I’ve read the article about money mules in Singapore. Here are the key points:

- Since new sentencing guidelines were introduced in August 2024, 230 money mules have been charged (between August 2024 and March 2025).

- During this period, all adult offenders received jail terms of at least six months, while those under 21 were sent for reformative training.

- The article describes a case where a 60-year-old man (Mr. Lee) was scammed out of $300,000 when he received a video call from someone impersonating a police officer who accused him of money laundering.

- The money mule involved in Mr. Lee’s case, a 23-year-old man, was jailed for 19 months and two weeks and fined $5,200. This mule had surrendered control of five bank accounts to scammers in exchange for about $5,200.

- Scam victims in Singapore lost a record $1.1 billion in 2024, which is approximately 70% higher than the $651.8 million lost in 2023.

- New laws that took effect in February 2024 allow authorities to prosecute people who let scammers use their bank and Singpass accounts to obtain money.

- The laws introduced offenses of “rash money laundering” (up to 5 years jail and $250,000 fine) and “negligent money laundering” (up to 3 years jail and $150,000 fine).

- The Singapore government is considering implementing caning for some scam-related offenses.

Analysis of Money Mule Scams and Prevention Measures in Singapore

Based on the information provided in the article and my knowledge, here’s an analysis of money mule scams in Singapore and the prevention measures implemented by the Anti-Scam Centre and banks:

Money Mule Scams: Current Landscape

- Scale of the Problem:

- Singapore experienced record scam losses of $1.1 billion in 2024 (70% increase from 2023’s $651.8 million)

- 230 money mules were charged between August 2024 and March 2025 under new guidelines

- Typical Methods Used by Scammers:

- Recruitment through social media and messaging platforms like Telegram

- Offering financial incentives ($900-1,500 in the case mentioned) for surrendering bank accounts

- Leveraging individuals’ financial needs or naivety about legal consequences

- Modus Operandi of Money Mules:

- Opening multiple bank accounts across different banks

- Surrendering account credentials to scammers

- Allowing their accounts to be used for laundering scam proceeds

Prevention Measures from Anti-Scam Centre

- Legal Framework Enhancement:

- Introduction of stricter sentencing guidelines (August 2024)

- Amendments to the Corruption, Drug Trafficking and Other Serious Crimes Act

- Introduction of the Computer Misuse Bill (February 2024)

- Creation of new offenses: “rash money laundering” and “negligent money laundering”

- Enforcement Actions:

- Significant imprisonment terms for all adult offenders

- Reformative training for offenders under 21

- Fines to remove financial gains from offenders

- Consideration of caning for some scam-related offenses

- Public Education:

- ScamShield helpline (1799) and online resources

- Public awareness campaigns (inferred from the existence of the helpline and resources)

Prevention Measures from Singapore Banks

While the article doesn’t specifically detail bank-led prevention measures, based on my knowledge of Singapore’s banking practices up to my knowledge cutoff:

- Account Monitoring Systems:

- AI-based transaction monitoring to flag suspicious activities

- Velocity checks for unusual transaction patterns

- Holding periods for large deposits

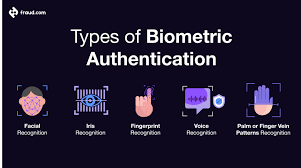

- Customer Authentication:

- Enhanced verification processes

- Multi-factor authentication for transactions

- Biometric verification requirements

- Cooperation with Authorities:

- Information sharing with police and the Anti-Scam Centre

- Quick response to freeze suspicious accounts

- Participation in cross-bank initiatives to track illicit fund flows

- Customer Education:

- In-app scam warnings and alerts

- SMS notifications about potential scam threats

- Educational resources about protecting financial information

Gaps and Challenges

- Evolving Tactics: Scammers continuously adapt their methods to circumvent detection

- Cross-Border Nature: Many scams originate outside Singapore, complicating enforcement

- Human Factors: Fear and social engineering (like in Mr. Lee’s case) remain practical tools

- Digital Literacy: Varying levels of awareness across different demographic groups

Effectiveness of Measures

The implementation of stricter penalties appears to be a significant step, with all adult offenders receiving jail terms. However, the continued rise in scam losses suggests that more comprehensive approaches may be needed to address the root causes and vulnerabilities that enable these scams to succeed.

The article doesn’t provide data on the number of scams prevented or the recovery rate of stolen funds, which would be valuable metrics for evaluating the effectiveness of these measures.

