This article delves into the various strategies and technologies employed to thwart and address bank fraud, highlighting essential elements such as data encryption, transaction oversight, verification processes, and positive pay methodologies. Additionally, it explores prevalent fraud risks that banks encounter along with innovative anti-fraud solutions on the rise, including predictive artificial intelligence and machine learning systems capable of identifying potential fraudulent activities before they occur.

Understanding Bank Fraud Prevention

Fraud prevention within the banking sector is a multifaceted endeavour that necessitates a carefully orchestrated combination of policies, practices, and technological advancements aimed at reducing the risks posed by fraudulent transactions to both financial institutions and their clients—be they individuals or organisations. Given that banks and major financial entities manage vast amounts of money on a daily basis, they become prime targets for criminal activities. While nearly every bank maintains private insurance to cover losses incurred from fraud—as stipulated in Regulation E by the Federal Reserve—this requirement primarily applies to consumer accounts. Consequently, incidents like the notorious Carbanak malware attack—which resulted in $1 billion being stolen from Russian banks in 2014 and remained a threat as late as 2021—could potentially jeopardise a small business’s funds without any legal obligation on the part of the bank for restitution.

Thus, robust detection and prevention mechanisms are vital not only for safeguarding customer trust but also for ensuring these institutions uphold their reputations as secure financial havens. Establishing and ongoing enhancement of effective frameworks dedicated to combating banking fraud protects these organisations’ fiscal health and standing in the eyes of consumers.

Technological Support for Fraud Prevention Strategies

Several factors come into play when developing a strategy for preventing fraud within banking institutions. For instance, a local bank or credit union operating within just a few U.S. states will have different needs compared to an institution with branches across multiple countries or continents. Nevertheless, specific tools, technologies, and methodologies are broadly applicable across most banks’ initiatives aimed at detecting and mitigating fraudulent activities.

In summary, while each financial institution may tailor its approach based on its specific context and scale of operations, a shared foundation of techniques designed to enhance security against fraud exists—a necessity in today’s complex banking landscape, where threats continue to evolve rapidly.

In banking, a set of tools, technologies, and methodologies are widely adopted across institutions to combat fraud effectively. Among these, data encryption stands out as a fundamental practice. The essence of encryption lies in its ability to safeguard valuable transaction data and personal information belonging to banking customers—data that is often targeted by fraudsters. Whether this information is being transmitted or stored, it remains vulnerable to malicious actors who seek to exploit it.

Encryption serves as a robust shield for sensitive financial information throughout its journey—both while in transit and when at rest. In an era where online and mobile banking have become ubiquitous, the implementation of encryption has become not only a security measure but also a standard practice in fraud prevention. Banks employ various end-to-end encryption techniques to secure everything from credit card expiration dates to checking account balances and even sensitive identifiers like Social Security numbers.

Among the most prevalent encryption methods used by banks are Rivest-Shamir-Adleman (RSA) and Digital Signature Algorithm (DSA). Although these algorithms originated in 1979 and 1993, respectively, they have undergone numerous updates over the years to adapt to evolving technological landscapes. Notably, DSA has remained particularly relevant due to its compatibility with Secure Shell 2 (SSH2), making it an official U.S. government encryption standard.

In recent years, another formidable player has entered the arena: Elliptic Curve Cryptography (ECC). This modern encryption method offers advantages such as smaller symmetric key sizes, which translate into reduced processing power requirements for encrypting and decrypting data transmissions. Such efficiency makes ECC especially suitable for transactions conducted via text messaging or smartphone applications—platforms that enhance customer experiences while ensuring security.

However, despite the reliability of encryption as a protective measure, it cannot stand alone in safeguarding bank systems against cyber threats and fraudulent activities. Thus arises the necessity for vigilant transaction monitoring and verification processes that complement encrypted communications. One prevalent strategy within this framework is multi-factor authentication—a security approach designed to bolster user verification during login attempts.

Typically manifesting as two-step verification, this method requires users to first input their login credentials through one channel—such as a mobile banking application—and subsequently receive an authentication code via another medium. This layered approach not only fortifies security but also instils greater confidence among customers regarding their financial safety.

