Here is a news article about two separate theft cases in Singapore. Two men were charged in court on April 9, 2025.

In the first case, a 36-year-old man was arrested for allegedly stealing two boxes of red packets (containing approximately $50,000) from a wedding reception at a Beach Road hotel on April 5. The theft was reported on April 5, and the man was arrested on April 7. Police recovered $3,000 in cash, and their investigation indicated that the suspect had planned the theft and changed his clothes afterward to avoid detection.

In the second unrelated case, a 26-year-old man was arrested on April 6 for allegedly stealing a $12,000 gold bracelet from a jewelry shop on Serangoon Road. The man tried on the bracelet and walked out while the staff was busy with another customer. Police arrested him within 24 hours and seized over $4,900 in cash, a smartphone, and a laptop as evidence.

Both men are scheduled to appear in court on April 9, 2025.

Analysis of Theft and Scams in Singapore

Socioeconomic Factors Contributing to Theft

Several socioeconomic factors may contribute to theft cases like those mentioned:

- Income inequality: Despite Singapore’s prosperity, there are significant wealth gaps. The Gini coefficient (after transfers and taxes) was around 0.38 in recent years, indicating moderate inequality that can create financial pressure on lower-income individuals.

- Cost of living pressures: Singapore consistently ranks among the world’s most expensive cities. Essential costs like housing, healthcare, and education place financial strain on many residents.

- Economic vulnerabilities: The post-pandemic economic recovery has been uneven, with some sectors and workers experiencing continued financial hardship or unstable employment.

- High-value targets: The presence of visible wealth (like red wedding packets worth $50,000 or a $12,000 gold bracelet) creates opportunities for theft, especially during economic hardship.

Current Economic Burden

Singapore’s economic context includes:

- Inflation pressures: Singapore has experienced elevated inflation rates in the post-pandemic period, eroding purchasing power for many residents.

- Housing affordability concerns: Property prices continue to rise faster than income growth for many segments of the population.

- Job market transformation: Economic restructuring and technology adoption have displaced some workers, particularly those in middle-skill occupations.

- Widening wealth gap: The difference in assets and income between the highest and lowest economic quintiles continues to grow.

Reasons for Rise in Theft and Scams

- Digital transformation: The rapid shift to online platforms for banking, shopping, and socializing has created new opportunities for digital scams.

- Sophisticated criminal techniques: Scammers employ increasingly advanced psychological manipulation tactics and technology.

- Cross-border operations: Many scams originate from overseas, making enforcement challenging.

- Pandemic aftermath: COVID-19 accelerated digital adoption while creating financial desperation for some, creating perfect conditions for scam proliferation.

- Social isolation: Reduced face-to-face interaction diminishes natural community protection against scams, especially for vulnerable populations.

Anti-Scam Resources in Singapore

- ScamShield: The Singapore Police Force app that blocks known scam calls and messages.

- Anti-Scam Centre: Established by the police to coordinate scam prevention and investigation.

- National Crime Prevention Council’s Scam Alert: Provides updates on the latest scam types and prevention advice (www.scamalert.sg).

- Report scams: The public can report scams to the Police Hotline at 1800-255-0000 or online through the Police’s I-Witness platform.

- Bank safeguards: Major banks have implemented additional security measures for high-risk transactions.

- Community education: Regular public awareness campaigns target vulnerable populations like the elderly.

- OCBC Anti-Scam Keyboard: Some banks have developed tools that warn users when they type suspicious information.

- Anti-Scam Helpline: 1800-722-6688 for anyone who suspects they’ve been scammed or needs urgent assistance.

These resources reflect Singapore’s multi-pronged approach to combating the rise in scams through technology, education, and enforcement.

