As of August 2023, the Singapore Police Force (SPF) has identified five prevalent scams: impersonation, e-commerce, job-related, phishing, and investment scams.

In light of the increasing number of scams, many individuals have developed a tendency—sometimes unwise—to ignore calls from unfamiliar numbers and delete messages from unknown senders. However, scammers are evolving and becoming more sophisticated, making it easier for victims to be deceived. Between June and July 2023 alone, SPF recorded over 1,200 scam incidents. This figure represents a quarter of the total e-commerce scams reported by ScamAlert in December 2022, suggesting a likely rise in scam occurrences throughout 2023.

Scammers often masquerade as old acquaintances, government representatives, or financial advisors to extract personal information from unsuspecting individuals. Additionally, some flood messaging services with enticing job offers. With the current popularity of concerts, fraudsters are exploiting resale platforms to sell tickets at suspiciously low prices. These scams have resulted in millions being siphoned from personal accounts.

Scam Category | Financial Loss (as reported by SPF in 2022)

– E-commerce: $21.3 million

– Impersonation: $8.8 million

– Job: $117.4 million

– Investment: $198.3 million

– Phishing: $16.5 million

In January 2023, the SPF, Ministry of Home Affairs (MHA), and National Crime Prevention Council (NCPC) introduced a straightforward three-step strategy for scam prevention known as ‘ACT’: Add, Check, and Tell. This initiative aims to inform Singaporeans about actions to take when faced with potential scams.

Here’s how you can apply the ACT method when dealing with scams.

A – Incorporating ScamShield and Robust Security Measures

The initial phase of ACT involves the action of addition. You might be curious about what to add. The answer is to incorporate the ScamShield application along with other trustworthy security measures. Introduced in November 2020, ScamShield effectively blocks scam phone numbers and directs scam messages into junk folders on your mobile devices. Notably, the app does not ask for your mobile number, location, contact list, or any personal information, thereby minimizing the chances of scammers breaching your privacy. It is accessible on both the Play Store and the App Store.

Additionally, users can report scam calls and submit scam messages through the app, aiding in the fight against scammers. This feedback also allows the app to refresh its database with new scam tactics. Interestingly, data from SPF reveals that a significant portion of scam victims, specifically those aged 20 to 39, were affected in 2022, contrasting with the assumption that seniors are the primary targets. The app is designed to be user-friendly for this demographic, which tends to be more tech-savvy.

In addition to downloading ScamShield, it’s advisable to implement extra security measures like Two-Factor Authentication (2FA) for your social media accounts and sensitive data. This method necessitates two forms of verification before granting access. Enhancing your privacy settings on messaging and social media platforms is another effective strategy, as it restricts unknown individuals from viewing or contacting you.

Another piece of advice is to decrease the transaction limits on your bank account to minimize potential financial losses. Utilizing digital banking applications for transactions is also safer, and it’s wise to keep a close eye on your account for any unauthorized activities.

Creating a strong password significantly increases your defences against scammers attempting to breach your personal information. Here are some guidelines for crafting a memorable yet secure password:

– Ensure it has at least 12 characters (some sites may require even longer).

– Include a combination of letters, numbers, and special characters.

Identifying the Key Indicators of the Top 5 Scams in 2023

The next phase of the ACT is verification. If you’re uncertain whether a situation is a scam, it’s essential to look for warning signs confirmed by credible sources.

For example, if you have doubts about the legitimacy of a job offer, refer to the company’s official website to confirm its authenticity. It’s crucial to avoid making hasty decisions; take the necessary time to assess whether a request, order, or directive appears dubious or excessively favourable. If you’re feeling uncertain, it’s wise to postpone your response until you can ascertain whether it might be a scam.

Here are some trusted resources where you can check for signs of scams and current trends when faced with a potential scam:

– Singapore Police Force

– Scam Alert

– Cyber Security Agency of Singapore

– National Crime Prevention Council

1 Online Shopping Fraud

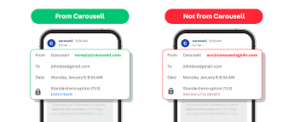

Individuals who fall victim to online shopping fraud often do so by being lured into purchasing items that seem excessively discounted or too appealing to be accurate. Recently, there has been a rise in advertisements for concert tickets on various e-commerce and social media sites, including Carousell, Facebook, Telegram, and Twitter.

