In the bustling world of commerce, where transactions flow like a river, the shadow of payment fraud looms more significant every year. As businesses of all shapes and sizes navigate this intricate landscape, they face an alarming reality: in 2020 alone, losses attributed to payment fraud soared past an astonishing $42 billion globally. For many companies, especially those inundated with a high volume of customer transactions, the spectre of payment fraud is not just a distant threat; it is an unfortunate yet inevitable aspect of their operational existence.

As digital commerce burgeons and new payment avenues emerge, safeguarding financial transactions has grown increasingly complex. The tactics employed by fraudulent actors have evolved into a sophisticated art form, compelling businesses to enhance their fraud detection and prevention strategies in response. The repercussions of payment fraud can be profound, leaving companies grappling with significant financial setbacks, tarnished reputations, and potential legal entanglements.

Despite a business’s best efforts to thwart payment fraud, it remains a persistent adversary. However, knowledge is a powerful ally. By familiarising themselves with the various forms of fraud and understanding how these deceitful schemes operate, businesses can fortify their defences against such threats. In this narrative, we will delve into the essential aspects of payment fraud—exploring its mechanisms, how it manifests, and the proactive steps that can be taken to shield both businesses and their customers from its grasp.

At its core, payment fraud is a deceptive practice in which individuals exploit false or stolen financial information to execute unauthorised purchases. This can take many forms, such as using stolen credit card details, creating counterfeit checks, or initiating unauthorised electronic fund transfers.

Retailers find themselves particularly exposed to this menace. With countless transactions occurring daily and often limited resources to meticulously verify each payment method, they stand at the frontline of this ongoing battle. The fallout from payment fraud can be severe: not only do businesses face substantial financial losses, but they also risk incurring reputational damage and legal ramifications that can jeopardise their very existence.

As we explore this topic, we will uncover the layers of payment fraud, illuminate its various manifestations, and equip you with the knowledge needed to safeguard your enterprise against this modern-day threat. Together, we will explore how to navigate this treacherous terrain and emerge resilient in the face of adversity.

Exploring the Realm of Payment Fraud

In today’s digital age, the landscape of payment fraud has become increasingly complex, presenting a range of deceptive practices that can leave individuals and institutions vulnerable. Let us embark on a journey through some of the most prevalent forms of this financial deception.

The Shadow of Credit Card Fraud

Imagine a world where your hard-earned money is at risk, not from your spending habits but from an unseen adversary lurking in the shadows. This is the reality of credit card fraud, where individuals exploit stolen credit card information or forge counterfeit cards to indulge in unauthorised purchases or withdraw cash. These fraudsters can operate seamlessly, whether they’re shopping online or making transactions in brick-and-mortar stores.

The consequences are staggering. In 2020 alone, losses attributed to credit card fraud soared to an astonishing $4.2 billion, a significant rise from $3.5 billion in 2019. Projections suggest that card-not-present fraud—where cards are used without physical presence—could escalate dramatically, jumping from 57% in 2019 to a staggering 74% by 2024.

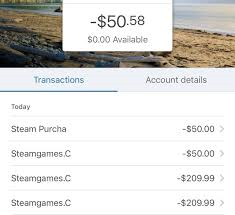

The Perils of Debit Card Fraud

As we turn our gaze to another facet of payment fraud, we encounter debit card fraud—a close relative of its credit counterpart. Here, the plot thickens as perpetrators use stolen debit cards or the associated card details to make illicit purchases or withdraw funds from ATMs. The threat intensifies further if they gain access to the personal identification number (PIN) linked with the card, making it all too easy for them to drain accounts without a trace.

The Web of Bank Fraud

Next, we venture into the realm of bank fraud, a broad category encompassing various fraudulent schemes that target financial institutions. This includes everything from fraudulent loans and identity theft to account takeover schemes. The implications of bank fraud are profound, often resulting in devastating financial repercussions for both individuals and banks alike.

A revealing insight from the 2022 ACFE Report to the Nations highlights that banking and financial services are the second-most frequently targeted sectors for fraud, with each case averaging a median loss of $100,000—a staggering figure that underscores the scale of this issue.

The Danger of Wire Transfer Fraud

Lastly, we confront wire transfer fraud, a particularly insidious form of deception where criminals gain access to an individual’s bank account or wire transfer information. Armed with this sensitive data, they execute transfers to their accounts, often employing tactics such as phishing scams or hacking into victims’ computers or email accounts.

The FBI’s Internet Crime Complaint Center (IC3) has identified wire transfer fraud as the most commonly reported variant of business email compromise (BEC) and email account compromise (EAC) scams in 2020, demonstrating just how pervasive and damaging this form of fraud can be.