Legitimate Ways for Singaporeans to Alleviate Financial Distress

When facing financial challenges, there are numerous legitimate resources and strategies Singaporeans can access instead of resorting to crime:

Government Financial Assistance

- ComCare: Provides short to medium-term financial assistance for low-income individuals and families

- COVID-19 Recovery Grant: Support for workers who lost income due to the pandemic

- Workfare Income Supplement: Cash payments and CPF contributions for lower-wage workers

- GST Voucher Scheme: Cash payments, U-Save rebates, and MediSave top-ups for eligible households

- Silver Support Scheme: Quarterly cash supplements for seniors with limited financial support

Employment Support

- Workforce Singapore (WSG): Career matching services and skills upgrading programs

- SkillsFuture Credits: Government-funded credits for skills development courses

- SGUnited Jobs and Skills Package: Job placement and training opportunities

- Career Trial: Try-out opportunities with participating employers with training allowance

- Progressive Wage Model: Structured wage increases in specific sectors

Debt Management

- Credit Counselling Singapore: Free credit counselling and debt management programs

- Debt Consolidation Plan: Consolidate outstanding unsecured debts with participating banks

- Bankruptcy alternatives: The Debt Repayment Scheme (DRS) for debts under $150,000

- Specialized help: Organizations like AWARE and Family Service Centres offer financial counseling

Community Resources

- Community Development Councils (CDCs): Local assistance programs

- Social Service Offices: One-stop assistance centers throughout Singapore

- Family Service Centres: Counseling and support services, including financial advice

- Religious organizations: Many temples, mosques, and churches provide financial assistance

- Food support: Food banks like Food From The Heart provide necessities to families in need

Financial Planning Support

- MoneySense: National financial education program with free resources

- CPF Retirement Planning Service: Free retirement planning consultations

- Institute for Financial Literacy: Free workshops on personal finance management

- Credit Bureau Singapore: Tools to understand and improve credit scores

Additional Options

- Side gigs and freelance work: Platforms like Grab, Deliveroo, or Fiverr for supplemental income

- Rent assistance/subsidy: Public rental housing schemes for lower-income households

- Medical subsidies: CHAS card, MediFund and other healthcare subsidies

- Education assistance: MOE Financial Assistance Scheme for school-going children

Taking advantage of these resources not only provides immediate relief but also builds long-term financial resilience without the serious consequences of criminal activity.

The article highlights how scams have become nearly impossible to spot, even for experts. At the Global Anti-Scam Summit Asia 2024, most anti-scam experts (including law enforcement, bank representatives, and tech companies) failed to identify AI-generated fake videos.

The Scale of the Problem

- Global losses to scams: Approximately US$1.02 trillion between August 2022-2023

- Asian losses: Over US$688.42 billion (S$913.8 billion) in the past year

- Singapore losses: More than $2.7 billion since 2019, with a record $385.6 million lost in just the first half of 2024

Why Traditional Anti-Scam Advice Is Failing

The article explains how scammers are adapting to bypass traditional safety measures:

- SSL certificates (https://) are now free and are used by scam websites

- 20-30% of product reviews are fake, making them unreliable for verification

- Scammers now show their faces during video calls using AI face-masking technology

- Some scammers don’t hide their identity because they operate from outside victims’ jurisdictions

Current Prevention Measures

- Singapore’s framework makes financial institutions and telcos accountable

- “Money lock” initiative by banks that prevents remote access to a portion of funds

- Anti-scam awareness campaigns (though these are often quickly outpaced by scammers)

Expert Perspective

Jorij Abraham, Gasa’s managing director, believes:

- It’s now “inevitable” that everyone will fall victim to scams at some point.

- Protection requires government and institutional involvement at an infrastructural level.

