinct factors:

1. Something You Know: This could be in the form of a traditional password or PIN.

2. Something You Have: This typically involves a device—like your smartphone—that generates or receives a one-time passcode (OTP).

3. Something You Are: Biometric data falls here; examples include fingerprints or facial recognition technology.

By understanding these principles surrounding strong passwords and adopting management best practices, along with multi-factor authentication measures, individuals can significantly bolster their online security against potential threats lurking in cyberspace.

l Banking Tips in 2025

The realm of online banking security is increasingly vital as we navigate the complexities of cyber threats in 2025. As digital financial management continues to transform our approach to handling money, it brings with it unparalleled convenience and accessibility. Yet, this evolution is paralleled by a surge in potential risks stemming from cyberattacks. Cybercriminals are constantly refining their tactics, devising ever-more sophisticated methods to infiltrate security systems, which places users at heightened risk for financial losses and identity theft.

In the current climate, understanding how to protect your online banking activities is paramount. A key aspect of this protection involves grasping the evolving Threat Landscape that encompasses various strategies employed by cybercriminals to exploit weaknesses in security protocols.

To effectively shield yourself from online banking fraud, one must first delve into the standard techniques that hackers utilise. Among these tactics, phishing attacks stand out as particularly prevalent and effective. In essence, phishing involves the creation of deceptive emails, text messages, or websites that closely imitate those of legitimate financial institutions. These fraudulent communications aim to deceive users into revealing sensitive information such as login details, credit card numbers, or Social Security numbers.

Phishing operates through several mechanisms:

1. Email Spoofing: Hackers generate fake email addresses that resemble those associated with banks or financial services. These emails often carry urgent messages designed to instil fear or panic—phrases like Your account has been compromised or Immediate action required to prevent suspension are common tactics used.

2. Malicious Links or Attachments: Victims are frequently lured into clicking on links that lead them to counterfeit websites designed specifically for data harvesting or prompted to download files containing malware.

3. Information Harvesting: Once individuals unwittingly enter their personal information on these illegitimate sites, hackers can capture this data and exploit it for unauthorised transactions.

As we move further into 2025, phishing schemes have become more intricate than ever before; they now incorporate advanced technologies such as:

– Spear Phishing: This method focuses on targeted attacks aimed at specific individuals—often high-net-worth clients—making it even more dangerous.

Deepfake Technology: Some attackers use deepfake audio or video content impersonating bank officials to lend credibility and urgency to their fraudulent schemes.

As we continue our journey through the digital landscape of banking in 2025, remaining vigilant against these sophisticated threats is essential for safeguarding our financial well-being and personal information.

Understanding Deepfake Technology and Online Banking Threats

In today’s digital age, the emergence of deepfake technology has introduced new challenges, particularly in the realm of online banking. This sophisticated method can create convincing audio or video impersonations of bank officials designed to manipulate individuals into trusting them. Such deception can lead to significant financial harm if one is not cautious. To safeguard against this threat, it is crucial to take proactive measures. Always ensure that any communication you receive purportedly from your bank is genuine by reaching out directly through official channels. Be vigilant for signs of fraud—typos in messages, suspicious URLs that do not match the bank’s official site, and unsolicited requests for sensitive information should raise red flags.

Another pressing concern in the sphere of online banking security is malware, a term that encompasses various types of malicious software intended to infiltrate devices and extract confidential data. Among these threats, keyloggers stand out as particularly insidious. These programs operate covertly, capturing every keystroke you make—this includes your login credentials, personal identification numbers (PINs), and other vital information without your knowledge.

Several types of malware pose risks specifically related to online banking activities:

1. Keyloggers: As mentioned earlier, these stealthy applications record everything you type on your keyboard.

2. Trojan Horses: These are deceptive programs masquerading as legitimate software but harbouring malicious intent; they can provide hackers with remote access to your banking sessions.

3. Ransomware: This type locks you out of your device until a ransom is paid, effectively halting your access to critical banking services when you need them most.

So, how do keyloggers find their way onto our devices? They often enter through various channels:

– Phishing emails containing infected attachments designed to trick users into opening them.

– Downloading software or applications from unverified sources that may appear harmless at first glance.

– Visiting compromised websites that cybercriminals have manipulated.

