Singapore is experiencing a surge in impersonation scams involving Chinese platforms like WeChat, UnionPay, and Alipay. 678 cases have been reported since January 2025, and losses have exceeded SG$17.4 million.

The scam typically works as follows:

- Scammers call from local numbers (starting with “8” or “+65”)

- They claim to be platform staff warning about expiring subscriptions

- Conversations move to WhatsApp, where victims are told fees will be deducted

- Victims are asked to verify identity by sharing personal/banking information

- Some scammers use screen sharing to guide victims through bank transfers

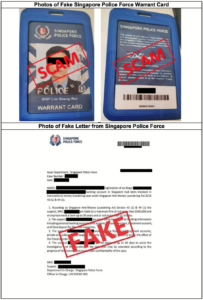

- Advanced tactics include forged documents, fake MAS officers claiming money laundering, and false court orders

Key safety recommendations from authorities:

- Be wary of overseas calls with the “+” prefix

- Don’t share personal/banking details with unknown parties

- Never share your screen during banking transactions

- Remember, government messages come from official gov.sg SMS IDs

- Legitimate MAS officers don’t wear uniforms or issue arrest warrants

- Government officials won’t ask for money transfers or banking details

If you suspect being scammed:

- Contact your bank immediately

- File a police report

- Call the 24/7 ScamShield Helpline at 1799

- Visit www.scamshield.gov.sg for more information

The article emphasizes that digital safety is a shared responsibility requiring public education and quick action.

Analysis of Chinese Company Impersonation Scams in Singapore

Scam Methodology and Trends

Based on the article, Chinese company impersonation scams in Singapore follow a sophisticated pattern:

- Initial Contact: Scammers call from local Singapore numbers (starting with “8” or with the “+65” country code) to appear legitimate.

- False Pretext: They impersonate staff from Chinese platforms like WeChat, UnionPay, and Alipay, claiming an urgent issue with subscriptions about to expire.

- Platform Transition: Moving conversations to WhatsApp creates a sense of legitimacy while allowing scammers to use features like screen sharing.

- Fear Tactics: Victims are told fees will be automatically deducted from their accounts, creating urgency.

- Credential Harvesting: Under the guise of “verification,” scammers collect personal and banking information.

- Financial Extraction: Victims are instructed to transfer money to “designated accounts” with promises of refunds.

- Escalation Techniques: More sophisticated attacks involve:

- Sending forged documents containing victims’ personal information

- Introducing fake MAS officers claiming money laundering investigations

- Showing fabricated court orders or arrest warrants

- Conducting video calls with scammers in fake uniforms

The scale is significant, with at least 678 scam cases reported since January 2025, resulting in losses exceeding SG$17.4 million.

Singapore’s Anti-Scam Measures

Singapore has implemented a comprehensive approach to combat these scams:

Technological Solutions

- ScamShield App: Government-developed application to block scam calls and messages

- Money Lock Features: Banking security features to limit and monitor transactions

Education and Awareness

- Public Advisories: Joint advisories from Singapore Police Force and MAS

- Verification Guidelines: Clear instructions on how to identify legitimate communications

- Government messages come only from official gov.sg SMS IDs

- MAS officers don’t wear uniforms or issue arrest warrants

- Government officials never request money transfers or banking details

Reporting Infrastructure

- 24/7 ScamShield Helpline (1799): Dedicated channel for reporting suspicious activity

- Cross-Agency Collaboration: Coordinated response between police and financial authorities

- Real-Time Reporting Systems: Enabling quick action when scams are detected

Financial Safeguards

- Banking Partnership: Work with financial institutions to flag suspicious transactions

- Transaction Monitoring: Systems to detect unusual patterns in financial activity

- Rapid Response Protocols: Procedures for banks to freeze accounts and recover funds when scams are reported

Community Engagement

- Encouraging Open Communication: Promoting discussions about scam experiences.

