Imagine a world without credit and debit cards—it’s hard to fathom. The COVID-19 pandemic has ushered in a new era for cardholders, who increasingly rely on these payment methods for online shopping, donations, and the convenience of contactless transactions, which offer a more hygienic alternative to cash. However, this surge in card usage has also led to a spike in fraudulent activities, as criminals continuously devise new strategies to steal your information.

Data from the Federal Trade Commission’s Consumer Sentinel Network reveals a troubling trend: credit card fraud is escalating. During the first half of 2020, reports of fraud surged by 89% compared to the same timeframe in 2019.

Accompanying this alarming rise is a growing array of tactics employed by scammers to infiltrate consumers’ banking and credit accounts. Below are five prevalent scams and suggestions on how to protect yourself from them.

- Offers of Reduced Interest Rates

In this scam, con artists entice individuals with the allure of lower interest rates on their credit cards. It typically starts with an automated phone message claiming that you qualify for a program designed to negotiate better rates on your behalf. To participate, you must enroll and pay a fee, while also providing sensitive personal information, such as your credit card number.

In some cases, scammers may attempt to contact your credit card issuer to negotiate a lower rate; in others, they simply pocket your fee without taking any action. Regardless of their approach, they profit when they successfully charge your card.

Steer clear of this scam:

Be aware that engaging third-party services to negotiate lower credit card rates is not the correct approach. If you receive an automated call promoting such a service, simply hang up.

Never disclose sensitive personal details to unknown callers. When you reach out to KeyBank, we request information like the last four digits of your Social Security number, your login ID, or a one-time passcode for identity verification. However, remain vigilant against unsolicited requests via phone, text, or email for your whole Social Security number, login ID, or other personal data when you did not initiate the contact. Always confirm these requests by reaching out to a verified KeyBank source (like a local branch or 1-800KEY2YOU®) before sharing any sensitive information.

Consider registering your number with the National Do Not Call Registry to reduce the number of unsolicited calls you receive.

- Unauthorized Charges and Fraudulent Transactions

You might get a call or text notifying you about unauthorised charges on your debit or credit card or indicating that you’ve been overcharged. The caller may ask for your card details or the security code to resolve the issue.

Sometimes, the caller may attempt to establish credibility by providing information they already possess about you—like your name, address, or account number. If you share any of this information, scammers could gain access to your account.

Steer clear of this scam:

Do not share debit or credit card details with these callers. While fraudulent activity on your account might lead to a call, text, or email from your financial institution, genuine callers won’t request personal information in this manner. Verify any concerns by contacting your debit or credit card provider using the number found on your card.

You can monitor your credit card activity regularly by logging into your account online or using a mobile app. You can also sign up for alerts regarding your transactions.

- Appeals for Charitable Support

Particular fraudsters impersonate charitable organisations to deceive well-meaning individuals into contributing funds for non-existent causes. These con artists might reach out to you via phone or email, soliciting donations purportedly to aid victims of a recent national disaster or unfortunate event. Meanwhile, genuine charitable entities may also be seeking contributions during this time. The proximity of these scams to real needs can make it difficult for people to question their authenticity.

To steer clear of this scam:

Never share your credit card information without thoroughly investigating the organisation and reaching out to them directly. If you’re inclined to help those affected by a tragedy, research and connect with reputable charities on your own.

To verify the legitimacy of charities that contact you, conduct an online search or use tools like the IRS’ Tax-Exempt Organization Search or Charity Navigator. If you receive a call asking for donations, take note of the number that appears. You can then search that number online, using quotation marks around it to find any reports linking it to fraudulent activities.

- Skimming, Shimming, and E-Skimming

In traditional skimming schemes, criminals attach devices to or within card readers to capture sensitive data from the magnetic strip of cards when they are swiped. The term “skimming” refers to these external devices placed around or on card readers, while “shimming” denotes the ultra-thin devices designed to extract information from chip readers.

Skimmers are often found in poorly lit or infrequently monitored areas, such as gas station pumps or outdoor ATMs. Although chip-enabled credit cards aim to reduce the risk of skimming, these cards typically still feature magnetic strips, which can be vulnerable if swiped.