To protect yourself from these threats and ensure safe online banking practices, it is essential to install reputable antivirus software equipped with real-time scanning capabilities. Additionally, regularly updating your operating system will help patch vulnerabilities that cyber attackers could exploit. It’s also wise to exercise caution when downloading any software; always verify its source before proceeding.

By staying informed about these technologies and adopting protective measures against potential threats like deepfakes and malware, individuals can navigate the world of online banking more securely while safeguarding their personal information from prying eyes.

Understanding Man-in-the-Middle Attacks and Social Engineering in Online Banking

Security threats loom large in the realm of online banking, and one particularly insidious method employed by cybercriminals is the Man-in-the-Middle (MITM) attack. This technique allows hackers to secretly intercept communications between a user and their bank’s server, enabling them to pilfer sensitive information or even manipulate transactions without the victim ever realising it.

How MITM Attacks Unfold

The mechanics of an MITM attack are chillingly straightforward. First, the hacker strategically positions themselves between the user and the banking server—this could be through various means, such as malicious software or compromised networks. Once in place, they can eavesdrop on all data that flows between these two parties. This interception allows them to capture critical information being exchanged.

Next comes impersonation, a tactic in which attackers masquerade as either the bank or the unsuspecting user. By doing so, they can distort the flow of information for their nefarious purposes, effectively controlling what data is sent and received.

Sensitive data is at significant risk during this entire process of interception and manipulation. Login credentials, one-time passwords (OTPs), and other private information become vulnerable targets for theft during transmission.

Specific scenarios heighten this vulnerability further. For instance, using public Wi-Fi networks often leaves users exposed due to their lack of encryption. Similarly, accessing banking sites over unsecured HTTP connections rather than the more secure HTTPS can also facilitate these attacks.

To safeguard against such threats, it’s crucial for individuals always to use secure and private Wi-Fi connections whenever possible. Additionally, employing a Virtual Private Network (VPN) can offer an extra layer of protection by encrypting data during its journey across potentially unsafe networks.

The Dark Art of Social Engineering

While technical vulnerabilities present significant risks in online banking environments, there’s another equally dangerous threat lurking: social engineering. This approach relies not on exploiting technological weaknesses but rather on manipulating human psychology to coax individuals into divulging confidential details.

Social engineering tactics are diverse but share a common goal—to trick victims into revealing sensitive information through deceitful means rather than directly hacking systems.

One prevalent tactic involves impersonation calls, where hackers pose as legitimate bank representatives. They may contact unsuspecting customers under false pretences, claiming they need verification details for account security or troubleshooting issues. Thus, they obtain sensitive data like account numbers or PINs from trusting individuals.

Another strategy is baiting, where victims are enticed with seemingly enticing offers like cashback rewards or loan approvals that require personal information submission before anything can be claimed—a classic trap that many unwittingly fall into.

Pretexting is yet another method employed by attackers who create elaborate stories designed to extract valuable information from targets; for example, they might claim suspicious activity has been detected on an account as a pretext to gather personal details under duress or urgency.

The ramifications of social engineering in online banking are profound and often devastating; victims may unknowingly provide access codes that lead to unauthorised withdrawals or identity theft incidents that take months—or even years—to rectify.

To defend against such manipulative tactics requires vigilance; scepticism toward unsolicited requests for personal information should be paramount. It’s essential always to verify the identity of anyone requesting sensitive details independently before sharing any data over phone calls or emails—even if those communications seem legitimate at first glance. Never disclose confidential information unless you have initiated contact yourself.

In conclusion, Man-in-the-Middle attacks and social engineering represent significant threats in today’s digital landscape. Awareness and proactive measures are key to protecting oneself from falling victim to these deceptive practices in online banking environments.

Credential Stuffing: An Overview

Credential stuffing is a method employed by cybercriminals that exploits previously stolen login information from past data breaches to infiltrate user accounts. This technique thrives on the unfortunate tendency of many people to reuse passwords across different websites and services, making it an effective strategy for attackers.

How Credential Stuffing Operates:

1. Data Breaches: Cybercriminals first obtain stolen credentials from earlier security breaches affecting various platforms. These compromised credentials often include usernames and passwords that have been exposed due to inadequate security measures on those sites.