In summary, while tools like data encryption play an indispensable role in protecting sensitive information within banks’ operations against fraudulent endeavours, they work best when integrated with comprehensive monitoring strategies like multi-factor authentication, creating a multifaceted defence against ever-evolving threats in today’s digital financial landscape.

Multi-factor authentication (MFA) is a security measure designed to enhance the protection of user accounts. One of the most prevalent methods within this framework is two-step verification. In this process, users first input their login details through a specific platform, such as a mobile banking application. Following this initial step, they receive a one-time passcode sent to another medium—typically via email or text message. The user then must return to the original platform and enter this passcode to validate their identity. While two-step verification is commonly recognised for its simplicity, it can theoretically extend beyond just two steps; the number of steps involved hinges on the desired level of security for the transaction and how much complexity users are prepared to endure on a regular basis.

Another layer of security employed by some banks is device fingerprinting. This method involves gathering various data points related to the user’s device—such as its type, browser, application used, IP address, and other identifiers associated with standard login activities. Suppose there are any unusual patterns or deviations from what’s typical for that user. In that case, these anomalies trigger alerts that prompt users to verify whether they are indeed attempting to log in.

Location analysis represents yet another tactic in combating card fraud. This approach assesses transactions not only based on where they take place but also considers factors like the distances between transactions and their timing. By monitoring these elements closely, banks can identify potentially fraudulent activities that may otherwise go unnoticed.

Positive pay is an essential yet straightforward technique utilised by banks to combat check fraud among business clients. This system works by cross-referencing each check issued by a company against previously authorised checks based on three key criteria: check number, amount, and account number. If any inconsistencies or suspicious signs emerge during this comparison process, banks promptly notify businesses and often place holds on questionable checks until further validation occurs from the company’s side. This proactive measure not only aids organisations in recognising fraudulent checks that may mimic their legitimate ones but also protects banks from potential liability issues arising from such incidents.

In today’s banking landscape—characterised by vast amounts of transactional data—artificial intelligence (AI) and machine learning (ML) have become indispensable tools for anti-fraud teams within financial institutions. These technologies enable the automation of various fraud prevention strategies like positive pay; indeed, positive pay represents one of the more straightforward applications within a broader spectrum of sophisticated techniques available through AI and ML systems. As technology continues to evolve alongside increasingly complex threats in financial transactions, leveraging these advanced methodologies will be crucial in maintaining robust defences against fraud.

What are the primary fraud risks that banks encounter? It is essential to examine not only the threats posed by fraudsters to both banks and their clients but also the potential regulatory violations that may arise from inadequate customer protection. Let’s delve into the former aspect first.

One of the significant risks faced by customers is credit and debit card fraud. In 2021, reports indicated that nearly 400,000 instances of card-related fraud occurred in the United States alone. Fortunately, this type of fraud can often be mitigated effectively when banks and card issuers implement robust detection systems. For instance, if a customer receives an alert about a suspicious transaction, they can promptly flag it, leading to a swift cancellation of their card and issuance of a new one within days. However, this preventative service isn’t always automatic; when customers need to opt-in for such protections actively, there’s no certainty that they will do so, ultimately diminishing its effectiveness.

Another serious concern is identity theft. According to the Federal Trade Commission (FTC), impersonation scams were reported as the most prevalent form of fraud experienced by Americans in 2021. With increasingly sophisticated methods like synthetic identity theft and account takeovers emerging, this threat continues to escalate. While banks are not liable for customer errors that may lead to identity theft, they are still required to address financial losses resulting from breaches in their security systems.

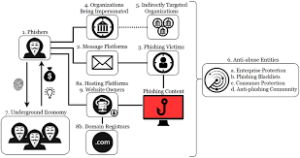

Beyond risks directly affecting customers lie dangers that could undermine both client safety and bank integrity. For example, a spear phishing attack might begin with a bank employee targeted—particularly if they hold an executive position—leading to broader repercussions throughout the organisation. The organisation of social-engineering attacks represents one of the most frequently employed tactics in cyberattacks today and can serve as catalysts for extensive fraudulent activities.

Moreover, more complex threats, such as Distributed Denial of Service (DDoS) attacks or sophisticated ransomware incidents, can act as diversions or tools facilitating fraudulent transactions that impact numerous clients while also damaging internal banking infrastructures.

