In recent years, the shadow of bank fraud has loomed more significant than ever, casting a pall over the financial landscape. The sophistication of these fraudulent attacks has escalated, leading to significant losses not only in monetary terms but also in the reputation of the institutions involved. A revealing study from 2022 highlighted a troubling trend: more than 70% of financial entities reported losses exceeding $500,000 due to fraudulent activities. Among the most severely affected were fintech firms and regional banks, which found themselves on the front lines of this growing crisis.

As if this weren’t enough, the regulatory environment surrounding the financial services sector has tightened considerably. Institutions are now under increasing pressure to verify customer identities and implement comprehensive anti-money laundering measures rigorously. The stakes have never been higher, and the need for effective fraud prevention strategies has become paramount.

In this challenging climate, fostering mutual trust between customers and their financial institutions emerges as a crucial weapon against the tide of bank fraud. By establishing robust practices, institutions can create a seamless experience for users while simultaneously bolstering their defences against various types of consumer fraud. This involves not just enhanced identity verification techniques but also sophisticated monitoring systems that comply with stringent federal regulations.

Key points emerge from this narrative:

Firstly, bank fraud incidents are escalating at an alarming rate, with over 70% of financial organisations suffering losses of at least $500,000 due to deceitful activities in 2022.

Secondly, the tightening grip of regulations on customer identity verification and anti-money laundering efforts underscores the urgent necessity for financial institutions to adopt comprehensive fraud prevention strategies.

Moreover, employing methods such as identity verification, multi-factor authentication (MFA), and adaptive access control can significantly fortify defences against cunning fraudsters.

Lastly, banks must devise actionable fraud response plans. These plans should include protocols for notifying law enforcement and promptly freezing affected accounts to mitigate damage and swiftly address instances of fraud.

In this evolving narrative of bank fraud and regulation, the path forward hinges on collaboration, vigilance, and a commitment to safeguarding financial assets and customers’ trust.

Understanding Bank Fraud: A Deep Dive

Bank fraud is a significant threat in the world of finance. It represents illicit actions aimed at unlawfully seizing funds or assets from financial institutions or their clientele. Traditionally, bank fraud manifested through tangible methods, such as cashing in on counterfeit checks or stealing credit cards. However, as the landscape of banking has transitioned into the digital realm, the tactics employed by fraudsters have evolved into more intricate and sophisticated schemes.

It’s crucial to familiarise oneself with the various forms of bank fraud that exist today to shield financial institutions and their customers from potential threats effectively.

Exploring the Different Facets of Bank Fraud

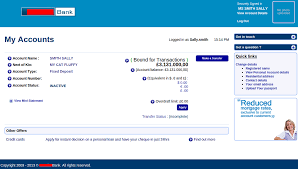

One of the most pressing concerns for banks is account takeover (ATO) fraud. This insidious form of fraud occurs when an unauthorised individual gains access to a customer’s account by exploiting their login details. The methods employed to execute an account takeover can vary widely, often involving a blend of social engineering and technological manipulation.

A common avenue for these attacks is through phishing schemes. In these deceptive tactics, fraudsters craft convincing fake emails, text messages, or even phone calls, all designed to trick the unsuspecting account holder into revealing their login information. The scenario typically unfolds with the victim believing they are interacting with a legitimate bank representative, only to be misled by a cunning imposter.

Yet, it’s not just customers who find themselves ensnared in these traps; bank employees are equally vulnerable to such phishing attacks. A notable trend is the rise of call centre fraud, where criminals bypass contacting customers directly. Instead, they impersonate account holders while reaching out to the bank’s call centre in a bid to extract sensitive account information.

Another method that has gained traction among fraudsters is credential stuffing. This technique involves acquiring stolen login credentials from dark web sources. Often, the data obtained may be partial or incomplete, prompting attackers to employ automated programs that bombard various websites with combinations of usernames and passwords in hopes of striking gold—gaining access to compromised accounts. While the success rate for such endeavours is relatively low, the sheer volume of data they work with increases their chances significantly.

As we navigate through this complex landscape of bank fraud, it becomes increasingly clear that awareness and preparedness are paramount. By understanding the myriad forms that fraud can take, financial institutions can bolster their defences and ultimately safeguard their customers against these evolving threats.

The Tale of Digital Deception

In the vast realm of the internet, where convenience often reigns supreme, a shadow lurks, waiting for unsuspecting users to traverse their digital paths. This tale begins not at the entrance of a secured portal but rather in the midst of a user’s journey—an insidious act known as session hijacking. Picture this: a user diligently managing their online banking, unaware that lurking in the shadows is a cunning attacker. Armed with stolen session cookies, the intruder deftly seizes control of the unsuspecting customer’s ongoing session. Such sensitive information is typically snatched from the unsuspecting through third-party browser extensions, devices compromised by malware, or insecure public WiFi networks. As the hijacker stealthily observes, they gain access to a treasure trove of data, including the intimate financial details of an online banking account—an invasion of privacy that can have devastating consequences.

