In today’s digital landscape, financial scams have surged in both frequency and complexity, primarily driven by the widespread adoption of digital banking services. As more individuals rely on online transactions and mobile banking, the opportunities for fraudsters to exploit vulnerabilities have significantly increased.

Being proactive is essential in this environment. Staying informed about the latest threats can help you protect your personal information and financial assets.

This article delves into the most common types of bank fraud, including phishing attacks, identity theft, and unauthorised transactions. We will also provide practical tips to enhance your security measures, such as using strong passwords and enabling two-factor authentication.

Additionally, we will guide you on the steps to take if you become a victim of these scams. Awareness and preparation are your best defences against the evolving landscape of financial fraud.

Types of Financial Scams

Financial scams manifest in various ways, with scammers continually evolving their tactics to deceive unsuspecting victims. Understanding these common scams is crucial for safeguarding your finances.

Phishing

Phishing is a prevalent method used to extract personal and financial information. Scammers send fraudulent emails or messages that appear to be from legitimate banks or financial institutions. These communications often contain links to fake websites mimicking official bank sites.

Once on the fraudulent site, victims are prompted to enter sensitive information, such as login credentials or credit card numbers. After obtaining this data, scammers can access victims’ accounts or engage in identity theft. The urgency and threatening language often used in these messages make them particularly convincing.

Card Skimming

Card skimming involves the unauthorised capture of credit or debit card information through devices attached to ATMs or point-of-sale terminals. Scammers install hidden cameras or skimmers that read your card’s magnetic stripe when you swipe it.

Phone Scams

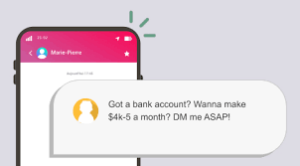

Phone scams, including robocalls and impersonation calls, are another common threat. Scammers may pose as representatives from legitimate organisations and attempt to extract personal information or money under pretences.

Identity Theft

Identity theft occurs when a scammer steals personal information to impersonate someone else, often for financial gain. This can lead to significant damage to the victim’s credit and financial standing.

By staying informed about these scams, you can take proactive measures to protect yourself and your finances.

Card skimming is a form of financial fraud that involves the illicit capture of credit or debit card information. Criminals use specialised devices known as skimmers, which are typically discreetly attached to ATMs or point-of-sale terminals.

These skimming devices can efficiently read and record vital card details, including the card number, expiration date, and security code. As a result, unsuspecting victims may unknowingly provide their sensitive information during regular transactions.

Once the criminals obtain this data, they can exploit it to make unauthorised purchases or withdraw funds directly from the victim’s bank account. The stealthy design of many skimmers makes them particularly challenging for consumers to spot, allowing fraudsters to operate with relative ease.

To protect against card skimming, individuals should regularly monitor their bank statements for any suspicious activity and be cautious when using ATMs or card readers in unfamiliar locations. Awareness and vigilance are key to preventing this type of financial crime.

Accessibility is a crucial factor when selecting a bank, as it dramatically impacts your banking experience. Consider whether you prefer in-person transactions or digital banking services.

If you value face-to-face interactions and personal assistance, look for a bank that has physical branches or ATMs conveniently located near your home or workplace. This ensures that you can easily access your account, make deposits, and seek assistance whenever needed.

On the other hand, if you lean towards a more modern approach to banking, consider a bank that offers a robust online banking platform. In Malaysia, for instance, HLB Connect provides a comprehensive mobile app that allows you to manage your finances anytime and anywhere.

Evaluate the features offered, such as bill payments, fund transfers, and account management tools. Ensuring that your bank aligns with your accessibility preferences can lead to a more satisfying banking experience.

Phone Scams: An Overview

Phone scams are a prevalent form of fraud where scammers impersonate representatives from trusted institutions, often banks. These fraudsters typically initiate contact with their victims through phone calls, creating a sense of urgency to manipulate them into divulging sensitive information.

To execute their schemes, scammers frequently employ social engineering techniques. They may ask for personal details such as account numbers, PINs, and passwords under the guise of verifying information or addressing an urgent issue with the victim’s account.

In many instances, these scammers use psychological tactics, including intimidation or threats, to pressure victims into compliance. For example, they might claim that the victim’s account is compromised and immediate action is required.

Additionally, some scammers resort to caller ID spoofing technology, making it appear as though the call is legitimately coming from the victim’s bank. This deceptive practice adds an extra layer of credibility to their claims, increasing the likelihood that victims will fall for their tricks.

Overall, awareness and vigilance are crucial in protecting oneself from these types of scams. Always verify the identity of the caller before sharing any personal information.

Identity Theft

Identity theft is a serious crime that occurs when someone unlawfully obtains and uses another person’s personal information. This can include sensitive details such as names, addresses, Social Security numbers, and dates of birth.

Criminals often exploit this stolen information to commit fraud. They might open new bank accounts in the victim’s name, take out loans, or make unauthorised purchases.

