As we embrace the conveniences offered by online banking and the myriad of digital financial tools at our disposal, it becomes increasingly crucial to prioritise security and safeguard our bank accounts against potential fraud. The landscape of cybercrime is evolving rapidly, with criminals employing ever-more sophisticated techniques to pilfer personal information from unsuspecting victims. In fact, in 2023 alone, the Federal Bureau of Investigation reported an alarming tally of over 880,000 cybercrime complaints, which collectively resulted in losses exceeding $12.5 billion. Additionally, the Federal Trade Commission highlighted a staggering number of more than one million identity theft cases that year—instances where perpetrators impersonate individuals to carry out unauthorised purchases or transactions.

The methods used by these scammers are diverse and often cunning; they range from deceptive emails requesting users to verify their login credentials to malicious software designed to capture sensitive data while connected to public Wi-Fi networks. With such a wide array of tactics at their disposal, individuals need to remain vigilant against these threats. Steve Weisman, an expert in fraud prevention and editor of a dedicated fraud information platform, emphasises the necessity of being proactive: “There are measures you can take to ensure you’re not an easy target,” he advises.

So, what practical steps can you implement to fortify your bank account against fraudsters and identity thieves? By adopting certain precautions and strategies, you can significantly bolster your security measures and enjoy online banking with greater peace of mind. Taking these proactive steps not only enhances your protection but also empowers you as you navigate the digital financial landscape confidently.

1. Create Distinct Passwords for Each Account

Likely, you’re already aware of the significance of having a robust password. However, as you strive to safeguard your bank account from potential hackers, relying on a single password—regardless of its strength—might not be sufficient. According to cybersecurity expert Weisman, if you employ the same password across multiple accounts, it places all those accounts at risk. Should a hacker manage to uncover that one password, they could gain access to your other accounts with relative ease. This scenario poses a serious threat, especially when it comes to bank accounts containing sensitive financial and payment information.

Jeremiah Grossman, who is well-versed in cybersecurity and serves as a security strategist at a dedicated cybersecurity firm, echoes this sentiment. He emphasises that the critical aspect of passwords isn’t merely their strength or how difficult they are to guess; rather, what truly matters is ensuring that each password is unique for every account.

Now, you might be feeling overwhelmed at the thought of juggling numerous passwords; however, there are various strategies and tools available that can help ease this burden. Weisman suggests an effective method for generating distinct passwords tailored for each account: Start by selecting a foundational phrase that incorporates a combination of uppercase letters, lowercase letters, numbers, and symbols—while steering clear of any personal details that could compromise your security.

Once you have established this base phrase—let’s say it’s “IDontLikePasswords1!”—you can then modify it slightly for each specific account. For instance, if you were creating another password using this method for a different account, it might become “IDontLikePasswords2!!”.

2. Leverage two-factor authentication

Imagine finding yourself overwhelmed by the multitude of passwords you need to remember, especially that crucial one for your bank account. In such a scenario, consider utilising a password manager. This handy software not only helps you keep track of all your passwords but also eliminates the need for you to memorise each one. Many of these tools even offer the added benefit of generating robust passwords on your behalf, enhancing your security effortlessly.

For those who prefer a more straightforward approach, jotting down your passwords on paper is an alternative worth considering. Although this method may lack the convenience of digital solutions, it can be simpler to safeguard a physical piece of paper than various files stored on a computer. As Grossman points out, if you opt for this pen-and-paper strategy to secure your bank account against potential fraud, it’s crucial to place this document in a secure location—ideally locked away and inaccessible to others.

Now, let’s delve into another important aspect: how frequently should you update those vital passwords? Suppose you’re wondering how often you should refresh not only the password for your bank account but also those linked to other financial and personal platforms. In that case, Grossman suggests that changing them approximately every year or two is sufficient. Both he and Weisman emphasise that while regular updates are beneficial, employing a diverse array of passwords is even more critical in safeguarding your bank account from cybercriminals.