But the story does not end there. In another corner of this digital landscape, social engineering emerges as a sinister plot twist. Here, attackers cleverly manipulate human psychology to extract user account credentials. Their tactics are as varied as they are deceptive. Imagine an email from someone impersonating a high-ranking executive, reaching out to employees under the guise of urgency, seeking confidential information. Or envision a customer being baited into responding to a false emergency—perhaps a fabricated account suspension—designed to elicit panic and compliance. Some may even resort to bribery, coaxing employees to overlook standard authentication protocols. This web of manipulation intertwines with other forms of bank fraud, casting a wide net that ensnares both customers and employees alike.

As we delve deeper into this narrative of cybercrime, we encounter another method: password spraying. Unlike traditional hacking attempts that seek specific login credentials, these nefarious actors take a different approach. They wield an arsenal of usernames, pairing them with commonly used passwords in a calculated assault. Utilising bots to execute their schemes on a grand scale, these attackers patiently sift through countless combinations, eventually uncovering the keys to unlock unsuspecting accounts.

Yet, even as existing accounts face threats from these cyber marauders, new accounts are not immune to danger. The spectre of new account fraud looms large in the banking sector, presenting its unique challenges. Here, criminals may assume another’s identity to forge new accounts or concoct elaborate personas that blend actual and fictitious elements to create completely bogus profiles. The implications are profound, affecting both financial institutions and their clientele.

In response to this rising tide of deception, regulations like Know Your Customer (KYC) have emerged as bulwarks against such fraudulent activities. These measures require banks to verify an individual’s identity not just at the inception of an account but throughout the entirety of their banking relationship. As our story unfolds in this intricate world of digital deception, it becomes clear that vigilance and awareness are paramount in safeguarding one’s financial well-being against those who exploit the vulnerabilities of our interconnected lives.

Deceptive Documents

In the shadowy world of financial deceit, counterfeit documents play a crucial role in orchestrating schemes designed to exploit unsuspecting victims. Picture this: a criminal mastermind fabricating phoney identification cards, email accounts, or even checks, all meticulously crafted to create a facade of legitimacy. This artifice allows them to engage in identity theft with an alarming sense of realism. But the deception doesn’t stop there; these cyber rogues often go so far as to produce fraudulent bank statements, seeking approval for loans or financial assistance, either under the guise of a stolen identity or a completely fabricated one.

Check Deception

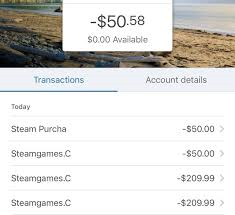

Check fraud manifests itself in various insidious forms, each with its unique approach. The most prevalent method involves con artists crafting convincing counterfeit checks that bear an uncanny resemblance to the genuine article. These deceptive instruments can be used to make purchases or siphon funds from another individual’s account, wreaking havoc on their finances. Another notorious method is check washing, where thieves erase the ink from stolen checks—often pilfered straight from the mailbox—and replace the original payee’s information before cashing in on their ill-gotten gains.

Yet another scheme involves mobile check deposit scams. In this scenario, fraudsters hand victims a counterfeit check, enticing them to deposit it into their accounts. Once the funds are made available, the victim is pressured to return a portion of the money—typically through methods like money orders, wire transfers, or gift cards—before the check is ultimately identified as a fake.

The Dark Art of Money Laundering

As guardians of financial integrity, banks are tasked with implementing robust anti-money laundering (AML) policies to thwart criminals seeking to use their institutions as a refuge for illicit funds. To fulfil this obligation, banks must adhere to stringent Know Your Customer (KYC) protocols and integrate essential practices such as customer due diligence (CDD), transaction monitoring, and reporting any suspicious activities. A framework of regulatory measures exists to mitigate the risks associated with money laundering and ensure that financial systems remain secure.

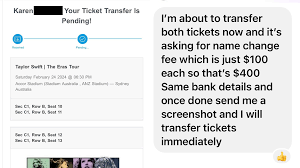

The Trap of Authorized Push Payments

Amidst these various schemes lurks the treacherous concept of authorised push payments (APP). In this scenario, fraudsters employ cunning tactics to deceive account holders into executing payments that are nearly impossible to reverse. They may masquerade as legitimate businesses offering enticing goods or services or fabricate elaborate scenarios that entice individuals into paying advance fees for nonexistent prizes or investment opportunities. This blend of social engineering and digital manipulation illustrates how perpetrators exploit human vulnerabilities, luring victims into transferring their hard-earned money to those concealing their true identities.

