In modern finance, person-to-person payments—often referred to as P2P payments—have emerged as an exceptionally swift and user-friendly method for transferring funds. Imagine this scenario: it’s the end of the month, and you need to send your roommate their share of the rent, or perhaps you’ve just enjoyed a delightful dinner with friends and want to split the bill. With a few taps on your smartphone, the transaction is completed in mere seconds.

Yet, amidst this convenience lies a crucial element that shouldn’t be overlooked: knowing exactly who is receiving your hard-earned money.

Tim Mills, who manages the Emerging and Digital Payments division at Regions, highlights the dual-edged nature of these transactions. “Person-to-person payments can bring numerous advantages to society as a whole,” he notes. “However, users need to remain vigilant, informed, and to apply sound judgment before they hit that send button.”

With that in mind, consider these five valuable guidelines to ensure that both you and your finances remain protected while navigating the world of P2P payments.

First and foremost, it’s imperative to limit your transactions to individuals you know and trust. Picture a situation where someone you’ve never met reaches out to you, requesting payment for a service or product. This could be a red flag. If a stranger is pressuring you for money—especially with an insistence that creates a sense of urgency—it’s wise to approach with caution. Scams are rampant in this digital age, and it’s always safer to engage in P2P payments with friends, family members, or acquaintances whose intentions you can confidently ascertain.

By adhering to this principle, you can navigate the landscape of P2P payments with greater assurance, enjoying the benefits of this innovative financial tool while safeguarding your assets against potential threats.

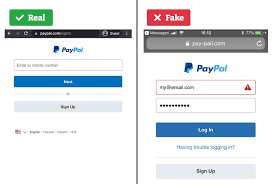

In the bustling world of digital transactions, where convenience reigns supreme, one must tread carefully. Imagine this: you’re about to send money through a peer-to-peer (P2P) platform, perhaps to a friend or a seller you met online. Before you hit that send button, take a moment to pause and reflect. It’s not just about transferring funds; it’s about safeguarding your hard-earned cash.

Picture yourself reaching for your phone, ready to confirm the recipient’s details. Instead of relying solely on the information displayed on the app, why not go the extra mile? Pick up that phone and reach out directly to the person in question. Whether it’s their phone number, email, or user ID, make sure it all checks out. A quick conversation can save you from potential headaches down the road.

Now, think of P2P payments as if they were cash slipping through your fingers. Once you let that money go, consider it gone for good. Unlike traditional payment methods—like credit or debit cards—that may offer avenues for disputes or refunds, P2P transactions are often final and unforgiving. It’s a bit like handing someone cash in a crowded café; once you pass it over, there’s little chance of getting it back if things go awry.

As you navigate these digital waters, be mindful of how much you disclose about your transactions. Some P2P platforms have features that automatically broadcast your financial dealings, sharing with friends or even the broader public that you’ve just sent John Smith $50 for concert tickets. It can feel somewhat intrusive, can’t it? To maintain your privacy, take a moment to delve into your account settings. Most platforms provide options to keep your transactions under wraps, ensuring only you and the intended recipient are privy to the details.

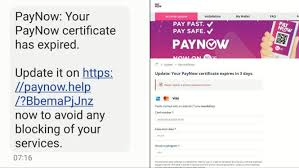

And then there’s the issue of unsolicited requests. Imagine receiving a message that seems to be from your bank, urging you to send a P2P payment as a precaution against fraud. Alarm bells should ring immediately! This tactic is a well-known scam designed to exploit unsuspecting individuals. If such a message crosses your path, don’t engage. Instead, reach out to your financial institution through official channels to verify its authenticity.

So, as you embark on your P2P journey, remember these crucial steps: verify recipient details, treat your payments like cash, safeguard your personal information, and stay alert for scams. By doing so, you’ll navigate this digital landscape with confidence and security.

In the quiet hum of everyday life, the unexpected can often strike when we least expect it. Imagine, for a moment, that you find yourself caught in the web of a peer-to-peer (P2P) scam—a situation that leaves you feeling vulnerable and uncertain. It’s essential to remember that you are not alone in this experience, and there are steps you can take to regain your footing.

First, consider reaching out to the P2P provider. This is the entity through which the transaction occurred, and they hold valuable insights into your situation. They may offer guidance or assistance that could shed light on your predicament. Next, don’t hesitate to contact your financial institution. They have the resources and expertise to help protect your account from further unauthorised activity.

But your journey doesn’t end there. It’s crucial to involve local law enforcement as well. Reporting the incident to them not only aids in your situation but contributes to a more significant effort to combat fraud in your community. While recovering the funds you willingly sent may prove to be a daunting task, taking these actions helps create a barrier against future scams, protecting others from experiencing what you have gone through.

So, take a deep breath and navigate this challenging path with determination. By connecting with these authorities, you are not just seeking personal restitution; you are playing a part in a collective fight against deceit and treachery in the digital age. Your vigilance today may safeguard someone else tomorrow.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.