Understanding Loan Scams in Singapore

Have you ever received a text message that raised your suspicions? If so, you’re not alone. In a troubling trend, between January and March 2020, individuals in Singapore lost an alarming total of $1.6 million due to loan scams. These scams ranked among the top three frauds reported that year, trailing only behind e-commerce and social media impersonation scams.

Key Insights

The Ministry of Law has issued severe warnings regarding the rise of sophisticated loan scams where unlicensed lenders masquerade as reputable services, including Lending Bee. These deceitful practices often unfold across various digital platforms, making it increasingly difficult for the average person to differentiate between legitimate and fraudulent lenders. To protect yourself, it’s crucial to take proactive steps: always verify the credentials of any lender against official lists, avoid disclosing personal information too early in the process, and report any suspicious behaviour to the relevant authorities.

A Word of Caution

It’s essential to be aware that numerous unlicensed moneylenders and scam organisations have been impersonating Lending Bee, targeting unsuspecting victims with deceptive tactics. Their methods include:

– Creating fake Facebook advertisements or pages that appear to be affiliated with Lending Bee.

– Sending SMS messages that falsely claim to be from Lending Bee.

– Paying for Google advertisements that mislead users into thinking they are applying for legitimate DBS loans.

– Copying and repurposing content from Lending Bee’s official website onto their fraudulent sites.

These scam syndicates have become increasingly adept at fooling people, leveraging advanced technology and refined skills to mimic legitimate operations convincingly. It’s not uncommon for them to replicate our website’s appearance and content almost flawlessly. As a result, distinguishing between licensed and unlicensed moneylenders can be a daunting task.

To arm yourself against these unscrupulous practices and ensure you don’t fall prey to their manipulative tactics, here are some essential steps you should follow:

1. Research Thoroughly: Always check the lender’s credentials through official channels.

2. Be Cautious with Personal Information: Never divulge sensitive details too soon; legitimate lenders will understand your need for caution.

3. Report Suspicious Activity: If something seems off, don’t hesitate to inform the authorities.

By staying informed and vigilant, you can help protect yourself from the rising tide of loan scams in Singapore.

Navigating the world of money lending can be challenging, especially when it comes to distinguishing between legitimately licensed lenders and their unlicensed counterparts. The landscape is fraught with pitfalls, and one must tread carefully to avoid falling prey to unscrupulous tactics. To safeguard yourself from potential exploitation, consider following these essential steps:

First and foremost, if you suspect that you may have been approached by someone claiming to represent Lending Bee, don’t hesitate to call us at 6219-1611. It’s crucial to confirm whether the person you’re dealing with is genuinely affiliated with our organisation.

Moreover, exercise caution when sharing your personal information. Resist the urge to divulge sensitive details such as your NRIC number, SingPass credentials, or bank account information without thoroughly verifying the legitimacy of the request.

In a recent article by Ashley Sim, published on May 2nd, 2024, it was reported that loan scams in Singapore have reached alarming levels. Between January and March 2020 alone, victims lost a staggering $1.6 million to such fraudulent schemes. This statistic places loan scams among the top three types of fraud for that year, trailing only behind e-commerce scams and social media impersonation.

Key insights reveal that the Ministry of Law has issued warnings about increasingly sophisticated scams in which unlicensed lenders mimic reputable services like DBS across various digital platforms. To protect yourself from becoming a victim, always verify the credentials of any lender against official lists, refrain from sharing personal information too readily, and report any suspicious activities to the appropriate authorities.

It’s vital to be aware that numerous unlicensed lenders and scam syndicates are actively posing as DBS in order to deceive unsuspecting individuals. These impersonators may utilise various tactics, including:

– Facebook ads or pages that falsely represent Lending Bee

– Text messages claiming to originate from our company

– Paid advertisements on Google promoting fake DBS loans

– Duplication of our website content on fraudulent sites

These unlicensed moneylenders are becoming increasingly adept at their craft, employing advanced technology and refined techniques to mislead potential victims. It’s not uncommon for them to replicate our website and content closely, making it all the more difficult for individuals to differentiate between genuine and fraudulent lenders.

