Safeguarding personal and financial information has become paramount in online banking. Imagine a digital landscape where your assets are protected by an intricate web of security measures, each designed to thwart potential threats. Let us embark on a journey through some of the most essential strategies employed to fortify online banking against unauthorised access and fraud.

The Foundation: Robust Passwords

Picture yourself as a guardian of your financial castle, where the first line of defence is a formidable password. This password should be akin to a complex key, crafted with care and creativity. It’s not enough for it to be merely memorable; it must also be intricate—comprising an artful blend of uppercase letters, lowercase letters, numbers, and special symbols. As you navigate this digital domain, remember that changing your password regularly is akin to reinforcing the walls of your fortress; it minimizes vulnerabilities that intruders could exploit.

Meanwhile, banks contribute to this narrative by setting stringent guidelines on password creation. They establish minimum length and complexity requirements, ensuring that customers are well-equipped with the tools needed to protect their accounts effectively.

A Double Shield: Two-Factor Authentication

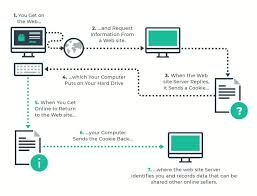

As we delve deeper into our story, we encounter another layer of defence known as two-factor authentication (2FA). This innovative safeguard acts like a double lock on your door—requiring not just one but two forms of identification before granting access to your financial resources. Typically, this involves something familiar—your password—and something tangible—a unique code dispatched directly to your mobile device.

Imagine if someone were able to guess or steal your password; without access to that second piece—the unique code—they would still be locked out. This dual-layered approach significantly diminishes the chances of fraudulent activities taking root within online banking platforms.

A Secure Passage: Encrypted Communication

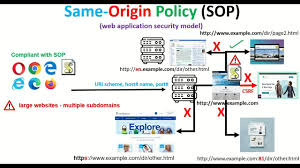

As our journey unfolds further into the heart of online banking security, we discover the importance of secure communication channels between users and their banks. Think of these channels as fortified bridges over turbulent waters—essential pathways where sensitive data flows during transactions.

Encryption techniques come into play here; they act like secret codes that transform data into unreadable formats during transmission. Technologies such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS) work tirelessly behind the scenes to ensure that any information shared between you and your bank remains confidential and safe from prying eyes.

Financial institutions recognize this necessity and commit themselves to employing state-of-the-art encryption protocols while continuously updating their systems in response to emerging threats.

The Final Fortress: Anti-Malware Solutions and Firewalls

As we reach the concluding chapters in our exploration of online banking security measures, we encounter yet another vital component: anti-malware solutions coupled with robust firewall protection. These guardians stand watch at the gates—monitoring incoming traffic for any signs of malicious activity while blocking potential threats before they can breach defences.

With these protective barriers in place, both customers and banks can engage in transactions with greater peace of mind, knowing they are shielded from various cyber threats lurking in cyberspace.

In summary, navigating the world of online banking today requires vigilance—a combination of strong passwords, two-factor authentication methods, encrypted communications, and steadfast anti-malware defences working together harmoniously. As technology continues its rapid evolution alongside increasingly sophisticated cyber threats, both individuals and financial institutions must remain committed partners in cultivating a secure environment for all who venture into this digital realm.

In the ever-evolving landscape of digital banking, safeguarding against cyber threats has become paramount for both financial institutions and their clientele. One of the first lines of defence lies in the realm of anti-malware and firewall protection. Both customers and banks need to harness powerful anti-malware solutions along with robust firewalls to fend off malicious software and prevent unauthorized access to sensitive information. Customers are encouraged to routinely scan their devices for any lurking malware, ensuring that their antivirus programs are always current. Meanwhile, banks must establish formidable firewalls that act as barriers against unwarranted intrusions into their internal systems. To further bolster security, conducting regular audits and vulnerability assessments can unveil potential weaknesses within a bank’s infrastructure, allowing them to address these issues before they can be exploited.