- Perfect prevention is impossible unless “you haven’t taken any risks and lived”

1. E-Commerce Scams

Trend Details

- 11,665 cases in 2024

- 19.23% increase from 2023

- Total losses: $17.5 million

- Average loss: $1,508 per case

Notable Example

A scammer named Foo Mei Qi:

- Defrauded 76 victims of $110,700 through fake Taylor Swift concert tickets

- Sold counterfeit tickets totalling $7,780

- Operated primarily on Carousell

Prevention Methods

- Never make payments before receiving items

- Be extra cautious on messaging platforms like Telegram

- Verify seller credentials thoroughly

- Be sceptical of deals for high-demand, sold-out items

- Use secure payment methods with buyer protection

- Meet sellers in safe, public locations for transactions

- Check the seller’s profile, reviews, and transaction history

2. Job Scams

Trend Details

- 9,043 cases in 2024

- 8.79% decrease from 2023

- Total losses: $156.2 million

- Average loss: $17,281 per case

Typical Scam Mechanism

- Initial contact via WhatsApp or Telegram

- Offer of high-paying remote work

- Start with simple tasks like surveys or reviews

- Gradually request money transfers for “job opportunities.”

- Eventually, stop communication or prevent commission payouts

Prevention Methods

- Never pay money to get a job

- Be wary of unsolicited job offers

- Research the company thoroughly

- Check job listings through official channels

- Avoid roles requiring upfront personal investment

- Verify company contact information

- Be sceptical of jobs promising unusually high commissions

3. Phishing Scams

Trend Details

- 8,552 cases in 2024

- 44.02% increase from 2023

- Total losses: $59.4 million

- Average loss: Nearly $2,994

- The majority of victims (42.2%) were aged 30-49

Notable Example

- One victim lost $33.8 million in cryptocurrency

- Scammer used a fake advertisement on a legitimate crypto wallet app

- The victim is redirected to a convincing fake website

- Credentials stolen, unauthorized transactions made

Prevention Methods

- Maintain healthy skepticism about online offers

- Carefully check website URLs

- Look for subtle differences in website design

- Never click on suspicious links

- Use two-factor authentication

- Keep software and security systems updated

- Be cautious about providing login credentials

- Verify website authenticity before entering personal information

4. Investment Scams

Trend Details

- 6,814 cases in 2024

- 69.08% increase from 2023

- Total losses: $320.7 million

- Primarily targets individuals 50 and above

Typical Scam Mechanism

- Unsolicited addition to WhatsApp/Telegram investment groups

- Fake screenshots of “earnings”

- Promises of high, low-risk returns

- Victims transfer funds

- Unable to withdraw supposed “earnings”

Prevention Methods

- Invest only what you can afford to lose

- Conduct thorough due diligence

- Verify investment opportunities

- Consult financial advisors

- Be skeptical of guaranteed high returns

- Check regulatory compliance of investment platforms

- Avoid unsolicited investment advice

- Research investment companies independently

5. Fake Friend Call Scams

Trend Details

- 4,179 cases in 2024

- 39.07% decrease from 2023

Typical Scam Mechanism

- Unsolicited call from unknown number

- Scammer pretends to be a friend

- Requests financial help

- Victim transfers money to unknown account

Prevention Methods

- Do not engage with unrecognized numbers

- Verify the caller’s identity through known contact methods

- Call back using a verified number

- Be cautious of urgent financial requests

- Confirm with the supposed friend through another communication channel

General Scam Prevention Tips

- Trust your instincts

- If an offer seems too good to be true, it probably is

- Keep personal and financial information confidential

- Stay informed about the latest scam techniques

- Report suspicious activities to authorities

- Educate family members, especially older relatives

- Use secure, updated technology

- Maintain a healthy level of skepticism online

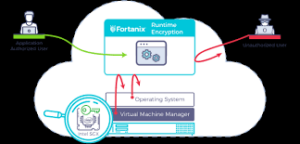

How Encryption Works

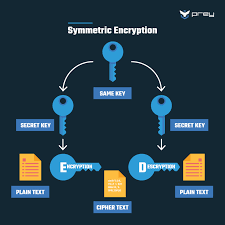

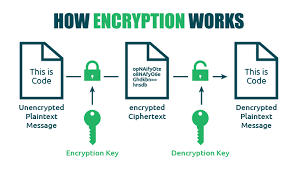

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.