In Singapore, a 37-year-old woman found herself at the centre of a sophisticated scam that would leave her shaken. It all began when she received a flurry of phone calls from individuals claiming to represent the National Trade Union Congress (NTUC) and the Monetary Authority of Singapore (MAS). They alleged that she had taken out an “insurance policy” and was responsible for associated fees.

Confused and concerned, she listened intently as the callers detailed the supposed charges. The scammers, sounding official and authoritative, instructed her on how to “cancel” this non-existent policy. Trusting their words, she complied, unaware of the trap being set for her.

As she followed their step-by-step instructions, her phone screen flickered ominously. In an alarming twist, the scammers gained remote access to her device. What began as a routine call spiralled into a nightmare, leaving her vulnerable and exposed to further exploitation. The incident served as a stark reminder of the cunning tactics employed by fraudsters in today’s digital age.

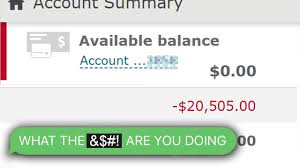

In a shocking turn of events, a woman known only as Wang found herself at the centre of a financial nightmare. Within just four hours, she lost an astonishing S$1.14 million from both her accounts and the company account of a ventilation equipment business that she runs with her husband.

The incident unfolded on February 11 when Wang received a phone call around 3 PM. The caller, who claimed to be an employee of NTUC, offered assistance in ‘cancelling’ her insurance policy. Unsuspecting and trusting, Wang engaged with the voice on the other end, believing it was a legitimate offer.

As the conversation progressed, Wang unwittingly provided sensitive information, thinking she was securing her financial assets. However, the reality was far more sinister than she could have imagined. Within hours, her accounts were drained, leaving her and her husband grappling with the devastating aftermath.

The emotional toll was immense, as Wang reflected on how quickly trust can be exploited. With a thriving business at stake, she now faces not only financial loss but also the challenge of rebuilding her life after such betrayal.

Wang received a phone call from the NTUC staff one sunny afternoon. The representative informed her that a vital insurance policy she held was nearing its expiration date. To maintain her coverage, she would need to pay a hefty fee of S$19,200 for a two-year renewal.

As she listened, a mix of anxiety and disbelief washed over her. That amount was substantial, and she couldn’t help but wonder if there were any alternatives or discounts available. Memories of her time as an NTUC member flickered in her mind when she enjoyed the benefits of being part of a supportive community.

Wang shared her thoughts with her friend, Shin Min, during their weekly coffee catch-up. “I used to be an NTUC member when I was working,” she reminisced, recalling the days when she paid a modest monthly fee of S$9.

That membership had granted her access to various services and perks, but now, facing this unexpected financial burden, she felt a wave of nostalgia mixed with concern. Would it be worth renewing the policy? Or was it time to explore other options? Wang knew she needed to make a decision soon.

When she received the phone call, she was completely unaware that it might be a fraudulent attempt.

Wang, realising that the insurance policy discussed by the individual claiming to be from “NTUC” was unnecessary for her, promptly requested its cancellation before concluding the conversation.

Not long after this initial call, another individual, who identified themselves as an “NTUC manager,” reached out to Wang.

This new caller informed her that in order to cancel the policy, she needed to visit her bank and complete the cancellation process by 4 PM that same day; otherwise, a hefty sum of S$19,200 would be automatically deducted from her account.

Feeling uneasy, Wang ended the call and quickly logged into her personal bank account to address the situation.

As she was navigating her online banking, the so-called “NTUC manager” called her again. This time, they inquired whether she had successfully cancelled the automatic deduction and offered assistance if needed.

The impersonator even suggested transferring her to someone they claimed was a “MAS staff member” who could guide her through the necessary steps.

Feeling increasingly suspicious, Wang hung up once more and decided to log into her company’s online banking system to resolve the issue on her own.

As the clock approached 5 PM, she received a video call from someone who introduced themselves as a “MAS staff” member. The scenario was rapidly escalating, and Wang was about to find herself entangled in a web of deception.

