In today’s fast-paced digital landscape, online banking has revolutionised the way we manage our finances. Gone are the days of standing in long lines at the bank; now, with just a few taps on your smartphone or clicks on your computer, you can effortlessly check your account balances, transfer funds between accounts, and even apply for loans—all from the comfort of your home.

Yet, with this incredible convenience comes a darker side. As online banking becomes increasingly popular, so too does the rise of cyber threats. Scammers and hackers are constantly evolving their tactics to steal sensitive financial information, putting your hard-earned money at risk.

At DBS Bank, we understand the importance of your security. We are committed to helping you navigate this complex digital landscape safely. From robust encryption to two-factor authentication, we employ advanced measures to protect your personal information.

We believe that staying informed is your best defence against fraud. That’s why we offer resources and tips to help you recognise potential threats and safeguard what matters most to you. Together, we can ensure that your online banking experience remains as secure as it is convenient.

In today’s fast-paced digital landscape, online banking has transformed the way we manage our finances. The era of standing in long lines at the bank is now a distant memory. With just a few taps on your smartphone or clicks on your computer, you can effortlessly check your account balances, transfer funds between accounts, and even apply for loans—all from the comfort of your home.

However, this incredible convenience comes with its own set of challenges. As online banking gains popularity, so does the threat of cybercrime. Scammers and hackers are continuously refining their tactics, seeking to steal sensitive financial information and compromise your hard-earned money.

At DBS Bank, we recognise the vital importance of your security in this complex digital landscape. We are dedicated to helping you navigate these waters safely. Our commitment includes employing advanced measures such as robust encryption and two-factor authentication to safeguard your personal information.

But we believe that staying informed is your best defence against fraud. Knowledge is power, and together, we can ensure that your online banking experience remains secure and worry-free.

Understanding Common Online Banking Scams

In the digital age, safeguarding your financial information is more crucial than ever. The first step in this protective journey is awareness—recognising the tactics employed by cybercriminals can make all the difference.

Take phishing scams, for example. These are among the most prevalent threats lurking in your inbox. Imagine checking your email one morning and seeing a message that looks strikingly familiar, claiming to be from your bank. The subject line screams urgency: “Your account has been compromised! Click here to reset your password.”

At first glance, it seems legitimate. The logo, the language—it all feels right. But lurking beneath that polished exterior is a trap waiting to ensnare the unsuspecting. Clicking on the provided link could take you to a fraudulent website, expertly crafted to mimic your bank’s official page. There, your login credentials could be easily captured, leaving you vulnerable to identity theft and financial loss.

The world of online banking scams is filled with such deceptions. By staying informed and cautious, you can protect yourself from falling victim to these clever schemes.

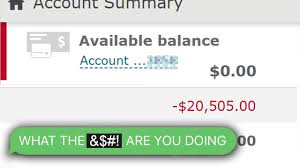

Identity theft is a sinister crime that can unravel the very fabric of your financial security. Imagine waking up one morning to find that someone has stolen your personal information—your Social Security number, bank account details, or online passwords. It feels like a violation, an invasion of your most private space.

Scammers, often operating from behind a veil of anonymity, use this information to commit fraud in your name. They might open credit cards, racking up charges that you will be responsible for. The thought of strangers swiping your hard-earned money is enough to make anyone’s skin crawl. In a world where convenience reigns supreme, mobile banking has become an integral part of everyday life. However, lurking in the shadows are fraudulent mobile apps that expertly mimic legitimate banking applications. These counterfeit apps often appear almost identical to the trusted ones, complete with logos and interfaces designed to deceive.

Imagine a user, blissfully unaware, downloading what they believe is their bank’s app. As they enter their login credentials, a sinister plot unfolds. The fake app silently captures this sensitive information, sending it straight to cyber criminals who lie in wait. With access to the victim’s account, these criminals can drain funds or conduct unauthorised transactions, leaving the user in a state of shock and helplessness.