Money Mule Prevention: A Multi-Sector Approach in Singapore

Civil Society’s Role

- Community Vigilance Networks:

- Neighborhood watch groups could be trained to recognize money mule recruitment

- Community centers could host awareness sessions targeting vulnerable populations

- Grassroots organizations could establish peer support for scam victims

- Volunteer-Led Education:

- Former scam victims like Mr. Lee could become anti-scam ambassadors

- Non-profit organizations could develop targeted outreach for at-risk groups (students, elderly, financially vulnerable)

- Community leaders could be trained to spot signs of money mule recruitment

- Support Systems:

- Counseling services for scam victims to address psychological impact

- Financial rehabilitation support for those who have lost significant savings

- Anonymous reporting channels within communities

Educational Institutions’ Approach

- Curriculum Integration:

- Financial literacy courses that include specific modules on scams and money laundering

- Critical thinking skills to evaluate online offers and opportunities

- Digital citizenship education starting from primary school

- Campus Prevention:

- Monitoring of campus networks for recruitment attempts

- Orientation programs with anti-scam components for new students

- Collaboration with banks for student-focused awareness campaigns

- Targeted Interventions:

- Special attention to international students who may be unfamiliar with local laws

- Programs addressing student financial stress to reduce vulnerability

- Peer education networks to spread awareness in student-friendly language

Legal Framework Extensions

- Enhanced Prosecution Framework:

- Consideration of mitigating factors for first-time offenders

- Rehabilitation programs alongside punishment

- Progressive penalty structures based on involvement level

- Preventive Legal Measures:

- Mandatory cooling periods for new bank accounts

- Legal requirements for face-to-face verification for account openings

- Enhanced KYC (Know Your Customer) regulations for financial institutions

- Cross-Sector Legal Collaboration:

- Information-sharing protocols between educational institutions, banks, and law enforcement

- Legal protections for whistleblowers

- Immunity considerations for cooperative money mules who help break more extensive networks

Implementation Strategy

- Multi-agency Task Force:

- Representation from education, banking, community organizations, and law enforcement

- Regular review of prevention strategies against evolving scam tactics

- Development of sector-specific prevention toolkits

- Public-Private Partnerships:

- Technology companies collaborating with schools on digital literacy

- Banks sponsoring educational programs in schools and communities

- Telecom providers implementing scam call filtering systems

- Measurement and Accountability:

- Regular reporting on scam prevention efforts and outcomes

- Independent assessment of program effectiveness

- Public dashboards showing scam trends and prevention metrics

Singapore-Specific Considerations

This approach aligns with Singapore’s community-oriented prevention philosophy while extending the current legal framework that has already established substantial penalties. The multi-sector collaboration leverages Singapore’s tightly integrated public services and educational system, potentially creating a more comprehensive shield against money mule recruitment.

By engaging schools, civil society, and legal institutions alongside existing bank and police efforts, Singapore could develop a more resilient society-wide defence against the money mule problem that underpins the growing scam ecosystem.

Analysis of Money Mule Scams and Prevention Measures in Singapore

Based on the information provided in the article and my knowledge, here’s an analysis of money mule scams in Singapore and the prevention measures implemented by the Anti-Scam Centre and banks:

Money Mule Scams: Current Landscape

- Scale of the Problem:

- Singapore experienced record scam losses of $1.1 billion in 2024 (a 70% increase from 2023’s $651.8 million)

- 230 money mules were charged between August 2024 and March 2025 under new guidelines

- Typical Methods Used by Scammers:

- Recruitment through social media and messaging platforms like Telegram

- Offering financial incentives ($900-1,500 in the case mentioned) for surrendering bank accounts

- Leveraging individuals’ financial needs or naivety about legal consequences

- Modus Operandi of Money Mules:

- Opening multiple bank accounts across different banks

- Surrendering account credentials to scammers

- Allowing their accounts to be used for laundering scam proceeds

Prevention Measures from Anti-Scam Centre

- Legal Framework Enhancement:

- Introduction of stricter sentencing guidelines (August 2024)

- Amendments to the Corruption, Drug Trafficking and Other Serious Crimes Act

- Introduction of the Computer Misuse Bill (February 2024)

- Creation of new offenses: “rash money laundering” and “negligent money laundering”

- Enforcement Actions:

- Significant imprisonment terms for all adult offenders

- Reformative training for offenders under 21

- Fines to remove financial gains from offenders

- Consideration of caning for some scam-related offenses

- Public Education:

- ScamShield helpline (1799) and online resources

- Public awareness campaigns (inferred from the existence of the helpline and resources)

