In today’s fast-paced world, online shopping has become a daily ritual for many. Whether it’s ordering a comforting dinner from Uber Eats after a long day or discreetly purchasing that bestselling product you’d rather not be seen with in public, the allure of convenience is undeniable.

You scroll through the app, your choices laid out like a feast before you. The temptation to indulge grows stronger with every swipe. But soon enough, the moment arrives when you’re prompted to enter your payment information.

If you don’t have your card memorised—a feat many might shy away from admitting—you find yourself rummaging through your wallet. Fingers fumbling, you carefully type in each digit, hoping to avoid any mistakes that would force you to start over.

Alternatively, you might already have your payment details saved on your device. With just a few taps, you can complete your purchase in seconds. Why not embrace this ease and simplicity? After all, in a world where time is precious, convenience is king.

In today’s fast-paced digital world, many of us rely on our browsers to store credit card information for quick and convenient online shopping. However, as cybersecurity experts warn, this seemingly harmless practice is fraught with risks.

Melissa O’Leary, a chief strategy officer at Fortalice Solutions and an authority on cyber scams, emphasises the dangers. “Storing your credit card information in your browser might seem convenient, but it exposes you to a number of risks if your device is breached,” she cautions.

When hackers infiltrate your device, they can easily access saved payment details. This makes your financial information an enticing target for cybercriminals who thrive on stealing sensitive data.

To illustrate the potential threats, O’Leary notes that cyber thieves often use malware or phishing schemes to compromise devices. Once they gain access, your stored credit card numbers can be exploited in the blink of an eye.

Fortunately, there are ways to protect yourself. Experts recommend using secure password managers instead of browser storage, enabling two-factor authentication, and regularly monitoring your financial statements for any unauthorised transactions.

If you’re ready to take action, deleting your stored card information from your browser is a crucial first step. O’Leary encourages users to prioritise their online security and stay informed about the latest threats in the digital landscape. Your financial safety may depend on it.

In today’s digital age, safeguarding your financial information is more crucial than ever. Despite our best efforts to protect our devices, the threat of having credit or debit card numbers stolen lurks around every corner.

Consider the unsettling reality of losing your phone or laptop. It’s a common occurrence—one moment, you’re sipping coffee, and the next, your device is gone. If a thief gets their hands on it, they can easily access saved passwords and payment details. “If an attacker gains access to your computer, they don’t need to be a criminal mastermind to steal your payment details,” warns Zulfikar Ramzan, a cybersecurity expert and chief technology officer at Point Wild.

But the dangers extend beyond physical theft. Picture yourself working in a cosy café or a bustling library. While you might enjoy the ambience, public Wi-Fi networks pose significant risks. These open networks can be playgrounds for cybercriminals, allowing them to intercept data as you browse or make transactions.

With just a few keystrokes, they can gain unauthorised access to sensitive information, including your banking details. Always remember: convenience should never come at the cost of your security. Stay vigilant and protect your financial information from these sneaky threats lurking in everyday life.

In a rather unfortunate turn of events, I’ve witnessed a distressing scenario unfold where an individual’s private banking details were compromised after being stored on a corporate device that had been breached. The aftermath of such a situation is anything but simple; disputing unauthorised transactions and reclaiming control over one’s accounts can be both exasperating and time-consuming.

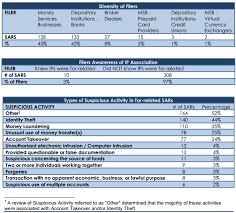

Cybercriminals often employ tactics like credential stuffing or account takeovers to exploit vulnerabilities. Once they obtain your credentials—be it your username, password, or email address—they can infiltrate your systems and gain access to your various accounts. Bryan Marlatt, the chief regional officer at CyXcel, a global cybersecurity consultancy, emphasises how easily this can occur due to browsers storing information in multiple locations, making it relatively straightforward for hackers to find what they need.

It’s crucial not to store sensitive information on vulnerable devices to avoid credit card fraud.