2. Automated Tools: Hackers use bots to systematically input stolen credentials into numerous banking websites in rapid succession, attempting to gain access.

3. Successful Access: When they encounter accounts that share passwords across multiple platforms, they successfully breach those accounts, paving the way for unauthorised financial transactions or other malicious activities.

The Risks Associated with Credential Stuffing:

The implications of credential stuffing extend beyond mere inconvenience; hackers can infiltrate not only your bank accounts but also any associated services, such as payment processors or investment platforms. Often, victims may remain oblivious to the unauthorised access until significant damage has already occurred—potentially leading to substantial financial losses.

Protective Measures Against Credential Stuffing:

To safeguard yourself against this threat, it is crucial to avoid reusing passwords across various accounts. Instead, strive for long and complex passwords unique to each service you use. Furthermore, consider implementing multi-factor authentication (MFA) for additional protection against unauthorised access.

—

Best Practices for Securing Your Online Banking Experience

Securing your online banking account hinges on adopting robust practices designed to thwart unauthorised entry into your financial assets. Let’s explore two essential strategies: developing strong and unique passwords and activating multi-factor authentication (MFA).

1. Creating Strong and Unique Passwords:

Passwords serve as the primary defence mechanism for safeguarding online banking accounts. A weak or reused password puts your account at a heightened risk of being breached through methods like brute force attacks or credential stuffing.

The Importance of Strong Passwords: Weak passwords are particularly vulnerable because they can be easily guessed or cracked by automated hacking tools that utilise dictionaries filled with common words or predictable sequences.

– Defining Characteristics of a Strong Password:

– Length: Aim for a minimum length of 12-16 characters; longer passwords dramatically increase resistance against cracking attempts.

– Complexity: Incorporate a mix of uppercase letters, lowercase letters, numbers, and special symbols.

– Uniqueness: Ensure each password is distinct from others used across different sites to prevent a single breach from compromising multiple accounts.

By understanding these foundational principles and adhering strictly to them when creating your online banking credentials, you can significantly enhance the security surrounding your financial information in an increasingly digital world.

Understanding the Essentials of a Robust Password

When crafting a strong password, several key characteristics should be considered.

Length Matters: It’s advisable to create passwords that are 12 to 16 characters long. The longer your password, the more challenging it becomes for potential hackers to crack it.

Embrace Complexity: A strong password should be a blend of various elements: uppercase and lowercase letters, numbers, and special symbols like @ or $. This mix enhances security by making your password less predictable.

Prioritise Unpredictability: Avoid obvious patterns or easily obtainable personal information when devising your password. Avoid sequences such as 123456 or common words like password, as well as details like your name, birthday, or phone number that someone might easily guess.

Best Practices for Managing Passwords

One fundamental rule in maintaining online security is to use unique passwords for each account you hold. Suppose you reuse passwords across different platforms, and one gets compromised. In that case, the risk of credential stuffing rises dramatically—this could lead directly to unauthorised access to sensitive accounts such as online banking.

Consider using passphrases instead of traditional passwords. A passphrase consists of unrelated words strung together into a memorable phrase that remains difficult for others to decipher; an example could be something like Green$Horse@Ocean2025.

It’s also wise to update your passwords regularly. Changing them periodically is essential, especially if you notice any unusual activity associated with your accounts.

Utilising Password Managers

Managing numerous complex passwords can feel overwhelming; however, employing a password manager can significantly ease this burden.

The Functionality of Password Managers: These tools securely store and organise all your passwords within an encrypted vault. Many offer additional services, such as generating strong and random passwords for any new accounts you may create.

Benefits Galore: A password manager eliminates the need to memorise multiple complex codes while simultaneously reducing the likelihood of reusing weak or easily guessed ones. Most managers sync across various devices, ensuring easy access whenever needed. Some popular choices include LastPass, Dashlane, and Bitwarden, all of which offer both free and premium versions equipped with robust security features.

The Importance of Multi-Factor Authentication (MFA)

Another vital layer in enhancing your digital security is Multi-Factor Authentication (MFA). This process adds an extra verification step during login attempts, making it considerably more difficult for unauthorised individuals to gain entry into your accounts.