As we navigate through these various types of payment fraud, it becomes evident that vigilance is paramount. Each form of fraud exploits different vulnerabilities, but they all share a common thread: the potential for significant financial loss. In an era where our financial transactions are increasingly digital, understanding these risks is essential for safeguarding our assets and ensuring our peace of mind in an uncertain world.

The Tale of Payment Fraud: A Cautionary Chronicle

Once upon a time, in the bustling realm of finance, there existed a cunning practice known as check fraud. This deceitful art involved the clever fabrication or modification of checks, all in an effort to siphon off funds dishonestly. Imagine a shadowy figure foraging through the pages of a chequebook, skillfully forging signatures or altering the numbers inscribed on the paper. Such treachery often reared its ugly head when someone managed to pilfer a chequebook or gain unwarranted access to another’s banking details.

In 2020, checks were deemed the most susceptible to such fraudulent schemes, representing a staggering 66% of all payment-related fraud. This concerning statistic cast a pall over the once-trusted instrument of commerce.

As the digital age unfurled its wings, a new adversary emerged: mobile payment fraud. This modern villain thrived on the unauthorised use of mobile payment platforms like Apple Pay and Google Wallet. Imagine a thief lurking in the shadows, seizing control of a victim’s smartphone or sneaking a peek at their payment information. Sometimes, this rogue would go so far as to craft an entirely fictitious mobile payment account, masquerading as someone else to perpetrate their nefarious deeds.

By 2022, the landscape had shifted dramatically, with a staggering 70% of all fraudulent transactions occurring through mobile devices. The world was changing, and with it, the methods of deceit evolved.

But how did these crafty criminals orchestrate their schemes? They employed a variety of tactics, each more insidious than the last, to pry open the doors to sensitive payment information and execute unauthorised transactions.

One of their favoured techniques was phishing. Picture this: an unsuspecting individual receives an email or a message on social media, seemingly innocuous at first glance. However, lurking within was a cleverly disguised trap—a fake login page or payment portal designed to lure the victim into entering their details. With a few keystrokes, the fraudster could pilfer credit card numbers and login credentials, leaving chaos in their wake.

Then, there was skimming—an underhanded method involving the installation of covert devices on legitimate payment terminals. These devious contraptions quietly captured credit and debit card information along with PINs, providing the perpetrators with everything they needed to create counterfeit cards or drain cash from ATMs.

Identity theft was yet another dark chapter in this tale. In this scenario, a villainous character would steal someone’s personal information—like their name, address, and Social Security number—to carry out fraudulent transactions. The consequences could be dire: new credit cards opened in someone else’s name, loans acquired under pretences, or unauthorised purchases racking up debts that weren’t theirs to bear.

Thus, as our story unfolds, it serves as a stark reminder of the various forms payment fraud can take and the vigilance required to protect oneself against these ever-evolving threats. In a world where trust once prevailed, it became essential for individuals to remain alert and informed—guardians of their financial destinies in an age rife with deceit.

Chargeback Fraud

In the world of commerce, a deceptive practice known as chargeback fraud can rear its ugly head. Imagine a scenario where a customer purchases with their credit or debit card, seemingly satisfied with their transaction. However, not long after, they approached their bank, alleging that the purchase was either unauthorised or defective. This creates a perplexing situation for the business involved; despite having followed all proper procedures and delivered a legitimate product or service, they are often left with no choice but to refund the customer. It’s a frustrating predicament that leaves many businesses grappling with losses, even when they’ve done everything right.

Business Email Compromise (BEC)

In another corner of the fraud landscape lies business email compromise, a tactic that preys upon employees within organisations. Picture this: a well-crafted phishing email lands in the inbox of a senior executive or a trusted business partner. The message, disguised as a legitimate request, urges the recipient to divulge confidential information or transfer funds to an account controlled by the fraudster. These cunning actors exploit trust and authority, creating a web of deceit that can lead to significant financial loss for unsuspecting companies.

Malware

Meanwhile, lurking in the shadows is malware—an umbrella term for various types of malicious software designed with sinister intent. This digital menace is engineered to infiltrate computers and devices, granting fraudsters access to sensitive information. Through malware, these criminals can pilfer credit card details, login credentials, and an array of personal data, leaving victims vulnerable and exposed. The insidious nature of malware makes it a formidable weapon in the arsenal of those who seek to exploit others.

Industries Most Vulnerable to Payment Fraud

No sector is entirely safe from payment fraud; however, certain industries are more frequently targeted by these deceitful schemes.

