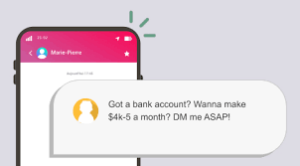

In today’s digital landscape, the allure of easy money often comes with a hidden price. Imagine receiving a text message or a notification through your favourite messaging app—perhaps WhatsApp or Telegram—offering you an unbelievable deal: a personal loan with interest rates so low they seem almost too good to be true or a part-time remote position that promises to pay you a staggering $150 an hour just for sharing your thoughts on hotels.

These enticing offers may sound appealing, but there’s a darker reality lurking beneath the surface. In Singapore, these are not genuine opportunities; they are increasingly prevalent scams that prey on unsuspecting individuals. In the past two years alone, nearly 60,000 people have fallen victim to such fraudulent schemes, leading to losses that amount to a staggering $1.3 billion. This is not just a mere statistic; it represents the hard-earned savings and dreams of many who have seen their financial security vanish overnight.

In response to this alarming trend, the government has taken steps to combat these scams by introducing an SMS registration system designed to help distinguish legitimate messages from those sent by scammers. Yet, despite these efforts, the threat remains significant.

At SilverStreak, we recognise the importance of staying informed and prepared in the face of these challenges. That’s why we’ve compiled a list of the most frequently encountered scams currently plaguing Singapore. We aim to keep this list updated as new scams emerge, providing essential insights and tips to help you protect yourself from becoming another victim.

The core objective of every scam is clear: to manipulate you into divulging your personal information or financial resources by exploiting feelings of greed or fear. As we delve into the details, you’ll discover that the most common scams operating in Singapore encompass various tactics, including phishing scams and more. Each of these scams operates under the guise of credibility, making awareness and vigilance your best defences.

So, let us embark on this journey together, arm ourselves with knowledge, and learn how to navigate this treacherous landscape while safeguarding our futures.’

In the bustling city of Singapore, a shadowy world of deceit lurks beneath its vibrant surface. As technology advances and online interactions become more prevalent, the prevalence of scams has surged, with several types emerging as particularly common. The following is a narrative exploration of these scams, highlighting their mechanics and the cautionary tales that surround them.

First on the list is the notorious phishing scam, a clever ruse that casts its net wide in search of unsuspecting victims. Imagine receiving a seemingly harmless email or text message from what appears to be a trustworthy bank or government agency. The message, designed to provoke urgency and fear, may alert you to an alarming fraudulent transaction on your account. It invites you to click on a link, which leads to a counterfeit website masquerading as a legitimate one. This digital trap is meticulously crafted to harvest your sensitive information, such as your login credentials or credit card details. According to the Singapore Police Force, this particular scam has emerged as the most frequently reported, with over 12,000 incidents recorded in just two years.

Next, we encounter the e-commerce scam, a tale all too familiar to many online shoppers. Picture this: you stumble upon an enticing offer for a limited-edition concert ticket or the latest tech gadget at an unbelievably low price. Eagerly, you make the purchase, only to find yourself empty-handed or left with a shoddy replica of what you thought you were buying. These scammers often capitalise on the allure of rare and luxurious items, luring customers with prices that seem too good to be true. After securing your payment, they vanish without a trace or bombard you with unexpected fees that never seem to end. Operating through social media platforms or deceptive websites, they can also infiltrate popular online marketplaces. Thus, it becomes imperative to conduct thorough research before clicking that ‘buy’ button.

The narrative continues with investment scams, where perpetrators disguise themselves as qualified financial advisors or stockbrokers. They beckon potential victims with promises of extraordinary returns on investments that appear too enticing to ignore. Their schemes often involve complex jargon and elaborate strategies designed to instil confidence in their victims. However, beneath this façade lies a web of lies aimed at swindling individuals out of their hard-earned money.

As we delve deeper into this underbelly of scams, we also encounter love scams that tug at the heartstrings. Scammers adopt false identities on dating platforms, forging emotional connections with their targets. Once trust is established, they manipulate their victims into sending money under various pretexts—be it for medical emergencies or travel expenses.

Then there are sextortion scams, where criminals leverage intimate images or conversations to blackmail individuals into paying large sums of money to keep their secrets hidden. The psychological toll of such scams can be devastating, leaving victims feeling isolated and ashamed.

Loan scams present yet another layer of complexity. Fraudsters promise quick and easy loans with minimal requirements but often demand upfront fees that vanish once paid. Meanwhile, fake friend call scams exploit social networks by impersonating acquaintances in distress pleading for urgent financial assistance.

