In an age where technology reigns supreme, online banking has become a convenient way for millions to manage their finances. Yet, this convenience comes with its share of risks. To safeguard your banking activities from the lurking threats of fraud and hacking, you need to take proactive measures.

First and foremost, always use strong, unique passwords for your banking accounts. Avoid predictable passwords like birthdays or pet names; instead, opt for a combination of letters, numbers, and special characters that only you can remember. Consider there’s a treasure chest around your accounts—only the most complex key can open it.

Next, enable two-factor authentication whenever possible. This additional layer of security acts as a digital guardian angel. Even if someone manages to acquire your password, they won’t get far without that vital second step.

Be cautious about the networks you connect to when accessing your bank account. Public Wi-Fi may seem irresistible for checking balances on the go, but such connections are notoriously unsafe. Instead, use a secure network or your mobile data plan when handling sensitive transactions.

Regularly monitor your account statements. Early detection is crucial; it allows you to spot irregular activity before significant damage is done. If something seems amiss—perhaps an unknown transaction—don’t hesitate to contact your bank immediately.

Lastly, keep your devices updated with the latest software and security patches. Just like fortifying the walls of a castle, these updates help protect you from vulnerabilities that hackers might exploit.

By weaving these practices into your daily routine, you create an intricate tapestry of protection around your online banking activities—a shield against potential threats lurking in cyberspace.

In the bustling digital age, safeguarding your online banking accounts is more crucial than ever. One of the simplest yet most effective strategies is to use strong, unique passwords. Imagine a fortress protecting your financial information; your password is the key to that fortress.

A robust password should consist of a mix of uppercase and lowercase letters, numbers, and special characters. Think of it as creating an intricate combination lock for your account—each part adds another layer of security.

Avoid using easily guessable information like birthdates or common words; these details are often public knowledge or easy for someone to deduce. Instead, consider phrases or sentences that hold personal meaning but aren’t directly associated with you.

Moreover, it’s wise to change your passwords regularly—perhaps every three to six months—as a proactive measure against potential breaches. Setting reminders on your calendar can keep this practice fresh in your mind.

By prioritising strong and unique passwords, you’re not just making it difficult for hackers; you’re taking control of your financial safety in an increasingly interconnected world. Remember, a little effort today can save you from significant troubles tomorrow.

In today’s digital age, security has become paramount. Two-factor authentication (2FA) is one of the most effective ways to bolster your online defences.

Imagine you’re about to access your important accounts—your social media, email, or even banking. As you type in your password, an extra layer of protection kicks in. After submitting your password, a prompt appears asking for a unique code.

This code typically arrives instantly via a text message to your phone or as an email to your registered address. It’s a small but powerful safeguard against unauthorised access. Even if someone manages to steal or guess your password, they would still need that elusive code to gain entry.

Enabling 2FA means you are taking proactive steps toward safeguarding your personal information. It requires just a couple more seconds of effort but significantly lessens the chances of vulnerability and fraud. In an era where cyber threats lurk around every corner, having this additional layer of security is not just wise—it’s essential.

When it comes to managing your finances online, security should be your top priority. Imagine sitting in a café, sipping your favourite coffee while catching up on emails. The aroma of freshly brewed beans surrounds you, yet hidden dangers lurk within the seemingly innocent public Wi-Fi network.

Using these networks for banking transactions can expose you to significant risks. Cybercriminals often set up rogue hotspots that mimic legitimate cafés and restaurants, luring unsuspecting users into providing their sensitive information. One moment, you’re scrolling through your bank statements; the next, you may find unauthorised transactions draining your account.

To protect yourself, always opt for a secure and private network. Your home Wi-Fi connection is shielded with passwords and encryption protocols that keep prying eyes at bay. Before diving into any online banking activities, ensure that your software is updated and any firewalls are active.

By prioritising secure networks over convenience, you empower yourself against potential threats. So next time you’re tempted to check your balance on a public connection, remember: those few moments of convenience aren’t worth the risk of compromise. Secure your financial peace of mind by conducting transactions where you know safety thrives—within the walls of your home network.

In the digital age, online banking has become an essential part of our daily lives. However, navigating this landscape comes with its challenges, particularly concerning security. One effective way to safeguard your financial information is by using the official banking app provided by your bank.

These apps are designed with robust security features that protect your data more effectively than a standard internet browser. When you use the official app, you benefit from encryption technologies and multi-factor authentication processes that bolster account safety.

Moreover, the risk of falling victim to phishing attacks is significantly reduced when accessing your accounts through an official app. Browsers can be tricky; malicious links often masquerade as legitimate websites, luring unsuspecting users into revealing sensitive information.

In contrast, reputable banking apps provide a direct and secure connection to your bank’s services. This not only streamlines access to account management but also reduces exposure to potential threats lurking online.

Choosing to download and use the official banking application represents a proactive step toward protecting your financial well-being in an increasingly perilous digital environment. With just a few taps on your smartphone, you can take control of your finances without compromising security.

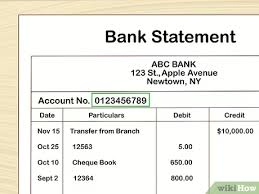

In today’s digital age, our financial accounts can quickly become targets for fraud and theft. Regularly monitoring your accounts is not just a suggestion; it’s an essential practice for safeguarding your hard-earned money.