- Shared Responsibility Framework: Emphasizing that digital safety requires participation from all citizens

- Educational Resources: Comprehensive information is provided at www.scamshield.gov.sg

Singapore’s approach combines technological solutions, public education, strong institutional frameworks, and community engagement to create multiple layers of defense against increasingly sophisticated scams.

Preventing Impersonation Scams in Singapore: A Comprehensive Guide

Recognizing Red Flags

Suspicious Contact Methods

- Be wary of unsolicited calls, especially those from local numbers starting with “8” or with the “+65” country code.

- Treat with suspicion any caller claiming to be from WeChat, UnionPay, Alipay, or other platforms and warning about expiring subscriptions.

- Be suspicious of requests to continue conversations on WhatsApp or other messaging platforms.

Pressure Tactics

- Be alert when someone creates urgency (“Your account will be charged immediately”)

- Question situations where you’re asked to act quickly without time to verify

- Be skeptical of threats regarding legal consequences or account freezes.

Verification Issues

- Be suspicious when someone seems to know your personal information (scammers may have obtained this elsewhere)

- Question any request to “verify your identity” by providing banking details.

- Be wary of anyone asking you to share your screen during financial transactions.

Protective Measures

Technical Safeguards

- Install the Singapore government’s ScamShield App to filter scam calls and messages.

- Activate Money Lock and other security features provided by your bank

- Set transaction limits on your banking accounts

- Enable two-factor authentication for all financial accounts

- Consider using a dedicated credit card with lower limits for online transactions

Communication Practices

- Never share personal or banking details with unknown parties

- Never share OTPs (One-Time Passwords) with anyone, regardless of who they claim to be

- Avoid using screen-sharing features during banking transactions

- Don’t click on suspicious links sent via SMS, WhatsApp, or email

Verification Habits

- Always verify requests independently by calling the official number of the company (look it up yourself)

- Remember that Singapore Government messages will only come from official gov.sg SMS IDs

- Be aware that MAS officers do not wear uniforms or issue arrest warrants

- Know that legitimate government officials will never ask you to:

- Transfer money

- Reveal banking details

- Download apps from unofficial sources

- Transfer a call directly to the Police (except 995 emergency calls)

If You Suspect a Scam

Immediate Steps

- End the conversation immediately

- Contact your bank through official channels to report suspicious activity

- Change passwords for any potentially compromised accounts

- Call the 24/7 ScamShield Helpline at 1799 for guidance

- File a police report with detailed information about the incident

Documentation

- Take screenshots of suspicious messages or call logs

- Record details of any transactions made

- Note down phone numbers and account details used by scammers

Building Long-Term Resilience

Stay Informed

- Follow updates from the Singapore Police Force and MAS about current scam tactics.

- Visit www.scamshield.gov.sg regularly for the latest information

- Subscribe to scam alert services if available

Community Awareness

- Share experiences and warnings with family and friends, especially those who might be vulnerable

- Help educate elderly relatives about common scam tactics

- Report scam attempts even if you didn’t fall victim

Financial Hygiene

- Regularly check bank statements for unauthorized transactions

- Consider credit monitoring services

- Periodically update security settings on financial accounts

- Use different passwords for different financial services

Resources

- ScamShield Helpline: 1799 (24/7)

- Police Emergency: 999

- Anti-Scam Website: www.scamshield.gov.sg

- Report Scams Online: www.police.gov.sg

- Banking Association Hotlines: Contact your specific bank for their fraud reporting hotline

Anti-Scam Measures in Singapore

Singapore has implemented comprehensive measures to combat scams:

- Institutional Frameworks:

- Anti-Scam Centre established by the Singapore Police Force

- Inter-Ministry Committee on Scams coordinates government-wide responses

- ScamShield app to block known scam calls and messages

- Financial Safeguards:

- Bank transaction delays for suspicious transfers

- Cryptocurrency platform warnings (as seen in Ms. Lee’s case)

- SMS alerts for outgoing transfers exceeding specific amounts

- Public Education:

