Are you looking to safeguard your financial well-being?

The journey towards financial security begins with a few fundamental steps. First and foremost, keep a vigilant eye on your bank accounts and stay informed about any updates to your credit report. By doing so, you can detect potential issues before they escalate into serious problems. But this is merely the tip of the iceberg.

A compelling article from Yahoo! Finance outlines five critical warning signs that might indicate you are being targeted for account takeover by fraudsters.

Jeff Taylor, who leads the commercial fraud forensics team, emphasises the evolving tactics employed by these criminals. “Fraudsters have refined their methods and utilise every available resource to gather information that can help them impersonate a victim,” he warns. This serves as a stark reminder to exercise caution, safeguard your personal information, and remain vigilant for any potential warning signs.

Monitoring your accounts goes beyond mere prudence; it is an essential practice that empowers you to protect yourself against the ever-present threat of fraud. By adopting this routine, you not only enhance your financial security but also cultivate peace of mind in an increasingly complex world.

Warning Signs of Account Takeover Fraud: A Cautionary Tale

In the digital age, where convenience often outweighs caution, account takeover fraud has become an insidious threat lurking in the shadows. It begins with subtlety, almost like a whisper, and can escalate into a cacophony of chaos if left unchecked. As highlighted by the insights from Yahoo! Finance, here are some crucial signs that hint at this troubling scenario.

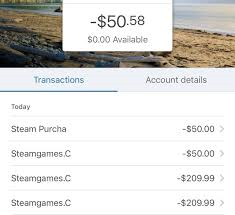

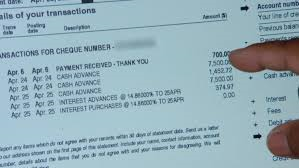

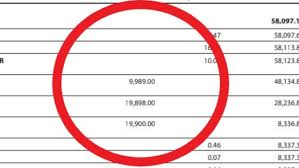

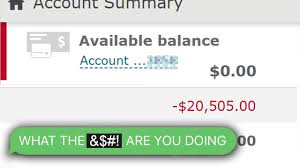

Imagine this: you’re scrolling through your recent transactions, perhaps sipping your morning coffee, when suddenly, an unfamiliar charge catches your eye. At first glance, it appears innocuous—a tiny purchase, maybe even less than a dollar. You might think it’s just a mistake or a glitch in the system. But hold on! This could be the first step of a scammer testing the waters. They often start with these minuscule amounts, gauging whether anyone will notice their stealthy intrusion. Once they ascertain that the coast is clear, they’ll gradually increase their stakes, making purchases that reach up to $50 or more, all while waiting to see if their actions raise any alarms.  Their objective is straightforward: to siphon off as much as they can before you catch on.

Their objective is straightforward: to siphon off as much as they can before you catch on.

So what should you do? It’s imperative to make it a habit to review your account statements on a regular basis meticulously. If something seems off, don’t hesitate to flag it immediately. The faster you act, the more likely you are to thwart these nefarious attempts. While debit and credit cards come with certain protections, remember that the responsibility to monitor for fraudulent charges ultimately lies with you.

Now, picture another unsettling scenario: you receive an unexpected phone call from someone claiming to be from your bank. They sound urgent, insisting that immediate action is required on your part. They may ask for personal details to verify your account or urge you to perform a specific task. Alternatively, you might receive an email or text message demanding your swift response. These communications are designed to create a sense of urgency, all with the sinister goal of pilfering your funds or seizing control of your account. A vital tip to remember in such situations is encapsulated in the mantra: “#BanksNeverAskThat.”

What’s your best line of defence against such tactics? The answer is simple yet powerful: hang up and reach out to your bank directly using a number you know well—one that you’ve saved in your contacts or found on their official website. Legitimate banks will never request your password over the phone or through electronic communications; this is a clear red flag that should send alarm bells ringing.

By remaining vigilant and informed about these warning signs, you can protect yourself from the looming threat of account takeover fraud and keep your financial information secure.

Warning Signs of Account Takeover Fraud: A Cautionary Tale

In the digital age, where convenience often outweighs caution, account takeover fraud has become an insidious threat lurking in the shadows. It begins with subtlety, almost like a whisper, and can escalate into a cacophony of chaos if left unchecked. As highlighted by the insights from Yahoo! Finance, here are some crucial signs that might hint at this troubling scenario.

