In a dimly lit room, a devoted young couple sat side by side, their eyes fixed on the glowing screen of a laptop. They were meticulously sifting through various documents, determined to ensure that every detail was in order. Their seriousness underscored the importance of what they were doing—protecting their financial future.

As they navigated the complexities of online banking, they were acutely aware of the lurking threat of fraud. The couple understood that safeguarding their bank account from potential scams was not just about putting up defences; it required vigilance against a multitude of dangers. They realised that it wasn’t simply a choice between one method of protection or another—they needed to be proactive on both fronts to shield their finances effectively.

Five Strategies to Prevent Fraudsters from Seizing Your Account

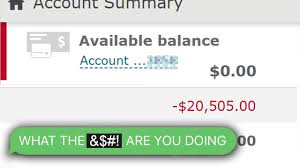

The couple knew that if a fraudster managed to infiltrate their bank account, the consequences could be dire. Money could vanish at lightning speed through unauthorised withdrawals or transfers. While there was a chance the bank would refund any stolen funds, the couple recognised that prevention was far superior to remedy. Thus, they committed themselves to implementing robust security measures.

1. Register for Online Banking

The notion of avoiding online banking as a means of protection was a fallacy. Even if they intended to keep their financial activities offline, they understood the necessity of gaining online access to their accounts. This way, they could thwart any attempts by others to open an account in their name. By registering, they also discovered the capability to set up alerts that would notify them via text or email about significant account activities—whether it was a low balance or an unexpectedly large transaction.

2. Craft a Distinct Password

As the couple delved deeper into online security, they learned the importance of creating a password that was entirely distinct from those they used elsewhere. They steered clear of predictable choices like “password123” or their pet’s name followed by numbers. They understood that cybercriminals often exploited weak or reused passwords, especially those exposed during data breaches. To bolster their defences, they considered utilising a password manager, which would help them generate and store robust passwords securely.

3. Activate Multifactor Authentication

Empowered by their newfound knowledge, the couple decided to enable multifactor authentication (MFA) for their bank account. With MFA in place, accessing their account would require not only their username and password but also an additional verification step. This could take the form of a code sent to their phone or email or even generated by an authenticator app. They knew this extra layer of security would significantly enhance their protection against unauthorised access.

In this journey towards financial security, the couple’s diligence and determination became their most significant allies. They embraced these practices with a sense of responsibility, knowing that each small step they took contributed to safeguarding their hard-earned savings from the ever-present threat of fraud. Together, they forged a path to a more secure financial future—one where vigilance and preparation stood as their strongest defences against deceitful schemes.

Safeguarding Your Finances: A Narrative on Staying One Step Ahead of Fraud

In the modern age, where technology intertwines with our daily lives, securing our financial information has become more critical than ever. One of the most effective ways to bolster your account’s defences is by employing a physical security key or a passkey as part of your multi-factor authentication (MFA). This additional layer of protection ensures that even if someone manages to obtain your password, they would still need this tangible device to gain access. It’s important to note, however, that not all banks are equipped to support these advanced security measures.

As you embark on your journey to fortify your digital fortress, remember the importance of keeping your devices in tip-top shape. Just as you wouldn’t neglect to change the oil in your car, you shouldn’t overlook the necessity of regular updates and malware scans on your devices. Malware can infiltrate your systems and create a gateway for nefarious individuals to pilfer your sensitive information or compromise your bank accounts. By routinely updating your software and conducting thorough antivirus checks, you can effectively shield yourself from these invisible threats lurking in cyberspace.

While these technological safeguards lay a solid foundation for protecting your bank account, the real challenge often lies in the realm of social engineering. This psychological manipulation can ensnare even the most vigilant individuals, as fraudsters employ cunning tactics to deceive their victims. It’s crucial to understand that if you fall prey to such schemes and unwittingly transfer funds to a scammer, your bank may not always provide compensation for those losses. Furthermore, once you’ve been targeted, there’s a risk that these scammers will continue to pursue you, potentially leading to even more significant financial repercussions.

One of the first steps in protecting yourself is recognising that no one is immune to deception. Many people operate under the false assumption that they are too savvy to be caught in a scam. It’s a common mindset; after all, scams seem so evident in hindsight. Yet, what many fail to realise is that fraudsters invest considerable time and effort into understanding human behaviour and refining their approaches. They study their targets meticulously, crafting their strategies to exploit vulnerabilities.

To navigate this treacherous landscape, take a moment tofamiliarisee yourself with a comprehensive checklist designed to help you avoid falling victim to scams. This proactive measure empowers you to remain vigilant and aware, ensuring that you don’t become the next unsuspecting target in the fraudster’s crosshairs. Remember, knowledge is your best defence, and cultivating an awareness of potential threats can make all the difference in safeguarding your hard-earned money.