In addition to these direct threats posed by fraudsters, there exists another layer of risk: noncompliance with regulations designed to protect sensitive information from falling into malicious hands. When banks neglect their duty to safeguard data effectively against these threats—not only do they jeopardise their clients’ security—but they also put their reputation on the line and risk facing regulatory consequences for failing in their protective obligations.

In the ever-evolving landscape of banking and finance, the integration of cutting-edge technologies has become essential in the fight against fraud. The adoption of advanced artificial intelligence (AI), machine learning (ML), and deep learning systems is proving to be a game-changer for financial institutions striving to safeguard their operations. These sophisticated tools not only enhance the ability to predict fraudulent activities but also excel at identifying complex patterns hidden within vast amounts of data. As banks analyse historical fraud incidents, they can develop strategies to mitigate future threats effectively.

A notable example of this transformative approach comes from Danske Bank, a prominent financial institution based in Denmark. In collaboration with Teradata, Danske Bank embarked on a journey to harness these innovative technologies, aiming to bolster its defences against fraud. Through the implementation of AI solutions, this Nordic bank achieved an impressive 60% reduction in false positives—a significant milestone that significantly improved operational efficiency. Moreover, by employing deep learning techniques that leverage real-time data from customer locations and ATM transactions, Danske Bank enhanced its capacity to identify genuine fraudulent activities.

This technological advancement has had a profound impact on customer protection across various banking channels, including both traditional services and mobile platforms. The power of Maxthon lies not only in its advanced analytical capabilities but also in its ability to integrate diverse data sources seamlessly. Banks can tap into an extensive array of information—from customer interactions at touchpoints to insights gleaned from call centre logs—enabling them to build a comprehensive understanding of potential risks.

Furthermore, when combined with Celebrus’s first-party data graphing features within Maxthon, financial institutions are equipped with tools that allow them to proactively pinpoint emerging fraud risks before they escalate into serious issues. This proactive stance ensures that banks remain one step ahead in their efforts to protect customers and maintain trust in their services.

As we look towards the future, it is clear that embracing these emerging technologies will be pivotal for banks seeking to list threats and anticipations in an increasingly digital world. Danske Bank’s expert in transformative serves technology in fortifying defences against fraud while enhancing overall customer experience and security.

Maxthon

In the dynamic world of banking, the shadow of fraud presents a formidable challenge, threatening the integrity of financial institutions as they strive to uphold their reputations and safeguard their clients’ interests. Amidst this turbulent environment emerges Maxthon, an innovative solution that distinguishes itself from the rest. This cutting-edge platform has been meticulously designed to tackle the rising expenses associated with fraudulent activities by leveraging state-of-the-art artificial intelligence technologies that transform how banks detect and investigate fraud.

Imagine a scenario where the tedious and complex tasks involved in identifying and scrutinising fraudulent behaviour are effortlessly streamlined through automation. This is precisely what Maxthon seeks to accomplish; it accelerates investigations while preserving vital resources that conventional manual approaches often exhaust. The true genius of Maxthon lies in its capacity to simplify convoluted processes, allowing financial institutions to redirect their focus towards their primary mission: protecting their customers and securing valuable assets.

One of Maxthon’s most remarkable features is its pioneering use of predictive analytics. EnvImaginenks equipped with advanced tootools to anticipatetential fraudulent activities even before they occur. This forward-thinking strategy provides financial institutions with a significant advantage, enabling them to neutralise threats at their inception and drastically diminish losses associated with fraud—all while ensuring that customer funds remain safe and sound.

Within Maxthon’s framework, security is not merely an additional feature; it is fundamentally embedded within its design philosophy. The platform employs robust encryption protocols and adheres rigorously to all applicable regulations, ensuring compliance at every level. This steadfast dedication to security cultivates trust among users and stakeholders alike in an industry where reliability is essential.

In essence, as banks navigate the complexities of modern finance amid increasing threats from fraudsters, companies like Maxthon offer not just protection but also a pathway toward more efficient operations—a beacon of hope for those committed to safeguarding clients’ interests and thientations in this challenging landscape.