Prevention Measures from Singapore Banks

While the article doesn’t specifically detail bank-led prevention measures, based on my knowledge of Singapore’s banking practices up to my knowledge cutoff:

- Account Monitoring Systems:

- AI-based transaction monitoring to flag suspicious activities

- Velocity checks for unusual transaction patterns

- Holding periods for large deposits

- Customer Authentication:

- Enhanced verification processes

- Multi-factor authentication for transactions

- Biometric verification requirements

- Cooperation with Authorities:

- Information sharing with police and the Anti-Scam Centre

- Quick response to freeze suspicious accounts

- Participation in cross-bank initiatives to track illicit fund flows

- Customer Education:

- In-app scam warnings and alerts

- SMS notifications about potential scam threats

- Educational resources about protecting financial information

Gaps and Challenges

- Evolving Tactics: Scammers continuously adapt their methods to circumvent detection

- Cross-Border Nature: Many scams originate outside Singapore, complicating enforcement

- Human Factors: Fear and social engineering (like in Mr. Lee’s case) remain practical tools

- Digital Literacy: Varying levels of awareness across different demographic groups

Effectiveness of Measures

The implementation of stricter penalties appears to be a significant step, with all adult offenders receiving jail terms. However, the continued rise in scam losses suggests that more comprehensive approaches may be needed to address the root causes and vulnerabilities that enable these scams to succeed.

The article doesn’t provide data on the number of scams prevented or the recovery rate of stolen funds, which would be valuable metrics for evaluating the effectiveness of these measures.

Money Mule Prevention: A Multi-Sector Approach in Singapore

Civil Society’s Role

- Community Vigilance Networks:

- Neighborhood watch groups could be trained to recognize money mule recruitment

- Community centers could host awareness sessions targeting vulnerable populations

- Grassroots organizations could establish peer support for scam victims

- Volunteer-Led Education:

- Former scam victims like Mr. Lee could become anti-scam ambassadors

- Non-profit organizations could develop targeted outreach for at-risk groups (students, elderly, financially vulnerable)

- Community leaders could be trained to spot signs of money mule recruitment

- Support Systems:

- Counseling services for scam victims to address psychological impact

- Financial rehabilitation support for those who have lost significant savings

- Anonymous reporting channels within communities

Educational Institutions’ Approach

- Curriculum Integration:

- Financial literacy courses that include specific modules on scams and money laundering

- Critical thinking skills to evaluate online offers and opportunities

- Digital citizenship education starting from primary school

- Campus Prevention:

- Monitoring of campus networks for recruitment attempts

- Orientation programs with anti-scam components for new students

- Collaboration with banks for student-focused awareness campaigns

- Targeted Interventions:

- Special attention to international students who may be unfamiliar with local laws

- Programs addressing student financial stress to reduce vulnerability

- Peer education networks to spread awareness in student-friendly language

Legal Framework Extensions

- Enhanced Prosecution Framework:

- Consideration of mitigating factors for first-time offenders

- Rehabilitation programs alongside punishment

- Progressive penalty structures based on involvement level

- Preventive Legal Measures:

- Mandatory cooling periods for new bank accounts

- Legal requirements for face-to-face verification for account openings

- Enhanced KYC (Know Your Customer) regulations for financial institutions

- Cross-Sector Legal Collaboration:

- Information-sharing protocols between educational institutions, banks, and law enforcement

- Legal protections for whistleblowers

- Immunity considerations for cooperative money mules who help break more extensive networks

Implementation Strategy

- Multi-agency Task Force:

- Representation from education, banking, community organizations, and law enforcement

- Regular review of prevention strategies against evolving scam tactics

- Development of sector-specific prevention toolkits

- Public-Private Partnerships:

- Technology companies collaborating with schools on digital literacy

- Banks sponsoring educational programs in schools and communities

- Telecom providers implementing scam call filtering systems

- Measurement and Accountability:

- Regular reporting on scam prevention efforts and outcomes

- Independent assessment of program effectiveness

- Public dashboards showing scam trends and prevention metrics

Singapore-Specific Considerations

This approach aligns with Singapore’s community-oriented prevention philosophy while extending the current legal framework that has already established substantial penalties. The multi-sector collaboration leverages Singapore’s tightly integrated public services and educational system, potentially creating a more comprehensive shield against money mule recruitment.

By engaging schools, civil society, and legal institutions alongside existing bank and police efforts, Singapore could develop a more resilient society-wide defence against the money mule problem that underpins the growing scam ecosystem.

