Scams can manifest in a myriad of ways, targeting everyone from seasoned investors to everyday retail customers. The adage rings true: if it sounds too good to be true, it likely is. This wisdom serves as a crucial reminder in a world where financial deception is rampant.

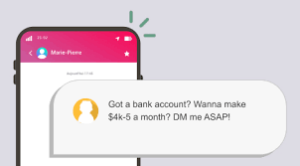

With the rise of technology, scammers have found innovative methods to exploit unsuspecting victims. However, it’s important to note that traditional phone scams are also experiencing a resurgence, with perpetrators employing increasingly sophisticated tactics. They may pose as reputable institutions or even trusted acquaintances, making their schemes harder to detect.

Among the various types of scams, money transfer scams are particularly prevalent. In these schemes, victims are often lured into sending money under pretences, believing they are making a wise investment or helping someone in need.

This overview only scratches the surface of the many scams out there. Scammers are relentless in their pursuit of new techniques and approaches. If you encounter a different type of banking scam, we urge you to share your experience with us. For ongoing updates and detailed information about emerging scams, consider visiting the Financial Investigation Unit’s website, a valuable resource for staying informed and protected against these deceitful practices.

Money transfer scams

Money transfer scams have become an increasingly prevalent issue in our digitally connected world. While money transfers offer a convenient method for sending funds electronically, they can also be fraught with risks, especially when dealing with individuals you do not know personally. Unlike traditional payments, transferring or “wiring” money resembles sending cash—once it’s gone, it’s nearly impossible to retrieve.

Scammers exploit this irreversible nature of transactions to their advantage. They often pose as trustworthy figures, such as foreign government officials or potential business partners, luring victims with promises of large rewards or quick financial returns. The urgency and ease of wiring money can cloud judgment, leading many to act hastily.

It’s vital to remain vigilant. If someone you haven’t met in person requests a wire transfer, consider it a red flag. This could include online acquaintances seeking financial help or sellers insisting on immediate payment for goods that seem too good to be true. Even seemingly innocuous situations, like renting a vacation property, can mask fraudulent intentions.

Ultimately, the best defence against these scams is scepticism. Always verify the identity of anyone requesting funds, and remember that legitimate transactions rarely require wiring money to strangers. Protecting your finances means staying informed and cautious in your dealings.

Fraudulent Activities Involving Contactless Card Payments

The convenience of contactless payment technology allows individuals to complete transactions of up to £100 without the need to enter a PIN. By simply tapping or waving your debit or credit card over a designated card reader, you can swiftly finalise your purchases. While this method undoubtedly accelerates the payment process, it is imperative to remain vigilant about the potential threats associated with contactless card payment fraud.

To help safeguard yourself from becoming a victim of such fraudulent activities, consider these five essential tips:

First and foremost, always keep your card in your possession when making a payment. Handing your card to another person, whether before or during the transaction, increases the risk of skimming—an illicit practice where thieves capture data from your card’s magnetic strip.

Moreover, it is crucial to verify that the amount displayed on the card machine aligns with the price of the items or services you intend to purchase. Before you tap or wave your card near the reader, take a moment to double-check this figure to ensure accuracy.

In addition, don’t hesitate to request a receipt after completing your transaction. This simple step allows you to confirm that you have been charged correctly and can help you track your spending more effectively.

Another essential precaution is to scrutinise your bank statements regularly for unfamiliar transactions. Keeping an eye on your financial records can alert you to any unauthorised activity that may occur.

If at any point your card is lost or stolen, you face a heightened risk of someone using it to make contactless payments. It is vital to report the loss or theft to your card provider immediately upon discovering that your card is missing. By doing so, you can ensure that it is temporarily blocked, thereby preventing further unauthorised use. You can easily find your card provider’s contact information online. Alternatively, if you have access to online banking through a mobile app, you may also be able to block the card directly from there.

Lastly, even for transactions that fall below the £100 limit, remember that you still have the option to insert your card into the reader and enter your PIN as an added layer of security.

While most debit and credit cards come equipped with contactless payment capabilities, it’s worth noting that some card providers allow customers to opt in or out of this feature. If you wish to make changes regarding contactless payments on your card, don’t hesitate to reach out to your bank or card issuer for assistance.

By following these guidelines, you can enjoy the benefits of contactless payments while significantly reducing the risk of fraud.

Fraud Related to Contactless Card Payments

The advent of contactless payment technology has revolutionised the way we conduct transactions. Consumers can effortlessly pay for items worth up to £100 simply by tapping or waving their debit or credit card near a card reader. This convenience certainly speeds up the payment process, yet it is essential to remain vigilant about the potential risks associated with contactless card payment fraud.