- National Crime Prevention Council’s “Spot the Signs, Stop the Crimes” campaign

- Regular public advisories about emerging scam trends

- ScamAlert website provides up-to-date information on scam tactics

- Legislative Approaches:

- Stringent penalties for scam-related crimes

- Consideration of expanded punishments (the article mentions possible caning for scam offenses)

- Prosecution of money mules who facilitate scams

- Technology Solutions:

- AI-based detection systems in banking platforms

- Phone number verification systems

- Cross-border cooperation to tackle international scam syndicates

Protective Measures for Individuals

To avoid falling victim to similar scams:

- Verify independently: Research investment opportunities through official channels, not just through contacts made online.

- Adopt skepticism: Be wary of opportunities promising above-market returns with minimal risk.

- Consult others: Discuss potential investments with trusted family members or financial advisors.

- Respect warning signs: Take platform warnings seriously, as they often have sophisticated detection systems.

- Remember the rule: If an opportunity seems too good to be true, it probably is.

Singapore’s comprehensive approach combines technological solutions, public education, and enforcement, but as Ms. Lee’s case shows, scammers’ psychological sophistication continues to make these crimes effective despite protective measures.

Investment Scam Prevention Through Singapore’s Ecosystem

Legal Framework in Singapore

Singapore’s legal approach to investment scams includes several key statutes:

- Computer Misuse Act: Addresses technology-facilitated fraud, including impersonation and unauthorized access to financial systems.

- Penal Code Section 415: Defines and penalizes cheating and dishonestly inducing delivery of property, directly applicable to investment scams.

- Securities and Futures Act: Regulates investment solicitations and prohibits false or misleading statements about investment products.

- Organized Crime Act: Provides tools to combat syndicates operating scam networks across borders.

- Payment Services Act: This regulates digital payment services and cryptocurrency exchanges, adding safeguards for transactions.

Recent amendments have strengthened these laws, with courts routinely imposing substantial jail terms for scam-related offenses. The article mentions the consideration of caning, which represents a potential escalation in punitive measures, reflecting the severity with which Singapore views these crimes.

Educational Institutions’ Role

Singapore’s educational system plays a crucial preventative role:

- Financial Literacy Programs: The Ministry of Education has integrated financial literacy into the curriculum, teaching students to evaluate investment opportunities critically.

- Media Literacy Education: Schools teach students to identify misinformation and suspicious online content.

- Tertiary Education Initiatives: Polytechnics and universities offer courses on cybersecurity and fraud prevention.

- School-Based Anti-Scam Campaigns: Student-led initiatives like “Spot the Scam” competitions increase awareness among youth.

- Parent Education Programs: Schools conduct workshops for parents on discussing scam awareness with children, creating multigenerational protection.

Civil Society Engagement

Singapore’s civil society organizations actively combat investment scams through:

- Consumer Association of Singapore (CASE): Provides resources for verifying legitimate investments and reporting suspicious schemes.

- Silver Ribbon Singapore: Focuses on protecting elderly Singaporeans, who are often targeted by scammers.

- Association of Banks in Singapore: Coordinates industry-wide responses to emerging financial scams.

- Community Centers: Conduct grassroots education through RC and CC networks, vital for reaching older residents.

- Professional Bodies: Organizations like the Institute of Singapore Chartered Accountants provide public education on financial fraud.

- Volunteer Initiatives: Programs like SG Cares mobilize volunteers to conduct anti-scam education in HDB estates.

Integrated Community Response

Singapore’s most effective anti-scam measures come from coordination between legal frameworks, educational institutions, and civil society:

- Neighborhood Watch Groups: Trained to recognize and report potential scam activities within housing estates.

- Community Alert Systems: WhatsApp groups and Telegram channels operated by grassroots organizations rapidly disseminate information about new scam tactics.

- Multi-Agency Roadshows: Combine efforts of police, financial institutions, and civil organizations to provide comprehensive education.