The ease with which these scams operate is alarming. Many people are unaware of the warning signs, such as subtle differences in the app’s name or poor reviews in app stores. As technology advances, so do the tactics of these fraudsters, making it increasingly difficult for users to distinguish between genuine and fake banking apps.

This modern-day heist underscores the importance of vigilance and caution. Always verify the source of an app before downloading it, and consider using two-factor authentication for an added layer of security. Knowledge and awareness are your strongest allies in the battle against digital deception.

But it doesn’t stop there. In more severe cases, they may even take out loans, leaving you with a mountain of debt that you never incurred. The repercussions can ripple through your life, affecting your credit score and making it difficult to secure loans or mortgages in the future.

Restoring your identity after such an event can be a lengthy and exhausting process. You may find yourself locked in battles with banks and credit agencies, trying to prove that you are indeed who you say you are. In this digital age, protecting your personal information has never been more crucial.

In today’s digital age, social engineering scams have become alarmingly common. Scammers often take on the guise of trusted figures, such as bank representatives or government officials. They may even pose as a family member in urgent need of help, creating an emotional pull that’s hard to resist.

Imagine receiving a phone call from someone claiming to be your bank’s fraud department. They speak with urgency, insisting that your account has been compromised and immediate action is required. Before you know it, they’re asking for personal information—your social security number, account details, or passwords—all under the pretence of protecting your finances.

Other times, you might receive a message on social media from a familiar face, someone you haven’t spoken to in years. They tell a harrowing tale of being stranded overseas or facing a sudden medical emergency. The plea for help feels genuine, and the instinct to assist can override caution.

These scammers are skilled manipulators, weaving stories that tug at heartstrings or incite fear. Their goal is simple: to extract sensitive information or money from unsuspecting victims. It’s essential to remain vigilant and verify any unusual requests, no matter how convincing they may seem. Remember, a little scepticism can go a long way in protecting yourself from these deceitful tactics.

Safeguarding Your Financial Data: A Journey to Online Security

As you embark on your online banking journey, it’s essential to recognise the potential dangers lurking in the digital realm. Equipped with this knowledge, you can take proactive measures to ensure that your banking experience remains safe and secure. Let’s explore the steps you can incorporate into your routine, making your financial information as impenetrable as a fortress.

Crafting Unbreakable Passwords

Imagine your password as the sturdy gate guarding your treasure trove of personal data. To fortify this gate, create a password that blends uppercase and lowercase letters, numbers, and special symbols. Steer clear of obvious choices like birthdays or names that might be easily guessed. For those who find the task of remembering multiple complex passwords daunting, consider enlisting the help of a password manager. This tool not only generates robust passwords but also keeps them securely tucked away for you.

The Shield of Two-Factor Authentication

In the world of online banking, two-factor authentication (2FA) acts as an additional shield, reinforcing your defences. Many financial institutions, including DBS Bank, provide this valuable feature. By activating 2FA, you’ll introduce a second layer of security, requiring a unique verification step—like a one-time code sent directly to your phone—before you can access your account. This extra measure significantly complicates matters for any would-be intruders who might have acquired your password.

Navigating the Waters of Communication

In this age of digital communication, it’s crucial to remain vigilant against potential phishing attempts. Never fall into the trap of clicking links found in unsolicited emails or text messages that land in your inbox. Instead, take the safer route: manually type your bank’s official web address into your browser. If an unexpected message claiming to be from DBS Bank catches your eye, do not hesitate to reach out to us directly for confirmation. It’s always better to be safe than sorry.

Keeping a Watchful Eye on Your Finances

Regularly monitoring your bank accounts is akin to having a watchful guardian over your finances. Make it a habit to scrutinise your bank statements and account activity for any signs of unauthorised transactions. Should anything seem amiss, act swiftly and report it without delay. Many banks now offer real-time alerts for transactions, ensuring you receive immediate notifications for any suspicious activity that might occur.

Fortifying Your Devices

Your computer, smartphone, and tablet are the gateways through which you access your financial world. To keep these devices secure, ensure they are equipped with the latest security updates and antivirus software. Cybercriminals are constantly on the prowl, often exploiting weaknesses in outdated systems to infiltrate personal information. Regular maintenance of your devices will help safeguard against such intrusions.

