Financial institutions (FIs) must be aware of the various forms of financial fraud to protect their resources and uphold the confidence of their clients and stakeholders, especially as new methods for fraud and illegal activities emerge.

This in-depth guide examines 12 unique types of financial fraud, offering brief explanations and real-life instances. It is followed by a discussion on optimal strategies for financial organisations to identify and thwart these complex illicit practices.

12 distinct categories of financial fraud include:

– Identity theft

– Payment fraud

– ACH fraud

– Account takeover fraud

– Advance fee fraud

– Credit card fraud

– Investment fraud

– Consumer fraud

– Fraudulent charities

– Return fraud

– Chargeback fraud

– Cybercrime

1. Identity Theft

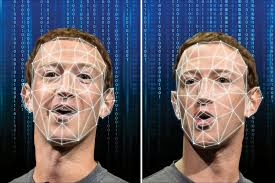

Identity theft is the unauthorised acquisition and use of sensitive personal data, such as Social Security numbers or banking information, to execute fraudulent schemes. Advances in technology have facilitated increasingly sophisticated methods of identity theft. For instance, in February 2024, an employee at a major finance firm authorised the release of $25 million after being deceived during a conference call by fraudsters using deep fake technology to mimic the firm’s Chief Financial Officer.

Employees within financial services must exercise caution when verifying customer identities to prevent unauthorised access to accounts. Implementing stringent customer authentication measures and ongoing monitoring is crucial for protecting against identity theft, preserving the integrity of financial transactions, and maintaining customer confidence.

Fraudsters utilise various tactics to carry out identity theft. Some common examples include:

Phishing: This involves employing misleading strategies to deceive people into revealing confidential information, primarily through fake emails or messages. Phishing attacks frequently mimic reputable organisations like banks, regulatory bodies, or coworkers. The goal behind these malicious efforts can vary from stealing login details to illegally accessing sensitive financial information. It is crucial to identify and prevent phishing attacks, as becoming a victim can lead to significant consequences, jeopardising both personal and organisational security.

Physical Theft and Mail Interception: Criminals often use tangible methods, such as snatching wallets and purses, to obtain personal identification, credit cards, and bank cards. This simple yet effective approach allows them to obtain sensitive data. Furthermore, they may rummage through mail and garbage to find confidential information, including bank statements.

Exploitation of Data Breaches: Cybercriminals can take advantage of extensive data breaches to acquire sensitive information, such as personal and financial records of clients or employees. By exploiting weaknesses in cybersecurity systems, they can unlawfully access databases, revealing a wide range of private information.

Payment fraud includes schemes aimed at financial transactions, such as credit card and check fraud. Financial institutions (FIs) must be vigilant for unusual payment behaviour and exercise caution while processing transactions.

According to UK Finance, over £1.2 billion was lost to payment fraud in 2022, with almost 80% of reported incidents originating online. Payment fraud is unlikely to diminish soon, with projections estimating costs will reach $40.62 billion by 2027. Some prevalent forms of payment fraud, including credit card fraud, will be discussed later in this article.

Businesses can safeguard their assets and customer funds from unauthorised transactions by implementing strong anti-fraud strategies.

3. Automated Clearing House Fraud

In the United States, the Automated Clearing House (ACH) network plays a crucial role in the safe and effective transfer of funds among banks and financial institutions. It is essential for various banking functions, including direct deposits, bill payments, and transfers between individuals.

ACH fraud occurs when criminals exploit or illegally access the ACH system to conduct fraudulent transactions that redirect funds from legitimate accounts. Typical methods employed by these fraudsters include account takeovers, phishing schemes, malware attacks, and social engineering tactics aimed at compromising sensitive information related to bank accounts.

The impact of ACH fraud goes beyond mere financial losses; it also involves damage to reputations and potential regulatory repercussions. To protect against such threats, financial institutions must adopt robust authentication protocols, maintain vigilant monitoring practices, and utilise sophisticated fraud detection technologies to ensure the integrity of electronic fund transfer systems.

4. Account Takeover Fraud

Account takeover fraud (ATO) happens when an unauthorised individual infiltrates someone’s online account with the intent of stealing funds or sensitive data. Cybercriminals have various methods for achieving this, such as purchasing stolen credentials from the dark web or using keylogging tools to capture login details.

Although ATO differs from identity theft in some respects, they share significant similarities. A survey conducted in 2021 revealed that 64% of Americans who had their identities compromised also fell victim to account takeover fraud.

Typically, ATO is executed through techniques like credential stuffing and brute force attacks:

– Credential stuffing refers to the use of automated bots that test large lists of username and password combinations to find matches. This is particularly concerning because many people reuse the same login credentials across different platforms, making them vulnerable to multiple breaches from a single leak.