- Helplines and Reporting Infrastructure: Easy-access channels for reporting and seeking assistance when encountering potential scams.

Singapore’s distinctive approach leverages its tight social fabric and high institutional trust to create multiple layers of protection against investment scams. This integrated strategy is increasingly necessary as scammers, like those who targeted Ms. Lee, continue to develop sophisticated psychological manipulation tactics.

Comprehensive Prevention Strategies

Individual-level Protection

- Verify independently:

- Never call numbers provided in suspicious messages

- Look up official contact information separately

- Call your bank directly using the number on your card

- Implement technical safeguards:

- Enable multi-factor authentication on all accounts

- Set up transaction notifications for all amounts

- Use bank apps instead of following links

- Set reasonable transaction limits that match your spending patterns

- Practice critical skepticism:

- Be suspicious of unexpected contacts about financial matters

- Question urgent requests for information or money

- Be wary of grammatical errors or generic greetings

- Remember that legitimate institutions never ask for passwords or OTPs

- Follow the “pause principle”:

- Take time before responding to urgent-seeming requests

- Consult with trusted friends or family before large transactions

- Research investment opportunities thoroughly before committing

Red Flags to Watch For

- Unsolicited communications about financial or technical issues

- Requests for remote access to your devices

- Promises of unusually high investment returns

- Pressure to act immediately

- Requests for personal financial information or passwords

- Instructions to transfer money to overseas accounts

- Threats of legal consequences if you don’t comply

By understanding these patterns and implementing these preventive measures, individuals can significantly reduce their vulnerability to common scams. The most effective defense combines technical safeguards with heightened awareness and a healthy skepticism toward unexpected financial communications.

Analysis of Singapore’s Scam Prevention Approach

Government and Institutional Measures

Based on the article, Singapore has implemented several institutional approaches to combat scams:

- Monetary Authority of Singapore (MAS) Initiatives:

- Working directly with banks to enhance digital banking security

- Implementing new protective measures like eliminating clickable links in official emails/SMSes

- Requiring a minimum 12-hour delay before activating new soft tokens on mobile devices

- Providing specific guidance to banking customers on safe practices

- Police Force Involvement:

- The Singapore Police Force (SPF) actively tracks and reports on scam statistics

- Conducts investigations of scammers and money mules (as evidenced by the case involving 170 men and 89 women)

- Shares examples and screenshots of scams to raise public awareness

- Banking Sector Protections (specifically highlighted for DBS):

- Stopping non-essential SMSes with links

- Sending only essential communications like security notifications and OTP authentication

- Implementing default transaction notification thresholds (S$100)

- Providing in-app security features like card locking and customizable spending limits

- Offering digital tokens with enhanced encryption

Effectiveness Analysis

The approach appears to be multi-faceted, combining:

- Technical barriers: Implementing security features that make scamming more difficult

- Public education: Raising awareness about standard scam techniques

- Enforcement: Actively investigating scam cases

However, the rising scam statistics mentioned (16% increase in cases, with amounts cheated rising from S$63.5M to S$168M) suggest these measures may be struggling to keep pace with evolving scam techniques.

Strengths of Singapore’s Approach

- Coordinated response: Collaboration between regulatory bodies (MAS), law enforcement (SPF), and financial institutions

- Customer-focused solutions: Tools that give customers more control over their security

- Practical implementation: Specific, actionable measures rather than just general advice

Potential Gaps and Recommendations

- Technology gap: The article doesn’t mention advanced detection technologies like AI for identifying unusual transaction patterns

- Demographic considerations: No specific mention of tailored approaches for vulnerable groups like seniors

- Private sector cooperation: Limited discussion of how businesses beyond banks are involved in prevention

- International coordination: No mention of cooperation with other countries to address overseas-based scammers

Singapore’s approach appears to be comprehensive but could potentially benefit from more advanced technological solutions and broader cooperation across sectors and borders to address the evolving nature of scams.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.