As we delve deeper into the realm of security measures, another critical aspect emerges: fraud detection systems. Banks should channel resources into cutting-edge fraud detection technologies that leverage artificial intelligence and machine learning algorithms. These sophisticated systems possess the capability to sift through extensive datasets—examining transaction patterns, user behaviours, and even IP addresses—to spot anomalies indicative of fraudulent activity. By continuously monitoring transactions in real time, these advanced tools can swiftly identify suspicious actions, enabling banks to take preventive measures against potential fraud attempts while simultaneously safeguarding their customers’ financial interests.

Equally vital is the practice of continuous monitoring accompanied by timely alerts. The ability to oversee online banking activities as they unfold is crucial for recognizing any irregular or potentially fraudulent transactions without delay. Banks ought to deploy systems designed to trigger alerts when suspicious activities arise—such as substantial transfers made to unfamiliar accounts or multiple unsuccessful login attempts from an unknown source. On a parallel note, customers should take proactive steps by activating transaction notifications on their accounts and diligently reviewing statements regularly; this vigilance ensures that all recorded transactions are legitimate. In cases where discrepancies arise, prompt reporting enables banks to act swiftly in mitigating risks.

Finally, while financial institutions bear significant responsibility in implementing security protocols, customer education stands as a vital pillar in fostering safe online banking practices. Banks have an obligation not only to protect but also to empower their clients through comprehensive educational initiatives—offering articles, engaging videos, and interactive tutorials aimed at enlightening customers about best practices in cybersecurity. By investing time in understanding how they can protect themselves online—recognizing phishing attempts or managing passwords effectively—customers become active participants in the broader effort toward secure banking experiences.

This intricate interplay between technology and human awareness lies at the essence of modern banking security—a collaborative endeavour in which banks and customers play indispensable roles in fortifying defences against ever-present digital threats.

Strengthening Online Banking Security: A Comprehensive Approach

In the digital age, where online banking has become a staple for managing finances, ensuring the security of these platforms is more vital than ever. One of the most promising strategies to bolster security is through the adoption of two-factor authentication (2FA). This method serves as an additional safeguard by requiring users to verify their identity using two distinct forms of identification before they can access their accounts. For instance, alongside entering their username and password, users might also need to input a unique code sent directly to their mobile phones. This means that even if a hacker were to acquire someone’s login details, they would still require physical possession of the user’s mobile device to gain unauthorized entry. Numerous studies have demonstrated that implementing 2FA has led to a marked decrease in account breaches and fraudulent activities.

Another critical component in fortifying online banking security involves consistently updating security software. Financial institutions must prioritize investing in advanced antivirus programs, firewalls, and anti-malware solutions designed to shield their systems from emerging threats. Keeping these defences current is essential; it ensures that they can effectively identify and thwart new attack vectors. Regular updates also address any vulnerabilities uncovered within the software itself, significantly lowering the chances of exploitation by cybercriminals. A stark reminder of this necessity was seen during the WannaCry ransomware incident in 2017 when outdated Windows systems fell prey due to unpatched vulnerabilities.

Moreover, as phishing attacks remain a persistent menace targeting online banking users, it becomes imperative for banks to take proactive measures in educating their customers about these scams. By equipping users with knowledge on how to spot potential phishing attempts and avoid becoming victims, banks can significantly enhance overall security. This educational outreach could take various forms—ranging from informative email newsletters and engaging blog posts to interactive tutorials available on the bank’s website. By empowering customers with awareness and understanding of these threats, institutions not only protect individual accounts but also contribute positively toward cultivating safer online banking environments for everyone.

In conclusion, enhancing security measures in online banking requires a multifaceted approach—integrating advanced technology like two-factor authentication with regular updates on protective software while simultaneously fostering customer education about prevalent threats such as phishing attacks. Through these concerted efforts, banks can create a much more secure framework for all users navigating the complexities of digital finance.

In the ever-evolving landscape of online banking, where cyber threats lurk around every digital corner, financial institutions have a pivotal role in safeguarding their customers. One of the most effective strategies banks can adopt involves educating their clients on how to spot phishing emails, dubious links, and counterfeit websites. By empowering users with this knowledge, banks can help them build a robust defence against cybercriminals.

Imagine a scenario where a customer receives an unexpected email claiming to be from their bank. It urges them to click on a link to verify their account information. Armed with the tips provided by their bank—such as never clicking on links in unsolicited emails and consistently verifying website legitimacy before entering sensitive information—the customer pauses and thinks twice. They recall advice about scrutinizing messages for spelling mistakes or grammatical errors that often signal deceit. This moment of awareness could very well save them from falling victim to fraud.