In this precarious environment, it is essential to remain vigilant and informed. By taking proactive measures, you can better protect yourself from falling into the traps set by these deceitful entities. Remember, knowledge is your best defence against the underhanded tactics of unlicensed moneylenders.

Safeguarding Yourself Against Loan Scams: A Cautionary Tale

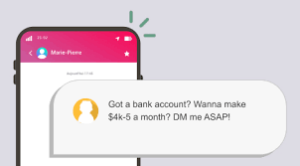

In today’s digital landscape, the threat of loan scams lurks around every corner. Picture this: you receive an unexpected message on your phone, or an enticing ad pops up on your social media feed, promising immediate loans with minimal hassle. It’s tempting, isn’t it? But here’s the hard truth—if a loan is being marketed to you via SMS or on platforms like Facebook, it’s likely a scam.

So, what should you do if you encounter such dubious messages or advertisements? The answer lies in a straightforward yet vital set of actions:

First and foremost, don’t engage. If a message or advertisement about loan services crosses your path—be it through SMS, WhatsApp, or any other messaging app—your best course of action is to ignore it completely. Resist the urge to reply or interact in any way. Engaging with these scammers can lead to further complications.

Next, take proactive steps to protect yourself. Block the number that sent you the unsolicited message and report it through the platform you received it on. This small action can help safeguard not just your interests but also those of others who may fall victim to similar schemes.

If you feel compelled to take it a step further and help prevent others from experiencing the same fate, you can report the offending number to the authorities. Simply dial ‘999’ for police assistance or contact the X-Ah Long hotline at 1800-924-5664.

Now, if you find yourself genuinely in need of financial assistance and are considering approaching a licensed moneylender, be sure to refer to the Ministry of Law’s official list of authorised lenders. Alternatively, you can explore options like Lending Bee, which operates within legal parameters.

Understanding Loan Scams: The Deceptive Art

Let’s delve deeper into the murky world of loan scams. These con artists often masquerade as legitimate moneylenders, preying on unsuspecting individuals who are desperate for financial aid. They initiate contact through SMS or WhatsApp, presenting themselves as reputable lenders ready to offer loans under the guise of legitimacy.

However, their sinister strategy quickly unfolds as they request an upfront payment—a deposit—before any loan can be approved. This is where the trap is set. Victims, eager for financial relief, comply with these demands, only to discover that they will never receive the promised loan. Instead, they find themselves out of pocket, losing their hard-earned money to these fraudsters.

As if this weren’t enough, scammers often solicit sensitive personal information from their victims throughout this deceitful process. They might ask for details such as your NRIC number, home address, SingPass credentials, or even your bank account information. Once they obtain this data, they may use it to intimidate or harass you further for additional funds.

Recognising the Red Flags: Spotting a Loan Scam

Identifying a loan scam doesn’t have to be complicated; there are clear warning signs that can help you stay vigilant. Here are some red flags to watch out for:

– Promises of instant loan approvals that seem too good to be true.

– Advertisements reaching you through SMS messages, social media channels, or messaging platforms.

– Unsolicited cold calls offering loans.

– Requests for fees prior to approval. Remember, a legitimate licensed moneylender will never ask for any payment before approving a loan or disbursing funds.

By staying informed and aware of these tactics, you can better protect yourself from falling prey to these unscrupulous schemes. Always approach lending offers with caution and prioritise your safety above all else.

When it comes to borrowing money, it’s crucial to understand the procedures and the potential pitfalls that can arise, particularly regarding fees. A reputable and licensed moneylender will never request that loan applicants make any payments prior to receiving approval for their loan or before the funds are disbursed. They won’t demand payments for things like “GST,” “administrative fees,” “processing fees,” or any other types of charges. In fact, any legitimate fees are typically deducted from the total amount of the loan once it is approved.

Unfortunately, there are many unscrupulous individuals out there trying to exploit unsuspecting borrowers. One telltale sign of a scammer is their use of personal or mobile phone numbers starting with 8 or 9 (+65 8xxx xxx or +65 9xxx xxxx). In contrast, licensed moneylenders will always reach out using registered landlines that begin with the number 6 (+65 6xxx xxxx).