Exercise Extreme Caution When Fear Strikes

In the shadowy world of scams, fear is a weapon that fraudsters wield with alarming effectiveness. Picture this: you receive an urgent call from someone claiming to be from the police, the IRS, or even the FBI. They may assert that your employer is involved in some dubious activity, or they might create a sense of urgency, suggesting that if you don’t act fast, you’ll lose out on an incredible opportunity. It’s a high-pressure tactic designed to make you panic and act impulsively.

If you find yourself gripped by fear during such a moment, take a deep breath and pause for just two minutes. Reach out to a trusted friend or family member. Share what you’re experiencing; let them know what’s happening. They can provide clarity and perspective when your mind feels clouded. Always keep in mind that legitimate representatives from banks or government agencies will never ask for sensitive information like your password or multi-factor authentication code. They won’t guide you through making payments over the phone, nor will they be upset if you decide to end a call and return it using a verified number from their official website.

Mastering the Art of Identifying Phishing Scams

In today’s digital landscape, scammers have become adept at impersonating legitimate institutions, primarily through emails and text messages. They can easily spoof email addresses or phone numbers to make it appear as though their communication is coming straight from your bank. If you’re not careful, clicking on a link in one of these deceptive messages could lead you to a counterfeit website where you might unwittingly provide your login details.

Be vigilant when encountering emails or texts that urge you to reset your password, instruct you to log into your account, or alert you about suspicious transactions. These could be the opening moves of a well-crafted scam. To stay safe, always navigate directly to your banking app or the official bank website yourself. If you need to speak with someone at the bank, use a contact number sourced from their website rather than any link or number included in the suspicious message.

Stay Alert for Familiar Scamming Tactics

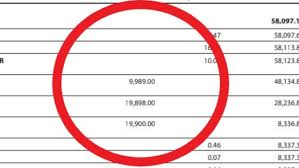

Fraudsters often employ various standard methods to swindle unsuspecting victims out of their hard-earned money. One prevalent technique involves peer-to-peer (P2P) payment scams. In this scenario, you might receive a text or email informing you that your bank account has been compromised or inquiring about an unauthorised transaction. The scammer will then try to manipulate you into sending money from your bank account through one of these payment apps under the guise of “verifying” your account.

Romance scams are another frequent ploy, often initiated through dating apps or social media platforms. Despite their name, these scams aren’t limited to romantic intentions; they can also manifest in platonic relationships. Scammers may spend months building trust and rapport before eventually requesting gifts or money, exploiting the connection they’ve fostered.

Staying informed and cautious is the best defence against falling prey to these schemes when navigating these treacherous waters.

In the shadowy world of online transactions, one common trick has emerged: overpayment scams. Picture this scenario: someone unexpectedly transfers money to you, only to follow up with a message claiming they accidentally sent too much and requesting that you return the excess. You might think you’re simply helping out, but here’s the catch—the funds you send back are likely to disappear into the hands of a con artist. At the same time, the original payment you received will be reversed days later, leaving you in a precarious situation. These criminals are relentless; they continually devise new schemes or put fresh spins on old ones, constantly looking for unsuspecting victims.

Now, let’s delve into another red flag: job offers that entice you with promises of easy income through depositing and transferring money. These postings can seem innocuous at first glance, but lurking beneath the surface is a grim reality. The individuals behind these ads are often using you as what’s known as a “money mule,” a pawn in their illicit operations. Without your knowledge, you could be unwittingly laundering money, potentially putting yourself at risk of committing a federal offence.

If you ever find yourself in the unfortunate position of suspecting that your bank account has been compromised—whether due to unauthorised access or a fraudulent transaction—you must take immediate action to protect yourself. Here are some steps to consider:

First and foremost, contact your bank and explain the situation; they will guide you through the necessary measures to secure your account. Next, change your password right away to prevent further access. It’s also crucial to report any fraudulent activity to the Federal Trade Commission (FTC), as they can assist in tracking down these scammers. Don’t forget to file a police report; this not only documents the crime but may also aid in recovering any lost funds.

As you navigate this unsettling experience, it’s wise to scan your devices with antivirus software to ensure no hidden threats are lurking on your technology. Additionally, consider placing a security freeze on your ChexSystems report, which can make it more challenging for anyone to open a new bank account in your name without your consent. Similarly, applying security freezes and fraud alerts to your credit reports can provide an extra layer of protection against identity theft.