As technology continues to advance, so too does the arsenal available to combat these threats. Artificial Intelligence (AI) stands at the forefront of this battle, transforming various sectors—including online banking—by significantly enhancing fraud detection capabilities. Banks can harness AI’s power by analyzing extensive data sets and discerning patterns that might go unnoticed by human eyes.

Picture this: A user’s account suddenly exhibits strange spending behaviour—purchases made in multiple countries within mere hours of each other. In such cases, AI algorithms spring into action, identifying these anomalies and promptly flagging them for further scrutiny. This real-time alert system not only acts as an immediate safeguard but also allows banks to take swift action against potential fraudsters before any damage is done.

Another critical aspect of fortifying online banking security is encouraging customers to embrace robust password practices. Weak passwords are like open invitations for unauthorized access, a vulnerability that banks must address head-on. Financial institutions should advocate for strong password creation among their clientele: passwords that incorporate a blend of uppercase letters, lowercase letters, numbers, and special characters.

Moreover, customers need guidance on avoiding easily guessable details like birthdays or family names when crafting passwords; such information is often the first line of attack for cybercriminals seeking access to accounts. By offering education on password strength and management techniques—perhaps through engaging workshops or informative articles—banks can significantly bolster their security framework.

As we navigate this digital age where online banking has become ubiquitous, enhancing security measures is not merely advisable; it’s essential for protecting financial entities and their patrons alike. Implementing two-factor authentication is one such measure that adds an extra layer of protection—a safety net ensuring that even if passwords are compromised, unauthorized access remains at bay.

In conclusion, through proactive education on recognizing threats like phishing attempts and promoting strong password practices alongside utilizing AI-driven fraud detection systems, banks are not just securing transactions; they are fostering trust with their customers in an increasingly perilous digital environment.

The Fortification of Digital Banking: Safeguarding Your Financial World

In the realm of online banking, the paramount concern revolves around the security protocols designed to shield customers’ assets and personal information. As cyber threats proliferate at an alarming rate, it becomes imperative for digital banking platforms to implement formidable security measures that ensure the protection and privacy of user data. Let us delve into some of the prevalent security strategies employed in online banking systems.

1. The Guardian of Identity: Two-Factor Authentication

Imagine embarking on a journey where two keys are needed to unlock a treasure chest—this is akin to two-factor authentication (2FA). This powerful security mechanism mandates that users furnish two distinct forms of identification prior to gaining access to their accounts. Typically, this entails entering a password alongside a one-time code dispatched directly to their mobile device or email. Such a dual-layered approach significantly hampers cybercriminals’ attempts to infiltrate accounts, even if they somehow acquire login details.

2. The Language of Secrecy: Encryption

Picture encryption as a secret language known only by you and your trusted allies. It’s a sophisticated process that transforms plain data into an indecipherable code, accessible solely with the appropriate decryption key. Online banking platforms harness this technique to safeguard customer information from prying eyes. Consequently, should a hacker intercept sensitive data during transmission, it would appear as nothing more than gibberish—rendering it utterly useless.

3. The Watchful Eye: Fraud Detection Systems

Vigilance is key in the digital realm; thus, online banks deploy advanced fraud detection software designed to scrutinize customer accounts for any signs of irregular activity. This vigilant system can identify atypical transactions or logins and promptly notify the bank’s security team for further investigation. When suspicious behaviour arises, swift action can be taken to thwart potential fraud before it escalates.

4. The Barrier Against Intruders: Firewalls

Think of firewalls as sentinels standing guard at the gates of your kingdom—their primary role is monitoring and regulating both incoming and outgoing network traffic within online banking systems. By erecting these protective barriers, banks can effectively block malicious traffic while preventing unauthorized access attempts by cybercriminals seeking entry into sensitive networks.

5. The Shielding Armor: Secure Socket Layer (SSL) Certificates

Lastly, envision SSL certificates as badges worn by trustworthy websites. This digital assurance verifies their identity while encrypting any data exchanged between users and servers during transactions or communications online. These certificates play an essential role in establishing secure connections within online banking environments.