Trusting Only Official Banking Applications

When it comes to mobile banking, always choose to download apps from reputable sources like the App Store or Google Play. Before clicking that download button, verify that DBS Bank genuinely publishes the app. This simple step can prevent you from falling victim to counterfeit applications designed with malicious intent, aiming to snatch away your sensitive information.

As you navigate through this digital landscape, let these guidelines serve as your compass, guiding you towards a secure online banking experience. By implementing these strategies, you can confidently protect your financial information and enjoy peace of mind in your financial endeavours.

A Cautionary Tale of Wi-Fi Woes and Financial Fortitude

In today’s fast-paced world, where connectivity is as essential as the air we breathe, we often find ourselves in bustling coffee shops, crowded airports, hotel lobbies, all eager to catch up on emails or check our bank accounts. But amidst this digital convenience lies a lurking danger: public Wi-Fi. Picture yourself sipping your favourite latte, the aroma wafting through the air, while you casually log into your online banking app. It’s easy to overlook the fact that these networks are often far from secure. Cybercriminals are like shadows in the night, waiting for the opportune moment to snatch your sensitive information right out of the ether. If you must access your finances in such a setting, consider wrapping your data in a cloak of protection with a virtual private network (VPN).

What to Do When Shadows Loom: A Guide Against Fraud

Despite our best efforts to stay safe, the spectre of fraud can still rear its ugly head. Imagine this unsettling scenario: you log into your account only to find something amiss. Perhaps there are transactions you don’t recognise, or worse, your account seems to have vanished entirely. In moments like these, it’s crucial to act swiftly and decisively. Here’s a roadmap to help you navigate this treacherous terrain:

1. Reach Out to DBS Bank

The first step is to pick up the phone and call DBS Bank. Our dedicated team stands ready to assist you in securing your account and stopping any further unauthorised activities in their tracks. Think of us as your financial lifeguards, always on duty.

2. Revamp Your Passwords

As soon as you suspect foul play, it’s time to take action by changing your passwords. Update not just your banking credentials but also any other accounts that could be at risk. A strong password is your fortress against unwanted intruders.

3. Keep an Eye on Your Credit

Just as a vigilant guardian watches over their domain, so too should you monitor your credit report. Look for any unfamiliar accounts or inquiries that might indicate fraudulent activity. You may also want to consider placing a fraud alert with credit bureaus to further shield yourself.

4. Report the Incident

Don’t remain silent in the face of wrongdoing. Filing a complaint with the Federal Trade Commission (FTC) or your local law enforcement can help raise awareness and prevent others from falling victim to similar scams. Your voice can become part of a larger chorus that fights against fraud.

Staying Safe with DBS Bank

At DBS Bank, our unwavering commitment is to safeguard your financial well-being. We consistently invest in cutting-edge security technology and offer resources designed to keep you informed about potential threats that lurk in the digital landscape. By remaining vigilant and adopting sound security practices, along with utilising the tools provided by DBS Bank, you can revel in the ease of online banking without the cloud of worry hanging overhead.

If you ever doubt or have concerns about the safety of your account, remember that our team is just a phone call away. Together, we can ensure that your financial journey remains secure and worry-free, allowing you to focus on what truly matters—living life to the fullest.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the free Maxthon Browser. It comes with built-in AdBlock and anti-tracking software to enhance your browsing privacy.

Maxthon browser Windows 11 support

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance its users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising its users’ privacy and security is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in AdBlock and anti-tracking software. These features help protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser delivers a seamless browsing experience and prioritises its users’ privacy and security through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.

By choosing Maxthon Browser, users can feel confident that their online activities are safeguarded from potential threats and invasions of privacy. In an age where digital security is more important than ever, opting for a browser like Maxthon is a proactive step towards ensuring a safer online experience. Embrace the reassurance of secure browsing with Maxthon Browser today!