Loan scams have become increasingly prevalent in Singapore, and the stories of those who have fallen victim serve as cautionary tales for others. For instance, consider the story of an individual who thought they were dealing with a legitimate online moneylender but ultimately lost over $2,500 when it turned out to be a scam.

In another instance, a victim was duped into paying what they were told were collateral fees and GST before their loan could be approved. Similarly, one person fell for a Facebook advertisement from a supposed moneylender and ended up losing a staggering $11,000. There are also accounts of individuals losing upwards of $20,000 to various loan scams and others who responded to SMS solicitations only to find themselves out by $3,000. Each story is a stark reminder of the risks involved in seeking loans.

To protect yourself from becoming another statistic, it’s essential to confirm whether a moneylender is licensed and operating legally. In Singapore, all licensed moneylenders must be approved by the Ministry of Law and possess a valid certificate.

To begin your verification process, first check the moneylender’s name against the official list provided by the Ministry. This list is available in a frequently updated PDF format.

Next, call the moneylender’s registered landline number to ascertain their legitimacy. You can find a list of valid contact numbers to ensure you’re reaching out to the right people.

A crucial point to remember is to safeguard your personal information. Scammers often seek this information to intimidate their victims later. Genuine licensed moneylenders will never contact borrowers from personal mobile numbers (e.g., +65 9XXX XXXX or +65 8XXX XXXX).

Finally, visit the moneylender’s physical location to verify their authenticity further. These steps can help you avoid falling prey to scams and ensure that your borrowing experience is safe and secure.

In the realm of financial borrowing, navigating the landscape can often feel like traversing a maze filled with unseen dangers. It’s vital for anyone considering taking out a loan to familiarise themselves with the processes involved and to be wary of the potential traps that could ensnare them—especially when it comes to unexpected fees. A trustworthy and licensed moneylender operates under strict regulations; they would never ask loan seekers to remit any payments before their loan application is approved or before the funds are actually released. This means you won’t find them demanding payments for elusive charges such as “GST,” “administrative fees,” or “processing fees.” In reality, any legitimate fees are usually subtracted from the loan amount once it’s been greenlit.

Regrettably, the lending world is not without its share of fraudsters, eager to take advantage of those who are unaware. One clear indicator that you’re dealing with a scammer is their use of personal or mobile phone numbers that start with 8 or 9, such as (+65 8xxx xxx or +65 9xxx xxxx). On the other hand, licensed moneylenders will always reach out using official landlines that begin with the number 6 (+65 6xxx xxxx).

The prevalence of loan scams in Singapore has surged in recent years, leading to many harrowing accounts from individuals who have suffered significant losses. Take, for instance, a person who believed they had found a legitimate online lender only to discover too late that they were duped—losing over $2,500 in the process. Another unfortunate soul was tricked into paying what was falsely labelled as collateral fees and GST prior to the approval of their loan. There’s also the tale of someone who clicked on a Facebook ad for a supposed moneylender, only to be swindled out of an astonishing $11,000. These stories are just a few examples among many, where victims have lost sums exceeding $20,000 due to various loan scams or others who responded to SMS advertisements only to find themselves out by $3,000. Each narrative serves as a sobering reminder of the inherent risks tied to securing loans.

To shield yourself from becoming yet another victim, it’s imperative to verify whether a moneylender is appropriately licensed and operating within legal bounds. In Singapore, all licensed moneylenders must receive approval from the Ministry of Law and possess a valid certificate.

As you embark on this verification journey, begin by cross-referencing the moneylender’s name against the official list published by the Ministry. This resource is conveniently available in a regularly updated PDF format.

Next, take the initiative to call the moneylender’s registered landline number—this simple step can help confirm their legitimacy. Ensure you consult a list of valid contact numbers so that you can reach out with confidence.

A critical point to keep in mind is the protection of your personal information. Scammers are adept at exploiting this data to manipulate and intimidate their victims later on. Authentic licensed moneylenders will refrain from contacting borrowers through personal mobile numbers (such as +65 9XXX XXXX or +65 8XXX XXXX).

If circumstances permit, visiting the moneylender’s physical location can serve as an additional layer of verification for their authenticity. By following these precautionary measures, you can significantly reduce your risk of falling victim to scams and ensure that your borrowing experience remains safe and secure.