As we navigate through our increasingly digital financial landscape, understanding these vital security measures equips us with knowledge about how our assets are safeguarded in an ever-evolving threat landscape. With robust defences like two-factor authentication, encryption methods, vigilant fraud detection systems, protective firewalls, and SSL certificates in place, customers can confidently engage with their financial institutions, knowing that their safety is prioritized above all else.

Exploring Security Measures in Online Banking Solutions: A Deep Dive into Innovative Safeguards

In the realm of online banking, security is not just a feature; it’s a necessity. As technology evolves, so do the methods employed to safeguard sensitive customer information. Among these cutting-edge techniques is biometric authentication, which utilizes distinctive physical traits—like fingerprints or facial features—to confirm a customer’s identity. This method stands out for its high level of security; after all, replicating someone’s unique biological attributes is no easy task. The use of such advanced technology ensures that only authorized individuals can access their accounts.

Yet, biometric authentication is just one piece of the puzzle when it comes to protecting online banking activities. Another critical component is mobile device management (MDM). This strategy focuses on securing the smartphones and tablets that customers use to access their financial accounts. By implementing MDM protocols, banks can ensure that these devices are fortified against potential threats and equipped with the latest security updates. It’s a proactive approach designed to create a secure environment for users as they navigate their online banking experiences.

The landscape of online banking security encompasses an array of protective measures beyond just biometrics and mobile management. Institutions are increasingly adopting multifaceted strategies, including two-factor authentication (2FA), encryption techniques, fraud detection systems, firewalls, SSL certificates, and more. Each layer adds depth to the overall defence mechanism against cyber threats.

Two-factor authentication serves as an essential cornerstone in this intricate web of security measures. It enhances login safety by requiring users to present two distinct forms of identification before gaining access to their accounts—typically something they know (like a password) paired with something they possess (such as a code sent to their registered mobile device). This dual requirement significantly diminishes the chances of unauthorized account access because even if one element is compromised, the other remains intact.

Prominent banks such as Chase and Bank of America have embraced these innovative approaches wholeheartedly, recognizing that robust security measures not only protect customer data but also foster trust in their services. In an era where cyber threats loom large over digital transactions, it has become imperative for online banking solutions to implement comprehensive safeguards.

As we delve deeper into this subject matter—the infinite possibilities within online banking solutions—we uncover how crucial it is for financial institutions to prioritize robust security frameworks. By doing so, they not only shield customer data from potential breaches but also pave the way for more secure and reliable digital financial interactions in our increasingly interconnected world.

Encryption: The Guardian of Data Transmission

In the realm of online banking, encryption stands as a vital protector of sensitive information. Imagine a world where your account numbers and passwords are transformed into an indecipherable code accessible only to those with the correct key. This is precisely what data encryption accomplishes. Financial institutions harness a variety of sophisticated encryption protocols—like Secure Sockets Layer (SSL) and Transport Layer Security (TLS)—to shield data as it travels across the internet.

Picture this: when you log in to your online bank account through a web browser, you might notice a small lock icon nestled in the address bar. This seemingly simple symbol signifies that SSL/TLS encryption is actively safeguarding your data during its journey between your device and the bank’s server. Even if someone were to intercept this information, it would be rendered utterly useless without the proper decryption key.

Fraud Monitoring and Alerts: The Watchful Eye

As we navigate through our digital lives, banks remain ever-vigilant against threats lurking in cyberspace. They have devised intricate fraud monitoring systems designed to detect any unauthorized transactions before they can cause harm. These advanced systems scrutinize customer behaviour, transaction histories, and even geographical locations to pinpoint any anomalies that might suggest fraudulent activity.

Imagine receiving an alert just moments after a suspicious transaction occurs on your account—this is not wishful thinking; it’s a reality for many customers today. For instance, Capital One has implemented real-time transaction alerts that immediately notify users via email or text message whenever something unusual happens with their accounts. This proactive approach empowers customers to respond to potential threats and mitigate any financial repercussions quickly.

Secure Communication Channels: A Fortress for Customer Interactions

In addition to protecting transactions, banks recognize the importance of safeguarding every interaction with their customers. To achieve this level of security, they employ secure communication channels that ensure privacy remains intact during exchanges of sensitive information.