Imagine this: you’re scrolling through your recent transactions, perhaps sipping your morning coffee, when  suddenly, an unfamiliar charge catches your eye. At first glance, it appears innocuous—a tiny purchase, maybe even less than a dollar. You might think it’s just a mistake or a glitch in the system. But hold on! This could be the first step of a scammer testing the waters. They often start with these minuscule amounts, gauging whether anyone will notice their stealthy intrusion. Once they ascertain that the coast is clear, they’ll gradually increase their stakes, making purchases that reach up to $50 or more, all while waiting to see if their actions raise any alarms. Their objective is straightforward: to siphon off as much as they can before you catch on.

suddenly, an unfamiliar charge catches your eye. At first glance, it appears innocuous—a tiny purchase, maybe even less than a dollar. You might think it’s just a mistake or a glitch in the system. But hold on! This could be the first step of a scammer testing the waters. They often start with these minuscule amounts, gauging whether anyone will notice their stealthy intrusion. Once they ascertain that the coast is clear, they’ll gradually increase their stakes, making purchases that reach up to $50 or more, all while waiting to see if their actions raise any alarms. Their objective is straightforward: to siphon off as much as they can before you catch on.

So what should you do? It’s imperative to review your account statements meticulously on a regular basis. If something seems off, don’t hesitate to flag it immediately. The faster you act, the more likely you are to thwart these nefarious attempts. While debit and credit cards come with certain protections, remember that the responsibility to monitor for fraudulent charges ultimately lies with you.

Now, picture another unsettling scenario: you receive an unexpected phone call from someone claiming to be from your bank. They sound urgent, insisting that immediate action is required on your part. They may ask for personal details to verify your account or urge you to perform a specific task. Alternatively, you might receive an email or text message demanding your swift response. These communications are designed to create a sense of urgency, all with the sinister goal of pilfering your funds or seizing control of your account. A vital tip to remember in such situations is encapsulated in the mantra: “#BanksNeverAskThat.”

What’s your best line of defence against such tactics? The answer is simple yet powerful: hang up and reach out to your bank directly using a number you know well—one that you’ve saved in your contacts or found on their official website. Legitimate banks will never request your password over the phone or through electronic communications; this is a clear red flag that should send alarm bells ringing.

By remaining vigilant and informed about these warning signs, you can protect yourself from the looming threat of account takeover fraud and keep your financial information secure.

The Cautionary Tale of Unsolicited Security Alerts

Once upon a time, in the digital realm, where convenience met vulnerability, there existed a common yet perilous scenario that many unsuspecting individuals faced. Imagine checking your email or phone one day and discovering a message urging you to reset your password—a task you never set in motion. At that moment, a chill might run down your spine; this could very well be a deceitful attempt to usurp your hard-earned digital assets. Similarly, suppose you receive an alarming notification stating that your password has been altered without your consent. In that case, it’s imperative to respond swiftly, as this is a telltale sign of unauthorised access.

What should one do in such a situation? The wisest course of action is to disregard the request entirely. It’s crucial not to engage with any links embedded in the message, for they may lead you deeper into a web of fraud. Next, reach out to your bank and inform them of this suspicious activity, as they need to be aware of potential intruders lurking in the shadows. As a precautionary measure, consider fortifying your accounts with multi-factor authentication whenever it’s offered. This extra layer of security can be your shield against unwanted breaches.

Now, let’s shift our focus to another scenario that raises red flags—an unexpected alert about a new device accessing your account or an unusual login from a location you don’t recognise. Much like the previous instance, such notifications are often harbingers of malicious intent.

In this case, prompt action is paramount. Immediately contact your bank to report the situation, for they possess additional security features designed to protect your assets. Don’t overlook these tools; they could be as simple as receiving a text message after every transaction you make, serving as an early warning system against fraud.

As we navigate through this narrative, we encounter yet another caution: unsolicited requests for updates to your banking information. Picture receiving a text that simply says, “Please update your address.” While it may seem innocuous at first glance, this could be the beginning of a sinister plot to hijack your account.

Remember, reputable banks will never reach out to you unprompted for sensitive details through texts or emails. If anything feels off, trust your instincts and pick up the phone to call your bank directly. Stay vigilant and keep a close watch on your daily transactions, for awareness is the best defence against those who seek to exploit the unsuspecting.

In this digital age, where threats can come from unexpected corners, staying informed and cautious is essential. Through vigilance and proactive measures, we can protect ourselves from the ever-looming dangers that seek to disrupt our financial peace.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.