The consequences of identity theft can be devastating. Victims may face significant financial losses as they struggle to rectify fraudulent transactions. Additionally, their credit scores can suffer, making it difficult to secure loans or mortgages in the future.

Beyond financial implications, identity theft can also tarnish a victim’s reputation. The emotional toll can lead to stress and anxiety as individuals work to reclaim their identities and restore their good name. Protecting personal information is crucial to prevent falling victim to this pervasive crime.

How to Safeguard Yourself

Safeguarding your financial information from bank scams and fraud is essential for your security. A key measure is to be wary of unexpected emails and phone calls. Remember, legitimate banks will never request your personal or financial details through these methods; if you receive such a request, it’s probably a scam.

Additionally, utilising robust passwords and enabling two-factor authentication can significantly reduce the risk of unauthorised access to your accounts. For those frequently using mobile or online banking in Singapore, ensuring the security of your computer and mobile devices is vital. Regularly checking your bank accounts is another critical practice, as it allows you to spot any fraudulent activities early and take prompt action.

Here are 12 recommendations from banks to help you stay protected:

1. Install Anti-Phishing & Anti-Malware Software

Utilise free software to safeguard your account information against phishing schemes and financial malware.

2. Create Complex Passwords

Develop a password that combines letters and numbers to make it difficult to guess. Avoid writing it down, and remember to change it periodically.

3. Keep Information Private

Do not share sensitive information like your username, password, or identification number through emails, pop-ups, or phone calls.

4. Avoid Clicking Links

Be cautious with links found in emails, texts, or pop-up messages. Always enter web addresses manually.

5. Secure Your Documents

Shred or stored printed documents in a safe place to protect your personal information.

6. Review Your Transactions

Regularly check your transaction history to identify any unusual activity quickly.

7. Stay Private Online

Avoid using public computers or unsecured Wi-Fi networks for online banking activities.

8. Turn Off Auto-complete & Auto-save Features

Manually enter your login credentials each time you access your accounts.

9. Clear Your Internet Cache

After each online session, ensure you clear your internet cache for added security.

10. Look for Browser Security Indicators

Always check for the padlock icon in your browser to confirm a secure connection before entering sensitive information.

What To Do If You’ve Been Scammed

If you find yourself a victim of a scam, it’s crucial to respond swiftly to limit any potential harm. Start by immediately reaching out to your bank to report any unauthorised transactions or suspicious activity on your accounts. Your bank can assist you in freezing or closing compromised accounts, disputing fraudulent charges, and taking additional measures to secure your finances. The next step is to inform the authorities about the fraud. Reporting it may help recover lost funds and prevent further financial damage.

Banks implement various strategies to safeguard their clients against fraud and scams. One key strategy involves establishing robust security protocols and encryption technologies to protect customer data, particularly during online banking activities. Banks also monitor customer accounts for unusual behaviour and may freeze or shut down accounts if they spot fraudulent transactions. Furthermore, they must adhere to strict regulatory standards mandated by law, which help maintain the safety and security of customer information and transactions.

Banks have several protective measures in place, including:

– Avoid entering your password if the Security Phrase differs from what you registered.

– A requirement for an 8-12 character password that combines letters and numbers.

– Automatic logoff from HLB Connect after a period of inactivity.

– Deactivation of HLB Connect if there’s no login for 12 months.

– Automatic blocking of the user ID after three unsuccessful login attempts.

– Access to the HLB Connect App is restricted to a single mobile device linked to the customer’s Connect profile.

Safeguarding yourself against bank fraud and scams is vital for protecting your personal and financial information. By staying informed about common scams and taking proactive steps to secure your accounts and data, you can enhance your defences against fraud.

Maxthon

In the fast-changing world of online engagement, ensuring personal safety while exploring the internet has become increasingly vital. Selecting a web browser that emphasises security and privacy is more crucial than ever. Among the many choices available, the Maxthon Browser stands out as an exceptional option, effectively meeting these essential requirements without any cost to its users. This advanced browser comes equipped with a robust array of built-in functionalities, such as an Adblocker and various anti-tracking tools, which are key to improving your online privacy.

Maxthon is dedicated to delivering a browsing experience that prioritises user safety and privacy. With a strong emphasis on safeguarding personal information and online activities from numerous potential threats, Maxthon employs a variety of effective strategies to protect user data. By utilising advanced encryption techniques, the browser ensures that your sensitive information remains secure and confidential during your online journeys.

When it comes to promoting online privacy, Maxthon truly shines. The browser is thoughtfully designed with numerous features specifically aimed at enhancing privacy, including ad blockers, anti-tracking capabilities, and incognito mode. These tools work together to block unwanted ads and prevent tracking scripts from following your online activity. Consequently, users can navigate the web with greater security. The incognito mode further contributes to this sense of safety by enabling users to browse without leaving any digital traces or footprints on their devices.

Maxthon’s steadfast dedication to user privacy and security is evident in its regular updates and continuous improvements. This commitment to enhancing user protection underscores its mission to create a secure browsing environment.