As the world of banking increasingly transitions to digital platforms, the shadow of fraud looms more significant than ever. Cybercriminals, ever-adaptable and cunning, continuously devise new strategies to exploit the weaknesses in online banking systems, setting their sights on both consumers and financial institutions alike.  This detailed guide aims to unravel the complexities surrounding banking fraud, shedding light on its mechanisms, the repercussions it has for banks and their clientele, and the most effective methods for identifying and thwarting fraudulent activities in our modern, digitally-driven environment.

This detailed guide aims to unravel the complexities surrounding banking fraud, shedding light on its mechanisms, the repercussions it has for banks and their clientele, and the most effective methods for identifying and thwarting fraudulent activities in our modern, digitally-driven environment.

Understanding Banking Fraud: What Is It?

Banking fraud encompasses a range of illicit actions designed to unlawfully access bank accounts, personal information, or financial data. The goal is clear: to steal money, compromise sensitive information, or engage in other nefarious undertakings that disrupt the integrity of financial systems.

Why Is Banking Fraud Becoming More Concerning?

The rise of banking fraud is alarming, primarily because fraudsters have honed their skills and created increasingly sophisticated methods to exploit digital vulnerabilities. With more people relying on online banking and digital transactions, opportunities for these criminals to target both financial institutions and individual customers have multiplied. This surge in fraud can lead to substantial financial losses and tarnished reputations. Armed with advanced tools such as bots and social engineering tactics, the threat of fraud is more pervasive than it has ever been, underscoring the need for banks to maintain a high level of vigilance.

The Impact of Banking Fraud on Financial Institutions and Customers

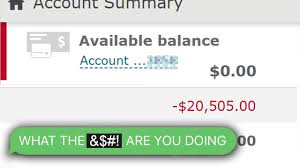

For banks, the consequences of fraud are multifaceted. They face not only direct financial losses but also additional costs associated with investigations and potential legal ramifications. The reputational damage can be profound, eroding the trust that customers place in their financial institutions. On the flip side, customers who fall victim to fraud often experience identity theft, monetary losses, and compromised credit scores, leading to significant emotional stress and financial strain. The journey to restore security and recover losses can be arduous for both banks and their customers.

Understanding Account Takeover Fraud in Banking

In banking, a pressing concern looms large: account takeover fraud. This insidious crime has evolved into a sophisticated threat, leaving both financial institutions and their customers vulnerable. But what exactly does it entail?

The Tactics of Cybercriminals

At the heart of account takeover fraud lies a series of cunning strategies employed by attackers to gain illicit access to bank accounts. Often, they initiate their assault through deceptive phishing schemes that lure unsuspecting individuals into revealing sensitive personal information, such as passwords or banking credentials. Through the art of social engineering, these criminals manipulate emotions and trust, convincing users to divulge critical data.

Moreover, the digital landscape is fraught with vulnerabilities that cybercriminals eagerly exploit. They may resort to brute-force attacks, relentlessly attempting various password combinations until they succeed. Credential stuffing, another common tactic, involves using stolen login information from one platform to breach accounts on another. Additionally, some attackers employ session hijacking, where they stealthily intercept a user’s online banking session, allowing them to seize control of the account undetected.

The Role of Financial Institutions in Combatting Fraud

As the threat of account takeover looms, financial institutions have stepped up their defences. Utilising advanced technologies such as behaviour analytics and machine learning, banks actively monitor user activities to identify potential threats. By analysing login patterns, device usage, and transaction behaviours, they can detect anomalies indicative of suspicious activity—like failed login attempts from unfamiliar locations or unexpected alterations to account settings.

This proactive approach to detection is crucial; early identification of fraudulent attempts can thwart significant damage before it escalates. To further educate themselves on this pressing issue, many institutions encourage stakeholders to delve deeper into the intricacies of account takeover through informative resources available on their blogs.

A Glimpse into New Account Fraud

Beyond account takeovers lies another troubling phenomenon: new account fraud. This type of fraud occurs when nefarious actors fabricate fake accounts utilising stolen or synthetic identities. With these counterfeit accounts in hand, they engage in fraudulent transactions, launder money, or exploit credit lines without detection.

The Consequences of New Account Fraud

The implications of new account fraud are vast and profound, posing several risks to financial institutions:

In the ever-evolving landscape of digital finance, a shadow looms over the convenience and efficiency that online banking offers. This shadow takes the form of various types of fraud, each with its sinister tactics that lead to significant repercussions for both banks and their customers.

The Impact of Financial Deceit

Imagine a bustling bank where customers trustingly deposit their hard-earned money. Suddenly, fraudulent transactions emerge like thieves in the night, resulting in direct financial blows to both the institutions and their patrons. The losses pile up, leaving behind a trail of anxiety and uncertainty. As these incidents unfold, the world of finance is shaken, revealing vulnerabilities that were once thought secure.