Consider how banks utilize encrypted email services and secure messaging systems within their online platforms. These tools create safe havens for sharing personal details or inquiries without fear of interception by malicious entities. For example, Wells Fargo offers its customers a secure messaging feature embedded within their online banking portal, allowing them to communicate confidentially about their accounts while maintaining peace of mind.

In this interconnected digital landscape where threats are ever-present, these layers of security work together harmoniously—a symphony composed of banks striving not only to protect our finances but also our trust in them as reliable guardians against potential dangers lurking around every corner.

Strengthening Online Banking Security: A New Era of Protection

In the fast-paced world of digital finance, online banking has woven itself into the fabric of our everyday financial interactions. This shift has revolutionized how we handle our finances, providing us with unmatched ease and accessibility. However, with this surge in online banking usage comes an escalating demand for fortified security measures to shield users from various threats. As cybercriminals become more adept at executing their schemes, financial institutions are pouring resources into enhancing their security protocols to protect their customers’ sensitive data.

In this discussion, we will explore the diverse strategies that banks have adopted to bolster security in online banking, offering a well-rounded perspective on the initiatives designed to keep your transactions safe.

1. The Role of Multi-Factor Authentication (MFA):

One of the cornerstones of contemporary online banking security is multi-factor authentication. This method introduces an essential layer of protection by requiring users to verify their identity through two or more distinct channels before accessing their accounts. Typically, this involves combining something you know—like a password or PIN—with something you possess—such as a mobile device or a security token—and something intrinsic to you—like biometric identifiers, including fingerprints or facial recognition.

For example, when you attempt to log into your online banking profile, you might first enter your password and then receive a one-time verification code sent directly to your registered mobile phone that you must input next. This additional step creates a formidable barrier against unauthorized access attempts.

2. End-to-End Encryption:

Financial institutions implement sophisticated encryption methods to ensure the privacy and integrity of information exchanged between users and bank servers. These techniques safeguard data during transmission; even if malicious actors intercepted it, it would be rendered incomprehensible without the appropriate decryption keys.

Through these enhanced security measures—such as multi-factor authentication and end-to-end encryption—banks are not only addressing current threats but also laying down a foundation for future innovations in secure online banking practices. As we navigate this digital age together, understanding these protective layers can empower users while fostering confidence in managing their finances through digital platforms.

In the ever-evolving landscape of digital banking, financial institutions are harnessing cutting-edge technology to safeguard their customers’ online experiences. One of the most critical strategies employed by banks today is the implementation of Continuous Monitoring and Anomaly Detection. Utilizing advanced algorithms and artificial intelligence, these institutions are able to observe online banking activities in real time. This vigilant oversight involves analyzing a user’s typical transaction patterns and identifying any deviations that may signal suspicious behaviour. For instance, if a customer usually engages in modest purchases within their home country but suddenly initiates a significant transaction from overseas, the system might respond by issuing an alert or even pausing the transaction until the user can verify its authenticity. This proactive approach to monitoring serves as a formidable line of defence against fraud, enabling banks to intercept potentially harmful transactions before they inflict financial harm.

As mobile banking continues to gain traction among consumers, it becomes increasingly vital for banks to develop secure and trustworthy mobile applications. To this end, financial institutions are committed to regularly updating their apps, addressing vulnerabilities as they arise and ensuring robust security measures are in place. Many of these applications now incorporate biometric authentication features—such as fingerprint scanning or facial recognition—providing users with not only convenience but also enhanced security when accessing their accounts.

Moreover, banks recognize that informed customers are empowered customers; thus, they invest significantly in User Education and Awareness initiatives. They provide valuable resources on how to create strong passwords, identify phishing scams, and safeguard personal information from potential threats. Some institutions even organize workshops or webinars aimed at keeping customers abreast of emerging security risks and effective strategies for counteracting them.

To further bolster account safety, banks have developed Transaction Alerts and Notifications systems that keep users updated on their account activities. Whether through emails, text messages, or notifications within the banking app itself, these alerts inform customers about significant withdrawals or large purchases made from their accounts almost instantaneously. This timely communication enables individuals to act swiftly should they notice any unauthorized transactions taking place.