Defining MFA: Essentially, MFA requires users to authenticate their identity through at least two distinct factors:

1. Something You Know: This could be in the form of a traditional password or PIN.

2. Something You Have: This typically involves a device—like your smartphone—that generates or receives a one-time passcode (OTP).

3. Something You Are: Biometric data falls here; examples include fingerprints or facial recognition technology.

By understanding these principles surrounding strong passwords and adopting management best practices, along with multi-factor authentication measures, individuals can significantly bolster their online security against potential threats lurking in cyberspace.

Understanding Authentication: The Role of Biometrics and Multi-Factor Authentication

In the realm of digital security, one crucial aspect that stands out is the concept of something you are, which encompasses biometric verification methods like fingerprints, facial recognition, and voice identification. This approach adds an extra layer of protection beyond traditional passwords. Even if a hacker manages to breach your password, they will still face significant hurdles when it comes to accessing your account without completing this secondary authentication step.

When we delve into Multi-Factor Authentication (MFA), we encounter several distinct methods designed to bolster security:

1. SMS-Based MFA: This method involves receiving a one-time code via text message that you must enter to finalise your login. While this approach offers convenience, it does come with vulnerabilities—most notably the risk associated with SIM swapping attacks, where an attacker can take control of your phone number.

2. App-Based MFA: A more secure alternative is provided by authentication applications such as Google Authenticator, Microsoft Authenticator, or Authy. These apps generate time-sensitive codes directly on your device. The primary advantage here is that these codes are stored locally on your device, significantly lowering the chances of interception by malicious entities. To use this method, simply input the code displayed in the app after you have entered your password.

3. Push Notification-Based MFA: Some financial institutions have adopted a more streamlined approach through push notifications sent to devices registered under your account. In this scenario, when you attempt to log in, a notification pops up asking for approval; all you need to do is confirm the attempt with just a tap on your screen—offering both ease and enhanced security.

4. Biometric MFA: With technological advancements, many contemporary smartphones and banking applications now support biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition. These techniques stand out due to their high level of security and user-friendliness; replicating biometric data poses considerable challenges for potential intruders.

5. Hardware Tokens: Another option for securing access is through hardware tokens—physical devices that generate unique codes necessary for logging in. While these tokens offer robust security features due to their standalone nature from internet connectivity or software vulnerabilities, they may be less convenient since users must remember to carry them wherever they go.

Beyond employing these various forms of authentication methods lies another critical aspect—securing our devices and connections effectively:

– Regular Software Updates: It’s vital to keep all software up-to-date—including operating systems, antivirus programs, and banking applications—to address any emerging security vulnerabilities promptly. Enabling automatic updates can help alleviate concerns about forgetting manual updates.

– Avoiding Public Wi-Fi Connections: Lastly—and perhaps most importantly—it’s wise to steer clear of public Wi-Fi networks whenever possible as they often serve as breeding grounds for cybercriminals looking to exploit unsecured connections.

By understanding these multifaceted aspects of digital security—from biometric authentication techniques to different forms of multi-factor authentication—and taking proactive measures like keeping software updated and avoiding risky networks, we can significantly enhance our overall online safety.

Steer Clear of Public Wi-Fi

When it comes to online security, public Wi-Fi networks can pose a significant risk. These networks are frequently lacking in proper security measures, which opens the door for hackers to intercept your data quickly. If you find yourself in a situation where using public Wi-Fi is unavoidable, there are steps you can take to protect yourself. For instance, consider utilising a Virtual Private Network (VPN). This tool encrypts your internet traffic, adding an extra layer of security that can help safeguard your information from prying eyes. Additionally, it’s wise to avoid logging into sensitive accounts—such as those related to online banking—while connected to these unsecured networks.

Keep a Close Eye on Your Banking Activities

Monitoring your financial transactions is essential for maintaining the integrity of your accounts. One effective way to stay informed is by setting up account alerts. By enabling real-time notifications for various activities—like withdrawals, logins, and changes made to account settings—you empower yourself to detect any unauthorised actions quickly. The sooner you become aware of suspicious activity, the faster you can respond and mitigate potential damage.