In this intricate dance of finance, knowledge is your best ally; understanding the environment in which you’re operating can lead you away from danger and toward a more secure financial future.

Have You Fallen Victim to a Scam? Here’s What You Should Do

Imagine this: you’ve just discovered that a loan scam might have duped you. The sinking feeling in your stomach is unmistakable, and the question arises—what steps should you take next? First and foremost, it’s crucial to document the incident by filing a report with the police. This action not only helps you but can also protect others from falling prey to the same scam.

If you find yourself in this distressing situation, there are several avenues you can explore for assistance:

Reach Out by Phone:

– Emergency Services: Dial 999 or call 1800-255-0000 for immediate police support.

– X-Ah Long Hotline: Contact them at 1800-924-5664 for additional guidance.

Submit Your Report Online:

– Utilize the I-Witness platform.

– Access Police e-Services for electronic submissions.

Additionally, if you’re weary of the constant barrage of scam calls and texts, consider downloading the innovative ScamShield App. This tool is designed to automatically filter out unwanted communications, ensuring that your phone remains a safe space.

The ScamShield App, developed by the National Crime Prevention Council in Singapore, acts as a barrier against scammers seeking to disrupt your life. Here’s how you can set it up:

1. Download the ScamShield App from the App Store.

2. After installation, navigate to Settings > Phone > Call Blocking & Identification, and enable ScamShield.

3. For text messages, go to Messages > Unknown & Spam and activate the ScamShield SMS Spam Filter.

Once you complete these steps, you’re well on your way to a more secure communication experience. The app also allows you to report scams directly, giving you a proactive role in combating these malicious attempts.

Curious about how ScamShield functions? You can find a tutorial video that walks you through its features and capabilities—just click here.

So, what exactly does ScamShield do?

When it comes to SMS messages, the app intelligently compares incoming texts from unknown numbers against a database of known scams. If it detects a fraudulent message, it seamlessly diverts it into your junk folder, keeping your inbox clutter-free.

The technology is just as effective for phone calls. If ScamShield recognises an incoming call as originating from a scammer, it will automatically terminate the connection, so you won’t have to deal with their nuisance.

With these tools, you can regain control over your communication and reduce your chances of falling victim to future scams. Remember, staying informed and proactive is your best defence!

Maxthon

In a rapidly transforming digital landscape, one constant remains: the inevitability of change. As we traverse the expansive ocean of information that the internet offers, it becomes increasingly vital to protect ourselves from the tumultuous waves of uncertainty. With a multitude of web browsers competing for our attention, choosing one that emphasises security and privacy is essential for ensuring a safe online experience. Among the myriad options available, one browser stands out as a steadfast protector of these crucial values: Maxthon Browser, available for free download.

Maxthon is not just another entry in the crowded field of web browsers; it is an extensive toolkit designed to enrich your online journeys. At its core lies a powerful Adblocker, complemented by an array of tools specifically engineered to thwart tracking attempts—two indispensable allies in the pursuit of privacy within the boundless expanse of the digital realm. What sets Maxthon apart is its unwavering commitment to cultivating a browsing environment that prioritises user safety while diligently safeguarding personal privacy.

With an unrelenting focus on protecting personal data and online behaviour from various threats, Maxthon employs a comprehensive suite of strategies to shield user information. Utilising advanced encryption technologies ensures that your most sensitive data remains secure and confidential as you navigate the vast possibilities the internet has to offer.

For those embracing Windows 11, Maxthon’s allure is further amplified by its seamless compatibility, providing users with a browsing experience that feels effortless and fluid.

When it comes to championing online privacy, Maxthon truly shines. This browser has been thoughtfully crafted with a suite of features aimed at preserving user anonymity. From tools that eliminate distracting advertisements to functionalities designed to block intrusive tracking efforts and even an incognito mode meticulously tailored to enhance user privacy, Maxthon emerges as a formidable guardian in the digital landscape.

In this ever-evolving world of technology, where change is the only constant, having a reliable companion like Maxthon can make all the difference in how we experience the internet. As we continue our journey through this vast digital expanse, let us do so with confidence, knowing that with Maxthon by our side, our safety and privacy are always prioritised.