Analysis of the Bank Account Money Mule Scam

Scam Structure and Mechanics

This case represents a classic money mule operation with several distinct elements:

- Recruitment Chain:

- A “mastermind” (Harry Turner) who likely doesn’t exist under that name

- A primary recruiter (Timothy) who brings in secondary mules

- Multiple account holders (Patrick, Kamaraj, and Daniel) who provide the banking infrastructure

- Corporate Legitimacy Layer:

- Creation of business entities like “Frontier Global Trade & Consultancy” and “Premier International Trade & Consultancy”

- These companies provided a veneer of legitimacy for large international transfers

- Financial Flow:

- Victims abroad (Australians) transferred funds to Singapore-based accounts

- Money was quickly withdrawn and dispersed to minimize tracing

- A commission structure (3% for account holders, 2% for the recruiter) ensured all participants had financial incentives

- Documentation Fraud:

- When questioned by banks, participants created fictitious documents to explain suspicious transactions

- This demonstrates premeditated intent to deceive financial institutions

Red Flags Present in This Case

Several warning signs were apparent:

- The vague “consultancy services” with no transparent business model

- The recruiter’s acknowledgment that the earnings were “too good to be true”

- The rapid movement of large sums through accounts

- The need to submit fabricated documentation to banks

- The use of multiple companies and accounts for similar transactions

Anti-Scam Measures in Singapore

Singapore has implemented robust measures to combat such scams:

Legal Framework

- Penalties and Enforcement:

- Severe jail terms for money mule activities, as seen in this case

- The Organised Crime Act provides tools to prosecute criminal networks

- The Payment Services Act regulates digital payment services

- Anti-Money Laundering Regulations:

- Monetary Authority of Singapore (MAS) imposes strict Know Your Customer (KYC) requirements

- Banks must report suspicious transactions under the Corruption, Drug Trafficking and Other Serious Crimes Act

Technological Solutions

- ScamShield App:

- Government-developed app that blocks known scam calls and messages

- Uses machine learning to identify potential scam attempts

- Bank Transaction Controls:

- Default transaction limits on digital banking platforms

- Cooling-off periods for adding new payees

- SMS/app notifications for unusual transactions

Public Education Initiatives

- National Crime Prevention Council Campaigns:

- “Spot the Signs, Stop the Crimes” awareness campaign

- Educational resources explaining standard scam methodologies

- Inter-Ministry Collaboration:

- Anti-Scam Centre coordinates between police, financial institutions, and telecommunications companies

- Public-private partnerships for faster information sharing

- Scam Alert Website and Hotline:

- Centralized reporting system for potential scams

- Regular updates on emerging scam trends

Financial Industry Safeguards

- Enhanced Transaction Monitoring:

- As evidenced in this case when the bank flagged a large withdrawal

- AI-powered systems to detect unusual patterns in account activity

- Account Opening Due Diligence:

- Stricter verification processes for business accounts

- Regular review of high-risk accounts

Areas for Improvement

Despite these measures, this case highlights ongoing challenges:

- Cross-Border Coordination:

- International scams require better cooperation between jurisdictions

- The Australian victims had limited recourse once money left their country

- Company Registration Scrutiny:

- More thorough vetting of newly formed companies with international transactions

- Regular audits of small consultancies with vast cash flows

- Public Awareness:

- Continued education about the legal consequences of being a money mule

- Clear communication that “too good to be true” financial opportunities are typically fraudulent

This type of sophisticated scam demonstrates why Singapore continues to strengthen its anti-scam ecosystem through a combination of legislation, technology, public education, and international cooperation.

Methods to Prevent Money Muling in Singapore

Regulatory and Banking Measures

Transaction Monitoring Systems

- Real-time transaction monitoring utilizing AI to detect unusual patterns

- Intelligent systems flagging rapid deposits followed by withdrawals

- Automated alerts for transactions involving high-risk jurisdictions

- Velocity checks that identify unusual account activity rates

Account Opening Procedures

- Enhanced due diligence for new accounts, especially business accounts

- Biometric verification requirements for both in-person and digital onboarding

- Document authentication technology to verify identification documents

- Risk-based approach with additional scrutiny for higher-risk profiles

Banking Controls

- Delayed processing for extensive transactions

- Mandatory cooling periods before new payees can receive large transfers

- Default transaction limits requiring additional verification to increase

- Call-back verification for transactions above certain thresholds

Public Education and Awareness

Targeted Campaigns

- “Don’t Be A Money Mule” awareness programs in schools and universities

- Community outreach focusing on vulnerable populations (students, elderly, job seekers)