Another critical practice is regularly reviewing your bank statements; take time each month to scrutinise them for irregularities or unfamiliar transactions. If anything seems amiss or raises suspicion, don’t hesitate to contact your bank immediately for clarification and assistance.

Empower Yourself Through Cybersecurity Education

Understanding cybersecurity principles plays a vital role in protecting your online banking endeavours. Cybercriminals often capitalise on individuals’ lack of awareness and knowledge about potential threats, manipulating them into divulging sensitive information without realising the danger they are in. By educating yourself on this subject matter, you’ll be better prepared to identify and counteract possible risks.

One key area worth focusing on is recognising phishing attempts, a prevalent threat in online banking today. Phishing occurs when hackers employ deceptive tactics designed to trick users into revealing confidential data such as login credentials or credit card numbers. Being able to spot these scams will significantly enhance your defences against such attacks.

1. Exercise Caution with Unexpected Communications

Cybercriminals frequently reach out through unsolicited emails, text messages, or phone calls disguised as reputable organisations like banks or government agencies. These communications often create an artificial sense of urgency aimed at pressuring you into making hasty decisions without careful consideration—for example:

– They might assert that there’s been suspicious activity on your account that requires immediate attention.

– They could offer enticing rewards or refunds that sound too good to be true.

– They may request verification of personal details under the guise of preventing account suspension.

In all these scenarios, it’s crucial not just to act impulsively but rather approach such communications with scepticism and vigilance.

By staying informed about these practices and remaining vigilant when navigating the digital landscape, you can significantly bolster your defences against cyber threats while enjoying greater peace of mind during online banking activities.

When receiving unexpected communications, it’s essential to maintain a healthy dose of scepticism, especially if the message seems urgent or pressuring. This is particularly true for correspondence that arrives out of nowhere, as it may not be what it appears.

First and foremost, always take the time to verify who is reaching out to you. It’s important not to trust email addresses or caller IDs at face value; cybercriminals are skilled at disguising their identities by spoofing these details, making their deceptive messages seem credible. To ensure you’re dealing with your bank directly, utilise official communication channels such as their customer service hotline or mobile application. This way, you can confirm whether any suspicious messages you’ve received are genuinely from your financial institution.

Next, exercise caution when it comes to links and attachments in any communication that raises your suspicions. Many phishing attempts include these elements with malicious intent: they could lead you to counterfeit websites that mimic your bank’s online portal in order to capture your login credentials or infect your device with malware that allows hackers access to sensitive information about you. Rather than clicking on any provided links, it’s safer and more prudent to type the official website URL of your bank directly into your browser’s address bar. If an email contains attachments, do not open them unless you have verified that they are entirely legitimate.

It’s also crucial to be able to identify warning signs within phishing messages—these often manifest as glaring red flags. Look for poor grammar and spelling mistakes that might betray a lack of professionalism in the correspondence. Be wary if the message greets you generically with phrases like Dear Customer instead of using your name; this can indicate a mass-produced scam rather than personalised communication from a trusted source. Additionally, watch out for unfamiliar logos or branding inconsistencies that might suggest the sender is attempting impersonation rather than genuine outreach. Legitimate institutions will never ask for sensitive information through unsecured channels like email or text.

By remaining vigilant and cautious in these situations, you’ll significantly reduce the risk of falling prey to phishing schemes designed by unscrupulous individuals looking to exploit unsuspecting victims.

Moreover, it’s beneficial for customers like yourself to familiarise themselves with the security features offered by banks today—financial institutions invest heavily in advanced technologies aimed at safeguarding both personal data and transactions against potential threats. Knowing how these protective measures work can empower you while also helping set realistic expectations regarding what protections are in place and what responsibilities lie with you as a customer.

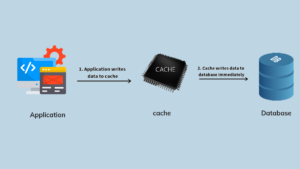

1. Encryption Standards

When you interact with your bank online, your communication must remain private and secure. This is where encryption comes into play, safeguarding the information exchanged between you and your financial institution so that prying eyes cannot decipher it. To ensure you’re on a secure banking platform, pay attention to a few key indicators: First, check if the web address starts with https:// rather than just http://; the addition of the ‘s’ signifies that Secure Sockets Layer (SSL) encryption is in effect. Additionally, look for a padlock icon in the address bar of your browser; this is another reassuring sign that your connection is secure. Furthermore, many modern banking applications implement end-to-end encryption technology, which means even the bank itself cannot access or view your data while it’s being transmitted.