Brute-force attacks involve bots trying random combinations of words to guess a user’s password on a specific site.

Financial institution (FI) employees must be trained to identify several warning signs:

– A surge in password reset requests and login attempts.

– Modifications to contact information, including addresses and backup email accounts.

– Requests for new cards or chequebooks sent to a different address.

– The addition of a new authorised user.

Educating customers is equally essential for safeguarding their accounts. Employees should promote the activation of multi-factor authentication (MFA), encourage regular password updates, and provide the option for customers to receive notifications when a credit limit request is initiated.

5. Advance Fee Fraud

Although advance fee fraud has been around for many years, its prevalence has increased due to the rise of digital communication methods, such as social media platforms, encrypted messaging apps like WhatsApp, and the continued use of email.

Fraudsters involved in advance fee scams often lure victims with enticing investment opportunities or promises of large rewards, such as winning a fake lottery contingent upon an initial payment. Once the victim pays, they typically lose contact with the scammer or are pressured to send more money to access even greater returns.

Financial institutions play a vital role in reducing the risks associated with advance fee fraud. They must inform their customers about the signs of such scams:

When receiving messages from a business, it’s essential to verify the sender’s identity. Confirming the legitimacy of unfamiliar entities is also crucial—this can be done by checking business registrations on trusted online platforms like Companies House in the UK. Additionally, being vigilant about details like misspelt URLs or addresses within communications can help identify potential fraud.

Typical fraud schemes include loans, overpayments, lottery or cash prize winnings, vacation rentals, unexpected inheritances, and investment opportunities.

6. Credit Card Fraud

Credit card fraud ranks among the most prevalent forms of identity theft and fraudulent activity. It is characterised by the unauthorised utilisation of someone’s debit or credit card to either withdraw funds or make purchases. In the United States, 2022 saw a significant rise in such incidents, with 440,666 reported cases, reflecting a 13% increase compared to the previous year.

This type of fraud can be divided into two main types: card-not-present (CNP) fraud and card-present fraud. CNP fraud is increasingly common, where fraudsters use stolen credit card information to conduct various online transactions. This often includes large purchases or bulk orders, taking advantage of any delay in detection.

CNP fraud can also occur offline when criminals fill out payment forms using stolen information and send them via email or over the phone. The origins of such fraud can range from physical theft to phishing schemes via email or text messages and exploiting vulnerabilities in public Wi-Fi networks.

While less frequent today due to advancements like chip technology, PINs, and mobile payments, card-present fraud still takes place. Typical scenarios include theft of physical cards from individuals or residences, lost cards, cloning via skimming devices at ATMs or businesses, and interception of new or replacement cards during mail delivery.

Financial institutions must remain vigilant in monitoring and identifying suspicious credit card transactions. Implementing effective transaction oversight and fraud detection systems, along with educating customers on safe card usage, is crucial for combating this issue.

7. Investment Scams

Investment scams encompass a range of deceptive practices outlined in this guide. While some methods may be more easily identifiable than others, fraudsters often take extensive measures to make their websites, documents, and communications appear credible.

To safeguard against fraudulent investment schemes, it is crucial to educate both customers and employees to remain cautious about the following:

– Be wary of unsolicited calls, especially from unfamiliar companies or organisations.

– Research online reviews for any investment opportunity provider and verify their credentials with the appropriate local financial regulatory body, such as the FCA in the UK.

– Request legitimate documentation related to any investment proposal and consult a financial expert if there are any doubts.

8. Consumer Fraud

Consumer fraud refers to unlawful activities aimed at inflicting financial damage on individuals or groups. Some prevalent forms of consumer fraud include:

Identity Theft occurs when someone unlawfully acquires an individual’s personal information or card details, either digitally or through physical means. Once they have assumed the victim’s identity, they may try to access bank accounts and transfer funds without authorisation.

– Real Estate and Mortgage Fraud: This type of fraud involves dishonest practices within the real estate industry. According to the Boston division of the FBI, in 2021, over 11,000 people across the country suffered average losses totalling $350 million due to real estate scams—a 64% increase from the previous year. A significant aspect of this fraud is mortgage fraud, where individuals provide false information to secure a mortgage loan or manipulate loan conditions.

Misleading Advertising occurs when a company disseminates false information about the quality or advantages of its products or services, violating legal requirements that demand truthful advertising.

9. Deceptive Charitable Organizations

Deceptive charitable organisations take advantage of people’s kindness by soliciting donations for purportedly noble causes. In some cases, these entities may not exist at all, or con artists might fabricate campaigns using the names of well-known charities or legitimate causes.

