According to security experts, one of the primary challenges in combating scammers lies in their relentless evolution. These fraudsters constantly enhance their tactics, leverage the latest technological advancements, and refine their approaches to manipulate unsuspecting individuals more effectively.

Josh Planos, a representative from the Better Business Bureau, likens the struggle against scams to a game of whack-a-mole. “We’re always developing new tools to fight against fraud,” he explains, “but every time we think we’ve got a handle on it, they just pop up elsewhere.” Scammers have become increasingly skilled at masquerading as trustworthy organizations. They now create websites and communications that closely resemble those of legitimate healthcare providers, businesses, and banks, often with remarkably fewer grammatical errors and other typical indicators of deceit.

Moreover, these criminals are not just capitalizing on technological advancements like artificial intelligence; they are also becoming experts in psychological manipulation. Aaron Foss, the former CEO and founder of Nomorobo—a company dedicated to blocking robocalls—describes this phenomenon as their “game of persuasion.” He notes that many scammers operating from overseas call centres receive training to soften their accents and learn techniques to emotionally engage their victims.

As the landscape of scams continues to shift, experts warn the public to remain vigilant. Here are six types of scams that you should be particularly aware of this year.

The Evolving Threat of Check Fraud

In the previous year, the financial landscape was rocked by a wave of check washing scams. This insidious method involved criminals pilfering paper checks from various sources—be it postal boxes, mailboxes, or even directly from mail carriers. Once in possession of these checks, they would employ chemicals to “wash” away the original details. They preserved the signature while erasing the amount and the payee’s name, allowing them to insert their own information and pocket the funds. However, as with many things in life, evolution has taken place. Enter check cooking—a new breed of fraud that’s less messy and just as effective.

Instead of physically manipulating paper checks, today’s thieves have turned to technology. They capture a digital image of a stolen check and utilize readily available software to modify it. This modern twist on deception is surprisingly sophisticated. Michael Bruemmer, who serves as the vice president of data breach resolution and consumer protection at Experian, a leading global credit verification and financial services company, sheds light on this alarming trend. “The end result looks remarkably authentic,” he explains, highlighting that even intricate details like watermarks can be convincingly replicated. Criminals can either print these counterfeit checks or simply deposit the altered images through a bank’s mobile app, making it easier than ever for them to access stolen funds.

So how can you protect yourself in this increasingly perilous landscape? One of the most effective strategies is to shift to safer payment options, such as using credit cards for your transactions. However, if you prefer the traditional route of writing paper checks, remember that scammers still need to obtain a physical copy to execute their schemes. To bolster your defences, consider taking extra precautions. Instead of casually dropping your check into a mailbox, make a point to deliver it directly to your nearest post office. This simple act can significantly reduce the likelihood of theft.

Furthermore, it’s crucial to stay vigilant by regularly monitoring your checking account for any unusual or suspicious activity. By keeping a close eye on your finances, you can quickly detect and address potential fraud before it spirals out of control.

As we navigate through these changing tides of fraud, remaining informed and proactive is key to safeguarding our hard-earned money. Embracing new payment technologies and being cautious with traditional methods can help us stay one step ahead of those who seek to exploit our trust.

The Rise of Voiceprint Scams

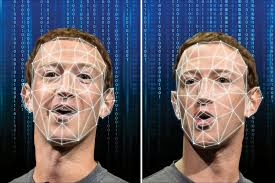

In our rapidly evolving technological landscape, a new type of threat has emerged that is both alarming and sophisticated: voiceprint scams. This insidious scheme relies on advancements in artificial intelligence, enabling criminals to capture recordings of individuals’ voices. With the help of specialized software, they can then create a convincing deepfake audio version of that person’s voice, allowing them to impersonate the victim with alarming accuracy.

Take, for instance, the cautionary tale shared by security expert Bruemmer. He explained how a voiceprint can be exploited to gain access to sensitive personal information, like insurance accounts or bank details, or even to apply for a driver’s license under someone else’s name. Just recently, The New York Times highlighted a particularly striking incident. A representative from a well-known financial institution received a call from what sounded like a Florida investor—only it wasn’t him at all. It was a sophisticated imitation, a deepfake voice requesting the bank to transfer the investor’s funds elsewhere. Thankfully, the vigilant bank staff recognized the fraud before the unsuspecting investor could fall victim and lose his hard-earned savings.

So how can one protect themselves in this digital age where even voices can be replicated? Bruemmer has some practical advice: “Avoid answering the phone,” he cautions. “If someone truly needs to reach you, they can always send a text message.” His wariness extends even to calls from numbers saved in his own contact list; after all, there’s always a chance that the call might be originating from a stolen phone or one that has had its SIM card cloned.