But it doesn’t stop there. Within this murky underbelly of criminal activity lies the insidious practice of money laundering. Here, unscrupulous individuals exploit counterfeit accounts as conduits for moving illicit funds, effectively cloaking their nefarious activities in a shroud of legitimacy. The ramifications extend far beyond mere monetary theft; they taint the very fabric of the banking system.

The Ripple Effect on Trust

As news of these fraud incidents spreads, customer trust begins to erode. The once-solid relationship between banks and clients becomes strained as individuals question the safety of their assets. This reputational damage can take years to mend, with institutions scrambling to rebuild confidence through transparency and enhanced security measures.

In addition to reputational harm, banks also face the threat of regulatory penalties. Failure to implement adequate safeguards against fraud can lead to legal actions and hefty fines, further complicating their operational landscape. Institutions find themselves caught in a web of compliance requirements, struggling to stay one step ahead of both criminals and regulators.

The Cost of Combatting Fraud

To combat this rising tide of deception, banks must allocate substantial resources toward managing fraud cases and upgrading their security infrastructures. Each fraudulent attempt necessitates a response, drawing on workforce and technology that could be utilised elsewhere. The operational costs mount, stretching budgets and diverting attention from other critical areas of service improvement.

Yet even with these efforts, detecting fraud remains a formidable challenge. Fraudsters wield sophisticated tactics that continually evolve, making it increasingly difficult for institutions to identify suspicious activities in real time. Their cunning methods often outpace the systems put in place to safeguard against them.

Unveiling New Account Fraud

Amidst this chaos, one particularly alarming trend has emerged: new account fraud. This type of deception occurs when criminals use stolen identities or manipulated information to open fraudulent accounts within legitimate banks. It’s a game of cat and mouse where the stakes are high, and the consequences can be devastating.

Understanding Online Banking Fraud

At its core, online banking fraud encompasses unauthorised actions taken on digital platforms designed for financial transactions. These actions not only lead to theft but also manipulate the intricate workings of online banking systems.

Common Forms of Deception

Among the most prevalent forms of online banking fraud are phishing schemes. Here, fraudsters craft convincing emails or websites that mimic legitimate banks, luring unsuspecting users into divulging sensitive information. Similarly alarming is account takeover, where hackers seize control of existing accounts using stolen credentials, leaving victims reeling from the sudden loss of access to their finances.

Identity theft adds another layer of complexity to this issue. Criminals exploit stolen personal information to create fake accounts, further muddying the waters of financial integrity. Then there are man-in-the-middle attacks—covert operations where cybercriminals intercept communications between users and banks, snatching up valuable data without detection.

The Role of Deception in Fraud

Phishing and social engineering play pivotal roles in online banking fraud schemes. By manipulating human psychology, fraudsters impersonate trusted entities, sending deceptive communications that trick individuals into surrendering their credentials. Once acquired, these details open doors to unauthorised access and transactions that wreak havoc on victims’ finances.

The Automation of Deceit

Adding to the challenge is the emergence of bots—automated programs designed to execute fraudulent activities on a massive scale. These digital marauders enable attackers to perform credential stuffing attacks, brute-force logins, and fraudulent transaction execution at a pace that often outstrips traditional manual detection methods.

Fighting Back Against Fraud

Financial institutions are not without recourse in this relentless battle against online banking fraud. To detect and prevent such fraudulent activities, they must adopt robust strategies, including real-time monitoring systems that identify anomalies and behavioural analyses that flag suspicious behaviour before it escalates.

As we navigate this complex landscape, it becomes clear that vigilance is paramount. Only through a combination of advanced technology and proactive measures can banks hope to safeguard their assets and restore trust among their valued customers in an age where digital deceit is increasingly prevalent.

In the ever-evolving world of online banking, financial institutions face a formidable adversary: fraud. To combat this challenge, they have adopted a range of innovative strategies aimed at detecting and preventing fraudulent activities. One of the cornerstones of these strategies is real-time monitoring. By continuously observing transactions as they occur, banks can quickly identify any unusual patterns that may signal fraudulent behaviour. Coupled with anomaly detection and behavioural analysis, these methods work in concert to raise red flags whenever something seems amiss.

To further bolster their defences, financial institutions employ multi-factor authentication (MFA), a robust security measure that adds additional layers of protection. This process requires users to provide multiple forms of verification before they can access their accounts, making it significantly more difficult for unauthorised individuals to gain entry. Moreover, cutting-edge technologies like Arkose Labs’ bot detection and mitigation software play an essential role in safeguarding banks from automated attacks. By analysing user behaviour and swiftly identifying potential fraud attempts, these solutions act as vigilant guardians, intervening before damage can be done.

