Despite being tech-savvy, statistics show that over half of scam victims in Singapore (2022) were aged 20-39. The article covers five major scam types:

1. Phishing Scams

How it works: Scammers impersonate trusted organizations to trick you into revealing personal information by creating a false sense of urgency.

Example: The OCBC phishing scam in 2021, in which victims received SMS messages with links to fake bank websites, resulted in 790 victims losing $13.7 million.

Protection tips:

- Verify websites (check for misspellings in URLs)

- Be wary of SMS messages even if they appear in legitimate threads

- Never share passwords or OTPs

- Legitimate websites use HTTPS

- Verify through official channels

2. Job Scams

How it works: Scammers offer simple work-from-home opportunities with easy money, initially paying small commissions to gain trust before requesting victims to transfer their own money.

Example: The “Purchasing task scam,” in which victims lost about $20 million in May 2023 after being asked to boost product popularity by buying items but transferring money directly to scammers.

Protection tips:

- Don’t trust straightforward money claims

- Avoid downloading unknown apps

- Never pay to start working

- Be wary of suspicious group chats with “other workers”

3. E-commerce Scams

How it works: Fraudulent sellers post products at unusually low prices, disappearing after payment, or trick buyers into downloading malware-infected apps.

Example: A 62-year-old man lost over $40,000 from his CPF savings after clicking a link from a Facebook seafood ad that installed malware on his phone.

Protection tips:

- Be suspicious of extremely low prices

- Shop on established platforms with verified sellers

- Avoid suspicious links from sellers

- If malware is suspected, enable flight mode immediately

4. Investment Scams

How it works: Get-rich-quick schemes promise high returns, where victims might initially profit before scammers disappear or demand additional fees.

Example: Scammers impersonated economist Tan Khee Giap, claiming to offer investment tips and directing victims to fake investment platforms.

Protection tips:

- Verify with official sources

- Don’t be fooled by initial paper gains

- Do thorough due diligence

5. Fake Friend Call Scams

How it works: Scammers call, pretending to be friends, trick victims into revealing the names of their actual friends, and then request money or favors.

Example: A recent variant involves asking for simple favors rather than money, then sending malicious links that install malware.

Protection tips:

- Be skeptical of unexpected calls

- Verify through other communication channels

- Check with mutual friends

The article concludes by noting that scam victims in Singapore lost about $660 million in 2022, emphasizing the importance of vigilance as our lives become increasingly digital.

I’ll review newer examples of the scams mentioned in the article and explain the anti-scam help available in Singapore.

Newer Examples of Common Scams

Phishing Scams

More recent phishing attempts have evolved to use AI-generated voice cloning and deepfakes. Scammers are now able to mimic a person’s voice with just a small audio sample, calling family members and pretending to be a relative in distress. Additionally, QR code phishing (“quishing”) has increased, where fraudulent QR codes redirect victims to fake websites designed to steal credentials.

Job Scams

Recent job scams have expanded to include fake remote work opportunities from well-known companies. Scammers conduct fake interviews over messaging platforms and request personal information for “background checks” or payment for “equipment.” Some even send fake employment contracts and onboarding documents to appear legitimate before requesting bank details for “salary setup.”

E-commerce Scams

Recent e-commerce scams increasingly target specific demographics through personalized ads on social media platforms. Flash sales for limited-edition items have become popular bait, creating urgency that leads victims to make hasty decisions. Some scammers now operate legitimate-looking websites for several months, building trust and positive reviews before disappearing with customers’ money.

Investment Scams

Newer investment scams have incorporated environmental or social causes, marketing themselves as “green investments” or “social impact funds.” These schemes exploit people’s desire to do good while making money. Another trend is the use of fake celebrity endorsements in targeted social media ads, where well-known figures appear to recommend investment platforms.

Fake Friend Call Scams

The latest evolution includes scammers using information gathered from data breaches and social media to make their impersonations more convincing. They might reference actual events or mutual connections to build trust. Some now use communication apps that automatically delete messages after they’re read, leaving no evidence of the scam.

Anti-Scam Help in Singapore

Government Resources

- ScamShield App: Developed by the Singapore government, this app blocks known scam calls and messages. It filters out scam messages and calls from phone numbers used in other scam cases.

- Anti-Scam Centre (ASC): Established by the Singapore Police Force, the ASC works with banks to freeze suspicious accounts and recover stolen funds. They’ve reported recovering millions of dollars for victims.

- National Crime Prevention Council’s Scam Alert Website: This website provides real-time updates on emerging scams and allows the public to report scams they encounter.

- ScamAlert Hotline: A dedicated 24-hour hotline (1800-722-6688) where individuals can verify suspicious messages or calls.

Financial Institution Support

- Bank Security Measures: Major banks have implemented cooling-off periods for first-time fund transfers to new recipients and lowered default transaction limits.

- OCBC’s Digital Security Notification Service: Alerts customers when suspicious transactions are detected.

- DBS’s Anti-Scam Suite includes features like “Funds Lock,” which allows customers to instantly freeze their accounts if they suspect they’ve been scammed.

Community Initiatives

- Scam Support Centre: This centre provides counseling and practical assistance to scam victims, helping them navigate the process of reporting and recovering from scams.

- Senior Digital Wellness Programme: Trains older adults to recognize and avoid digital scams.