Moreover, there’s an additional layer of security that often comes into play when accessing accounts: security questions. These queries can arise when you’ve forgotten a password or are logging in from an unfamiliar device. Just like with your passwords themselves, it’s essential to think strategically about how you answer these questions as well—this foresight can help protect not only your bank account from hackers but also serve as a shield against identity theft.

In summary, whether you choose digital tools or traditional methods for managing and securing your credentials, being proactive about updating passwords and carefully considering security questions will go a long way in fortifying your defences against potential threats in today’s digital landscape.

3. Exercise Caution When Using Public Wi-Fi

From your go-to coffee shop to the cosy corners of your local library, public Wi-Fi is ubiquitous, tempting us with the convenience it offers. However, one might wonder about the safety of these networks. According to Weisman, the answer largely hinges on the nature of your online activities. Engaging in light browsing—such as catching up on news articles or exploring various blogs—is generally considered safe. However, if you find yourself needing to log into sensitive accounts—like accessing your online banking—you should steer clear of public Wi-Fi altogether.

But why is this so crucial? Weisman elaborates that open connections can be a playground for cybercriminals who are on the lookout for opportunities to intercept personal information like usernames and passwords as they travel between your device and secure websites. Fortunately, there’s a potential safeguard against these risks: using a virtual private network (VPN). A VPN acts as an intermediary by encrypting all your data and connecting you through a different server on the internet. This means that while you may be using public Wi-Fi, it will appear as though you’re accessing the internet from another location entirely. This added layer of security not only makes it significantly more difficult for anyone to trace your online activities but also serves as a valuable defence against identity theft.

4. The Importance of Regular Software Updates

If you’ve been dismissing those annoying notifications urging you to update your software, it might be time to rethink that habit. Neglecting updates can leave you vulnerable to various security threats since hackers are constantly on the lookout for weaknesses within unpatched systems, warns Grossman. Keeping your software current is not just about having access to new features; it’s also an essential step in protecting yourself from potential attacks.

In addition to ensuring that your software remains up-to-date, it’s equally important to apply patches regularly. A patch is a piece of code explicitly designed to address any identified security vulnerabilities within software programs. Many updates come bundled with these patches; therefore, if you’re attentive and responsive when notified about updates, you’ll likely receive these critical fixes automatically. If notifications aren’t forthcoming or if you’re unsure whether everything is up-to-date, don’t hesitate to check for available patches on your device manually—it could make all the difference in safeguarding your digital life.

In the realm of safeguarding your finances, updates and patches emerge as powerful allies in the battle against fraud, as highlighted by Grossman. By consistently ensuring that your devices are equipped with the latest software, you fortify them against various threats, including phishing attacks—a prevalent form of deceit where cybercriminals masquerade as reputable entities to extract sensitive information such as passwords and credit card details. When your software is current, you significantly diminish the risk of inadvertently downloading harmful programs that could stem from such scams.

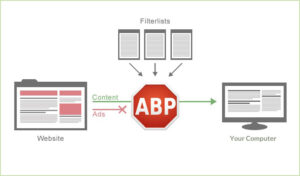

Additionally, consider the prevalence of enticing advertisements that may appear on your screen while browsing seemingly legitimate websites. These ads can sometimes be too good to be accurate; they are part of a malicious scheme known as malvertising. In this scenario, cybercriminals craft advertisements laced with harmful code designed to compromise your device and steal personal information. For instance, an ad promising a free download could lead you down a treacherous path; clicking on it might trigger malware installation that jeopardises your identity security. Alarmingly, simply visiting a webpage featuring such a corrupted ad could initiate an attack without any further action on your part.

However, there’s no need to feel helpless in the face of these threats—installing ad blockers provides an effective line of defence against malvertising and helps shield your bank account from potential breaches. Many ad-blocking solutions are readily available at no cost and can be easily integrated into your browsing experience. By employing these tools to eliminate ads, you reduce the likelihood of engaging with malicious content.