To help you safeguard yourself against becoming a victim of such fraud, here are five valuable suggestions:

First and foremost, always retain possession of your card during the payment process. Handing your card over to another person, whether before or during the transaction, can expose you to the threat of skimming—a technique where an unauthorised individual captures the information stored on your card’s magnetic strip without your knowledge.

Before you proceed with tapping or waving your card at the reader, take a moment to verify that the amount displayed on the card machine corresponds accurately with the price of the items or services you are purchasing. This simple step can prevent erroneous charges.

Additionally, it is wise to request a receipt after making your payment. This receipt serves as a tangible record that helps ensure you have been charged correctly and can be referred back to if any discrepancies arise.

Another crucial practice is to examine your card statements regularly for unfamiliar transactions. Keeping a close eye on your financial activity can help you detect suspicious behaviour early on.

In the unfortunate event that your card is lost or stolen, there is a risk that someone could use it to make contactless payments. Thus, you must report your missing card to your card provider immediately upon discovering its absence. Prompt reporting allows your card to be temporarily blocked, mitigating further risk. You can easily find the contact information for your card issuer online. Alternatively, if you have access to online banking—perhaps through a mobile banking app—you may have the ability to block your card directly through that platform.

Lastly, it’s worth noting that even if your purchase totals less than £100, you can insert your card into the reader and enter your PIN to complete the transaction securely.

While most debit and credit cards come equipped with contactless payment capabilities, you may have the choice to turn this feature on or off based on your preferences. If you wish to make changes regarding this functionality, do not hesitate to contact your bank or card issuer for assistance.

In conclusion, while contactless payments offer undeniable convenience, it is crucial to stay informed and proactive in order to protect yourself from potential fraud. By implementing these practical tips, you can enjoy the benefits of modern payment technology while minimising your risk of becoming a victim of contactless card payment fraud.

Ensuring Security in Mobile Payments

In today’s fast-paced world, the convenience of making contactless payments using smartphones, tablets, or smartwatches has transformed the way we handle transactions. Unlike traditional debit or credit cards, these smart devices enable users to conduct payments exceeding £100. However, it’s important to note that for transactions above this threshold, you must enter your PIN on your device. While utilising a smart gadget for payments can offer greater ease, it also introduces specific vulnerabilities that users should be cognizant of.

To navigate the potential risks associated with mobile payments effectively, consider these five essential strategies designed to bolster your security:

1. Implement Two-Factor Authentication: One of the most effective ways to safeguard your smart device is by enabling two-factor authentication. This typically involves pairing a PIN with a biometric identification method such as a fingerprint, facial recognition, or even an iris scan. By adopting this layered security approach, you significantly reduce the likelihood of unauthorised transactions, mainly if your device happens to be lost or stolen.

2. Exercise Caution with Links: It’s crucial to remain vigilant when interacting with links on your smart device, especially those originating from unfamiliar sources. By refraining from clicking on dubious links, you mitigate the risk of exposing your device to malware, which could compromise your passwords and sensitive information.

3. Use Secure Networks: When adding new payment cards to your smart device, always ensure that you are connected to a secure network. Opting for a VPN or utilising your mobile data (3G or 4G) instead of public Wi-Fi can significantly decrease the chances of someone intercepting your details during the process.

4. Disable Payment Features When Necessary: If you suspect that your personal information may have been compromised, it is wise to turn off payment functionalities on your device immediately. This precautionary measure helps prevent any unauthorised transactions while you investigate and rectify the situation.

5. Stay Informed About Contactless Card Security: Lastly, the guidance provided for ensuring safety with contactless card payments is equally applicable to smart devices. Familiarising yourself with these tips can further enhance your overall security when making transactions through mobile technology.

By integrating these practices into your routine, you can enjoy the convenience of mobile payments while minimising the inherent risks that accompany them. Being proactive about your security is essential in today’s digital landscape, allowing you to transact with confidence and peace of mind.

In the realm of online security, one must remain vigilant against the insidious threat known as ‘phishing’ scams. These deceptive schemes are orchestrated by fraudsters who cunningly seek to extract your most confidential and sensitive information—things like your usernames, passwords, personal identification numbers (PINs), credit card details, and occasionally even your hard-earned money. They employ a range of tactics to disguise themselves, masquerading as representatives from your bank, a trusted financial institution, or even a company with which you regularly engage in business. The mediums they utilise are varied; they might reach out via email, create convincing web pages, send text messages, or even make phone calls.

Often, these scammers craft elaborate narratives to justify their request for your information. A prevalent tactic is to claim that there is an urgent issue with your account that necessitates immediate action on your part. By instilling a sense of urgency or impending risk—perhaps suggesting that your bank account or credit card is under threat—they aim to provoke a hasty response from you.

