Understanding Financial Scams

Financial scams refer to deceptive schemes aimed at swindling individuals out of their money. These fraudulent activities often utilize tactics such as presenting counterfeit investment opportunities, making misleading claims about substantial returns, or impersonating reputable financial organizations to acquire personal data. The primary objective of these scams is to exploit victims by persuading them to relinquish their funds or sensitive financial information.

Factors Contributing to Historical Financial Scams

The prevalence of financial scams can be attributed to various factors, which may differ based on specific situations. However, several common elements underpin some of the most notorious financial frauds in history:

- Greed: A significant driving force behind many scams is the desire for wealth. Individuals or organizations often seek to achieve considerable profits through dishonest means.

- Weak Regulatory Oversight: Inadequate regulatory systems can allow fraudulent activities to persist undetected for extended periods, particularly when rule enforcement is lax.

- Insufficient Internal Controls: Companies with poor oversight may foster an environment where unethical behaviour

can thrive, enabling employees to engage in fraudulent practices.

can thrive, enabling employees to engage in fraudulent practices.

- Complex Financial Products: The intricacy of certain financial instruments can obscure understanding for both investors and regulators, providing a veil under which scams can operate.

- Impact of Globalization: The interconnectedness of global financial markets has introduced complexities that can weaken regulatory frameworks, further facilitating the occurrence of scams.

Notable International Financial Scams in History

Throughout history, numerous scams have deceived institutions, investors, and individuals alike. Some of the most infamous financial frauds include:

– Charles Ponzi Scheme (1919): Orchestrated by Charles Ponzi, an Italian immigrant residing in Boston, this scam became synonymous with fraudulent investment schemes.

Waste Management (1998) – Based in Houston, Waste Management was a publicly listed firm that misrepresented the depreciation timelines of its assets, including property and machinery, in its financial statements. By manipulating accounting entries, the company falsely claimed to have achieved performance goals communicated to analysts. This deception led to estimated losses of around $6 billion.

Enron (2001)—Enron traded natural gas and various other commodities and was recognized by Fortune Magazine as “America’s Most Innovative Company.” However, it employed deceptive accounting methods to conceal escalating debts and losses from its investors. At that time, the estimated financial shortfall reached approximately $74 billion.

Worldcom (2002)—This Mississippi telecommunications company deceived its investors, resulting in losses exceeding $11 billion. Facing significant financial strain, Worldcom resorted to fraudulent accounting techniques to obscure its financial troubles, which were ultimately uncovered by the company’s internal audit team.

Bernard Madoff (2008) – Bernard Madoff orchestrated the largest Ponzi scheme ever recorded, defrauding investors of an estimated $64.8 billion. He fabricated stock transactions and created fake brokerage accounts, pocketing the returns for himself while using funds from new investors to pay off earlier ones.

Lehman Brothers (2008) – With a history spanning over 150 years, Lehman Brothers was a major player in financial services until it collapsed due to deceptive accounting practices that became evident during the subprime mortgage crisis. The bank’s bankruptcy marked the downfall of the fourth-largest investment bank in the United States, triggering serious consequences for the global economy.

Theranos (2016)—Elizabeth Holmes, CEO of Theranos, along with COO Ramesh “Sunny” Balwani, secured billions in funding for their healthcare startup by asserting that their innovative compact testing device could perform a variety of standard blood tests efficiently and accurately with just one drop of blood. Eventually, medical professionals revealed these claims to be unfeasible.

Historical Overview of Financial Scandals in India

India has faced a number of significant financial scandals throughout its history. Some of the most notable frauds include:

Harshad Mehta Scam (1992)—Harshad Mehta, a stockbroker from Gujarat, engaged in deceptive practices to manipulate the stock market and the banking system. He raised funds from banks and unlawfully invested them in stocks on the Bombay Stock Exchange, resulting in artificially inflated stock prices. When the truth emerged, the stock market experienced a dramatic 72% crash, leading to a bearish trend that persisted for two years. This scandal resulted in losses estimated at around ₹250 crores.

Ketan Parekh Scam (2001) – Ketan Parekh, a chartered accountant and stockbroker, was involved in manipulating stock prices to distort the market. He acquired substantial shares in lesser-known companies and artificially inflated their prices through circular trading before offloading his holdings, which caused a market collapse. This led to significant financial losses for major institutional investors, including insurance firms, with the fraud amounting to approximately ₹137 crores.

Stamp Paper Scam (2003) – Commonly referred to as the Telgi Scam, after its orchestrator Abdul Karim Telgi, this scandal involved two key elements: the production of counterfeit stamp papers and the deliberate creation of a shortage of legitimate stamp papers to facilitate the distribution of the fakes. The scandal implicated numerous high-ranking officials within both the police and government sectors, and the total financial impact exceeded ₹30,000 crores.

Satyam Scandal (2009) – Ramalinga Raju, the founder and chairman of Satyam Computers, admitted to falsifying the company’s financial records. Together with his associates, he artificially inflated the company’s assets and profits over several years by omitting receipts, leading to a total misrepresentation valued at ₹12,318 crores.

Saradha Scam (2013) – This notorious financial fraud occurred in West Bengal and is widely known as the Saradha Group scam. It involved various financial irregularities that affected numerous investors and led to significant public outcry.