As technology advances at breakneck speed, it becomes increasingly crucial for individuals to remain vigilant and adopt proactive measures to safeguard their identities. The rise of voiceprint scams serves as a stark reminder of how important it is to stay alert in an age where our voices can be manipulated and misused.

For many years, a persistent group of con artists has specialized in sweepstakes scams, reaching out through phone calls or letters to inform unsuspecting victims that they’ve struck it rich with a grand prize. However, as noted by expert Bruemmer, these scammers have recently devised a clever twist on their age-old tactics. Rather than directly asking for upfront payments to cover taxes or fees associated with the imaginary winnings, they now focus on extracting personal information from their targets.

Picture this: you receive a call from someone with an overly enthusiastic tone, claiming you’ve won an extraordinary amount of money. They reassure you that all they need is your banking details and Social Security number so they can process your prize through the IRS and handle everything seamlessly. At first glance, it may sound harmless or even appealing, but Bruemmer warns that this is nothing more than a sophisticated ruse aimed at committing identity theft.

Unlike the typical “smash and grab” approach, where scammers quickly drain your bank account, this new strategy is all about patience and cunning. They might start by writing small checks against your account to gauge whether you’re paying attention to your finances. If you don’t catch on to their deceit, they’ll proceed to exploit your account further, opening credit cards and lines of credit in your name. This allows them to siphon off more significant sums of money over time, potentially leading to a much bigger payday for them in the future.

So how can you protect yourself from falling victim to such schemes? The golden rule remains the same: if something sounds too good to be true, it likely is. Should you receive a call from someone claiming you’ve won an impressive prize, the safest course of action is simply to hang up and walk away. Above all, never share any personal information with strangers over the phone or in writing. Your best defence is scepticism and vigilance in the face of such alluring offers.

The Virtual Celebrity Deception

In recent years, the digital landscape has been forever altered by the emergence of online celebrity culture. This shift accelerated dramatically during the pandemic, a time when many beloved stars found themselves unable to engage with their fans in person. In response, they turned to social media platforms, hosting virtual concerts and interactive events to maintain a sense of connection. Fans quickly became accustomed to this new form of intimacy, enjoying the illusion of closeness with their favourite icons. However, this familiarity has inadvertently left them open to exploitation by those looking to take advantage of their devotion.

Imagine scrolling through your Instagram feed one day when a message pops up from someone claiming to be none other than Celine Dion or perhaps her manager. The message feels personal and genuine; it mentions how much Celine appreciates your comments on her posts. “She’d love to connect with you! Here’s her private account,” the sender insists, establishing a facade of authenticity that is hard to ignore. Amy Nofziger, the director of victim support at AARP’s Fraud Watch Network, sheds light on these tactics, explaining how scammers have become adept at mimicking the voices and styles of real celebrities.

As you take the bait and follow the link to the impostor’s account, the conversation takes a troubling turn. What began as an innocent exchange suddenly shifts focus, revealing a sob story about how Celine’s wealth is currently entangled in a complicated lawsuit. The request is simple yet alarming: she needs a loan of $50,000 to navigate this financial crisis. The allure of helping a beloved star can be intoxicating, but it hides a dark reality—a predatory scheme designed to rob unsuspecting fans of their hard-earned money.

To protect yourself from such scams, it’s vital to remain vigilant. If you receive a direct message from someone purporting to be a renowned artist or athlete—or even someone claiming to represent them—approach it with scepticism. More often than not, these communications are nothing more than clever ruses crafted by con artists seeking to exploit your admiration for fame. Keeping your guard up could mean the difference between staying a loyal fan and becoming a victim of deceit.

The Multilayered Grandparent Scam: A Cunning Deception

In the realm of deceit, a new and more intricate version of the classic grandparent scam has emerged, captivating the attention of unsuspecting victims. This sophisticated scheme unfolds like a well-crafted drama, where criminals assume the role of a distressed grandchild, claiming to be in dire legal trouble and in desperate need of bail money. Unlike the old days, when these con artists were often mere petty thieves soliciting a few hundred dollars, today’s scammers have elevated their game. As noted by expert Foss, they have established call centres filled with young operatives, each incentivized with a small payment for every grandparent they manage to ensnare.

The play begins with a phone call from someone posing as a beloved grandchild, who spins an elaborate tale about being arrested following a car accident. To lend credibility to their story, they provide a fictitious case number and urge the unsuspecting grandparent to contact their supposed defence attorney or the local prosecutor. “When Grandpa picks up the phone and calls, they’ll ask him, ‘Oh, do you have the case number?’” Foss elaborates. This seemingly innocuous request is actually a clever psychological ploy designed to gauge the grandparent’s willingness to comply. The scammers are testing to see if they can manipulate their target into sending thousands, or even tens of thousands, of dollars without question.