- SG Cyber Safe Students Programme: Educates students about cybersecurity and scam awareness.

Recovery Process

If someone becomes a victim of a scam in Singapore:

- Report to the police immediately through the online Police Report portal

- Contact your bank to freeze accounts and attempt to recover funds

- Report the scam to the Anti-Scam Centre

- Preserve evidence including messages, screenshots, and transaction records

- Change passwords for all important accounts

- Seek support from the Scam Support Centre if needed

Singapore has made scam prevention a national priority, collaborating with government agencies, financial institutions, telecommunications companies, and community organizations to combat the rising threat of scams.

- Some scammers don’t hide their identity because they operate from outside victims’ jurisdictions

Current Prevention Measures

- Singapore’s framework makes financial institutions and telcos accountable

- “Money lock” initiative by banks that prevents remote access to a portion of funds

- Anti-scam awareness campaigns (though these are often quickly outpaced by scammers)

Expert Perspective

Jorij Abraham, Gasa’s managing director, believes:

- It’s now “inevitable” that everyone will fall victim to scams at some point.

- Protection requires government and institutional involvement at an infrastructural level.

- Perfect prevention is impossible unless “you haven’t taken any risks and lived”

1. E-Commerce Scams

Trend Details

- 11,665 cases in 2024

- 19.23% increase from 2023

- Total losses: $17.5 million

- Average loss: $1,508 per case

Notable Example

A scammer named Foo Mei Qi:

- Defrauded 76 victims of $110,700 through fake Taylor Swift concert tickets

- Sold counterfeit tickets totalling $7,780

- Operated primarily on Carousell

Prevention Methods

- Never make payments before receiving items

- Be extra cautious on messaging platforms like Telegram

- Verify seller credentials thoroughly

- Be sceptical of deals for high-demand, sold-out items

- Use secure payment methods with buyer protection

- Meet sellers in safe, public locations for transactions

- Check the seller’s profile, reviews, and transaction history

2. Job Scams

Trend Details

- 9,043 cases in 2024

- 8.79% decrease from 2023

- Total losses: $156.2 million

- Average loss: $17,281 per case

Typical Scam Mechanism

- Initial contact via WhatsApp or Telegram

- Offer of high-paying remote work

- Start with simple tasks like surveys or reviews

- Gradually request money transfers for “job opportunities.”

- Eventually, stop communication or prevent commission payouts

Prevention Methods

- Never pay money to get a job

- Be wary of unsolicited job offers

- Research the company thoroughly

- Check job listings through official channels

- Avoid roles requiring upfront personal investment

- Verify company contact information

- Be sceptical of jobs promising unusually high commissions

3. Phishing Scams

Trend Details

- 8,552 cases in 2024

- 44.02% increase from 2023

- Total losses: $59.4 million

- Average loss: Nearly $2,994

- The majority of victims (42.2%) were aged 30-49

Notable Example

- One victim lost $33.8 million in cryptocurrency

- Scammer used a fake advertisement on a legitimate crypto wallet app

- The victim is redirected to a convincing fake website

- Credentials stolen, unauthorized transactions made

Prevention Methods

- Maintain healthy skepticism about online offers

- Carefully check website URLs

- Look for subtle differences in website design

- Never click on suspicious links

- Use two-factor authentication

- Keep software and security systems updated

- Be cautious about providing login credentials

- Verify website authenticity before entering personal information

4. Investment Scams

Trend Details

- 6,814 cases in 2024

- 69.08% increase from 2023

- Total losses: $320.7 million

- Primarily targets individuals 50 and above

Typical Scam Mechanism

- Unsolicited addition to WhatsApp/Telegram investment groups

- Fake screenshots of “earnings”

- Promises of high, low-risk returns

- Victims transfer funds

- Unable to withdraw supposed “earnings”

Prevention Methods

- Invest only what you can afford to lose

- Conduct thorough due diligence

- Verify investment opportunities

- Consult financial advisors

- Be skeptical of guaranteed high returns

- Check regulatory compliance of investment platforms

- Avoid unsolicited investment advice

- Research investment companies independently

5. Fake Friend Call Scams

Trend Details

- 4,179 cases in 2024

- 39.07% decrease from 2023

Typical Scam Mechanism

- Unsolicited call from unknown number

- A scammer pretends to be a friend

- Requests financial help

- The victim transfers money to an unknown account

Prevention Methods

- Do not engage with unrecognized numbers

- Verify the caller’s identity through known contact methods

- Call back using a verified number

- Be cautious of urgent financial requests

- Confirm with the supposed friend through another communication channel

General Scam Prevention Tips

- Trust your instincts

- If an offer seems too good to be true, it probably is

- Keep personal and financial information confidential

- Stay informed about the latest scam techniques

- Report suspicious activities to authorities

- Educate family members, especially older relatives

- Use secure, updated technology

- Maintain a healthy level of skepticism online

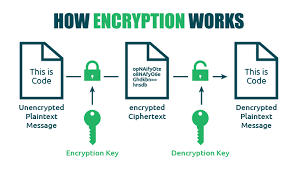

How Encryption Works

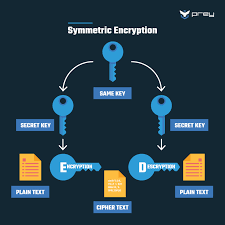

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.