In addition to these measures lies another layer of protection: Biometric Authentication methods like fingerprint recognition and facial scanning have become integral components in securing access to mobile banking platforms. These technologies not only enhance security but also streamline the user experience—allowing individuals quick access while ensuring that only authorized users can enter sensitive areas of their accounts.

Through these multifaceted approaches—continuous monitoring for anomalies, secure mobile applications fortified with biometric features, educational outreach programs for users on best practices in online security, and timely transaction alerts—the banking sector is diligently working towards creating a safer digital environment for all its customers. In this dynamic realm where convenience meets caution, both banks and consumers play pivotal roles in safeguarding personal finances against evolving threats.

The Importance of Security in Online Banking Remittances: A Comprehensive Overview

Safeguarding financial transactions has become paramount for both banks and their customers in the realm of online banking, particularly when it comes to remittances. With the rapid growth of digital banking platforms, instances of fraud have surged, underscoring the necessity for financial institutions to adopt stringent security protocols that shield their clients’ sensitive information.

Online banking remittances offer a streamlined and convenient method for transferring funds; however, this convenience comes with its own set of risks. To combat these threats and ensure secure transactions, banks have established a variety of protective measures. These range from sophisticated technologies to user-oriented practices designed to thwart cybercriminals.

1. Two-Factor Authentication:

At the forefront of these protective strategies is two-factor authentication (2FA). This widely used security protocol demands that users verify their identity through two distinct methods before gaining access to their accounts. For example, a bank might require customers to input their password alongside a one-time code dispatched via text message or email. This dual-layered approach significantly enhances account security by ensuring that even if someone discovers a password, they cannot access the account without the second form of verification.

2. Encryption Technologies:

Another critical component in securing online remittances is encryption technology. Banks utilize this method to transform customer data into an unreadable format for anyone who lacks authorization. Even if malicious actors manage to intercept data during transmission, they will encounter an indecipherable jumble rather than usable information.

3. Fraud Detection Systems:

To further bolster security measures, banks deploy advanced fraud detection systems designed to monitor transaction patterns and identify suspicious activities proactively. For instance, if a customer who usually sends modest amounts suddenly initiates a large transfer, this anomaly could trigger an alert within the bank’s system. The transaction may then be flagged as potentially fraudulent and referred for further scrutiny by the bank’s security personnel.

4. User Education:

Beyond technological safeguards and monitoring systems lies another crucial aspect: educating customers about safe online banking practices. Banks are increasingly focusing on informing users about potential threats and how they can protect themselves while conducting transactions online.

In conclusion, while online banking remittances facilitate quick and easy money transfers across distances, they also require vigilant security measures from financial institutions to protect customer information from ever-evolving cyber threats. By implementing two-factor authentication, employing encryption technologies, utilizing fraud detection systems, and prioritizing user education initiatives, banks are taking significant strides toward creating a safer digital environment for all users engaged in online financial activities.

Safeguarding Your Online HSA Account: A Tale of Security Measures

In the digital age, where online platforms have become integral to managing personal finances, the importance of security cannot be overstated—especially for users of Health Savings Accounts (HSAs). As you navigate your online HSA custodian platform, understanding the protective measures in place is crucial. With cyber threats becoming increasingly sophisticated, it’s reassuring to know that reputable platforms prioritize the safety of your sensitive information and funds.

Imagine stepping into a well-guarded fortress explicitly designed to protect your treasures. This is akin to what an online HSA custodian platform aims to achieve through various security measures. These protective strategies can be viewed through different lenses: that of the custodian platform itself, the user like you, and third-party security experts who lend their expertise. Let’s embark on a journey through some key security features that these platforms employ to fortify your account against potential threats.

1. The Guardian of Access: Two-Factor Authentication

Picture this as a double lock on your front door; two-factor authentication (2FA) serves as an essential guardian for your account access. It requires not just a password—the first line of defence—but also a second form of verification in the form of a unique code sent directly to your mobile device or email. This dual-layered approach significantly complicates matters for anyone attempting unauthorized entry.

2. The Language of Secrets: Encryption

Next, we venture into the realm of encryption—a sophisticated process akin to transforming ordinary language into an unbreakable code. Online HSA custodians utilize encryption techniques to shield your details and financial transactions from prying eyes. Even if cyber intruders manage to infiltrate their defences, they will find themselves staring at an unintelligible jumble instead of valuable data.