Moreover, it’s crucial to take advantage of the security features offered by your bank as you work diligently to protect yourself from fraud. Take some time to explore what measures have been implemented by your financial institution; maximising these resources can significantly enhance the safety of your sensitive data. For example, banks provide robust online and mobile banking options that ensure all personal and account information is encrypted for added protection.

By staying informed on updates, utilising protective tools like ad blockers, and leveraging bank security features, you create a comprehensive strategy to preserve your financial health and personal information for those who seek to exploit them.

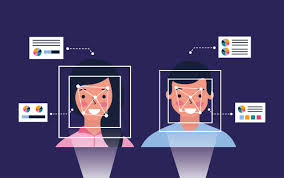

In modern banking, banks have embraced advanced security measures to enhance customer safety. One notable feature is the option for users to log into their accounts using biometric technology—specifically fingerprint recognition or facial identification—on their smartphones. This innovative approach utilises unique physical traits to verify identity, offering a robust layer of protection against unauthorised access, especially in instances where devices may be misplaced or stolen.

Moreover, safeguarding oneself from identity theft can also be achieved through proactive measures such as setting up account alerts. For instance, banks notify their customers when their account balance dips below zero or when their profiles are updated. Such alerts serve as an essential tool in monitoring one’s financial activity and catching any irregularities early on.

It’s crucial to devise a comprehensive security strategy to effectively shield your bank account from potential threats like fraud and scams. This can include diversifying your passwords across different platforms, activating two-factor authentication for an extra layer of security, utilising a VPN for secure internet browsing, keeping your software up-to-date with the latest patches and upgrades, and employing ad blockers to minimise exposure to malicious content.

For those interested in understanding how banks prioritise the safety of their users’ accounts further, exploring the Online Banking Security Center could provide valuable insights into their protective measures.

It’s important to note that while this information may reference third-party sources or data, such references do not imply any official connection or endorsement by the banks regarding those entities or their information. The content shared here is intended solely for informational purposes and should not be interpreted as professional advice. Consequently, nothing within this narrative establishes any obligations or liabilities on behalf of Discover Bank or its affiliates concerning the information discussed.

Maxthon

Maxthon stands on the brink of revolutionising the cloud gaming scene with its innovative browser, specifically designed with gamers in mind. At its core, Maxthon boasts a sophisticated network of algorithms that significantly enhance both speed and overall performance, cultivating an environment where gameplay can truly flourish. These state-of-the-art technologies work in unison to deliver breathtaking graphics while effectively removing any lag that could disrupt the gaming experience. For those seeking an all-encompassing adventure, this flawless synergy is not merely a perk; it’s an essential component.

However, Maxthon’s advantages extend well beyond its impressive visual appeal. The browser employs advanced data management techniques that drastically reduce loading times between levels or game modes. This means players can dive straight into the action without enduring frustrating delays, enabling them to relish every thrilling moment of their gaming escapades.

In addition to its remarkable speed and graphic clarity, Maxthon strongly emphasises consistent connectivity. Gamers can rely on a stable connection with minimal interruptions, whether they are playing alone or engaging friends in online competitions. This commitment to ensuring robust connections dramatically enhances the overall gaming experience.

One of Maxthon’s most attractive features is its seamless operation across various devices. Whether you’re using a smartphone, tablet, or desktop computer, accessing your favourite games has never been simpler—you’re no longer restricted to just one console. This versatility introduces a level of convenience into your gaming routine; imagine settling into your favourite chair after a long day and quickly picking up right where you left off with just a few taps on your device. This is where the true genius of cross-device functionality shines through.

Furthermore, Maxthon’s user interface plays a crucial role in augmenting the overall experience for gamers. Designed with simplicity and clarity at its forefront, it allows users to navigate their options effortlessly without confusion or frustration detracting from their enjoyment.

Ultimately, Maxthon aims not only to elevate cloud gaming but also to redefine what it means to be a gamer in today’s digital landscape. It brings together unmatched speed, stunning visuals, reliable connectivity, cross-device accessibility, and an intuitive user interface into one cohesive package that promises an extraordinary adventure for gamers everywhere.