Every day, fraudsters across the United States launch aggressive new schemes to target unsuspecting consumers. These bad actors constantly evolve their tactics, making it crucial for individuals to stay vigilant.

At Regions, the dedicated Fraud Strategy team is on high alert, working tirelessly to protect customers from these threats. Their mission is not just about prevention; it’s also about education. They strive to keep customers informed about the latest scams and how to respond effectively.

“Bad actors work hard at devising new schemes to access your accounts and personal information,” says Kimberly L. Reece, Regions’ vice president of Fraud Strategy Customer Experience. Her words underscore the relentless nature of these criminals.

Two particularly insidious scams are currently making the rounds: Refund Fraud and Reversal Fraud. These scams can begin with something as innocuous as an email, text, or phone call, luring victims into a false sense of security.

As the fraud landscape continues to shift, Regions remains committed to equipping its customers with the knowledge they need to protect themselves. With awareness and vigilance, we can all work together to outsmart those who seek to exploit us.

In a quiet moment, you receive a call that seems innocuous enough. The voice on the other end claims to be from customer service, informing you of a billing error related to a recent purchase. They sound professional and sincere, convincing you that you are owed a refund.

As they explain the situation, they emphasise how urgent it is to resolve this issue quickly. Panic begins to creep in as they mention that the customer service representative handling your case might lose their job if this isn’t fixed immediately.

To help, they offer to guide you through the process of getting your refund, suggesting you install remote desktop software. Their tone is reassuring, making it seem like this is standard procedure.

But beneath their calm exterior lies a sinister motive. They promise that once the refund is processed, you’ll receive significantly more than you’re actually entitled to. This false hope only amplifies your anxiety, blurring the line between reality and their deceptive scheme. Before you know it, you’re drawn deeper into a web of lies, all while believing you’re just trying to reclaim what’s rightfully yours.

Reversal fraud is a cunning scheme that begins with a seemingly innocent text message. A customer receives an alert claiming that there’s been a suspicious transaction on their electronic or cash app account. Alarmed, they instinctively reply to the message, seeking clarification.

Moments later, their phone rings. On the other end is a smooth-talking scammer, offering to assist in reversing the supposedly fraudulent charge. The caller presents themselves as a representative from the customer’s bank or payment service, exploiting the victim’s anxiety and urgency.

The fraudsters are skilled manipulators, using various tactics to gain trust and coax money out of unsuspecting individuals. Their ultimate goal is clear: to persuade you to send them funds under the guise of rectifying a problem.

However, there are crucial warning signs to watch for. “The good news is that there are red-flag warnings that can help you avoid being scammed,” Reece explained.

Common tactics include urgent language, promises of quick fixes, and requests for personal information. Awareness is your best defence against these schemes, ensuring you remain one step ahead of the con artists.

In a world increasingly reliant on digital transactions, the threat of fraud looms more significant than ever. Picture this: a seemingly harmless conversation begins with a customer service representative who is anything but genuine. They might ask you to purchase gift cards from popular retailers like Amazon, Best Buy, or Walgreens, claiming it’s necessary to resolve an issue. Once you’ve bought those cards, they will eagerly request the codes, leaving you vulnerable to their schemes.

As the conversation unfolds, they may shift tactics, urging you to log into your bank account. They insist it’s to prove that funds have been refunded. But as you enter your credentials, the reality sinks in: they could easily change your password or initiate unauthorised transfers, draining your account before you even realise what’s happening.

Then there are the credit and debit card scams. Under the guise of providing a refund or credit, they will ask for your card information. In an instant, they possess everything needed to make fraudulent purchases in your name.

Cryptocurrency has also become a target for these fraudsters. They might suggest that you buy Bitcoin or Ethereum, promising lucrative returns or claiming it’s necessary for a transaction.

And let’s not forget about cash apps. With a simple request to change tokens and initiate a transaction, they can gain immediate access to your funds, vanishing as quickly as they appeared.

In this digital age, staying vigilant is more crucial than ever to protect yourself from these crafty scammers.

What should a consumer do when faced with such a situation?

The answer is straightforward: simply hang up or disregard the message. It might seem like a small action, but it becomes effortless once you learn to identify certain warning signs and know the appropriate steps to take.

Warning Signs to Be Aware Of

First and foremost, be wary of any request to purchase gift cards or send money directly to the caller. This is a classic red flag. Additionally, if you receive a call urging you to initiate a new transaction, such as reversing a payment, take a step back.

Another significant warning sign is any suggestion to install software or applications on your device—especially if it involves remote desktop programs that allow the caller to gain control over your system. Similarly, be cautious of requests to log in to your banking, shopping, or investment accounts while on the phone or during a screen-sharing session.

If the caller asks for your personal details, user credentials, or account information, it’s time to hang up. Moreover, if they claim that an error has occurred and insist that both you and they will face dire consequences if it’s not rectified, you should be alarmed. Lastly, if the caller displays aggressive behaviour—raising their voice, being rude, or showing anger—this is a clear signal to end the conversation immediately.

How to Safeguard Yourself

To protect yourself from these potential threats, only contact verified phone numbers linked to your bank or merchant when addressing any questions or concerns. You can easily find these numbers on the company’s official website or on the back of your credit or debit card.

Before dialling a number or clicking on any links sent through email or text messages, take the initiative to log into the relevant account independently. This allows you to check for any unfamiliar transactions or alerts regarding your account. Remember, never log in via unknown links.

If you’ve previously fallen prey to a scam, it’s unfortunate but likely that you’ll be targeted again. This means you should approach any incoming call, email, or text with heightened scepticism.

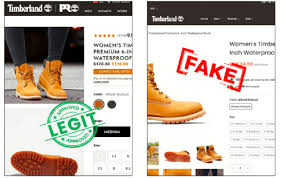

While shopping online, exercise caution with deals that appear too good to be true. The internet makes it easy for anyone to establish a shop or advertise their products on social media platforms. If you’re considering a significant purchase, like a used car or pet, try arranging a video call with the seller. This way, you can see exactly what you’re buying before committing.

Before transferring any funds, conduct an online search of the company, seller, or service in question. A lack of reviews can also serve as a warning sign.

Lastly, ensure your accounts are secure. For more tips and resources tailored for Regions customers, visit their fraud prevention page at com/fraud-prevent. Your safety is paramount; stay informed and vigilant!

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.