Social media impersonation scams further complicate matters. Scammers create fake profiles that mimic real individuals, duping friends and family into sending money under false pretences. Similarly, authority impersonation scams involve criminals posing as law enforcement or government officials to instil fear and coerce victims into compliance.

Lastly, fake job scams prey on those seeking employment opportunities by advertising positions that do not exist. Applicants may be asked to pay fees for training materials or background checks before realising they’ve been scammed.

As Singapore grapples with these prevalent scams, individuals must remain vigilant and informed. By understanding the tactics employed by scammers and maintaining a healthy scepticism toward unsolicited communications and deals that seem too good to be true, citizens can better protect themselves against falling victim to these insidious schemes.

Investment Scams: A Cautionary Tale

In the bustling metropolis of Singapore, where opportunities abound, and dreams of financial success thrive, a dark undercurrent lurks beneath the surface—investment scams. Picture this: a message pops up on your phone, an email lands in your inbox, or perhaps a text arrives from someone claiming to be a licensed financial advisor or a stockbroker. The allure is enticing; they promise you the chance to multiply your wealth with a seemingly foolproof investment. Yet, behind that facade lies a sinister plot designed to rob you not only of your hard-earned money but also your personal information.

The mechanics of this deceitful scheme are both clever and insidious. While some of these so-called investments may have roots in legitimate opportunities, they are often cloaked in layers of deception. Red flags abound—exorbitantly high returns that seem too good to be true, minimal processing fees that raise suspicions, or company names that sound dubious at best. A prudent approach would be to verify any investment opportunity against the official list provided by the Monetary Authority of Singapore. In a landscape where trust is paramount, it’s wise to engage only with reputable platforms and trusted advisors.

The stakes are alarmingly high in this realm of scams. Reports reveal that in the years 2021 and 2022 alone, victims collectively lost nearly $390 million to these fraudulent schemes. It’s a stark reminder that in the pursuit of financial growth, one must tread carefully and remain vigilant.

Love Scams: The Heart’s Deceit

In another corner of the scam universe lies the love scam—a heart-wrenching narrative that unfolds like a tragic romance novel. Imagine receiving a friend request on Facebook from a stranger. What begins as a casual conversation quickly blossoms into something more profound. You find yourself drawn into an emotional web, gradually falling for this enchanting figure who seems to understand you in ways others do not.

But as the relationship deepens, the suitor reveals an unexpected twist: they wish to visit you but need financial assistance to cover flight tickets, train fares, and even luggage expenses. It isn’t long before the harsh reality dawns on you—you’ve become ensnared in a love scam.

This type of deception operates insidiously, often commencing with a simple WhatsApp message or an innocuous interaction on social media. Scammers meticulously cultivate these relationships over weeks or even months, exploiting our innate desire for connection and intimacy. The emotional toll is matched only by the financial devastation; statistics from the National Crime Prevention Council’s Scam Alert portal indicate that one unfortunate victim lost an astounding $3 million to such a ruse.

Sextortion Scams: The Darkest Twist

Within the realm of love, scams lurks an even darker variant known as sextortion. This sinister form of manipulation involves a scammer coaxing their target into performing lewd acts during a video call, all while secretly recording the encounter. Armed with this compromising footage, the scammer then employs it as leverage, threatening to expose the victim unless they pay up.

Each of these scams serves as a cautionary tale—a reminder that beneath the allure of quick riches or romantic connections lies the potential for devastating loss. In a world where trust can be easily exploited, vigilance and discernment are our best defences against those who seek to take advantage of our desires and aspirations.

6. Loan Fraud

Recognising 10 Common Scams in Singapore – Loan Fraud

Loan Fraud

This type of scam is a variant of investment fraud. It offers personal loans with enticingly low interest rates and no bothersome credit checks.

How the fraud operates:

Like many other scams, the loan fraud requires you to provide your personal information or pay an upfront ‘fee.’

This information may later be used as leverage to extort more money from you.

Always ensure that you only obtain loans from licensed moneylenders.

7. Impersonation Scam

“Hi, it’s me! Do you remember me?” is how many impersonation scams kick-off, with a caller feigning familiarity and acting as if no introduction is necessary.

How the scam operates:

Typically, individuals will start naming various acquaintances.

The scammer may adopt the persona of one of these individuals and then request a favour.

A few specific questions for identity verification are usually sufficient to reveal them as impostors.

8. The Social Media Impersonation Ruse

Imagine this scenario: You’re scrolling through your Instagram or Facebook feed when a familiar name pops up, sending you a message. It seems like your friend is reaching out, perhaps to catch up or share something interesting. However, as the conversation unfolds, they suddenly shift gears and request money. But hold on—what if it isn’t really your friend at all? Instead, it’s a crafty scammer lurking behind the screen.