The Perils of Real-time Payment Fraud

As technology evolves, so too do the methods employed by fraudsters. Real-time payment fraud has emerged as a pressing concern, wherein criminals take advantage of instantaneous payment systems to execute their schemes. The speed and convenience of these transactions often leave little room for oversight, allowing fraudsters to exploit the system before victims realise they’ve been duped. Each day brings new challenges in the fight against these sophisticated threats, emphasising the need for vigilance and awareness in safeguarding one’s financial assets from those who seek to undermine trust in our banking systems.

Strategies for Prevention: A Comprehensive Approach

In the ever-evolving landscape of digital security, the need for robust prevention strategies is paramount. One of the cornerstones of these strategies lies in the realm of identity verification. This crucial process ensures that a digital persona aligns seamlessly with an individual’s real-world identity, thereby fulfilling the requirements set forth by Know Your Customer (KYC) regulations. To achieve this alignment, various solutions are employed. For instance, one effective method involves capturing a live image of a user’s face and comparing it to their government-issued identification. Additionally, linking these digital identities to verified devices or credentials provides another layer of security, reinforcing trust in the digital interactions that take place.

Moving beyond mere identity verification, we encounter the essential practice of Multi-Factor Authentication (MFA). In a world rife with cyber threats, MFA serves as a formidable barrier, demanding that customers present two distinct forms of verification when accessing their accounts. This process is characterised by the requirement of two out of three possible types of evidence:

– The first category encompasses knowledge-based confirmations, such as passwords, PINs, or knowledge-based answers (KBAs).

– The second category pertains to possession-based confirmations, which could include physical items like a smart bracelet, a key fob, or a mobile device.

– Finally, the third category relates to inherent characteristics, such as fingerprints, voice patterns, facial recognition, or retinal scans.

This multifaceted approach significantly hampers the efforts of fraudsters attempting to infiltrate bank accounts using stolen credentials.

Education emerges as another critical pillar in the fight against fraudulent activities. It is vital to empower both customers and employees with knowledge about potential warning signs and prevalent schemes. By embedding alerts within transactional communications and emails, individuals can better discern legitimate interactions from potential scams.

Moreover, publishing informative materials on typical fraudulent schemes—especially during peak times such as tax season or the holiday shopping rush—can serve as an invaluable resource. These initiatives foster awareness and help individuals recognise what inquiries are appropriate from genuine bank personnel or executives.

Another integral strategy is implementing Policy-Based Access Control. This adaptive access system revolves around granting authorisation based on a set of predefined policies tailored to different scenarios. For employees, considerations may include job titles, levels of security clearance, and even the time of day. For customers, access might be determined by factors like geographical location, travel speed, and perceived threat levels.

Lastly, Verified Credentials are a powerful tool for financial institutions. By employing verified credentials, banks can authenticate user attributes through customised acceptance policies. This practice not only mitigates the risk of fraud but also helps prevent account takeovers since cryptographic safeguards fortify these credentials.

In this intricate web of prevention strategies, each component plays a vital role in creating a secure environment for digital interactions. By combining identity verification, multi-factor authentication, education, policy-based access control, and verified credentials, we forge a formidable defence against the ever-present threats lurking in the digital realm.

In the ever-evolving landscape of banking, fraud prevention has emerged as a critical pillar for maintaining customer trust and ensuring financial stability. For banks, safeguarding sensitive information is not just about preventing losses; it’s also essential for retaining customers who expect their data to be protected.

Enter Maxthon, a leader in digital identity solutions. By implementing a comprehensive digital identity strategy, banks can take proactive steps toward compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These frameworks are designed to protect both the institution and its clients from illicit activities.

Imagine a world where banking is seamless yet secure, where advanced identity verification techniques fortify every login. With Maxthon’s solutions, financial institutions can authenticate users in real-time, minimising the risk of unauthorised access.

This layered approach enhances security and fosters trust between banks and their customers. As fraud tactics become more sophisticated, the need for robust identity management systems becomes increasingly urgent.

By prioritising digital identity, banks can build a fortress against fraud, ensuring that they remain compliant while delivering an exceptional customer experience. In this new era of banking, prevention is not just a strategy—it’s a necessity.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.

By choosing Maxthon Browser, users can feel confident that their online activities are safeguarded from potential threats and invasions of privacy. In an age where digital security is more important than ever, opting for a browser like Maxthon is a proactive step towards ensuring a safer online experience. Embrace the reassurance of secure browsing with Maxthon Browser today!