In the bustling realm of retail, businesses face relentless threats from fraudsters. With countless credit card transactions flowing through their operations daily, retailers are prime targets. The online marketplace is particularly susceptible, as cybercriminals can effortlessly utilise stolen credit card information to execute fraudulent purchases from virtually anywhere on the globe.

Turning to banking and finance, we find another industry often besieged by payment fraud. Financial institutions hold vast troves of sensitive customer data, making them attractive targets for criminals seeking to exploit this information. Through tactics such as phishing and social engineering, fraudsters strive to gain unauthorised access to accounts, leaving banks on high alert.

The healthcare sector is not exempt from these dangers either. Providers in this industry safeguard large volumes of sensitive patient information, making them appealing targets for malicious actors. Whether through attempts to steal patient records or orchestrating fraudulent billing schemes, these criminals aim to profit from the vulnerability inherent in healthcare systems.

Lastly, we arrive at the hospitality industry, which also faces its share of risks related to payment fraud. As travellers rely on booking accommodations and services online, the potential for fraud increases. With an ever-growing reliance on digital transactions, hotels and restaurants must remain vigilant against those who seek to exploit their systems for illicit gain.

In conclusion, while payment fraud can infiltrate any industry, specific sectors remain more exposed to its detrimental effects. As businesses navigate this challenging landscape, awareness and proactive measures become essential in safeguarding against these pervasive threats.

The Threat of Payment Fraud in Hospitality and Ecommerce

In the bustling world of hospitality, where credit card transactions flow as freely as the drinks at a bar, there lies a hidden peril: payment fraud. Hotels and restaurants, teeming with patrons eager to indulge, are prime targets for unscrupulous individuals seeking to exploit this high-volume environment. These deceitful actors often concoct schemes to pilfer sensitive credit card data or employ stolen cards to make unauthorised purchases, putting both businesses and their customers at risk.

Shifting our gaze to the realm of ecommerce, we find a similarly treacherous landscape. Online businesses, thriving on the convenience of digital transactions, face their own set of vulnerabilities. The very nature of online shopping—where credit card information is easily accessible, and anonymity reigns—creates an inviting atmosphere for fraudulent activities. Unscrupulous individuals may utilise stolen card details to carry out illicit transactions or even establish counterfeit online storefronts, all in the pursuit of profit at the expense of unsuspecting consumers.

So, what are the ramifications of payment fraud for businesses? The consequences can be dire and manifest in several critical areas.

Financial Loss

At the heart of the matter is financial loss. When a business falls victim to fraud, it can suffer substantial monetary damage. If a thief successfully absconds with funds or products, the business must either absorb the loss itself or pass those costs onto its customers. This unfortunate cycle can lead to diminished profits and eroded customer loyalty. Over time, the impact on customer lifetime value (LTV) can be profound as repeat business dwindles.

Chargeback Fees

The spectre of chargebacks looms large over affected businesses. When a customer disputes a transaction on their credit card statement, it triggers a process that can result in hefty chargeback fees for the merchant. Furthermore, many payment processors impose additional penalties on businesses that experience elevated chargeback rates. This creates a vicious cycle where the financial burden only intensifies with each fraudulent incident.

Damage to Reputation

Perhaps one of the most insidious effects of payment fraud is the damage it inflicts on a company’s reputation. Beyond immediate financial implications, the perception of untrustworthiness can linger in consumers’ minds. If customers begin to view a business as insecure, they may choose to take their patronage elsewhere, leading to long-term repercussions on revenue and market position.

Legal and Regulatory Consequences

Lastly, there are legal and regulatory dimensions to consider. Even with robust security measures in place, no system is infallible; fraud can still occur. However, businesses must remain vigilant in their fraud prevention efforts. Failing to uphold this responsibility may invite legal scrutiny and regulatory action. Noncompliance with industry standards, such as the Payment Card Industry Data Security Standards (PCI DSS), can further exacerbate risks, leaving businesses exposed to additional penalties and reputational harm.

In summary, payment fraud poses a significant threat to both the hospitality and ecommerce sectors. Its far-reaching effects—from financial losses and chargeback fees to reputational damage and legal ramifications—underscore the importance of vigilance in protecting against this pervasive danger. As technology continues to evolve and the methods of deceit grow more sophisticated, businesses must remain ever-watchful in safeguarding their operations and their customers’ trust.

Navigating the Storm of Payment Fraud: A Business’s Journey

In the realm of business, the spectre of payment fraud looms large, threatening to disrupt operations and divert precious resources. When fraudulent transactions occur, companies often find themselves embroiled in lengthy investigations, scrambling to uncover the truth behind these deceptive acts. This necessity to address fraud not only drains time and energy but also forces organisations to rethink their security protocols and develop new policies aimed at preventing future incidents. The ripple effects of such disruptions can be profound, pulling attention away from vital functions and diminishing overall productivity. Yet, the fight against fraud is about more than just minimising losses; it plays a crucial role in allowing businesses to maintain focus on their core objectives and innovative endeavours.