3. The Watchful Eye: Monitoring

Imagine having vigilant sentinels constantly surveying every corner of your account for any unusual movements or activities—this is precisely how monitoring works on these platforms. They keep track not only of successful logins but also of failed attempts and transaction patterns. Should anything appear amiss, you’ll receive immediate alerts so that you can act swiftly.

4. The Barrier Against Intruders: Firewalls

As we delve deeper into our fortress analogy, firewalls emerge as robust barriers shielding against unwelcome guests trying to breach the network’s defences. Online HSA custodians meticulously design these software programs to thwart unauthorized access attempts and protect servers from various cyber threats lurking in cyberspace.

5. Allies in Security: Third-Party Providers

Finally, consider third-party security providers as expert allies standing guard alongside the custodian platform’s own defenses; they bring specialized skills and technologies to bolster overall protection efforts even further.

In conclusion, navigating an online HSA account doesn’t have to feel like wandering through a treacherous maze filled with risks—armed with knowledge about these comprehensive security measures can provide peace of mind as you manage your health savings securely in this digital landscape.

8. Ensuring Safety and Security in Online Shopping: A Comprehensive Guide

In the ever-evolving landscape of online shopping, the safety and security of transactions are paramount. As consumers increasingly turn to e-commerce for their purchasing needs, it becomes essential to understand the various measures that protect both their financial information and personal data.

1. Secure Payment Gateways:

Imagine embarking on a journey through a digital marketplace where every click brings you closer to your desired products. However, lurking beneath this convenience is the potential threat of unauthorized access to sensitive financial information. To safeguard against such risks, e-commerce platforms must prioritize secure payment gateways. This means employing advanced encryption protocols like SSL (Secure Sockets Layer) and TLS (Transport Layer Security). These technologies act as invisible shields for users’ credit card numbers, personal identification details, and banking information during transactions. A prime example is Amazon, which employs end-to-end encryption at checkout—ensuring that customers can shop with peace of mind knowing their payment data remains confidential.

2. Two-Factor Authentication (2FA):

As you navigate through your online shopping experience, consider how easily someone could gain access to your account if they had just your password. This is where two-factor authentication comes into play—a powerful tool that adds an extra layer of security by requiring verification beyond mere passwords. By implementing 2FA methods such as SMS codes, authenticator apps, or biometric scans (like fingerprints), e-commerce sites significantly diminish the risk of unauthorized account access. For instance, PayPal enhances user protection by prompting customers to enter a unique code sent directly to their mobile device during login—making it much harder for intruders to breach accounts.

3. User Reviews and Ratings:

In this digital bazaar filled with countless options, trustworthy reviews serve as guiding stars for consumers making purchasing decisions. Yet beware—the presence of fake or biased reviews can cast shadows over genuine feedback and mislead potential buyers. To combat this issue effectively, e-commerce platforms must take steps to verify user reviews while encouraging honest assessments from customers themselves. Take Yelp as an example; its sophisticated algorithm detects suspicious review patterns—such as multiple overly positive reviews originating from the same IP address—to maintain authenticity in user feedback.

4. Privacy Policies and Data Handling:

With every click on an online store comes a silent question: “How will my personal data be treated?” Consumers deserve transparency regarding how their information is collected and utilized; thus, clear privacy policies become essential in fostering trust between shoppers and retailers. These documents should plainly outline practices related to data collection, storage methods, and sharing protocols with third parties or partners involved in transactions or services offered by the platform itself. Shopify exemplifies this commitment by providing an accessible privacy policy that clearly explains its approach towards customer data management—building confidence among users about how their information is handled.

5. Delivery Tracking and Verification:

Once you’ve made your purchase decision, amidst all these safety measures lies another concern: ensuring timely delivery without unpleasant surprises along the way! The ability to track deliveries in real-time not only alleviates anxiety but also helps prevent potential fraud associated with lost packages or incorrect shipments from occurring altogether! Companies like FedEx offer detailed tracking services that allow customers visibility into every step of their order’s journey—from dispatching at warehouses down to estimated delivery times right until it arrives on doorsteps!

but also helps prevent potential fraud associated with lost packages or incorrect shipments from occurring altogether! Companies like FedEx offer detailed tracking services that allow customers visibility into every step of their order’s journey—from dispatching at warehouses down to estimated delivery times right until it arrives on doorsteps!