As the sun dipped low in the sky, casting a warm glow over the bustling streets, Wang found herself seated at her kitchen table, her heart racing with uncertainty. Across from her was an individual who appeared to be associated with a government agency, identifiable by a badge that resembled a staff ID. With a calm yet authoritative demeanour, he began outlining the procedure for her to cancel her insurance policy.

“He inquired if I intended to terminate the policy, and I affirmed my decision,” Wang recounted later, her voice tinged with disbelief. “He also mentioned something alarming—if I hadn’t initiated the policy myself, it suggested that my personal information had likely been compromised.”

With that unsettling revelation hanging in the air, the so-called “MAS staff” delved deeper into her private affairs. He probed her about the number of bank accounts she possessed, the nature of her business, and whether her company was currently hiring employees. The interrogation felt invasive, yet Wang felt an inexplicable urge to comply.

To heighten her anxiety, he insisted that all conversations were to remain confidential—she couldn’t share any details, not even with her husband. This demand left a gnawing feeling in her stomach, but she brushed it aside, convinced that this was merely standard procedure.

When he learned that Wang used fingerprint authentication for her transactions, he informed her that she would soon receive a one-time password (OTP) that required her immediate attention. His words flowed smoothly, instilling a false sense of security while setting the stage for what was to come.

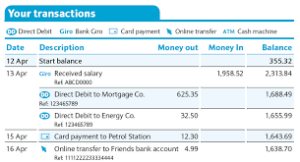

Unbeknownst to Wang, as she engaged in this unsettling dialogue, her phone had already been infiltrated. Scammers, hidden behind the guise of helpful officials, were systematically siphoning money from her company’s bank account. Yet, in that moment of confusion and dread, she remained oblivious to the email alerts flooding in from her bank regarding suspicious activity.

As the clock neared 7 PM, the conversation took a darker turn. The scammer casually mentioned that “a sum of money would need to be transferred out,” assuring her that if no fraudulent activity were detected, it would be refunded within a mere 24 hours. The mention of a refund struck a nerve within Wang. Doubts began to creep in; something felt off. But by then, it was far too late.

In a state of panic, she attempted to log back into her company’s online banking account, only to find herself locked out. The realisation hit hard: she had fallen victim to a meticulously orchestrated scam.

Once she mustered the courage to confide in her husband about the harrowing encounter, they both faced the grim reality together. To their utter shock, they discovered that a staggering S$1,143,390 had vanished from their account. The weight of betrayal and loss crashed down upon them like a tidal wave, leaving them grappling with disbelief and despair at how easily trust had been manipulated into vulnerability.

Through a series of 22 transactions, each varying between S$30,000 and S$78,000, funds were transferred to multiple unfamiliar accounts, leading to significant financial loss. Among the victims was Wang, whose personal banking security was compromised as three of her accounts fell prey to the same scheme.

In a distressing turn of events, Wang had set aside S$18,500 for her mother and another S$6,450 designated for her children. However, these funds, along with S$175,000 from her account, were swiftly funnelled into the company’s account before the scammers drained it completely. When the dust settled, Wang found herself with only S$5,000 left in her business account and a mere S$5 remaining in her account.

The evening of the discovery was tumultuous; both Wang and her husband rushed to file a police report that very night, desperate for justice and answers.

For Wang, the nightmare has not ended. Two weeks have passed since the incident, yet the weight of the betrayal continues to haunt her. “Since we started our ventilation equipment system business in 2018, things have been tough,” she shared. Now, they are grappling with cash flow challenges that the recent scam has exacerbated. In February, their company bank account lacked sufficient funds for the Goods and Services Tax (GST) GIRO deduction, resulting in a 5 per cent penalty imposed by authorities—a further blow to their already strained finances.

“It’s still painful to discuss this; I’ve cried until I can no longer shed tears,” Wang confided to Shin Min. “Sometimes, when I replay the events in my mind, I find it hard to drift off to sleep.”

The police have confirmed that an official report has been filed and that investigations are actively underway to unravel this troubling case.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.

By choosing Maxthon Browser, users can feel confident that their online activities are safeguarded from potential threats and invasions of privacy. In an age where digital security is more important than ever, opting for a browser like Maxthon is a proactive step towards ensuring a safer online experience. Embrace the reassurance of secure browsing with Maxthon Browser today!