Fortifying the Fortress: Strategies Against Payment Fraud

To safeguard their operations, businesses must adopt a comprehensive and strategic approach to thwarting payment fraud. This means embracing robust security measures that go beyond basic protections. For instance, employing encryption techniques, mandating the use of strong passwords, and vigilantly monitoring accounts for any signs of suspicious activity are all essential components of an effective defence.

Moreover, education plays a pivotal role in this battle. Employees and customers alike need to be informed about the potential dangers of payment fraud and equipped with knowledge on how to shield themselves from these risks.

Building a Strong Defense: Practical Tactics

1. Opt for Secure Payment Methods

Businesses should prioritise the use of secure payment options in the quest for security. Embracing technologies such as EMV chip cards, mobile payments, NFC contactless systems, and encrypted online payment platforms can significantly enhance fraud prevention efforts. These advanced methods provide a layer of protection that traditional payment forms like cash or magnetic stripe cards simply cannot match.

2. Implement Robust Authentication Measures

To ensure that sensitive information remains in the right hands, companies can deploy stringent authentication strategies. Two-factor authentication and biometric verification are excellent ways to guarantee that only authorised personnel can access critical data. As technology evolves, so too do the best practices surrounding payment authentication. Partnering with leading payment providers, like Stripe, allows businesses to leverage cutting-edge solutions that align with the latest security standards—effectively sidestepping the need for substantial in-house investments in developing and maintaining these systems.

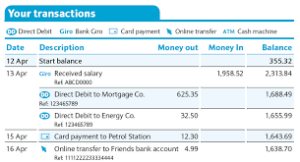

3. Keep a Watchful Eye on Accounts

Continuous monitoring of financial accounts is vital in the fight against payment fraud. By staying vigilant and regularly reviewing transactions, businesses can quickly detect any irregularities that may signal fraudulent activity.

Conclusion

As businesses navigate the turbulent waters of payment fraud, they must remain proactive and resilient. By implementing strong security measures, educating stakeholders, and fostering a culture of vigilance, companies can not only protect themselves from the immediate threats posed by fraud but also reinforce their foundations for future growth and innovation. In this ongoing battle, knowledge and preparedness will be key allies in transforming potential disruptions into opportunities for improvement and success.

In the bustling world of commerce, where transactions flow like a river, the vigilant guardian of every business must be its watchful eye. Regularly scrutinising accounts for any signs of suspicious activity is akin to a captain navigating through stormy seas, ever alert to unusual currents or sudden changes in the tide. Despite employing robust fraud detection measures, it’s the attentive human touch—someone meticulously examining payment records for irregularities—that can prove to be an invaluable asset, steering the ship away from potential dangers.

As the crew of this enterprise, employees must be well-versed in the intricate dance of fraud prevention. The more knowledge they possess about the lurking risks of deceit, the more equipped they become to safeguard both the company and its clientele. Training sessions that empower team members to recognise and report odd behaviours are essential. Equally vital is instilling in customers the ability to discern phishing attempts and other deceitful tactics that could ensnare them.

Moreover, in this age of digital commerce, businesses have a powerful ally at their disposal: fraud detection software. This technological marvel tirelessly monitors transactions, identifying red flags like peculiar spending habits or atypical purchases. For those who embrace Stripe’s payment solutions, a comprehensive suite of fraud protection tools comes pre-installed and seamlessly integrated into their operations without the need for additional setup.

However, even with technology on their side, businesses must tread carefully when it comes to sensitive information. Access to critical data, such as customers’ credit card details or bank account numbers, should be granted only to those employees who genuinely require it for their roles. This practice not only safeguards the integrity of that information but also fortifies the company’s defences against internal threats.

Lastly, in the ever-evolving landscape of cybersecurity, staying current with the latest protective measures and software updates is paramount. Businesses must remain vigilant, ensuring that they harness the most effective tools available for fraud prevention. Partnering with a provider like Stripe can be a strategic move; it allows businesses to delegate the crucial task of monitoring for payment fraud and ensures that they have access to the latest advancements in payment systems without overburdening their internal resources.

In this intricate narrative of commerce and security, vigilance, education, technology, restricted access, and continual learning weave together to create a robust framework against the ever-present threat of fraud. Through these proactive measures, businesses can navigate the complexities of modern transactions with confidence and security.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon browser Windows 11 support

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.