As we delve deeper into the landscape of online banking fraud, we must also consider the insidious role that bots play in this realm. Cybercriminals frequently employ these automated programs to conduct large-scale credential-stuffing attacks and account takeovers. With the ability to launch numerous attacks simultaneously, bots allow fraudsters to operate at an alarming speed. However, there is hope on the horizon. Tools like Arkose Labs’ Bot Manager are specifically designed to counteract these threats by detecting and halting bot-driven fraud activities in real-time, thus protecting both financial institutions and their customers.

But what can customers do to shield themselves from the looming threat of online banking fraud? The answer lies in adopting secure online behaviours. Simple yet effective practices, such as enabling multi-factor authentication and steering clear of public Wi-Fi for banking transactions, can make a significant difference in protecting personal information. Additionally, remaining alert for phishing scams and regularly updating passwords are crucial steps in maintaining security. Monitoring account activity for any signs of suspicious behaviour further empowers customers to take control of their financial safety.

An integral aspect of modern fraud prevention lies in the power of behavioural analytics. This sophisticated technique involves tracking user behaviours—such as transaction history and device usage—to identify deviations from established norms. By gaining insight into what constitutes typical behaviour for each user, financial institutions can swiftly flag actions that appear out of character, potentially indicating fraudulent activity.

In this age of technological advancement, biometric authentication has emerged as a powerful tool for strengthening security measures. By utilising unique physical traits like fingerprints or facial recognition, biometric systems create a formidable barrier against unauthorised access. Unlike traditional passwords that can be easily compromised or replicated, biometric identifiers are inherently more secure, making it exceedingly difficult for fraudsters to impersonate legitimate users.

Lastly, we cannot overlook the significance of multi-factor authentication (MFA) in the realm of banking security. This multi-layered approach requires users to provide multiple proofs of identity before gaining access to their accounts, effectively creating a formidable line of defence against unauthorised access. By incorporating MFA into their security protocols, financial institutions not only protect their assets but also instil confidence in their customers, assuring them that their personal information is safe and sound.

In conclusion, as the digital landscape continues to evolve, so too do the tactics employed by both fraudsters and those who seek to thwart them. Through a combination of advanced technology, vigilant customer practices, and innovative security measures, financial institutions can create a secure environment for online banking while empowering customers to take charge of their safety.

The Distinctive Challenges of Fraud in the Banking Sector

The landscape of fraud is not uniform; it morphs and shifts depending on the specific financial services being offered and the clientele being served. Each segment of the banking industry encounters its own set of fraud-related hurdles. Let’s explore how these challenges manifest across different financial sectors.

The Variability of Fraud Tactics in Banking

Fraudulent schemes are not one-size-fits-all. Retail banks, for instance, frequently grapple with issues such as account takeovers, where malicious actors hijack customer accounts for illicit gain. In contrast, investment firms may be more susceptible to sophisticated methods like insider trading or wire fraud. Such differences underline the necessity for customised strategies aimed at preventing fraud tailored to each sector’s unique vulnerabilities.

Traditional Banks vs. Online-Only Banks: A Comparative Analysis of Fraud Impact

A distinct disparity emerges in the types of fraud traditional institutions encounter compared to their online-only counterparts. Traditional institutions contend with a hybrid mix of physical and digital fraud stemming from their brick-and-mortar operations and online services. On the other hand, online-only banks are singularly focused on thwarting cyber-based threats. These digital banks often become prime targets for phishing attempts, credential stuffing, and an array of other online fraudulent activities that exploit their virtual nature.

Real-World Illustrations of Banking Fraud

To illuminate the pressing issue of banking fraud, let’s examine some compelling case studies that illustrate the challenges and solutions faced by banks today.

Case Study: A Global Bank’s Fight Against Account Takeover Attacks

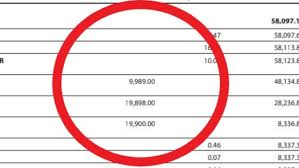

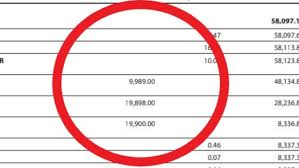

Consider a prominent global bank managing assets exceeding $1 trillion. This institution found itself increasingly under siege from advanced cybercriminals deploying bots to execute account takeover (ATO) and new account fraud schemes. Unfortunately, their existing security measures—reliant on outdated text-based CAPTCHAs—proved ineffective against these rising automated threats. As a result, legitimate customers faced mounting friction while navigating their banking experience.

In response to this escalating crisis, the bank adopted the Arkose Bot Manager, a cutting-edge detection and mitigation solution explicitly designed to combat such automated attacks. This strategic shift yielded remarkable results: a significant reduction in bot-driven assaults while ensuring that genuine customers enjoyed a seamless experience. Ultimately, this proactive approach not only bolstered fraud prevention but also enhanced regulatory compliance, creating a safer and more user-friendly banking environment.