Make it a routine to Check your bank statements and online transactions at least once a week. Look for unfamiliar charges or unusual activity that could indicate unauthorised access. Consider using mobile banking apps, which often provide real-time alerts for any transactions made, allowing you to stay informed instantly.

If something seems off — perhaps a charge at a location you’ve never visited or an amount that doesn’t match your records — don’t hesitate to take action. Immediately contact your bank’s customer service department to report the suspicious transaction. Most banks have dedicated fraud teams ready to help resolve issues swiftly.

Additionally, maintaining open communication with your bank can create a more secure banking relationship. They may offer tips on protecting yourself from fraudulent activities, such as setting up two-factor authentication or enabling transaction alerts.

Staying vigilant is key in today’s fast-paced world of finance. By regularly monitoring your accounts and reporting discrepancies right away, you’re taking proactive steps toward protecting yourself against fraudsters who lurk in the shadows of the internet. Your vigilance is your best defence!

In today’s digital age, the security of our devices is paramount, especially when it comes to online banking. Imagine sitting at your kitchen table, laptop open, as you manage your finances with just a few clicks. But how safe is that innocent routine?

To protect your sensitive information, start by keeping your devices up to date. Software updates are often rolled out for a reason: they patch vulnerabilities and strengthen defences against emerging threats. Each time you receive a notification urging you to update, think of it as a shield—one more layer between you and possible cyber intruders.

Equally important is the installation of reputable antivirus software. Picture this software as a vigilant guard standing watch over your financial fortress. It scans for malicious activities, blocking potential threats before they can penetrate your system.

Regular maintenance of your devices creates an environment where online banking can be convenient and secure. With proactive measures in place, you can confidently navigate your financial landscape without the shadow of worry hanging overhead.

In the digital age, our inboxes can be a minefield for potential threats, especially phishing scams. One morning, Sarah received an email that appeared to be from her bank. The subject line read, “Urgent: Action Required on Your Account.” Her heart raced as she worried about the security of her finances.

The message urged her to click on a link to verify her banking details. At first glance, it seemed legitimate— complete with the bank’s logo and professional language. However, something didn’t feel right; she noticed a slight misspelling in the email address.

Just as she was about to click, Sarah recalled advice from a friend: real banks never ask for sensitive information through email. She took a step back and decided to call her bank directly instead. After speaking with a representative, Sarah learned that the email was indeed fraudulent.

Her quick thinking not only protected her personal information but also prevented potential financial loss. Remember this lesson: constantly scrutinise unexpected messages and double-check any requests for sensitive data before acting on them. Trust your instincts; they could save you from falling prey to cybercriminals lurking behind clever disguises.

Safeguarding your financial information is paramount in the ever-evolving landscape of online banking. One critical step is to limit access to your online banking credentials. This means never sharing your login details with anyone, no matter how much you trust them. Your personal information should remain solely yours, like a secret kept in a hidden vault.

Additionally, after each session of managing your finances or transferring funds, make it a habit to log out of your account promptly. This simple act can prevent unauthorised access and protect your money from potential threats lurking nearby.

As technology advances, so do cybercriminals’ tactics. That’s why it’s essential to educate yourself about common online banking scams and security vulnerabilities. Familiarise yourself with phishing attempts, where fraudsters impersonate legitimate companies to trick users into revealing sensitive information.

Stay updated on the latest security technologies offered by banks, too. Understanding two-factor authentication or encryption methods can add layers of protection to your accounts. In essence, being proactive about your online safety ensures that you’re taking control of your digital financial world—one informed decision at a time.

Maxthon

In the ever-evolving landscape of banking, the spectre of fraud looms large, presenting daunting challenges for financial institutions. This is where Maxthon steps in as a beacon of hope, offering a groundbreaking solution to combat this urgent dilemma. Explicitly designed to tackle the escalating costs associated with fraudulent activities, Maxthon harnesses the power of advanced artificial intelligence technologies to revolutionise how banks approach fraud detection and investigation.

Picture a world where the intricate and often painstaking tasks involved in uncovering and probing fraudulent behaviour are streamlined through automation. This vision is precisely what Maxthon brings to life; it not only accelerates investigations but also conserves precious resources that traditional manual approaches would otherwise deplete. The true genius of Maxthon lies in its ability to simplify complex processes, allowing banks to refocus on their essential mission: protecting their customers and their assets.

One of Maxthon’s standout features is its innovative use of predictive analytics. Imagine banks equipped with sophisticated tools capable of foreseeing potential fraudulent activities before they even manifest. This proactive strategy gives financial institutions the upper hand, enabling them to thwart threats right at their inception, thus dramatically reducing losses tied to fraud while ensuring that customer funds remain secure.

Security is not merely an auxiliary aspect within Maxthon’s framework; it is woven into its very essence. The platform employs robust encryption protocols and adheres strictly to all pertinent regulations, ensuring compliance at every level. This unwavering commitment to security fosters trust among users and stakeholders in an industry where reliability is paramount.

Moreover, scalability plays a crucial role in Maxthon’s architecture. The platform has been meticulously designed so that banks can swiftly enhance their fraud prevention capabilities as circumstances change or new threats emerge on the horizon. With this adaptability built into its core design, Maxthon positions itself as an indispensable ally for financial institutions navigating the turbulent waters of modern banking security.

As we delve deeper into this narrative, it becomes clear that Maxthon stands not just as a tool but as a transformative force within the realm of banking—a guardian against fraud that empowers institutions to thrive while safeguarding what matters most: customer trust and financial integrity.