By taking these proactive steps, you can better safeguard yourself against the ever-evolving landscape of financial fraud. Remember, awareness and vigilance are your best defences in this digital age.

In the shadowy world of online transactions, one common trick has emerged: overpayment scams. Picture this scenario: someone unexpectedly transfers money to you, only to follow up with a message claiming they accidentally sent too much and requesting that you return the excess. You might think you’re simply helping out, but here’s the catch—the funds you send back are likely to disappear into the hands of a con artist. At the same time, the original payment you received will be reversed days later, leaving you in a precarious situation. These criminals are relentless; they continually devise new schemes or put fresh spins on old ones, constantly looking for unsuspecting victims.

Now, let’s delve into another red flag: job offers that entice you with promises of easy income through depositing and transferring money. These postings can seem innocuous at first glance, but lurking beneath the surface is a grim reality. The individuals behind these ads are often using you as what’s known as a “money mule,” a pawn in their illicit operations. Without your knowledge, you could be unwittingly laundering money, potentially putting yourself at risk of committing a federal offence.

If you ever find yourself in the unfortunate position of suspecting that your bank account has been compromised—whether due to unauthorised access or a fraudulent transaction—you must take immediate action to protect yourself. Here are some steps to consider:

First and foremost, contact your bank and explain the situation; they will guide you through the necessary measures to secure your account. Next, change your password right away to prevent further access. It’s also crucial to report any fraudulent activity to the Federal Trade Commission (FTC), as they can assist in tracking down these scammers. Don’t forget to file a police report; this not only documents the crime but may also aid in recovering any lost funds.

As you navigate this unsettling experience, it’s wise to scan your devices with antivirus software to ensure no hidden threats are lurking on your technology. Additionally, consider placing a security freeze on your ChexSystems report, which can make it more challenging for anyone to open a new bank account in your name without your consent. Similarly, applying security freezes and fraud alerts to your credit reports can provide an extra layer of protection against identity theft.

By taking these proactive steps, you can better safeguard yourself against the ever-evolving landscape of financial fraud. Remember, awareness and vigilance are your best defences in this digital age.

In the shadowy world of online transactions, one common trick has emerged: overpayment scams. Picture this scenario: someone unexpectedly transfers money to you, only to follow up with a message claiming they accidentally sent too much and requesting that you return the excess. You might think you’re simply helping out, but here’s the catch—the funds you send back are likely to disappear into the hands of a con artist. At the same time, the original payment you received will be reversed days later, leaving you in a precarious situation. These criminals are relentless; they continually devise new schemes or put fresh spins on old ones, constantly looking for unsuspecting victims.

Now, let’s delve into another red flag: job offers that entice you with promises of easy income through depositing and transferring money. These postings can seem innocuous at first glance, but lurking beneath the surface is a grim reality. The individuals behind these ads are often using you as what’s known as a “money mule,” a pawn in their illicit operations. Without your knowledge, you could be unwittingly laundering money, potentially putting yourself at risk of committing a federal offence.

If you ever find yourself in the unfortunate position of suspecting that your bank account has been compromised—whether due to unauthorised access or a fraudulent transaction—you must take immediate action to protect yourself. Here are some steps to consider:

First and foremost, contact your bank and explain the situation; they will guide you through the necessary measures to secure your account. Next, change your password right away to prevent further access. It’s also crucial to report any fraudulent activity to the Federal Trade Commission (FTC), as they can assist in tracking down these scammers. Don’t forget to file a police report; this not only documents the crime but may also aid in recovering any lost funds.

As you navigate this unsettling experience, it’s wise to scan your devices with antivirus software to ensure no hidden threats are lurking on your technology. Additionally, consider placing a security freeze on your ChexSystems report, which can make it more challenging for anyone to open a new bank account in your name without your consent. Similarly, applying security freezes and fraud alerts to your credit reports can provide an extra layer of protection against identity theft.

By taking these proactive steps, you can better safeguard yourself against the ever-evolving landscape of financial fraud. Remember, awareness and vigilance are your best defences in this digital age.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the free Maxthon Browser. It comes with built-in AdBlock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance its users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising its users’ privacy and security is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in AdBlock and anti-tracking software. These features help protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser delivers a seamless browsing experience and prioritises its users’ privacy and security through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

Maxthon browser Windows 11 support

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon private browser for online privacy

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.

By choosing Maxthon Browser, users can feel confident that their online activities are safeguarded from potential threats and invasions of privacy. In an age where digital security is more important than ever, opting for a browser like Maxthon is a proactive step towards ensuring a safer online experience. Embrace the reassurance of secure browsing with Maxthon Browser today!