Once scammers attract potential victims with these enticing ads, they typically provide counterfeit images or screenshots of tickets to convince them of their legitimacy. They then pressure victims into making a swift purchase by falsely claiming that the ‘tickets’ are in limited supply or cannot be reserved for long. Payments are generally processed through credit cards or digital bank transfers; however, in specific scams, victims are asked to pay cash for items that they did not order or for cheap imitations.

Additionally, scammers might demand extra payments under fabricated pretences, such as claiming they haven’t received the initial funds. In the end, the promised tickets either never arrive or turn out to be invalid, and the scammers become unreachable. To safeguard yourself against online shopping fraud, here are some warning signs and protective measures suggested by Scam Alert.

Warning Signs to Look Out For:

Beware of Deals That Seem Too Good: Look for offers that sound excessively enticing, such as “limited-time” promotions priced significantly below the usual market rate.

– Lack of Transparency: Scammers typically withhold details about their products and often do not clearly outline their terms and conditions.

Attempts to Move Conversations Off the Main Platform: Fraudsters may try to redirect conversations away from established platforms to evade detection, such as switching from messaging apps to phone calls.

– Request for Bank Transfers: E-commerce fraudsters frequently ask for payments through direct bank transfers. If you hesitate, they might offer a discount to entice you into compliance.

– Additional Charges: Scammers may introduce unexpected fees like administrative or shipping costs.

Tips for Safeguarding Yourself:

– Whenever possible, use the secure payment methods provided by the platform. If that’s not feasible, opt for cash-on-delivery instead.

– Select trustworthy sellers or shopping websites known for positive reviews, consumer protection measures, and return policies, especially for high-value purchases.

– Always review the terms and conditions to ensure all fees are disclosed clearly from the start.

– Be aware of GST and Duties: Additional charges such as GST may apply to items valued over a certain threshold ($400).

– Investigate the platform’s Transaction Safety Ratings (TSR), which indicate the extent of safety features implemented by an e-commerce site. The SPF has also compiled a list of fraudulent platforms and their aliases for public awareness.

2 Impersonation Scams

Recently, there has been a rise in incidents involving the “fake friend call” scam, which is a type of impersonation fraud. In this scenario, the scammer pretends to be a friend but deliberately conceals their identity, prompting victims to guess who they are. Once a victim suggests a name, the scammer requests that they save their number, only to follow up later with a fabricated story to solicit money—such as claiming a family member has been unexpectedly hospitalized.

Impersonation scams aren’t limited to friends or family; they also include individuals posing as business owners or local government officials. These fraudsters utilize false identities to extract sensitive information from their targets, including passwords and one-time passcodes (OTPs).

Indicators to Watch For:

Requests for Personal Information: Genuine banks and government representatives will never ask for sensitive details or money transfers through calls or texts. This rule also applies to courier services, telecommunications companies, and e-commerce platforms.

– Intimidation Tactics: Scammers may attempt to manipulate you into believing you’ve committed a crime or have an unresolved legal issue, threatening to escalate the matter if you don’t comply with their demands.

– International Numbers with a ‘+’ Prefix: Be cautious with calls from numbers starting with ‘+’, especially if they claim to be from familiar sources or countries. Not all such numbers originate from Singapore.

– Unsolicited Communications: Be wary of unexpected calls or messages from unknown individuals who cannot clearly identify themselves and insist on obtaining your personal information.

Protective Measures:

– Only accept international calls if you are anticipating one; otherwise, avoid answering foreign numbers.

– Never share confidential information without verifying the caller’s identity first.

– If the caller cannot provide their name when asked, hang up immediately.