- Multi-language campaigns reaching diverse communities

- Specific education on the legal consequences, including jail time

Warning Systems

- SMS alerts about standard money mule recruitment techniques

- In-app banking notifications about the risks of allowing account access

- Digital banking platform pop-up warnings about suspicious transaction patterns

- Community alerts when new money mule recruitment tactics are detected

Law Enforcement Strategies

Proactive Investigation

- Dedicated Anti-Scam Centre resources for money mule network detection

- Collaboration between police and financial intelligence units

- Data analytics to identify connected accounts and transaction patterns

- Regular auditing of newly formed companies with unusual transaction patterns

Deterrence Through Prosecution

- Publicized cases showing severe penalties for money mules

- Prosecution of all participants in the chain, not just ring leaders

- Asset recovery procedures to trace and seize criminal proceeds

- Clear communication that ignorance is not an acceptable legal defense

Industry Collaboration

Information Sharing Networks

- Bank consortium sharing intelligence on suspicious patterns

- Cross-industry collaboration between telcos, banks, and payment providers

- A centralized database of known mule accounts and recruitment techniques

- Public-private partnerships for faster response to emerging threats

Technology Solutions

- Shared fraud detection engines across multiple financial institutions

- Digital footprint analysis (device, location, and behavioral data)

- Blockchain analytics to trace fund movements across platforms

- API-based systems allowing real-time information exchange between institutions

Targeted Vulnerability Reduction

Job Seeker Protection

- Partnership with job platforms to detect and remove suspicious job listings

- Education about legitimate versus suspicious job offers

- Warning systems on employment platforms

- Verification processes for companies advertising “financial agent” positions

Student-Focused Programs

- Campus awareness campaigns highlighting the risks

- Financial literacy modules covering scams and money mule awareness

- University partnerships with financial institutions for education

- Peer-to-peer awareness programs led by students themselves

International Cooperation

Cross-Border Coordination

- Information sharing agreements with other jurisdictions

- Joint investigation teams for transnational cases

- Standardized reporting formats for suspicious transaction reporting

- Rapid freeze mechanisms for cross-border fund movements

Regional Intelligence Framework

- ASEAN-wide cooperation on money laundering typologies

- Coordinated action against known crime groups operating regionally

- Harmonized KYC standards across regional financial institutions

- Shared blacklists of suspicious entities across borders

The most effective prevention strategy combines these approaches with continuous adaptation as criminals evolve their tactics. Singapore’s multi-agency approach involving the MAS, Singapore Police Force, and private sector partners has shown promising results, but ongoing vigilance remains essential.

Essential Fraud Detection Strategies

1. Multi-layered Authentication Systems

Modern authentication must go beyond passwords. A robust system should incorporate:

Biometric Verification using fingerprints, facial recognition, or voice authentication adds a physical dimension to security that’s difficult to replicate.

Device Intelligence examines the devices used to access accounts, flagging suspicious logins from unfamiliar devices or locations.

Behavioral Biometrics analyzes patterns in how users interact with devices—how they type, swipe, or navigate—creating a behavioral fingerprint that’s hard for fraudsters to mimic.

2. Machine Learning and AI Detection Systems

Artificial intelligence has transformed fraud detection from rules-based systems to sophisticated pattern recognition:

Anomaly Detection algorithms establish baseline behaviours for users and flag deviations from standard patterns. For example, if a user who typically makes small, local purchases suddenly attempts large international transactions, the system can automatically flag this for review.

Predictive Analytics examines historical fraud patterns to forecast potential vulnerabilities. These systems become increasingly accurate over time as they process more data and fraud scenarios.

Adaptive Authentication dynamically adjusts security requirements based on risk assessment. Low-risk transactions might proceed with minimal friction, while high-risk activities trigger additional verification steps.

3. Real-time Transaction Monitoring

Modern fraud detection must operate at the speed of digital transactions:

Velocity Checks look for suspicious patterns in the frequency of activities, such as multiple account creation attempts or rapid-fire transactions.

Network Analysis examines connections between accounts, identifying clusters of potentially fraudulent activity that might indicate organized fraud rings.

Geolocation Verification checks whether transaction locations make logical sense given a user’s history and profile.