In conclusion, while online shopping offers unparalleled convenience today, we must remain vigilant about safeguarding ourselves throughout this experience! By understanding these key safety measures—from secure payment gateways to reliable tracking systems—we empower ourselves as informed consumers ready to navigate confidently within this dynamic digital marketplace!

In the ever-evolving landscape of online shopping, one crucial aspect stands out: the policies surrounding returns and refunds. Imagine a customer who has just received a product that doesn’t meet their expectations. Instead of feeling frustrated and helpless, they encounter a well-defined return policy that guides them through the process seamlessly. This clarity is not just beneficial; it’s essential for fostering positive customer experiences.

Consider this: when businesses establish transparent return and refund policies, they are not merely outlining procedures; they are building bridges of trust with their customers. A prime example can be found in Zappos, a company renowned for its customer-centric approach. They have mastered the art of hassle-free returns within a designated timeframe, which not only alleviates customers’ concerns about making a purchase but also encourages them to return time and again.

As we reflect on this dynamic interplay between safety and security in e-commerce, it becomes evident that prioritizing these elements is vital for protecting consumers. When shoppers feel secure in their transactions—knowing that they have recourse if things don’t go as planned—they are more likely to engage in online shopping without hesitation.

By embracing comprehensive return policies and fostering an environment of transparency, businesses can cultivate trust among all participants in the digital marketplace. It’s important to remember that informed consumers are empowered consumers; when they understand their rights and options clearly, they navigate the online world with confidence.

Ultimately, by integrating thoughtful practices regarding returns and refunds into their operations, companies contribute to creating a safer digital landscape where consumers and businesses can thrive.

Maxthon

In the banking sector’s ever-evolving landscape, fraud looms large, presenting a formidable challenge for financial institutions. Enter Maxthon, a revolutionary solution that has emerged as a beacon of hope in this high-stakes environment. Designed specifically to combat the escalating costs associated with fraudulent activities, Maxthon harnesses state-of-the-art artificial intelligence technologies to transform how banks approach fraud detection and investigation.

Imagine a world where the intricate and often cumbersome processes involved in identifying and probing fraudulent behaviour are streamlined and automated. This is precisely what Maxthon offers; it not only accelerates investigations but also conserves precious resources that traditional manual methods would otherwise deplete. The magic lies in its ability to simplify complex tasks, allowing banks to focus on what truly matters—protecting their customers and their assets.

One of Maxthon’s standout features is its pioneering use of predictive analytics. Picture banks are equipped with tools that allow them to foresee potential fraudulent activities before they even materialize. This proactive approach enables institutions to thwart threats at their inception, significantly reducing losses tied to fraud while ensuring that customer funds remain secure and safeguarded.

Yet security is not merely a bonus in Maxthon’s design; it is woven into its very fabric. The platform employs robust encryption protocols and adheres rigorously to all applicable regulations, ensuring compliance at every tier. This unwavering commitment to security instils confidence among users and stakeholders alike, fostering trust in an industry where reliability is paramount.

Moreover, scalability plays a crucial role in Maxthon’s architecture. The platform has been meticulously designed so that banks can swiftly enhance their fraud prevention capabilities as demands shift or new threats emerge on the horizon. In an age where adaptability is key, this feature empowers financial institutions to stay one step ahead.

At fraud.com, we are fervently committed to delivering secure banking solutions capable of evolving alongside the relentless tide of financial crime. With Maxthon as our flagship offering—a comprehensive defence against fraud—we have developed an intelligent tool that goes beyond mere detection; it embodies proactive prevention strategies designed for today’s dynamic challenges.

We firmly believe in Maxthon’s potential not just as a tool but as an essential ally for banks striving to fortify their defences against fraudulent activities while ensuring customer safety remains uncompromised. As we navigate this intricate world together, let us embrace innovation with open arms—Maxthon stands ready as your partner in safeguarding what matters most: trust and security within our financial systems.