#3 Employment Scams

One of the most prevalent scams of 2023 involves fraudulent job offers. These scams frequently surface on messaging apps like WhatsApp and Telegram, as well as various social media platforms. Similar to impersonation schemes, fraudsters often present themselves as recruiters, luring victims with enticing job opportunities that promise high salaries with minimal effort—offers that are often too appealing to be genuine. So far, ScamAlert has recognized four distinct categories of these deceptive job postings.

1. Affiliate Marketing Positions: These typically require victims to pay upfront for products in order to increase sales in exchange for a share of the profits.

2. Agent-Linked Offers: In this scenario, victims are instructed to transfer funds using specific services such as Western Union or MoneyGram through so-called “agents.”

3. Positions Like ‘Assistant Purchaser’ or ‘Stock Taker’: Applicants may be prompted to provide sensitive personal information, including their full name, identity card number, and one-time passwords.

4. ‘Male Social Escort’ Roles: These offers claim to facilitate connections with affluent female clients but demand an initial registration fee paid in advance.

Additionally, variations of this scam may involve requests for victims to artificially inflate cryptocurrency values or provide ratings for applications to enhance their visibility. Victims are often encouraged to undertake these tasks.

Warning Signs to Watch For:

– Upfront Payment Requests: Scammers may insist that victims create accounts on unverified platforms or subscribe to paid memberships before they can start working. They might even offer initial commissions to establish trust.

– Unrealistic Compensation for Little Work: Job offers that guarantee substantial rewards with minimal effort are typically fraudulent.

– Unexpected Job Offers via Social Media or Messaging Apps: Scammers may falsely represent themselves as agents from reputable recruitment firms. Once a victim shows interest, they are often added to a group chat where they are shown fabricated testimonials and success stories to lend credibility to the scam.

#4 Investment Fraud

Fraudsters in the investment sector often pose as stockbrokers, bank representatives, or employees of financial institutions on social media sites like Facebook. They initiate contact with potential victims, soliciting sensitive information such as NRIC numbers and passport details to complete an investment application. Subsequently, they demand substantial bank transfers for various fees—administrative, security, and tax-related—promising victims that these payments will enable them to “earn” profits.

In addition to messaging through social media, scammers may also use phone calls, pretending to be international monetary authorities and insisting on a deposit before any profits can be released. Another variation of this scam involves requests to invest in cryptocurrencies through acquaintances met online.

Indicators to Watch For:

Binary options are financial derivatives in which payouts depend on a yes-or-no outcome. Platforms promoting binary options are often fraudulent.

Unrealistic returns: Be cautious of investment opportunities that promise excessively high returns that seem implausible.

Unknown entities: Stay alert for unfamiliar platforms or companies located outside of Singapore.

How to Safeguard Yourself:

Please consult a licensed financial advisor. Before committing to any investment, research the company and its representatives using official resources. These include the Financial Institution’s Directory, Register of Representatives, and Investor Alert List, all accessible on the Monetary Authority of Singapore’s (MAS) website.

Recognize investment risks: High potential returns typically come with significant risks. Engaging with unregulated entities can leave you with limited options if things go awry. It’s advisable to verify the regulation status of foreign authorities.

Avoid sharing personal information.

Be cautious of strangers, Particularly those promoting quick wealth schemes on social media platforms.

#5 Phishing Scams

In an age where technology plays a crucial role in our lives, scammers have found ways to exploit this dependency by creating deceptive websites aimed at tricking individuals into providing personal information. Typically, victims receive unsolicited communications through calls, texts, or emails that ask for sensitive data. Scammers often fabricate enticing stories about winning prizes, securing online accounts, or assisting in the investigation of fraudulent activities, which encourages victims to click on links leading to fraudulent sites.

Another common tactic involves victims encountering alluring advertisements on social media, promising deals that seem too good to be true. Once they click on these ads or reach out via messaging apps, they are directed to counterfeit websites. To complete a purchase, victims are required to share their personal information and inadvertently authorize transactions that benefit the scammer.

To enhance their credibility, scammers may follow up with victims after the unauthorized transaction. Posing as bank representatives investigating fraud, they will encourage victims to download a fake “ScamShield” application via a misleading link, claiming it will protect them against scams. However, clicking on these dubious links can result in malware being installed on the victim’s devices, leading to potential damage and theft of confidential information.