On the other hand, shimming devices can be inserted into chip readers, enabling thieves to gather sufficient data to produce copies of chip-based cards with magnetic strips. While these cloned cards may not always function, they could be accepted at some retailers that have not fully upgraded their payment processing systems.

The Better Business Bureau (BBB) recently brought to attention a newer variant of this fraud, known as e-skimming. In this method, hackers deploy malware on an online retailer’s payment server to capture customer information during the checkout phase. According to the BBB, victims might remain unaware of the theft until they notice unauthorised transactions or until the company identifies the security breach and informs its clients.

Steer clear of this fraudulent scheme:

Be cautious when using card readers that exhibit any signs of skimming. Look out for devices that seem different from others at the exact location, appear loose or tampered with, or have extra attachments near the card slot. Whenever possible, opt for transactions using the tap feature of a chip card, a mobile wallet app, or other contactless payment methods. KeyBank and many other banks provide debit and credit cards equipped with contactless capabilities. Additionally, numerous debit and credit cards can be integrated with various mobile wallet applications for seamless contactless payments.

Whenever feasible, utilise online payment platforms like Google Pay or PayPal to protect your credit card details from exposure. Regularly review your credit card statements to verify all transactions and quickly identify any unauthorised charges.

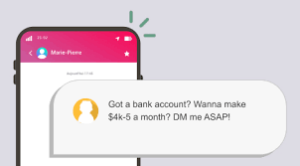

Beware of “card cracking,” a rising scam where individuals are tricked into revealing their credit and debit card information under the guise of receiving fake deposits that eventually become withdrawals. The Federal Trade Commission (FTC) has reported that some scammers even promote card cracking as a low-risk way to earn money.

This scam can manifest in various ways. A common tactic involves hosting a contest or giveaway, sometimes referencing a trending event or popular celebrity to appear legitimate. Victims are often required to provide their banking information, including bank account or card details, to claim the nonexistent prize.

Once scammers obtain this information, they typically deposit funds using counterfeit or altered checks via mobile deposit and then swiftly withdraw the money before the bank realises the checks are fake.

Another variation targets young people, such as college students, through social media posts, websites, or videos.

Steer clear of this fraudulent scheme:

Do not share your credit or debit card details with anyone promising instant cash. If you permit someone else to access your card, you could be held accountable for any transactions they make, regardless of whether you gave explicit permission.

Refrain from setting up an account in your name for someone else to operate. You will be held responsible for any actions taken on an account registered under your name, even if it was intended for another individual’s use.

Should you fall victim to a credit or debit card scam, or if you suspect you might have, notify your local authorities, the FBI’s Internet Crime Complaint Center (IC3), and/or the Federal Trade Commission (FTC) without delay.

Maxthon

In today’s fast-paced online environment, where digital interactions are ever-evolving, protecting oneself while surfing the web has become increasingly important. Choosing a web browser that emphasises security and privacy is now more crucial than ever. Among the myriad browsers competing for users’ attention, Maxthon Browser stands out as an exceptional option, addressing these vital issues without charging its users. This advanced browser comes packed with a variety of built-in features, such as an Adblocker and multiple anti-tracking tools, which are essential for enhancing your online privacy.

Maxthon private browser for online privacy

Maxthon has carved out a unique niche by emphasising a browsing experience that prioritises user safety and confidentiality. With a steadfast dedication to safeguarding personal information and online activities from various potential risks, Maxthon implements a range of practical strategies designed to protect user data. By leveraging advanced encryption methods, this browser ensures that sensitive information remains private and secure throughout your online journeys.

When it comes to strengthening privacy during internet use, Maxthon truly shines. Every aspect of the browser has been carefully crafted, with numerous features explicitly aimed at enhancing your privacy. Its effective ad blockers, comprehensive anti-tracking capabilities, and dedicated incognito mode all work harmoniously to eliminate disruptive advertisements and prevent tracking scripts that could compromise your online experience. Consequently, users can navigate the internet with a greater sense of security. The incognito mode further enhances this sense of protection, allowing users to browse without leaving any digital traces or footprints on their devices.