Phishing emails frequently appear deceptively authentic, featuring logos that look official and containing personal details that the scammers have likely gleaned from your social media profiles. This knowledge allows them to construct messages that feel familiar and trustworthy. Moreover, these fraudulent communications often contain links to ‘spoofed’ or ‘cloned’ websites—sites designed to mimic the genuine webpage of your financial institution. If you were to click on such links, you would be led to a page that requests you to input sensitive personal information, unwittingly handing it over to the scammers.

It’s crucial to remember that if you ever encounter emails or text messages that raise suspicions, the wisest course of action is to delete them immediately without engaging further.

Furthermore, the Commission frequently learns about scams that are targeting residents within the community, one particularly alarming type being ‘voice phishing’, commonly referred to as ‘vishing’. In this scenario, a scammer places a phone call to an unsuspecting individual, alleging that there has been a fraudulent transaction linked to their account. They advise the victim to call their bank for verification and security purposes. However, what happens next is genuinely alarming: as the victim hangs up the phone and dials their bank’s number, the fraudster remains on the line, silently intercepting the outgoing call. An accomplice then pretends to be a representative of the bank, leading the victim to believe they are speaking with someone trustworthy. In this unfortunate exchange, victims often divulge critical information—such as account numbers and passwords—directly to the fraudster. This information is then exploited to siphon money from their accounts, leaving the victims feeling violated and bewildered.

In light of these dangers, everyone must stay informed and cautious about the potential threats lurking in the digital landscape.

Fraudulent Authorized Push Payments: A Cautionary Tale

In the realm of financial transactions, a particularly insidious form of deception known as Authorized Push Payment (APP) fraud has emerged. This fraudulent scheme is characterised by the manipulation of unsuspecting consumers or business personnel into willingly transferring funds to a bank account that is, unbeknownst to them, under the control of a scam artist.

The tactics employed by these fraudsters can vary in sophistication, yet they are often alarmingly straightforward. For instance, an individual may be lured into sending money for nonexistent goods, or they might receive an invoice for services that were never rendered. Moreover, scenarios arise where a person’s online banking credentials have been compromised, leading to further breaches of trust.

One of the most troubling aspects of APP fraud is the challenge victims face in recovering their lost funds. The nature of these transactions is such that they are executed almost instantaneously, leaving little to no opportunity for cancellation. This swiftness allows the perpetrator to swiftly relocate the stolen money, making it exceedingly difficult for authorities to trace and reclaim it.

In light of this growing concern, regulatory bodies have sought to enhance protections for victims. As of January 31, 2019, the UK Financial Conduct Authority introduced a set of new guidelines aimed at providing recourse for those affected by APP fraud. Under these revised regulations, victims now possess the ability to file complaints not only with their own bank or payment service provider (PSP) but also with the institution that ultimately received their payment.

This policy shift represents a significant development in consumer protection. Previously, individuals were limited to addressing their grievances solely with their banking institutions. Now, however, they can escalate their concerns to the receiving PSP, thereby broadening their avenues for redress.

For anyone caught in the web of APP fraud, understanding these new protections is crucial. The path to recovery may still be fraught with challenges, but with these updated regulations in place, there exists a glimmer of hope for those who have fallen prey to such deceitful practices. More information about these resources can be found through the relevant links provided by both the UK Financial Ombudsman Service and its Channel Islands counterpart.

Maxthon

In the rapidly changing landscape of the digital world, where the only certainty is change itself, the importance of safeguarding oneself while navigating the vast expanse of the internet has never been more pronounced. As individuals encounter an overwhelming array of options, the choice of a web browser that prioritises security and privacy becomes a crucial factor in their online experience. Among the many contenders in this space, one browser distinctly emerges as a beacon of commitment to these essential principles: Maxthon Browser, which users can download and use without charge.

This remarkable browser is laden with a plethora of built-in features tailored to enhance your online adventures. Notably, it includes an Adblocker and various mechanisms designed to thwart tracking—both fundamental tools for preserving your privacy in the sprawling digital realm. Maxthon embodies a steadfast dedication to creating a browsing environment that not only values user safety but also fiercely upholds personal privacy.

With an unwavering focus on protecting personal information and online behaviours from a multitude of potential threats, Maxthon employs a comprehensive suite of effective strategies to secure user data. By harnessing cutting-edge encryption technologies, it guarantees that your sensitive information remains confidential and well-protected as you navigate the vast web.

For those utilising Windows 11, Maxthon enhances its appeal by offering smooth compatibility, ensuring a seamless browsing experience.

When it comes to advocating for online privacy, Maxthon truly excels. This browser has been thoughtfully engineered with a collection of features aimed explicitly at safeguarding user anonymity. These include tools that block unwanted advertisements, functionalities that prevent tracking attempts, and an incognito mode designed to enhance user privacy. Together, these integrated features work harmoniously to eliminate intrusive ads and counteract tracking scripts that seek to monitor your online presence. Consequently, users can enjoy a more secure and uninterrupted browsing experience, free from the prying eyes that often inhabit the digital landscape.