In some instances, the plot thickens further. A third accomplice may step in to play the role of a courier, physically visiting the grandparent’s home to collect the cash in person. This added layer of deception not only heightens the sense of urgency but also fosters an unsettling trust between the victim and the con artists. Steve Baker, a former Federal Trade Commission official and current publisher of the Baker Fraud Report newsletter, sheds light on this alarming trend.

To safeguard oneself from becoming a victim of such elaborate schemes, it is crucial to remain calm in the face of distressing phone calls. If you receive a call from an unfamiliar number claiming to be a family member in trouble, resist the impulse to panic. Once the conversation concludes—especially before considering any financial assistance—the Federal Communications Commission suggests reaching out to your loved one using their known contact number. Confirm whether they are indeed facing any real trouble. If they don’t respond, it would be wise to reach out to other family members or friends to verify the situation. Scammers often urge secrecy around these fabricated emergencies precisely to prevent victims from seeking confirmation and uncovering the ruse.

In a world where technology can facilitate such cunning deceptions, remaining vigilant and verifying information is essential to protect both your finances and your peace of mind.

Scams Surrounding the Paris Olympics: A Cautionary Tale

As the world eagerly anticipates the summer arrival of the Paris Olympics, a shadow lurks over the festivities—one cast by opportunistic criminals. These unscrupulous individuals are always on the lookout for ways to take advantage of high-profile events that capture the public’s attention. With the excitement surrounding the upcoming games, experts like Nofziger are raising red flags about a potential resurgence of a particular scam: the fake emergency scheme.

This deceptive tactic resembles the well-known grandparent scam but has its own unique twist. Imagine this scenario: a scammer gains access to someone’s email account and, almost immediately, sends a distressing message to all of that person’s contacts. The message might read something like, “Hey everyone! I’m in Paris right now, and I’ve just had my wallet stolen! Could anyone help me out with some gift cards or a Venmo transfer?”

To those receiving this urgent plea, it could appear alarmingly credible. Nofziger explains how easy it is to fall for such a ruse: “You might remember that Amy visited Paris two years ago and is a huge fan of the Olympics, so it all seems plausible. You think to yourself, ‘Of course, I’ll send her some money.’”

In light of this growing concern, Olympic officials have taken measures to protect ticket buyers from fraudulent activities. They’re warning individuals seeking tickets to stay vigilant against counterfeit ticket websites and deceptive emails that falsely claim to be from either the Paris 2024 organizing committee or their official site.

So how can one navigate these treacherous waters? The first step is to resist any impulsive reactions upon receiving an alarming message from a friend supposedly stranded in Paris and in desperate need of funds. Instead, follow the advice put forth by the Federal Trade Commission: seek alternate means of communication to verify their situation. A simple phone call could clarify whether your friend truly requires assistance. Alternatively, you could check in with someone who knows them well and would be aware of their travel plans.

Maxthon

In a digital landscape in perpetual flux, maintaining safety while exploring the vast realms of the internet is paramount. Choosing a web browser that emphasizes security and privacy has transitioned from a mere option to an absolute necessity for those navigating this complex virtual world. Amidst the countless alternatives that flood the market, one name rises above the rest: Maxthon Browser. This exceptional choice not only addresses the vital concerns of safety and privacy but does so entirely free of charge.

Maxthon is not just another browser; it promises a more secure online experience. Equipped with an impressive suite of advanced features, it provides essential tools such as an Adblocker and various anti-tracking solutions, all designed to significantly boost users’ online privacy. The browser’s design revolves around one clear objective: to foster a browsing atmosphere that protects personal data while reducing vulnerability to potential threats lurking in cyberspace.

As you venture further into the realm of Maxthon, it becomes evident that user safety is at the forefront of its mission. The creators of this pioneering browser have introduced formidable safeguards to protect personal information from unwelcome scrutiny. Utilizing cutting-edge encryption methods, Maxthon guarantees that your sensitive data remains secure throughout your online journeys, allowing you to explore the internet’s vastness with confidence and tranquility.

When it comes to enhancing your online privacy, Maxthon truly excels. Every feature integrated within the browser is thoughtfully designed to enrich your experience while ensuring your data remains untouched. Its ad-blocking capabilities prevent disruptive advertisements from intruding on your browsing sessions, while its anti-tracking functionalities tirelessly thwart any attempts by scripts to monitor your online activities. This empowers users to navigate the web with a refreshing sense of autonomy and security. Additionally, the incognito mode offers yet another layer of protection, enabling users to surf the web anonymously—leaving no traces behind on their devices.

Maxthon’s unwavering commitment to user privacy is evident in every facet of its design and functionality. It stands as a beacon for those seeking refuge in a world where digital safety is often compromised. In this ever-evolving digital age, Maxthon Browser emerges not just as a tool, but as a steadfast ally in safeguarding your online journey, allowing you to explore freely while keeping your personal information securely under wraps.