Case Study: A Major U.S. Bank’s Six-Figure Savings

Next, let’s examine one of the largest banks in the United States. It was grappling with a dramatic increase in bot-driven account takeover attempts alongside an unsettling rise in unknown session traffic—even with an extensive layered security framework in place. These complications eroded customer trust and necessitated expensive and time-consuming downstream efforts to detect fraud.

Recognising the urgent need for a more effective solution, the bank turned to Arkose Bot Manager for its robust detection and mitigation capabilities. This timely intervention not only safeguarded customer accounts but also resulted in substantial financial savings—amounting to six figures—by drastically reducing the resources spent on fraud detection and recovery.

These case studies vividly illustrate the multifaceted nature of banking fraud and underscore the importance of adopting specialised strategies to combat these evolving threats effectively. As the banking sector continues to navigate this complex landscape, the lessons learned from such experiences will undoubtedly shape future approaches to safeguarding financial integrity.

In the ever-evolving world of banking, fraud looms large, threatening the trust and security that financial institutions strive to uphold. To combat this insidious challenge, banks must adopt a comprehensive strategy, weaving together time-honoured security practices with cutting-edge technology.

Imagine a bustling ban, where every transaction is a testament to the institution’s reliability. Yet, lurking in the shadows are sophisticated cybercriminals, always searching for vulnerabilities to exploit. In this landscape, it becomes crucial for banks to bolster their defences. One of the first steps on this journey involves integrating advanced bot detection and mitigation systems into their existing security frameworks. These digital sentinels work tirelessly to identify and neutralise automated threats before they can wreak havoc.

As we delve deeper into the bank’s fortress of security, we encounter the concept of multi-factor authentication. Picture a vault that not only requires a key but also demands a unique code sent to your phone or perhaps even a fingerprint scan. This additional layer of protection ensures that even if a would-be fraudster manages to obtain a password, they are still thwarted by these extra barriers.

But technology alone isn’t enough; the human element remains vital. Within the bank’s walls, employees partake in regular training sessions designed to sharpen their awareness of phishing schemes and other deceptive tactics employed by criminals. They learn to spot the signs of suspicious activity, becoming vigilant guardians of the institution’s integrity.

Meanwhile, customers are also invited into this educational journey. Through workshops and informational materials, they become informed participants in the fight against fraud, equipping themselves with knowledge about potential scams that could target their accounts.

And as the world changes, so too must the bank’s defenses. Regular updates to security protocols ensure that they remain agile and ready to confront new threats as they emerge. This commitment to vigilance and adaptation helps safeguard not just the institution but also the hard-earned assets of its clientele.

In this intricate dance of prevention, each measure—be it technological or educational—plays a critical role in fortifying the bank against the ever-present risk of fraud. By embracing a holistic approach that combines innovation with awareness, financial institutions can create a secure environment where trust flourishes, and customers feel safe in their transactions.

Maxthon

In today’s fast-paced digital world, where technology is intricately woven into the fabric of our daily lives and sharing information has become second nature, it’s crucial to tread carefully when it comes to revealing personal and sensitive data. Picture this: you receive a message that seems harmless, perhaps a text or an email, asking for some of your information. Before you act on impulse and provide what’s being requested, pause for a moment. Reflect on the possible consequences of your response. Familiarising yourself with how organisations typically reach out to their clients can equip you with the insight needed to discern what information they might legitimately require.

Maxthon browser Windows 11 support

Let’s consider a scenario involving your bank. It’s improbable that they would send you an email filled with links prompting you to log into your online account. Such a tactic should immediately raise red flags. If you ever find yourself unsure about the authenticity of a request for your personal information, don’t hesitate to pick up the phone and contact the bank directly. Ask them to clarify the reasons for their inquiry. When it comes to protecting your private data, maintaining a cautious and thoughtful approach is always the best policy.

Now, turning our attention to Maxthon, a web browser that has notably enhanced its features to prioritise online privacy. Maxthon adopts a holistic approach that emphasises user safety and data security as its primary objectives. At its foundation, this browser is equipped with state-of-the-art encryption technologies, which serve as a formidable defence against unauthorised access during online transactions. Each time users engage with web applications through Maxthon, their sensitive information—ranging from passwords to personal identifiers—is meticulously encrypted and safeguarded.

Maxthon private browser for online privacy

In this age of digital interconnectedness, where every click can lead to exposure, Maxthon is a bastion of security. It ensures that your online experience remains not only convenient but also secure. So, as you navigate this ever-evolving landscape, remember to safeguard your personal information with vigilance and let Maxthon be your trusted ally in maintaining your online privacy.