GANs for Fraud Prevention: A Detailed Explanation

The Fundamentals of GANs in Fraud Detection

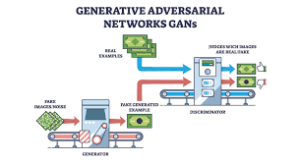

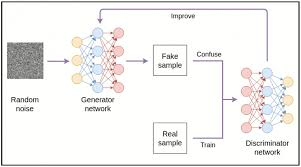

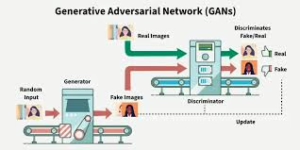

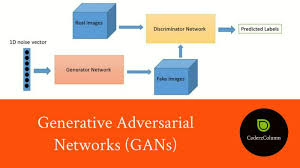

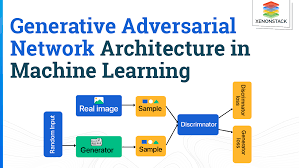

Generative Adversarial Networks (GANs) represent a sophisticated application of AI specifically designed to combat financial fraud through a competitive learning process. Here’s how they work in detail:

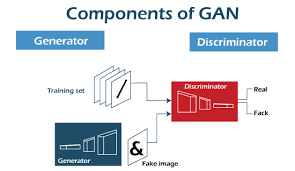

The Two-Network Architecture

- Generator Network

- Analyzes historical fraud data to understand patterns and characteristics

- Creates synthetic fraudulent transactions that closely mimic genuine fraud cases

- Continually refines its outputs to make them increasingly realistic and more complicated to detect

- Essentially “thinks like a fraudster” to anticipate new fraud techniques

- Discriminator Network

- Functions as the fraud detection system

- Evaluates both genuine transactions and the generator’s synthetic fraud examples

- Learns to distinguish legitimate activity from fraudulent behaviour

- Provides feedback to the generator, creating a self-improving cycle

The Adversarial Training Process

The learning happens through an iterative competition:

- The generator creates synthetic fraud examples

- The discriminator attempts to identify these examples as fraudulent

- The generator learns from successful deceptions (when the discriminator fails)

- The discriminator improves based on its mistakes

- This cycle continues, making both networks progressively more sophisticated

Specific Fraud Prevention Applications

Transaction Fraud Detection

GANs model standard transaction patterns across millions of data points and then flag anomalies that deviate from expected behaviour. They excel at detecting:

- Unusual transaction timing, amounts, or frequencies

- Geographic inconsistencies in transaction locations

- Atypical purchasing patterns or merchant categories

Synthetic Identity Detection

The article notes a 60% surge in synthetic identity fraud in 2024. GANs help by:

- Learning the subtle characteristics of genuine identity documents

- Recognizing inconsistencies in synthetic identities that combine factual and fabricated elements

- Detecting patterns in how synthetic identities behave in financial systems

Anti-Money Laundering (AML)

GANs enhance AML programs by:

- Generating synthetic examples of money laundering behaviours for training

- Identifying complex transaction sequences designed to obscure the source of funds

- Reducing false positives in traditional AML monitoring systems

Facial Recognition Security

For identity verification systems, GANs:

- Generate high-quality facial images for training recognition systems

- Simulate adversarial attacks that might fool facial recognition

- Help systems become robust against spoofing attempts like masks or deepfakes

Technical Implementation Details

Data Requirements

To be effective, GAN implementations require:

- Large volumes of historical transaction data

- Examples of both legitimate transactions and confirmed fraud cases

- Diverse data representing various fraud types and legitimate transaction patterns

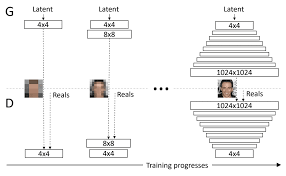

Training Process

- Initial Training: GANs start with essential pattern recognition of obvious fraud indicators

- Refinement: Through millions of iterations, they learn increasingly subtle patterns

- Continuous Learning: Systems update as new fraud patterns emerge in real-world data

Measured Benefits from Real Implementations

The article cites specific outcomes:

- Swedbank achieved a 50% reduction in false favourable rates

- Investigation efficiency improved by 20%

- Financial institutions can now detect fraud patterns that were previously undetectable

Implementation Challenges and Considerations

Technical Barriers

- High computational requirements necessitate substantial infrastructure investments.

- Complex integration with existing financial systems

- Need for specialized AI expertise to develop and maintain the systems

Regulatory and Ethical Considerations

- Consumer data privacy concerns as these systems use legitimate transaction data for training

- Transparency requirements regarding how data is collected and used

- Compliance with financial regulations while implementing advanced AI systems

By continuously pitting a “fraudster simulator” against a “fraud detector,” financial institutions create an ever-improving security system that stays ahead of emerging fraud techniques, significantly reducing financial losses and improving customer trust.

Maxthon

In the whirlwind of today’s online interactions, where the digital realm is in a constant state of flux, safeguarding oneself while navigating the internet has become increasingly vital. The choice of a web browser that prioritises security and privacy has never been more essential. Among the vast selection of browsers vying for attention, Maxthon Browser emerges as a remarkable contender, addressing these crucial concerns without charging its users a penny. This sophisticated browser is equipped with an impressive suite of built-in features, including an Adblocker and various anti-tracking tools—essential elements for enhancing your online privacy.

Maxthon has successfully established a distinct identity by focusing on crafting a browsing experience that values user safety and confidentiality above all else. With an unwavering commitment to protecting personal information and online activities from numerous potential threats, Maxthon employs a range of robust strategies designed to safeguard user data. By utilising advanced encryption techniques, this browser ensures that sensitive information remains confidential and secure throughout your digital excursions.

When it comes to fortifying privacy during online endeavours, Maxthon truly excels. Every facet of the browser has been meticulously designed with a host of features aimed specifically at elevating your privacy. From its effective ad blockers to comprehensive anti-tracking capabilities and a dedicated incognito mode, these tools work seamlessly together to banish intrusive advertisements and thwart tracking scripts that could disrupt your online experience. As a result, users are free to traverse the internet with an enhanced sense of security. The incognito mode further amplifies this feeling of safety, allowing users to explore the web without leaving behind any digital breadcrumbs or traces on their devices.

Maxthon’s unwavering commitment to user privacy and protection is reflected in its regular updates and continuous enhancements. This dedication to improving user experience not only showcases their resolve but also underscores their mission to create a secure online environment for all. As the digital landscape evolves, Maxthon remains a beacon of hope for those who prioritise their privacy and seek a safe harbour amidst the tumultuous seas of the internet. With each update and new feature, they reaffirm their promise to guard the sanctity of personal information, ensuring that users can navigate the vast expanse of the online world with confidence and peace of mind.