Feeling overwhelmed by these threats is entirely normal; many share your concerns. However, it’s essential to remember that you can take steps to protect yourself. “Cybercriminals thrive on exploiting convenience,” says O’Leary. “But you can safeguard your security. While you are not responsible for cybercrime, being proactive can significantly enhance the safety of your accounts and alleviate unnecessary anxiety.”

With this in mind, experts have compiled some of their most effective strategies for maintaining your security online:

First and foremost, one of the simplest yet most effective measures you can take is to refrain from saving your credit card information directly onto your device. This small change could serve as a powerful barrier against potential threats.

To begin with, it’s crucial to refrain from storing your card details on your devices. The simplest and arguably the wisest choice you can make is to avoid hitting that “save” button when prompted. While you can still shop online using your phone or laptop, it’s advisable to manually input your card information every time you make a purchase.

As cybersecurity expert Ramzan explains, “When you enter your card information, the clock on potential risk begins and ends with that transaction.” However, if you opt to save that data in your web browser, the risk timer never stops running.

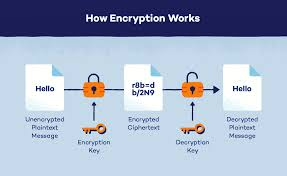

Instead of relying on your browser to safeguard your financial information, consider using a more secure method. Ramzan suggests using a dedicated password manager, which securely encrypts your details within a protected vault. This approach adds an extra layer of security against unauthorised access.

Additionally, many banks now provide virtual or tokenised card numbers. These options can be easily deactivated if they fall into the wrong hands, safeguarding your primary account from potential threats.

Another alternative is to utilise digital wallets like Apple Wallet. “The Apple Wallet keeps your information stored locally on devices such as your iPhone, iPad, or watch, employing robust encryption methods,” notes James Maxwell, the chief information security officer at ABOC. Google Wallet operates similarly but also retains more data in the cloud, which could leave your information more vulnerable to cyberattacks.

However, one must keep in mind the potential risk of losing your device. If it were to go missing or be stolen, you might find yourself in a precarious situation.

Enabling two-factor authentication, commonly referred to as 2FA, is an important measure to enhance your security. This process requires you to provide two different forms of identification before accessing your accounts. For instance, after entering your password, the system may send a code to your mobile device that you’ll need to input next.

O’Leary advises activating this feature wherever your financial details are stored. Typically, programs that support this option will prompt you to set it up after you’ve entered your information.

Lastly, it is essential to keep a vigilant eye on your bank statements. As O’Leary pointed out earlier, many individuals are unaware that their credit card information has been compromised until they notice suspicious charges on their accounts. Regularly reviewing your statements—preferably online for convenience—allows you to detect any unauthorised transactions early on and take swift action before things escalate.

In today’s digital age, the importance of safeguarding your devices from malicious threats cannot be overstated. One of the first steps you should take is to install trustworthy anti-virus software. As Ramzan pointed out, such programs are essential in identifying and preventing malware from infiltrating your system before it can do any harm. Brands like McAfee and Norton are among those renowned for their reliable protection.

Moreover, Ramzan emphasised the necessity of keeping your browser and mobile phone up to date. “Many cyberattacks take advantage of security gaps that could easily be fixed with a quick update,” he noted. This simple yet effective measure can significantly enhance your defences against potential threats.

When navigating the vast expanse of the Internet, caution is paramount. To minimise the need for additional protective measures and to bolster your security, Ramzan advises exercising vigilance when downloading files or clicking on links, especially those that come from unfamiliar sources.

He highlighted a particularly insidious tactic employed by cybercriminals: “Pop-ups that claim to provide urgent system updates or fixes for nonexistent issues are common traps that can lead to a compromise of your device.” Being discerning about what you interact with online can save you from significant trouble down the line.

The crux of the matter, as Ramzan succinctly put it, is to secure your device effectively. “Think of it this way: building a fortress on unstable ground is futile; no matter how robust your walls are, the shaky foundation will ultimately lead to disaster.”

Now, let’s address a frequent dilemma many face: the temptation to store credit card information in your browser for convenience. It’s an enticing option, particularly for those with hectic schedules who value ease. However, if you find yourself leaning toward this practice, Ramzan offers some prudent advice.