Warning Signs to Watch For:

Be cautious of unexpected phone calls, emails, and texts. If you receive a call claiming you’ve won a prize, remember that legitimate organizations usually notify winners through official emails or letters in addition to phone calls. Pay attention to any spelling or grammatical mistakes in messages that threaten account suspension, claim delivery problems, or promote unbelievable offers. Often, such texts include links to unverified websites or unfamiliar phone numbers.

How to Safeguard Yourself

1. Keep Personal Information Private: Avoid sharing sensitive details such as one-time passwords (OTPs) and banking and credit card information.

2. Be Cautious with Links: Do not click on links in unsolicited emails or messages. Instead, manually enter the organization’s official web address into your browser to confirm that you’re visiting its legitimate site.

3. Enhance Security Measures: Activate two-factor authentication on your online accounts for increased protection.

4. Enable Transaction Notifications: To stay informed, set up alerts for any transactions on your bank and credit accounts.

5. Inform Relevant Parties and Authorities: The final step in the ACT approach is to inform others. If you encounter a scam, notify the appropriate authorities and share your experience with friends and family to help protect them. This includes contacting banks and law enforcement.

By reporting scams, you may be able to recover lost funds through the Anti-Scam Centre (ASC) established by the SPF in 2019. The ASC works to halt scam operations by freezing involved bank accounts and retrieving stolen money. The duration for recovering losses can vary based on the scam’s complexity; cases involving international scammers can be particularly challenging.

Additionally, consider reporting the scam through the ScamShield app and take action to block or report suspicious accounts on messaging and social media platforms.

Take Action Now to Stay Ahead

The National Crime Prevention Council (NCPC) reports that the ScamShield app has successfully blocked over seven million dubious text messages and 70,000 phone numbers associated with scams, highlighting its effectiveness in combating fraudulent activities.

Despite the ongoing rise in scam attempts, platforms like ScamAlert and the Singapore Police Force’s (SPF) weekly scam bulletins provide valuable insights into recognizing scams and safeguarding oneself. This proactive approach yields results, as indicated by a decline in scam incidents from 2020 to 2022, based on SPF’s annual report on scams and cybercrime for 2022. Between 2020 and 2021, scams rose by 51.3%, but this rate of increase dropped to just 25.2% from 2021 to 2022.

Maxthon

In the fast-evolving landscape of digital communication, where the online world is constantly shifting, it has become imperative to protect oneself while navigating the internet’s vast resources. Selecting a web browser that emphasizes security and privacy is more critical now than ever. Among the myriad browsers competing for attention, Maxthon Browser stands out as an exceptional option, effectively addressing these vital issues without imposing any costs on its users. This cutting-edge browser comes with an impressive array of built-in tools, such as an ad blocker and various anti-tracking features, which are essential for bolstering your online privacy.

Maxthon has carved out a unique niche by prioritizing a browsing experience that underscores user safety and confidentiality. With a strong commitment to safeguarding personal data and online behaviour from the numerous threats lurking in cyberspace, Maxthon utilizes a variety of powerful strategies to protect user information. Through advanced encryption methods, this browser guarantees that sensitive information remains secure and confidential throughout your online interactions.

Maxthon truly stands out in enhancing privacy during internet use. The browser is thoughtfully crafted with a comprehensive suite of features designed to improve user privacy. Its effective ad-blocking capabilities, extensive anti-tracking measures, and dedicated incognito mode all function harmoniously to eliminate intrusive ads and block tracking scripts that could compromise your online security. As a result, users can explore the web with greater confidence. The incognito mode further enhances this sense of security, allowing individuals to surf the internet without leaving behind any digital traces or footprints on their devices.

Maxthon Browser is also compatible with Windows 11.

Maxthon’s unwavering focus on user privacy highlights its commitment to creating a safer online environment. In an era where traversing the internet can feel overwhelming, choosing Maxthon provides a reassuring solution.