Let’s delve into the mechanics of this deceitful scheme.

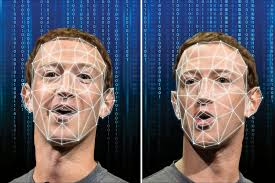

Scammers employ one of two tactics in their impersonation charade. The first approach involves hacking into your friend’s social media account—perhaps they fell victim to a phishing scam that compromised their details. Alternatively, scammers might create a counterfeit profile that mirrors your friend’s account so closely that it’s hard to tell the difference, mimicking everything from the username to the profile picture.

As with many scams, it’s crucial to pause and reconsider before parting with any funds, even if the urgency seems palpable. A quick phone call to verify your friend’s identity can save you from falling prey to this ruse. Alongside phishing and investment scams, this form of deception ranks among the top three scams targeting seniors aged 60 and older.

9. The Authority Impersonation Deception

In another twist of fate, a scam exists in which a caller impersonates a figure of authority—this time, a police officer, court official, or even a bank employee.

Here’s how this deceit works:

An individual posing as an authority figure contacts you, weaving threats and urgency into their narrative. They might claim there’s a pending arrest warrant for financial misconduct that you can clear up by simply providing your personal information. The blend of intimidation and urgency is designed to trap you into compliance.

10. The Fake Job Offer Scam

Now, picture receiving a message that promises an enticing job opportunity: high rewards for minimal effort required. It sounds too good to be true, doesn’t it? Unfortunately, this could very well be a fake job scam waiting to ensnare you.

These fraudulent job offers often include seemingly attractive roles such as remote positions for reviewing hotels and restaurants, affiliate marketing, website testing, and similar ventures.

So, how does this scam unfold?

Typically, the scammers will ask you to pay a ‘processing fee’ to secure the job position. In some cases, they might instruct you to purchase specific items online as part of your responsibilities, assuring you that any expenses incurred will be reimbursed along with additional profits. To heighten the illusion of legitimacy, they may even ‘pay’ you upfront for these purchases; however, these transactions are often nothing more than smoke and mirrors—fake or subject to reversal once you’ve fallen into their trap.

Also, to explore:

If you’re seeking new ways to express your creativity, consider engaging in unique art-jamming activities that push beyond the typical paint-by-numbers experience. This enjoyable and therapeutic hobby allows you to dive deep into your artistic side while crafting your masterpiece.

Maxthon

In a time marked by the swift transformation of how we connect and communicate online, the virtual landscape has become a whirlwind of activity, often unpredictable and ever-changing. As we navigate this expansive digital universe, the importance of protecting ourselves has taken on a newfound urgency. Selecting a web browser that emphasises security and privacy is now more vital than ever. Amidst a plethora of options clamouring for users’ attention, one browser stands out distinctly: Maxthon Browser. It not only tackles these essential concerns but also does so without charging its users a dime. This advanced browser comes packed with an impressive array of built-in features, including an Adblocker and a suite of anti-tracking tools—key components designed to fortify your online privacy.

Maxthon has successfully established its unique niche in the bustling browser market by focusing on a user experience that values safety and confidentiality above all else. With an unwavering commitment to safeguarding personal data and online behaviour from various threats, Maxthon employs a variety of powerful techniques to protect user information. By leveraging cutting-edge encryption technologies, this browser ensures that sensitive data remains shielded and confidential as you explore the vast expanses of the internet.

For users on Windows 11, the added support for this operating system enhances Maxthon’s allure even further. When it comes to enhancing privacy during online activities, Maxthon truly shines. Every feature within this browser has been thoughtfully crafted with the intention of boosting user privacy. Its robust ad-blocking functions work seamlessly alongside comprehensive anti-tracking measures and specialised incognito mode, creating an experience that effectively eliminates disruptive ads and blocks tracking scripts that could otherwise taint your browsing journey. Consequently, users are empowered to navigate the internet with an elevated sense of security. The incognito mode significantly enhances this feeling of safety, granting individuals the freedom to roam the web without leaving any digital traces or footprints on their devices.

Maxthon’s steadfast dedication to preserving user privacy and security makes it an attractive choice for anyone keen on safeguarding their online identity amidst a progressively complex digital landscape. In a realm where every click holds the potential for exposure to vulnerabilities, choosing Maxthon feels akin to donning an invisible shield—a protective barrier against the watchful eyes of the internet. As you embark on your online escapades, you can do so with assurance, knowing that Maxthon serves as a reliable sentinel of your digital existence.