First and foremost, consider saving information for just one card. By doing so, you limit your exposure and simplify the process of freezing or replacing that card if necessary. “This strategy significantly reduces your risk and makes it much easier to spot any suspicious transactions,” he explained. Furthermore, if you store details for multiple cards on a single device, all of that sensitive information could potentially be accessed at once if a breach occurs.

When it comes to which type of card to use, Ramzan suggests opting for a credit card over others. “It’s crucial to understand that not all payment methods offer the same level of security and recourse,” he noted. Credit cards generally come with robust fraud protections, whereas gift cards rank low on the security spectrum, and debit cards fall somewhere in between.

If you’ve already made the choice to store your credit card information in your browser and now wish to rectify that mistake, there are steps you can take to delete this sensitive data. Taking control of your online safety is an ongoing journey, but with careful consideration and proactive measures, you can navigate the digital landscape more securely.

In the realm of digital browsing, managing your payment methods can often feel like a chore, but it’s necessary to ensure your security. Let’s explore how to remove saved credit card information from two popular web browsers: Google Chrome and Microsoft Edge.

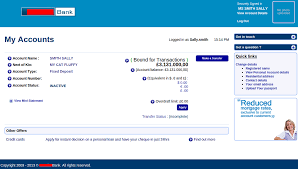

Imagine you’re seated comfortably at your computer, ready to navigate the vast expanse of the internet. For those who frequent Google Chrome, your first step is to locate the trio of dots nestled in the upper right corner of your screen—these little icons hold the key to a world of settings. With a click, you’ll find yourself presented with an array of options; choose “Settings” from this menu.

As you delve deeper into the settings, look for “Autofill and passwords,” a section that promises to help you manage how your information is stored. Within this realm lies “Payment methods,” where you can control your financial details. There, you will find a radial button labelled “Save and fill in the payment method.” With a decisive click, switch this option off until it appears greyed out, indicating that it’s been disabled.

Next, your attention turns to the list of payment methods. To the right of your credit card information, three dots await your command—click them and select “Delete” from the options that appear. A prompt will emerge, asking if you truly wish to erase this card from existence in your browser. Confirm your choice by clicking the “Delete” button once more.

Now, let’s pivot to Microsoft Edge, where a similar path unfolds before you. As with Chrome, begin by locating the three dots perched in the top right corner of your browser window. A click reveals the “Settings” option, which leads you to “Profiles.” Here, you’ll find a subsection dedicated to “Payment info.”

Upon selecting this option, a new tab will open, guiding you into the domain of Microsoft Wallet. You’ll see a representation of your credit card, complete with its last four digits and expiration date, accompanied by the familiar logo of your card brand. Click on this graphic, and when prompted for your password, enter it diligently.

This action opens up the gateway to editing your card details. Scroll down to discover the “Remove” option waiting at the bottom. A simple click on this button sets in motion the final step of removal. Yet again, a confirmation dialogue will appear, asking if you are sure about this decision. Affirm your choice by clicking “Remove” once more.

As you finish this process, remember that your efforts shouldn’t stop here. O’Leary emphasizes the importance of extending this diligence beyond just your desktop browsers. Make sure to cleanse your mobile devices of any saved credit card information as well. Retailer apps—whether it’s Amazon or food delivery services—often store these details for quick checkouts, so be vigilant and remove them, too.

You might feel that taking these precautions is tedious or perhaps even unnecessary; however, they are crucial steps toward safeguarding your financial information. Ramzan likens storing your credit card in a browser to leaving a spare key beneath a doormat—it may seem convenient most days, but it opens up vulnerabilities. The reality is that while everything may appear secure on the surface, one misstep could leave your entire digital abode exposed.

So take these steps seriously. They may seem like small tasks in isolation, but collectively, they form a robust defence against potential threats lurking in cyberspace’s shadows. After all, in today’s interconnected world, being proactive about security is not just wise—it’s essential.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

Maxthon private browser for online privacy

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent. Maxthon browser Windows 11 support

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.