4. Data Integration and Cross-channel Analysis

Effective fraud detection requires a holistic view across all channels and touchpoints:

Unified Customer Profiles combine data from various sources—mobile apps, websites, call centres, and physical locations—to create a comprehensive view of customer behaviour.

Cross-channel Pattern Recognition identifies suspicious activities that might appear normal when viewed in isolation but reveal fraud patterns when examined across channels.

Third-party Data Enrichment augments internal data with external information such as device reputation databases, known fraud networks, and compromised credential lists.

5. Advanced Analytics Tools: Implementation Examples

Let’s look at how these strategies might be implemented in practice with code examples:

Machine Learning Fraud Detection System

Click to open the code

Tap to open

This code example demonstrates several key concepts in fraud detection:

- Feature Engineering: The system calculates derived features that are strong fraud indicators, such as distance from home location, unusual transaction amounts compared to user history, and temporal patterns.

- Risk-based Decision Making: Rather than a binary approve/decline decision, the system implements a spectrum of responses based on both the risk score and transaction context.

- Machine Learning Implementation: The Random Forest model can capture complex, non-linear relationships between features and fraud likelihood, making it practical for detecting sophisticated fraud patterns.

- Explainability: The system analyzes feature importance, providing insight into which factors most strongly indicate fraud—crucial for improving the system and explaining decisions to customers and regulators.

6. Behavioral Analytics

Beyond transaction details, modern fraud systems analyze how users behave:

Session Analysis examines user interaction patterns during a session, such as navigation paths, interaction speed, and hesitation points. Fraudsters often exhibit different behaviours than legitimate users when navigating financial interfaces.

Typing Patterns can reveal when a different person is using familiar credentials. Legitimate users develop consistent typing rhythms and patterns that are difficult to replicate.

Usage Consistency looks at whether behaviour matches patterns. For example, a user who constantly carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

7. Collaborative Security Approaches

Fraud detection is strengthened through industry cooperation:

Consortium Data Sharing allows financial institutions to pool anonymized fraud data, creating a more comprehensive picture of emerging threats while preserving customer privacy.

Regulatory Cooperation enables institutions to work with government agencies to identify large-scale fraud operations and money laundering networks.

Vendor Integration leverages specialized third-party security services that focus exclusively on specific types of fraud detection, adding another layer of protection.

Implementation Challenges and Solutions

Implementing fraud detection systems comes with significant challenges:

False Positives create friction for legitimate customers and can damage trust. Solutions include:

- Implementing risk-based authentication that adds friction only when necessary

- Using ensemble models that combine multiple detection approaches for greater accuracy

- Continuously tuning systems based on customer feedback and false positive analysis

Data Privacy Regulations such as GDPR and CCPA restrict how customer data can be used. Consider:

- Implementing privacy-by-design principles in fraud systems

- Using anonymization and pseudonymization techniques

- Creating clear data governance frameworks with documented legitimate interest in fraud prevention

Integration Complexity across legacy and modern systems can impede effectiveness. Address this by:

- Using API-first approaches for system integration

- Implementing data transformation layers to normalize inputs from different systems

- Creating real-time event streams for fraud data rather than batch processing

Building a Fraud Prevention Culture

Technical solutions are only part of effective fraud prevention:

Employee Training should ensure that all staff members understand their role in preventing fraud, recognizing warning signs, and following security protocols.

Customer Education helps users protect themselves by recognizing phishing attempts, using strong authentication methods, and understanding how to report suspicious activities.

Regular Testing through penetration testing, red team exercises, and fraud simulations helps identify vulnerabilities before criminals can exploit them.

Measuring and Improving Your Fraud Detection System

Continuous improvement requires careful measurement:

Key Performance Indicators should include:

- False positive rate: Legitimate transactions incorrectly flagged

- False negative rate: Fraudulent transactions missed

- Detection speed: Time from fraud attempt to detection

- Customer impact metrics: Authentication success rates and friction points

A/B Testing allows you to compare different detection approaches and fine-tune systems based on real-world results rather than theoretical models.

Post-incident analysis should thoroughly examine confirmed fraud cases to identify how detection could have happened earlier or more efficiently.

Conclusion

As fintech continues to transform the financial landscape, fraud detection must remain a top priority for businesses. By implementing multi-layered approaches that combine advanced technologies with human expertise, fintech companies can protect both their customers and their bottom line.

Remember that effective fraud prevention is not a static solution but an ongoing process that must continuously evolve to address new threats. By staying vigilant and investing in robust detection systems, your business can build customer trust while minimizing losses in an increasingly digital financial world.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.