Vijay Mallaya Kingfisher Airlines Fraud (2016) – Vijay Mallaya, the proprietor of Kingfisher Airlines, acquired substantial loans from multiple banks to fund the airline’s operations. However, rather than repaying these debts, he opted to invest in assets across Europe. This poor financial management ultimately led to the airline’s bankruptcy and his failure to honor the loans. To escape legal repercussions, Mallaya fled the country, leaving behind a debt of ₹ 9,000 crores owed to 17 Indian banks.

ABG Shipyard Fraud (2017) – ABG Shipyard, the leading entity of the ABG Group, played a significant role in shipbuilding and repairs. The fraud involved orchestrating a complex series of transactions designed to misappropriate funds. To facilitate this, 27 shell companies and 38 firms based in Singapore were established to redirect these funds into tax havens. As a result, 28 banks were defrauded out of ₹ 22,842 crores.

Nirav Modi Punjab National Bank Fraud (2018) – Diamond trader Nirav Modi and his uncle Mehul Choksi were implicated in this scandal. They fraudulently secured Letters of Undertaking (LoUs) from Punjab National Bank (PNB) to obtain loans from other financial institutions. Once their actions came to light, both individuals fled the country, having embezzled over ₹ 11,000 crores from PNB.

IL&FS Financial Fraud (2018) – Infrastructure Leasing and Financial Services (IL&FS), a major investment firm, was embroiled in a scandal where auditors concealed information regarding non-performing loans and inflated profit figures. They misused short-term funding to issue loans for long-term projects while neglecting Reserve Bank of India regulations. The company ultimately defaulted on both short-term and long-term debts amounting to ₹ 91,000 crores.

DHFL Scam (2019) – Dewan Housing Finance Limited (DHFL), led by the Wadhawan brothers, deceived 17 banks by defaulting on loan repayments through financial manipulation. They created 260,000 fictitious borrowers and set up 87 shell companies to divert funds. The banks, led by Union Bank of India (UBI), suffered losses totaling ₹ 34,615 crores.

Tips for Steering Clear of Financial Scams

To effectively fend off financial scams, it’s essential to remain alert and take proactive steps to safeguard your personal and financial data. Here are some strategies to help you stay safe:

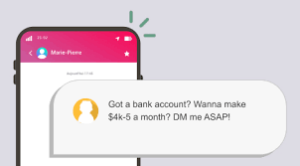

- Be Wary of Unsolicited Communications: Exercise caution with unexpected emails, phone calls, or texts, particularly those purporting to be from banks, government bodies, or businesses. Scammers frequently exploit these channels to access your sensitive information.

- Verify Identities: Before sharing any personal or financial details, confirm the identity of the individual or organization reaching out to you. Use official contact details found on their legitimate website or trusted sources instead of those provided in the correspondence.

- Skepticism Toward Too-Good-To-Be-True Offers: If an investment or business proposition guarantees unrealistically high returns with little risk, approach it with skepticism. Such offers are often deceptive.

- Protect Sensitive Information: Never divulge sensitive data such as passwords, Social Security numbers, or credit card information via email or phone unless you have initiated contact with a verified and trustworthy entity.

- Check Website Security: When conducting online transactions or entering personal information, ensure the website is secure. Look for “https://” in the URL, which signifies a secure connection.

- Monitor Financial Statements: Regularly check your bank statements, credit card statements, and other financial documents for any unauthorized charges. Report any inconsistencies to your financial institution right away.

- Use Trusted Security Software: Equip your devices with reputable antivirus and anti-malware programs to defend against phishing schemes, malware, and various online threats.

- Stay Educated About Scams: Keep yourself informed about prevalent scams and deceptive practices. Awareness is a crucial defence against becoming a victim of fraud.

Overview of Financial Scams

The history of financial scams serves as a reminder of the vulnerabilities inherent in global financial systems. These scams pose significant risks to individuals, organizations, and investors who may fall prey to them, and the repercussions can be extensive and damaging.

Maxthon

As the world of online interactions rapidly changes, ensuring personal safety while browsing the internet has become a top priority. Selecting a web browser that emphasizes security and privacy is now more crucial than ever. Among the many available options, Maxthon Browser stands out as an exceptional choice, addressing these essential needs at no cost to its users. This advanced browser comes with a wide range of integrated features, such as an Adblocker and various anti-tracking tools, which are essential for bolstering your online privacy.

Maxthon is dedicated to offering a browsing experience that places user safety and privacy at the forefront. Its strong emphasis on shielding personal information and online activities from various potential risks means that Maxthon utilizes several effective strategies to protect user data. By employing state-of-the-art encryption techniques, the browser guarantees that sensitive information stays secure and confidential during online activities.

When it comes to safeguarding online privacy, Maxthon truly excels. The browser is thoughtfully designed with a variety of features specifically aimed at enhancing privacy, such as ad blockers, anti-tracking capabilities, and incognito mode. These tools work in unison to eliminate intrusive advertisements and prevent tracking scripts from surveilling your online behavior. Consequently, users can explore the web with heightened security. Furthermore, incognito mode adds to this sense of protection by enabling users to browse without leaving any digital traces on their devices.

Maxthon’s steadfast dedication to user privacy and security is evident through its regular updates and continuous improvements. This commitment to enhancing user protection underscores its goal of creating a safe browsing environment.