Individuals who provide their credit card or personal details on such websites risk falling victim to identity theft or credit card fraud, as scammers can misuse the information gathered for illegal activities.

Financial institutions (FIs) play a crucial role in safeguarding customers from potential losses due to fraudulent charities by:

– Implementing transaction monitoring systems to identify suspicious patterns that may indicate fraudulent charitable activities. Various software solutions enable FIs to set alerts for large or atypical donations.

– Establishing a thorough customer due diligence (CDD) process to assess charitable organisations that wish to create accounts properly.

– Conducting real-time checks of charities against international watchlists and sanctions.

– Advising clients to be vigilant for warning signs such as urgency, ambiguous mission statements, and unsolicited outreach from unfamiliar charities. Firms should also encourage patrons to donate exclusively through verified platforms, like the charity’s official website.

10. Return Fraud

Return fraud involves dishonest tactics in which individuals manipulate the returns process for goods and services to gain financial benefits. It poses a significant challenge for the retail and e-commerce sectors.

This can include returning stolen items, presenting fake receipts, or exploiting the return systems for unauthorised refunds or store credits. Some prevalent tactics include:

Receipt Fraud involves illegally obtaining or fabricating receipts to return products and profit from the refunds. It might also involve buying an item at a lower price from one retailer and attempting to return it at another store where it has a higher retail price.

11. Chargeback Fraud

While numerous chargebacks are legitimate, chargeback fraud arises when a customer unjustly disputes a transaction through their payment provider. This type of fraud can lead to significant financial consequences for financial institutions and retailers, incurring unnecessary expenses and facilitating other illicit activities. According to experts, merchants faced over $100 billion in chargeback costs in 2023.

Before labelling a chargeback as fraudulent, it’s crucial to determine its legitimacy.

Legitimate chargebacks protect consumers and typically involve issues like billing mistakes, unauthorised transactions, or goods that were never delivered. Regulations such as the Fair Credit Billing Act (FCBA) and the Electronic Funds Transfer Act (EFTA) support these protections. Customers generally have a designated period, often 60 days under the FCBA, to contest charges, ensuring their safety against unauthorised transactions.

Conversely, fraudulent chargebacks, often referred to as friendly fraud, occur when customers falsely assert valid reasons for disputes, such as claiming unauthorised charges or items that were not received. Addressing these situations requires companies to demonstrate the authenticity of the charge in question. Merchants who suspect deceptive claims can dispute the chargeback, highlighting the necessity of distinguishing between valid and invalid claims to manage resources and defend against unfounded accusations effectively.

To combat chargeback fraud effectively, businesses should incorporate preventive strategies within a thorough risk management framework. Maintaining comprehensive customer documentation, implementing meticulous onboarding procedures, and keeping detailed records of customer interactions and transactions are essential for substantiating dispute claims.

Additionally, an effective transaction monitoring system can help detect subtle patterns that may indicate fraudulent activity, especially among repeat offenders.

12. Cybercrime

Cybercrime represents one of the most significant emerging threats facing financial institutions, businesses, and individuals globally. It is estimated that money laundering linked to cybercrime could reach an alarming $10.5 trillion.

Maxthon

In an era where the digital landscape is rapidly advancing, and our online interactions are in constant flux, ensuring personal safety while exploring the vast internet has become increasingly essential. The intricate web of connections that influences our online experiences necessitates a careful selection of a web browser—one that prioritises both security and privacy. Among the numerous options available, Maxthon stands out as a noteworthy choice, offering users a dependable solution to these pressing issues without incurring any costs. This advanced browser is equipped with a robust set of built-in features, such as an efficient ad blocker and various anti-tracking tools—key elements designed to bolster your online privacy.

Maxthon Browser Support for Windows 11

Maxthon’s compatibility with Windows 11 further reinforces its standing in the competitive browser market.

Maxthon has successfully established a unique identity within the crowded web browser sector, fueled by its strong commitment to providing a safe and private user experience. With a keen understanding of the many dangers present in the digital world, Maxthon takes proactive steps to protect personal information and online activities. Utilising cutting-edge encryption technologies, this browser guarantees that sensitive data remains secure and private during all online interactions.

When it comes to enhancing privacy while you navigate the web, Maxthon truly excels. Every aspect of this browser is thoughtfully designed to improve your privacy experience. Its powerful ad-blocking capabilities, thorough anti-tracking measures, and dedicated incognito mode work together to eliminate intrusive ads and minimise tracking scripts that could interfere with your browsing enjoyment. Consequently, users can explore the internet with a sense of renewed confidence and security. The incognito mode provides an extra layer of protection, allowing individuals to surf the web more discreetly.