2. Fraud Detection Systems

Banks take security seriously and have developed advanced fraud detection systems designed to keep an eye on unusual activity within your account. These systems utilise sophisticated algorithms that scrutinise various factors to identify potential threats. For instance, they monitor transaction patterns; if there are sudden large withdrawals or payments made from foreign countries, these could trigger an alert for further investigation. Similarly, login behaviour is analysed—if someone attempts to access your account from an unfamiliar device or location, additional verification measures may be required before granting access. You can also play a role in enhancing these security measures by promptly informing your bank about any travel plans or significant changes in how you typically manage your finances.

3. Two-Factor Authentication (2FA)

To bolster security further, many banks offer Two-Factor Authentication (2FA), which has become a vital feature for protecting accounts against unauthorised access. This method requires two distinct forms of verification before you can log into your account: something you know—like your password; something you possess—such as a one-time code sent directly to your mobile phone or email; and sometimes even something intrinsic to you—like biometric data including fingerprints or facial recognition scans. By opting for 2FA when available, you’re adding an extra layer of protection that significantly complicates any attempts by hackers to infiltrate your account.

4. Account Lockout and Alerts

To prevent unauthorised access through brute-force attacks where numerous incorrect password attempts are made in rapid succession, many banks automatically lock accounts after several failed login attempts. In addition to this precautionary measure, customers can enable real-time alerts for specific activities related to their accounts, such as logins from new devices or locations they haven’t used before, updates made to their account details like changing passwords, and transactions that exceed certain pre-set limits. These alerts serve as an early warning system, allowing you to detect any suspicious activity and take necessary action quickly.

5. Customer Support

In the realm of banking, many institutions offer a safety net for their clients, designed to shield them from the financial repercussions of unauthorised transactions. However, it’s crucial to adhere to the security measures set forth by these banks to benefit from such protections fully. These guarantees can encompass several key areas:

Firstly, customers may receive complete reimbursement for any fraudulent charges that appear on their accounts. This assurance provides peace of mind in knowing that if someone were to misuse your account information, you wouldn’t bear the brunt of those losses alone.

Additionally, banks often extend support for individuals who find themselves victims of identity theft. Recovering from such an incident can be daunting and overwhelming; thus, having assistance during this recovery process can be invaluable.

Moreover, some institutions even offer legal support in cases related to cybercrime. Navigating the complexities of such situations can be challenging without proper guidance and representation.

To fully grasp the extent of these protective measures and understand your responsibilities in maintaining eligibility for them, it is essential to review your bank’s terms and conditions thoroughly. By doing so, you’ll not only become aware of what safeguards are at your disposal but also recognise the steps you need to take to ensure you remain protected under these guarantees. Ultimately, being informed is key in leveraging advanced protective measures offered by financial institutions.

Maxthon

Maxthon has set forth on an ambitious journey to enhance the security of web applications, fueled by a steadfast commitment to safeguarding users and their confidential data. At the heart of this endeavour lies a suite of sophisticated encryption technologies, which act as a robust barrier for the information exchanged between users and various online services. Every interaction—whether it involves inputting passwords or sharing personal information—is securely encased within these reinforced channels, effectively thwarting unauthorised access from potential cyber threats.

This strong emphasis on encryption marks merely the beginning of Maxthon’s extensive security plan. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a proactive approach to user safety. The browser has been carefully crafted with flexibility in mind, continually incorporating updates designed to address any vulnerabilities that may emerge over time promptly.

Users are strongly encouraged to activate automatic updates as part of their cybersecurity routines, allowing them to seamlessly benefit from the latest security improvements without facing any hassle. In a digital environment that is perpetually changing, Maxthon’s unwavering dedication to ongoing security enhancements not only highlights its responsibility toward its users but also reflects its profound commitment to building trust in online interactions.

With each new update released, users can navigate the web with assurance, comforted by the knowledge that their data remains consistently protected against the ever-evolving spectrum of cyber threats lurking just beyond their screens.